- BTC noticed a surge in lengthy liquidations previously 24 hours.

- This comes because the market awaits the discharge of the CPI report and the result of the Federal Reserve assembly.

Bitcoin’s [BTC] worth corrected to close $66,000 in the course of the intraday buying and selling session on eleventh June, forward of twelfth June’s U.S. inflation report and FOMC assembly.

The coin has, nonetheless, rebounded barely since then to change arms at $67,243 as of this writing, in response to CoinMarketCap’s knowledge.

As reported by CNBC, economists count on the Might Client Value Index (CPI) to point out a modest enhance of 0.1% from April. Nonetheless, this is able to nonetheless translate to a 3.4% annual enhance in costs.

The Federal Reserve is predicted to do nothing relating to rates of interest.

Nonetheless, its officers will take different actions, comparable to releasing quarterly updates to their Abstract of Financial Projections, which might be influenced by the CPI report.

Lengthy merchants bear the brunt

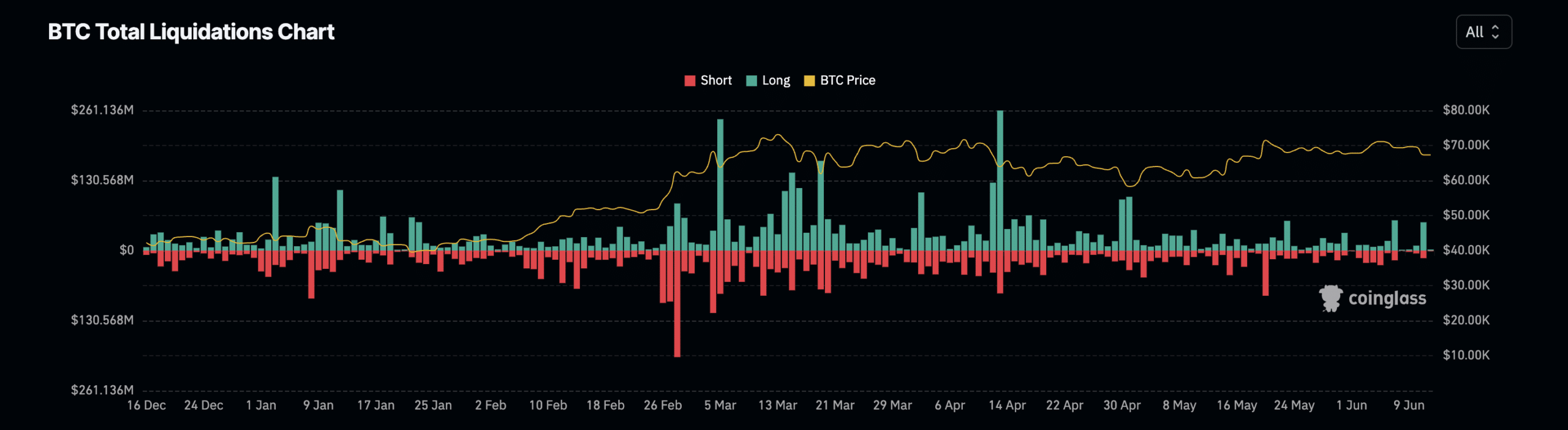

BTC’s worth droop on eleventh June led to a surge in lengthy liquidations in its futures market. Based on Coinglass, liquidations on that day totaled $67 million, with 77% of them being lengthy liquidations.

Liquidations occur in an asset’s derivatives market when a dealer’s place is forcefully closed because of inadequate funds to keep up it.

Lengthy liquidations happen when the worth of an asset all of a sudden drops, forcing merchants who’ve open positions in favor of a worth rally to exit their positions.

AMBCrypto discovered that on the day in query, BTC’s lengthy liquidations totaled $52 million, whereas quick liquidations totaled $14 million.

Bitcoin to surge?

Though many lengthy merchants have been plunged into losses previously 24 hours, market observers famous that the coin’s historic efficiency hints at a attainable restoration very quickly.

In a submit on X, pseudonymous crypto analyst Gumshoe famous that 4 FOMC conferences have been held thus far this 12 months, and every one adopted the identical sample.

BTC’s worth declined 10% within the 48 hours earlier than these conferences and totally recovered on the day of the conferences. Based on Gumshoe, “The market always prices in overly bearish statements, then reverses.”

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

One other crypto analyst, Jelle, shared the identical sentiments. The analyst opined the Federal Reserve conferences “have been good for the market recently.”

Based on Jelle, the previous 4 FOMC occasions have coincided with native bottoms and resulted in over 20% rallies for the main crypto asset.