- Bitcoin’s worth hike has pushed spot buying and selling quantity to multi-year highs

- Market has seen an inflow of recent traders this 12 months too

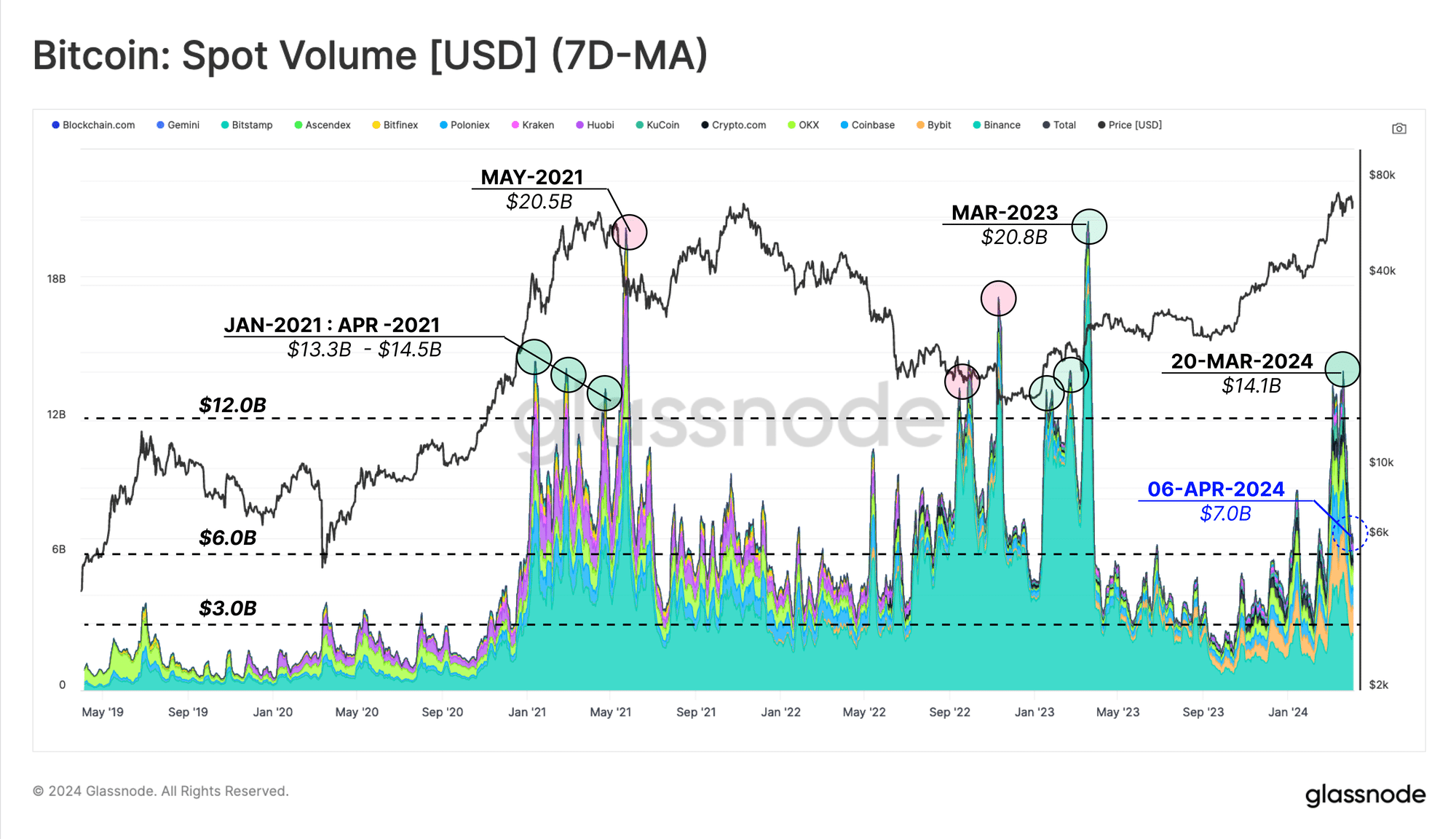

Bitcoin’s [BTC] worth rally, which started in October 2023, has pushed its spot buying and selling quantity to the highs seen through the 2020-2021 bull market, in accordance with a Glassnode report.

In keeping with the on-chain knowledge supplier, whereas the latest headwinds confronted by BTC’s worth have led to a slight retraction, the coin’s day by day spot commerce quantity is at the moment sitting at round $7 billion.

Glassnode assessed the coin’s spot commerce quantity by evaluating the metric’s 180-day transferring common (sluggish) and its 30-day transferring common (quick). This comparability confirmed that because the market rally started in October 2023, the BTC market “has seen the faster average trade significantly higher than the slower one.”

The on-chain knowledge supplier added that this means that the coin’s year-to-date development is “supported by strong demand in spot markets.”

