- Miners are going through one of many steepest declines in income in years.

- Studies urged that the power generated may very well be put to higher use for extra income.

Bitcoin Miners have skilled a major income decline over the previous few months, with earnings hitting a few of the lowest ranges in years.

Nonetheless, current reviews recommend that Bitcoin miners might need a promising alternative to offset these losses by transitioning to Synthetic Intelligence (AI).

Bitcoin Miners may generate extra income, says VanEck report

Bitcoin Miners have been going through a decline in income as a result of a wide range of elements, together with decrease Bitcoin costs, rising mining issue, and rising operational prices.

Nonetheless, a current report from VanEck means that miners may offset these losses by partially transitioning into the Synthetic Intelligence (AI) trade.

In response to the report, Bitcoin miners possess the power infrastructure that the AI and high-performance computing (HPC) sectors desperately want.

By redirecting a few of their sources to help these industries, miners may generate an extra $13.9 billion in yearly income by 2027.

The VanEck report highlights that this shift may very well be essential for miners, lots of whom are battling weak stability sheets. These monetary challenges usually stem from extreme debt, over-issuance of shares, excessive government compensation, or a mixture of those elements.

Diversifying into the AI sector may present miners with a much-needed enhance to their profitability and long-term sustainability.

Bitcoin miner sees income decline

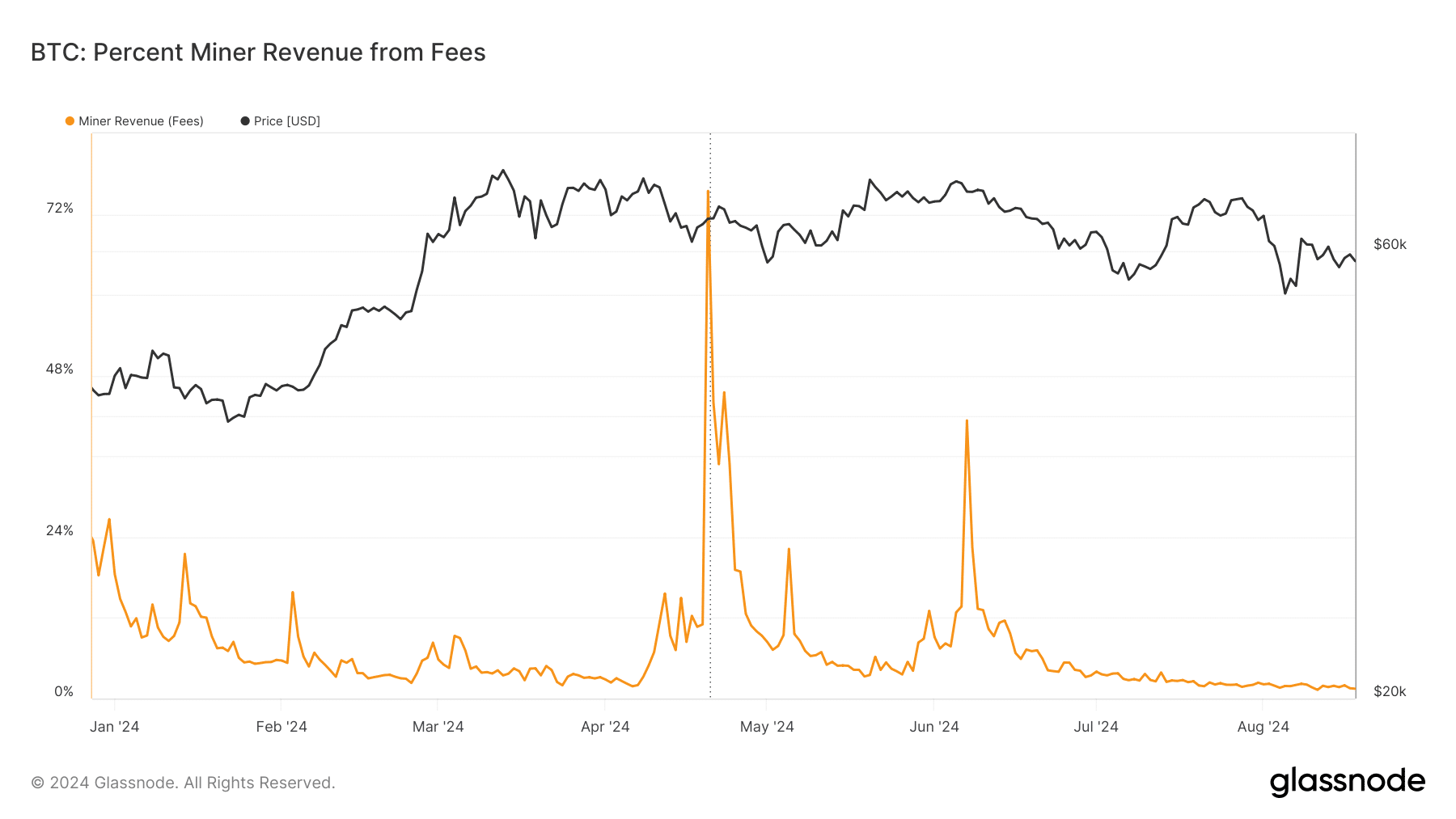

A current evaluation of Bitcoin miner income on Glassnode reveals vital fluctuations all through 2024, with notable spikes in late April/early Might and June.

In late April and early Might 2024, miner income surged by over 70%, adopted by one other vital spike in June 2024, reaching roughly 40%.

Nonetheless, after these peaks, the chart reveals a dramatic decline in miner income, dropping to round 0%.

This sharp decline underscores a vital problem for Bitcoin miners: their heavy reliance on block rewards for almost all of their earnings.

Provided that the proportion of income generated from transaction charges usually stays low, usually beneath 10%, miners are predominantly depending on block rewards to maintain their operations.

The reliance on block rewards poses a major long-term threat as a result of these rewards halve roughly each 4 years as a part of Bitcoin’s programmed financial coverage.

Bitcoin value struggles beneath $60,000

As of this writing, Bitcoin (BTC) is buying and selling at roughly $58,600, reflecting a modest improve of lower than 1%. Over time, there was a powerful correlation between the value of Bitcoin and the income generated by Bitcoin miners.

At the moment, Bitcoin is going through vital challenges in reclaiming its psychological stage of $60,000, which it has struggled to breach in current weeks.

Learn Bitcoin (BTC) Value Prediction 2024-25

The continued issue in surpassing this key stage is compounded by bearish market sentiment.

An evaluation of Bitcoin’s Relative Energy Index (RSI) signifies that it’s beneath the impartial line, signaling that the market remains to be in a bearish pattern.