- Bitcoin miners have been accumulating the coin for over a month.

- BTC gained bullish momentum within the final 24 hours as its worth surged by 4%.

Bitcoin [BTC] halvings have been probably the most outstanding occasions within the historical past of cryptos, as they play a vital function in shaping BTC’s future. After every halving, BTC took its time to achieve bullish momentum and attain new highs.

Because the final halving occurred just a few months in the past, AMBCrypto deliberate to verify whether or not BTC has been following its previous pattern.

What are Bitcoin miners as much as?

Ali, a preferred crypto analyst, lately posted a tweet mentioning fascinating data associated to BTC halving cycles.

As per the tweet, it’s been 119 days because the 2024 Bitcoin halving. Within the final two cycles, BTC hit a market prime round 530 days post-halving. If BTC follows an analogous pattern, then this simply is likely to be the early phases of BTC’s bull cycle.

Because the halving, BTC’s hashrate has been fairly steady. This meant that miners have been persevering with their operations at a gentle tempo. At press time, BTC’s hashrate stood at 602.28 EH/s.

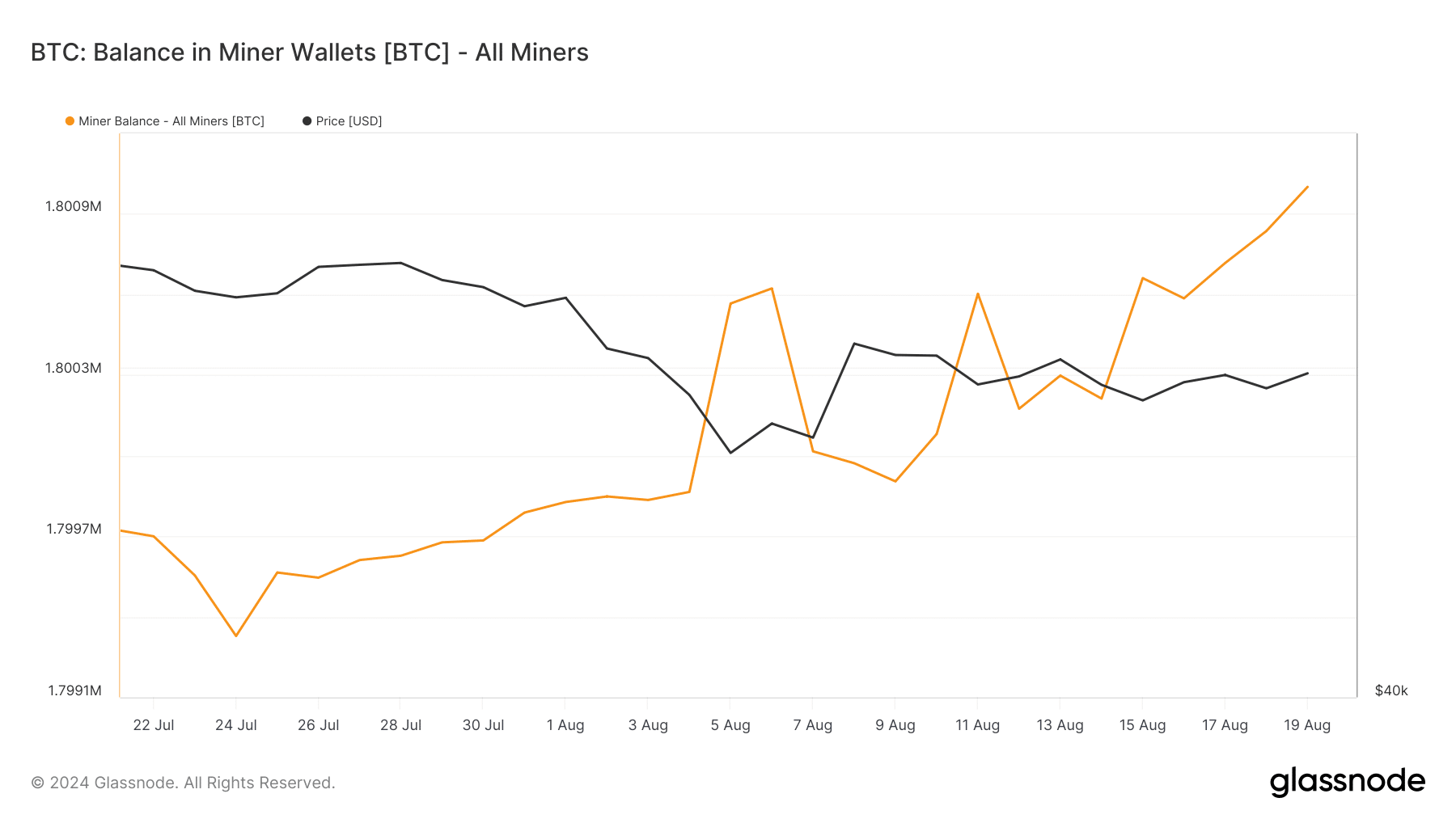

AMBCrypto deliberate to take a look at Glassnode’s knowledge to learn the way BTC miners have been behaving. As per our evaluation, BTC miners’ income has been on a declining pattern for the final 30 days.