Moreover, along with the surge within the coin’s spot commerce quantity, BTC’s worth rally has resulted in an uptick within the circulation of cash out and in of cryptocurrency exchanges. Glassnode mentioned,

“The monthly average of total Exchange Flows (inflows plus outflows) is currently at $8.19B per day, significantly higher than the peak in the 2020-2021 bull market,”

Surge in new demand

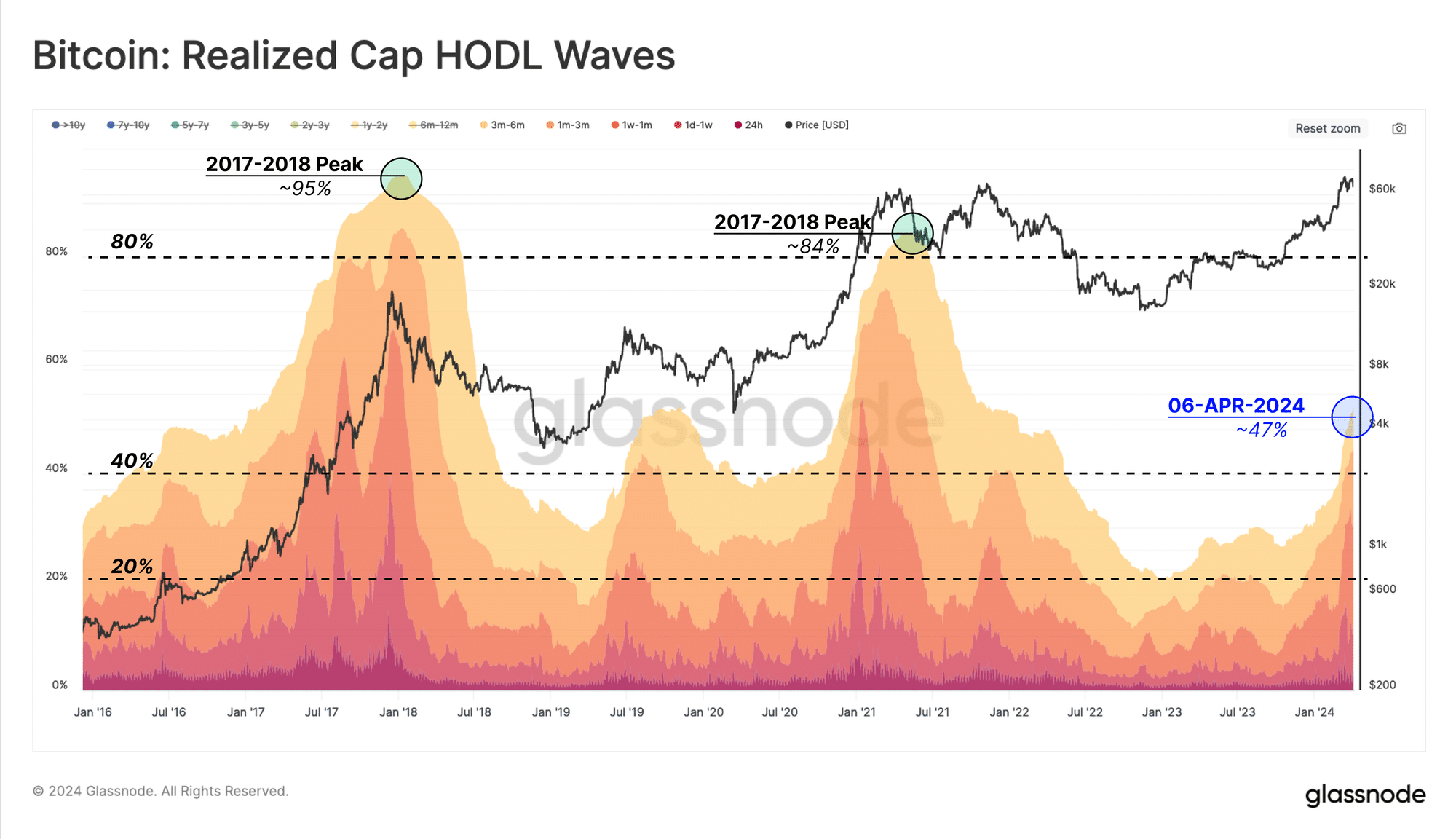

The continued rally has additionally led to a spike within the variety of new traders holding BTC. As long-term holders distribute their long-held cash for good points, they’ve been scooped up by new traders who intend to revenue from the market rally.

Glassnode assessed BTC’s Realized Cap HODL Waves and located that there was a rally within the “share of wealth held by coins younger than six months.”

The truth is, during the last 12 months, BTC’s provide held by addresses youthful than six months has grown considerably. The identical had a determine of 47%, at press time.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

In keeping with Glassnode,

“This suggests that the capital held within the Bitcoin holder base is roughly balanced between long-term holders and new demand.”

Lastly, it’s price stating that Glassnode additionally claimed that it’s key to concentrate to the conduct of those new traders as “their share of the capital increases.”

This, as a result of this cohort of BTC holders is often extra price-sensitive than long-term holders (LTHs). They’ve their cash simply accessible and are prepared to dump as soon as BTC’s worth falls under their price foundation.