- Bitcoin holder buys hit $10 billion for the primary time.

- Bitcoin massive holders provide hit 262,000 BTC over the previous 30 days.

Bitcoin [BTC], the most important cryptocurrency by market cap, has lately skilled a pointy decline in its costs. At press time, the king coin was buying and selling at $58679. This marked a 6.69% decline over the previous 24 hours.

Previous to this decline, BTC was in upward motion, reaching a excessive of $64,404 within the final week. Nonetheless, the sharp decline on day by day charts has outweighed all of the weekly beneficial properties to document a 1.71% drop on weekly charts.

This sudden decline raises questions on panic promoting and the position of long-term holders in making certain Bitcoin’s stability.

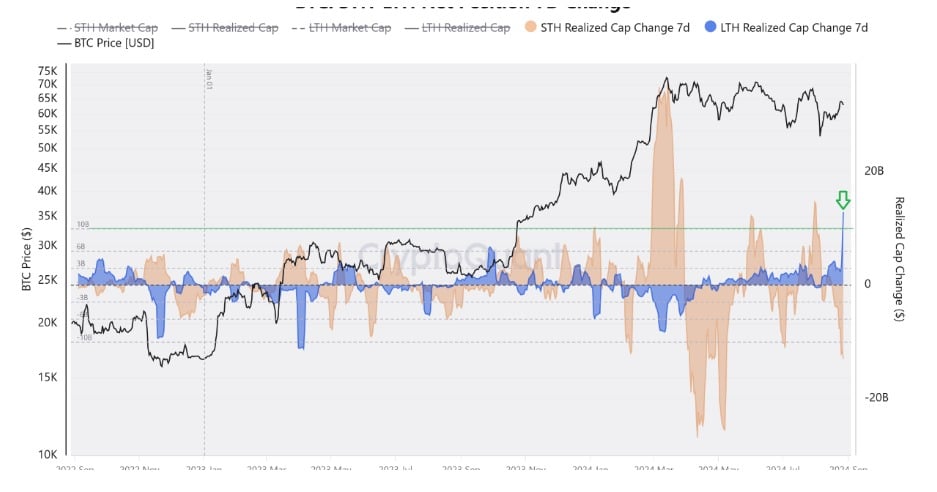

Lengthy-term Bitcoin holder buys hit $10 billion

Based on CryptoQuant analyst Amr Taha, long-term holders are much less more likely to promote and to buy and maintain throughout market downturns.

In his evaluation, Amr Taha posited that long-term holders have spent $10 billion to buy the crypto. Additionally, these patrons have averted promoting because the market was at present in a downturn.

In a submit, the analyst shared,

“For the first time ever, the realized capitalization of long-term holders has exceeded $10 billion.”

Based mostly on this commentary, holders who handed the 155-day mark continued to carry their crypto. Moreover, as witnessed over the previous 30 days, establishments have elevated their purchases.

Huge BTC buyers comparable to Marathon, Blackrock, Galaxy Digital, Metaplanet amongst others have elevated their holdings over the previous 30 days.

These establishments are massive holders and have a tendency to build up their belongings for a chronic interval.

