- BTC may prime out in late 2025 primarily based on historic developments.

- Analysts consider BTC may hit $200K — $260K by the top of 2025; the Energy Legislation mannequin suggests $400K.

Based mostly on historic developments, Bitcoin [BTC] may very well be in its final stage earlier than the ultimate leg of this cycle’s bull run.

Most market observers level to This fall 2024 as a possible breakout for the 6-month-long value vary.

If that’s the case, a bullish break-out would set off BTC’s subsequent and closing value rally for this cycle. Nonetheless, most market cycle analysts consider BTC may prime out by Q3/This fall 2025.

So, how excessive can the asset go earlier than it tops out?

How excessive can BTC go, $200K?

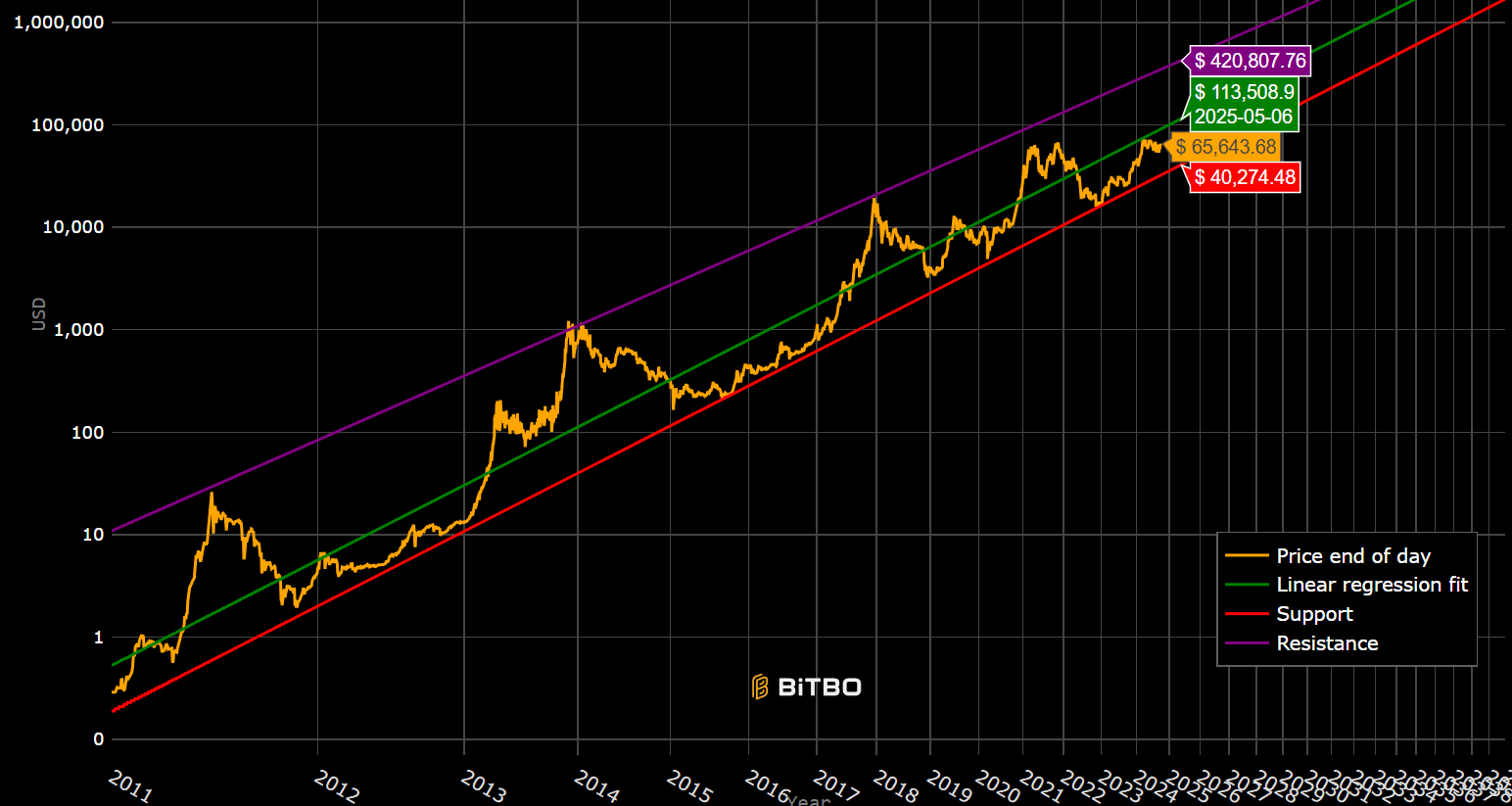

In line with the Bitcoin energy regulation mannequin, the tough estimate could be round $400K if the historic developments play out.

For context, BTC at all times hit the mannequin’s resistance degree and topped out in earlier cycles, aside from the 2021 one.

If the development repeats, the mannequin projected $400K because the probably goal to observe, an outlook bolstered by analyst Ali Martinez. Even the Inventory-Over-Circulation (S/F) mannequin goal was near $400K.

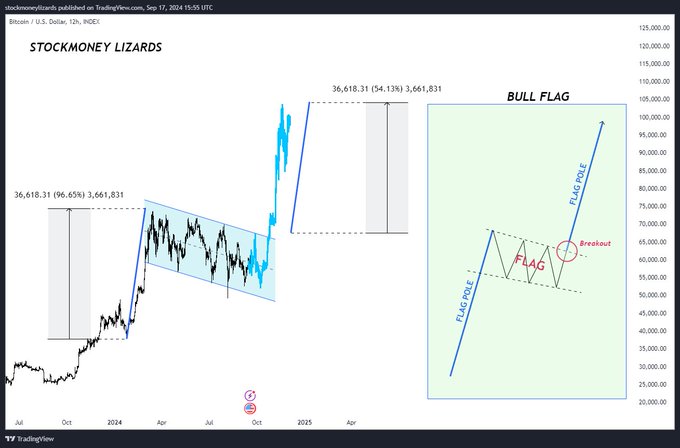

Nonetheless, Stockmoney Lizards, one other BTC analyst, projected that BTC may hit a prime close to $200K—$260K by October 2025.

“We are entering what could be the final pump of this Bitcoin cycle. The cycle top is expected around September to October 2025. My personal price target for Bitcoin is between $200,000 and $260,000.”

The analyst timeline and October 2025 goal have been primarily based on previous developments, the place BTC topped out 48 months after the earlier peak.

Curiously, his value goal was just like that of Customary Chartered Financial institution. The financial institution projected that BTC may hit $250K by the top of 2025.

For 2024, the financial institution foresaw BTC climbing above $125K if Trump wins the election. Nonetheless, if historic patterns performed out, Stockmoney Lizards estimated $100K per BTC by year-end.

In the meantime, BTC was valued at $65K at press time. Nonetheless, the macro entrance was more and more turning into a key tailwind for the asset.

After the U.S. Fed pivot on the 18th of September, China launched an aggressive financial stimulus package deal to revive the financial system.

Market pundits consider that these macro updates may enhance BTC’s rally.