- Jack Mallers asserted Bitcoin is the last word hedge towards financial uncertainty.

- Regardless of volatility, vital investor curiosity in Bitcoin continued.

Ever because the approval of the Bitcoin [BTC] spot ETF, the king of cryptos has remained within the limelight.

As extra institutional buyers enter the crypto markets, the query arises — why has Wall Road all of a sudden develop into so bullish about crypto?

Jack Mallers’s perception on the present macroeconomy

In a dialog with Anthony Pompliano, Jack Mallers, CEO of Strike, implied that this renewed curiosity in cryptocurrency could also be due to the deep-rooted issues that we’ve got within the present geopolitical setup.

He additional said that permitting the banking system to fail could also be one resolution, whereas the second concerned debasing the forex. Mallers thought of the latter extra doubtless, suggesting that,

“I think Bitcoin is the best thing you can own.”

Right here, Maller is viewing Bitcoin as a hedge towards forex debasement and macroeconomic uncertainty.

Additional, when questioned about why buyers shifting away from the greenback and investing in belongings like shares, actual property, Bitcoin, and gold together with Wall Road, Mallers famous,

“I think it’s the best expression of fiat debasement. It is the antithesis of fiat currency. It has no Central Bank, it has no government, its monetary policy is fixed, its supply is capped, it’s everything that fiat isn’t. And, so, if your problem is Fiat debasement then it’s best expressed through Bitcoin.”

Diverging opinions on Bitcoin

Nonetheless, amidst Bitcoin’s value volatility, many are nonetheless divided on whether or not they need to purchase or promote Bitcoin.

Clearing the air across the identical, standard crypto analyst Ali Martinez, in his latest X (previously Twitter) submit, shared that there was vital shopping for exercise amongst sure buyers in latest days.

This confirmed continued confidence within the long-term potential of Bitcoin and optimism about its future worth.

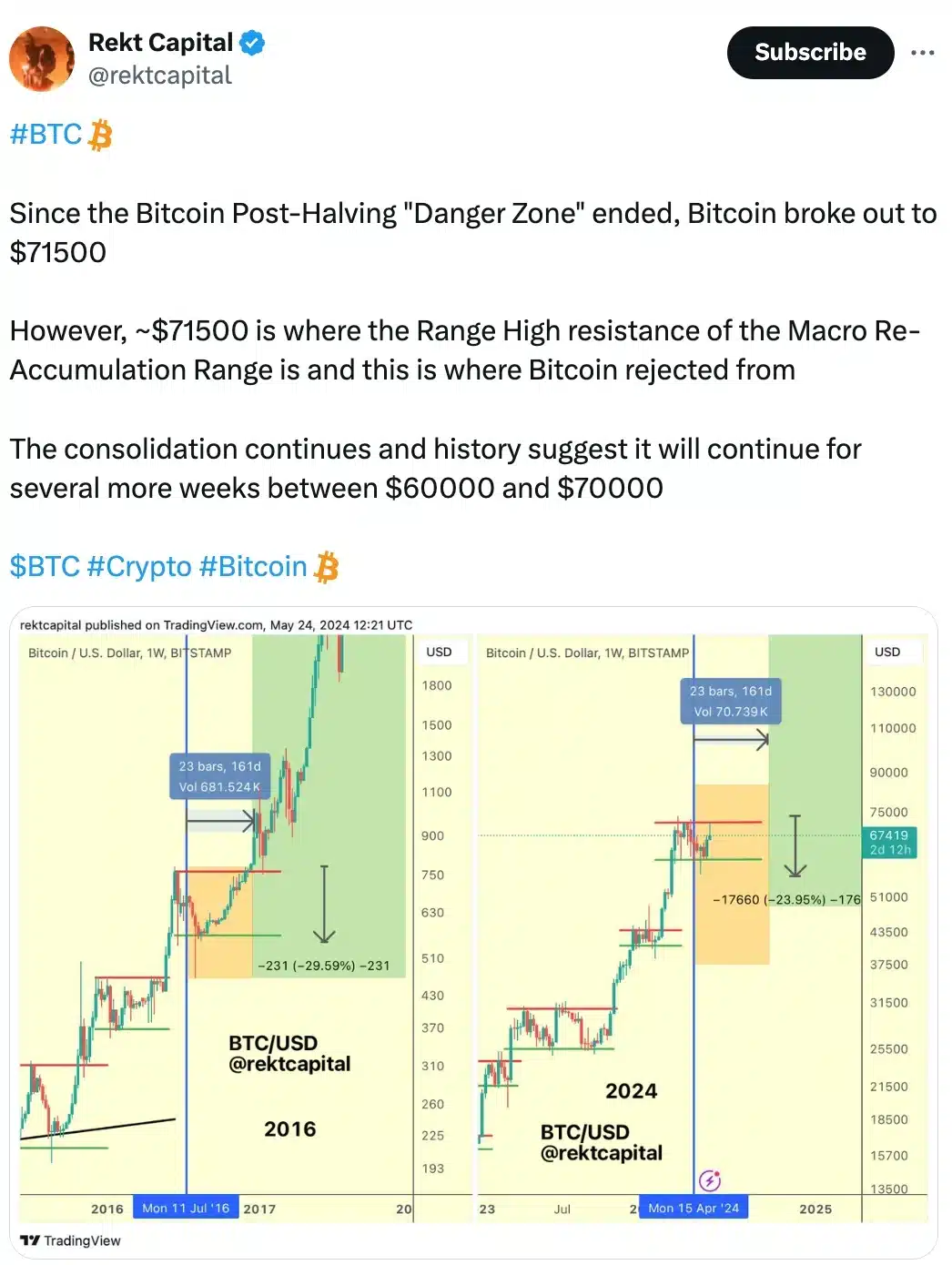

Quite the opposite, pseudonymous dealer Rekt Capital predicted that though the “danger zone” has subsided, Bitcoin should still expertise a possible dip of roughly 13% from its present worth.

Bitcoin vs. shitcoins

Amid the hypothesis and uncertainties enveloping Bitcoin, Mallers staunchly championed a maximalist perspective, affirming Bitcoin’s supremacy because the quintessential type of cash.

Moreover, Mallers scrutinizes Ethereum [ETH] for straying from basic financial rules, attributing its selections to founder affect and exterior pressures prompting protocol adjustments.

He stated,

“What bothers me is the intentional conflation Ethereum was founded to be the better Bitcoin and it often rides the coattails of Bitcoin and it often conflates itself with Bitcoin story and a lot of these things.”

He ended the dialog giving his opinion on meme cash –

“I mean to be honest like I don’t really give a s**t about s**tcoins to be totally candid.”