Nevertheless, it was stunning to see a substantial rise in miners’ stability throughout the identical interval. This clearly meant that miners have been accumulating BTC as they hoped for a value improve.

Moreover, CryptoQuant’s knowledge additionally revealed that BTC’s Miners’ Place Index was inexperienced, indicating that miners have been promoting fewer holdings in comparison with its one-year common.

Purpose behind miners’ accumulation

Since miners have been stockpiling BTC, AMBCrypto took a have a look at different datasets to seek out out the attainable cause behind this tactic.

The Bitcoin Rainbow Chart, an indicator that reveals BTC’s state in reference to its value, instructed that BTC was within the “accumulation” part.

This meant that it was the correct time to purchase extra earlier than the coin’s value gained bullish momentum.

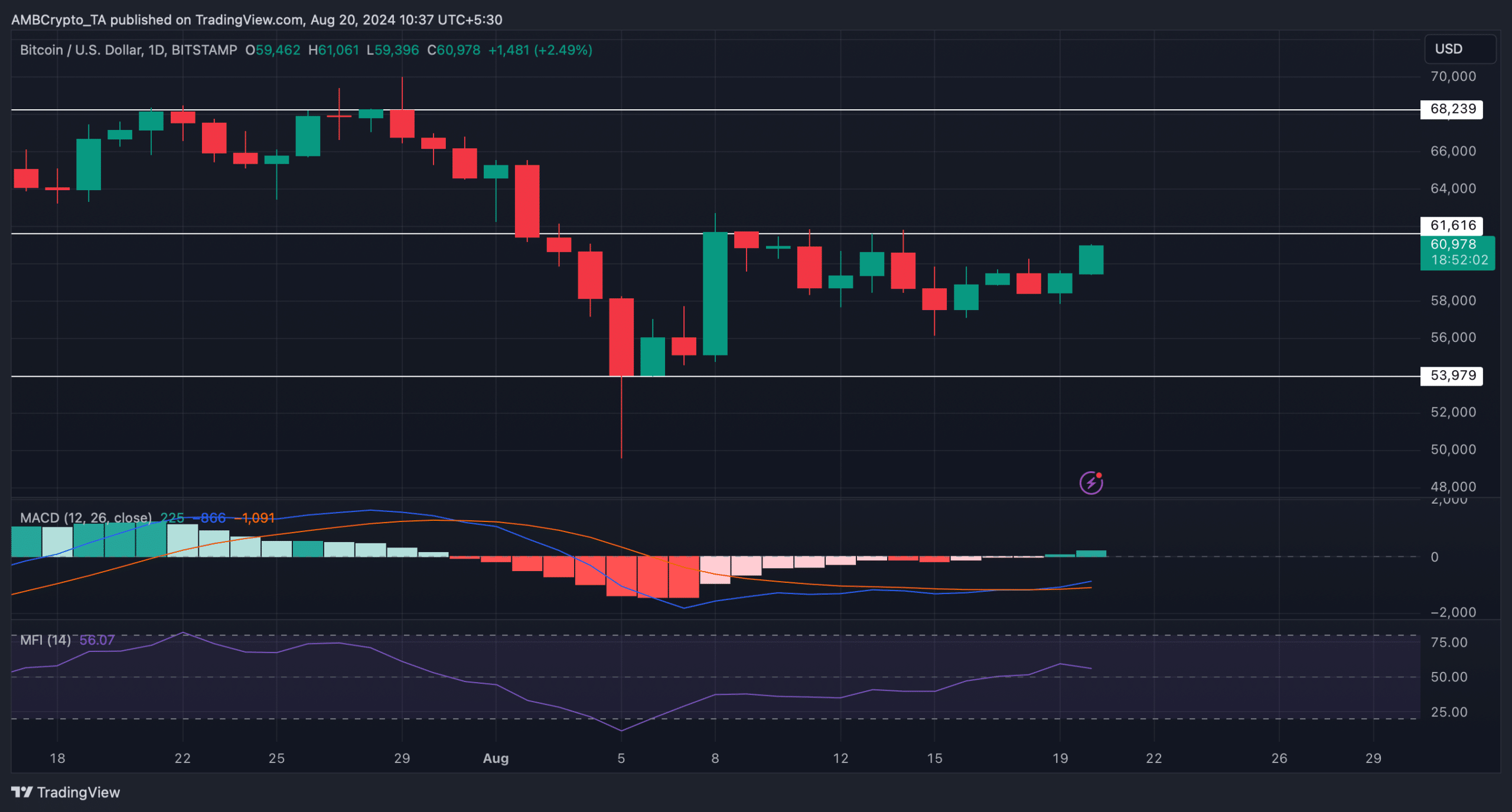

CoinMarketCap’s knowledge revealed that BTC bulls entered the market within the final 24 hours because the coin’s value elevated by 4%. On the time of writing, BTC was buying and selling at $60,930.84 with a market capitalization of over $1.2 trillion.

AMBCrypto then assessed the coin’s every day chart to determine whether or not this uptrend would final.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The technical indicator MACD displayed a transparent bullish crossover, which meant that the probabilities of a continued value improve have been excessive. Nonetheless, the Cash Movement Index (MFI) registered a decline.

This indicated that traders may witness just a few slow-moving days.