- Bitcoin’s LTHs are distributing slower, signaling a possible shift in market sentiment

- Historic developments recommend decreased LTH promoting strain typically results in upward value momentum

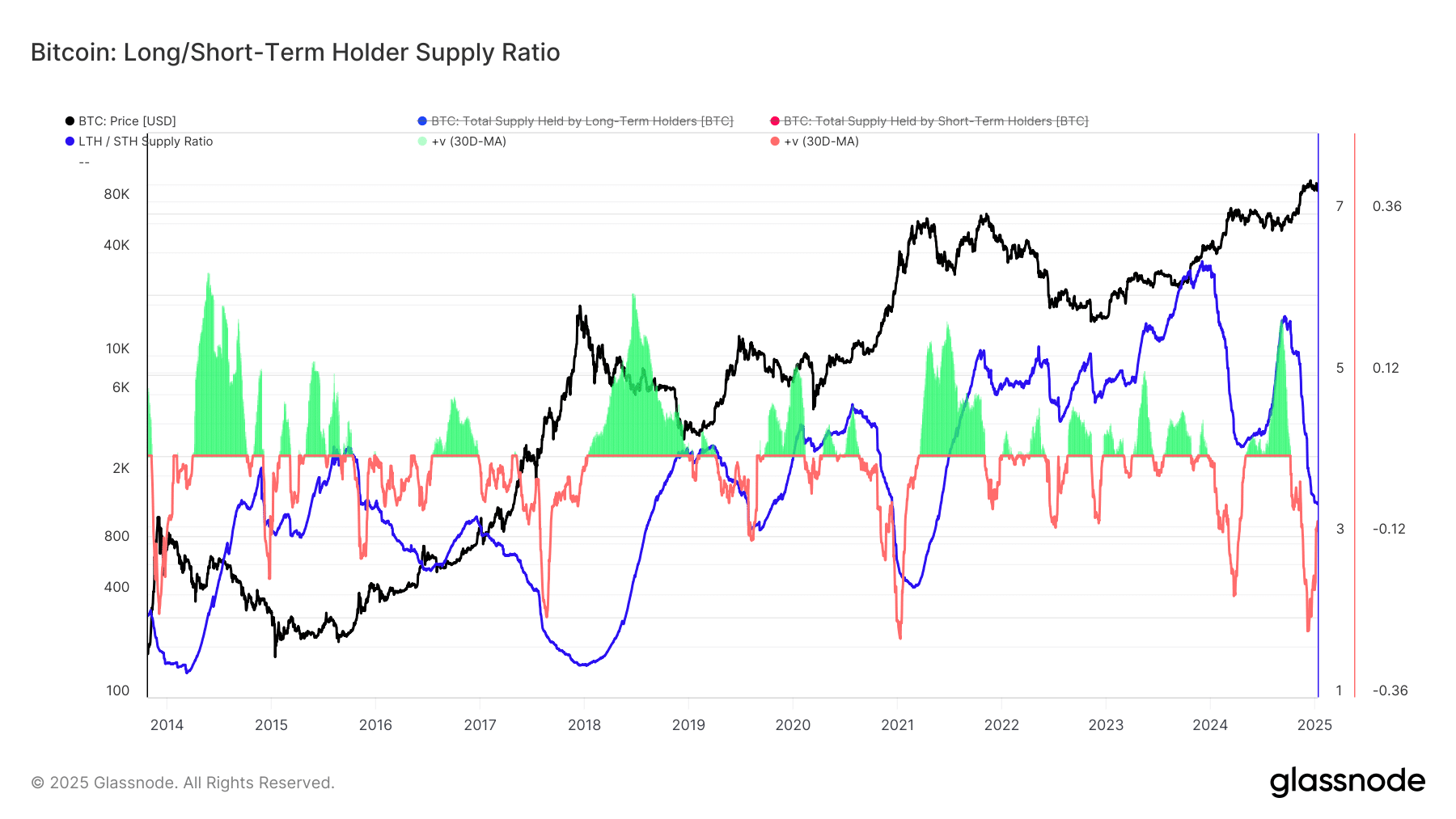

Bitcoin’s [BTC] value gave the impression to be hovering round 12% beneath its all-time excessive at press time, leaving many to marvel concerning the future path of the market. Regardless of this dip, nevertheless, LTHs proceed to distribute their Bitcoin holdings, albeit at a slower tempo.

In reality, on-chain knowledge revealed a key shift – Whereas LTHs are nonetheless promoting, the speed of distribution has begun to gradual. Extra importantly, the 30-day % change in LTH provide advised that this distribution cycle could have hit its peak, signaling that the promoting strain might quickly ease.

LTH distribution developments

Latest knowledge revealed that LTHs have continued to distribute their Bitcoin, even with the worth simply 12% beneath its all-time excessive. This ongoing promoting habits implies that these long-term holders are cautious, probably pushed by macroeconomic components or a technique of taking earnings throughout unsure market circumstances. Regardless of this continued distribution, the tempo of promoting has began to gradual.

There’s a declining 30-day change in LTH provide, suggesting that the height of LTH promoting strain could have handed. This shift will be attributed to enhancing market sentiment and the stabilization of exterior pressures, which can have eased among the considerations that prompted earlier promoting.

30-Day % change in LTH provide

The 30-day % change in LTH provide measures the web accumulation or distribution of Bitcoin by LTHs over a rolling month-to-month interval. When this metric rises, it typically indicators accumulation, whereas a decline sometimes signifies lively distribution.

The information revealed a plateau in LTH distribution, suggesting the promoting part could also be ending. Traditionally, such slowdowns precede durations of decreased promoting strain. As LTHs cut back distribution, downward strain on Bitcoin might ease, permitting for consolidation or a possible bullish reversal.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Comparability to earlier cycles and potential implications

When evaluating the present pattern to earlier cycles, it’s clear that related distribution slowdowns have marked the top of bear markets or the beginning of bull markets. In 2015, 2019, and 2020, LTH distribution slowdowns have been adopted by decreased market volatility, setting the stage for upward developments. Throughout these occasions, Bitcoin noticed better stability, increased confidence, and recent inflows from new buyers – All contributing to cost hikes.

If this pattern follows previous cycles, Bitcoin could stabilize at its press time value earlier than transferring upwards. The shift in LTH habits and decreased promoting strain might sign the beginning of a value rally. This might result in bullish momentum or prolonged consolidation, relying on market circumstances.

As historical past has proven, such moments of decreased promoting strain typically set the stage for Bitcoin to realize new highs. Nevertheless, whether or not the market follows this sample once more stays to be seen.