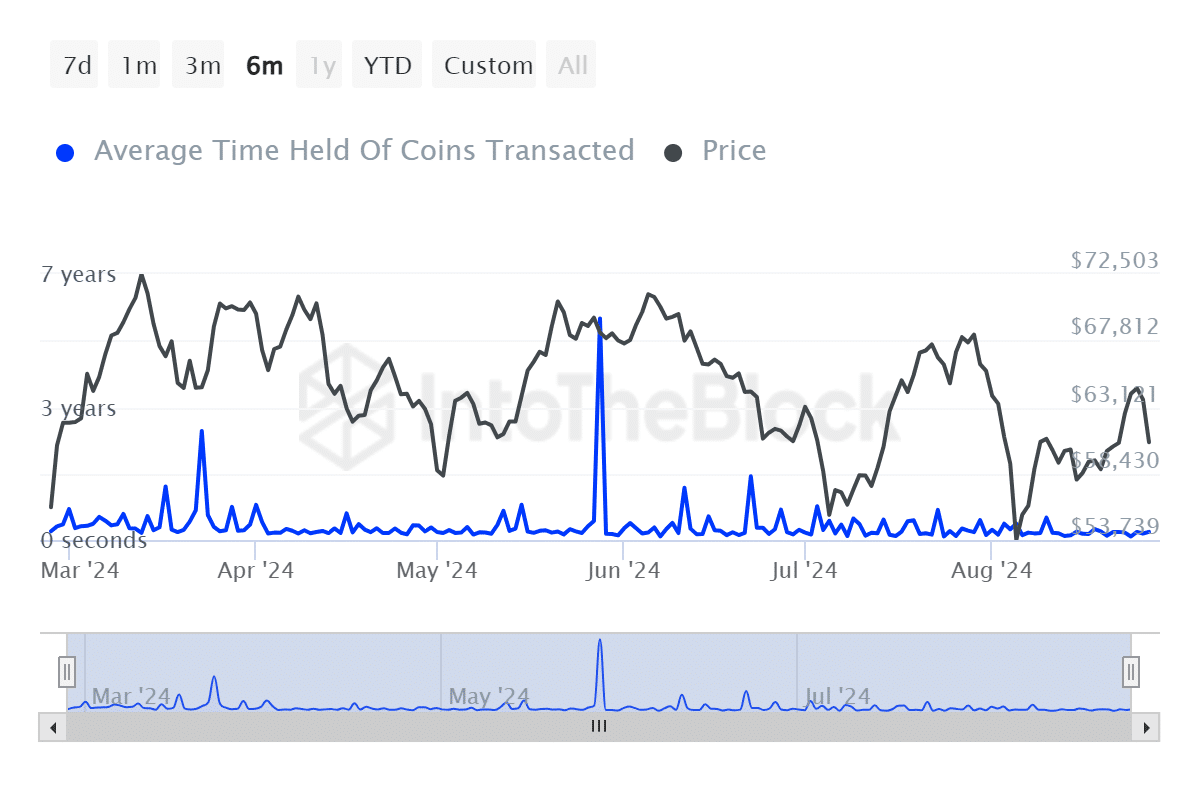

This phenomenon means massive holders have lengthy accumulation phases. As information from IntoTheblock exhibits, massive holders take no less than 5 months to a few years to promote their belongings, whereas small holders are inclined to promote their holdings.

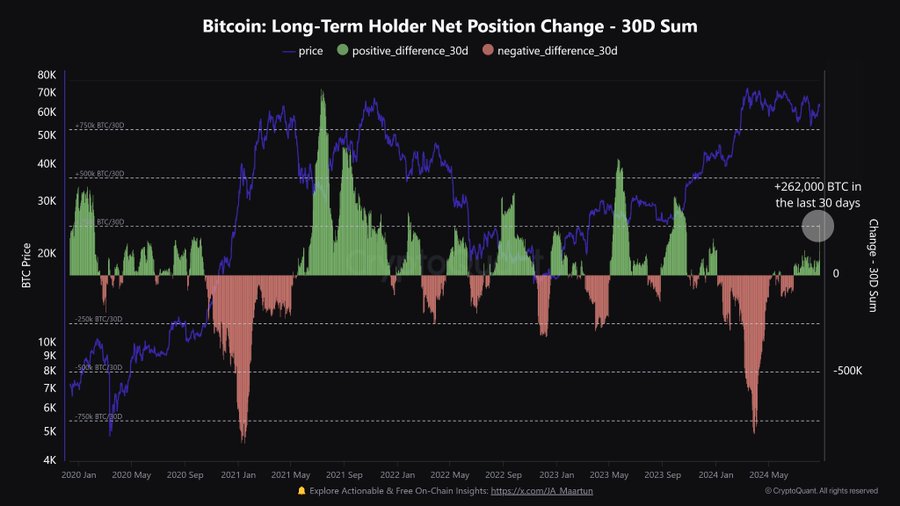

Lengthy-term holders provide elevated by 262,00 BTC

Whereas long-term holders are much less more likely to promote, their provide has skilled exponential progress. As shared by Cryptoquant, long-term holders management over 75% of the whole BTC provide.

Via their X (previously Twitter) web page, they shared the evaluation, noting that,

“In the past 30 days, Long Term Holders supply increased by 262,000 $BTC.They now control 14.82 million Bitcoin, which accounts for 75% of the total supply.”

The final 30 days have witnessed excessive BTC volatility hitting a low of $49577. These worth fluctuations defined the elevated accumulation by long-term holders.

These holders have a tendency to buy extra belongings throughout market downturns and reintroduce them to the market throughout a chronic bull market. The technique ensures they purchase cheaply and promote later at excessive returns.

Thus, for long-term holders, low BTC costs are a shopping for alternative to build up.

Due to this fact, though Bitcoin is experiencing a downturn, this introduced a shopping for alternative for long-term holders. Elevated shopping for actions end in shopping for stress, which in flip drives costs up.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

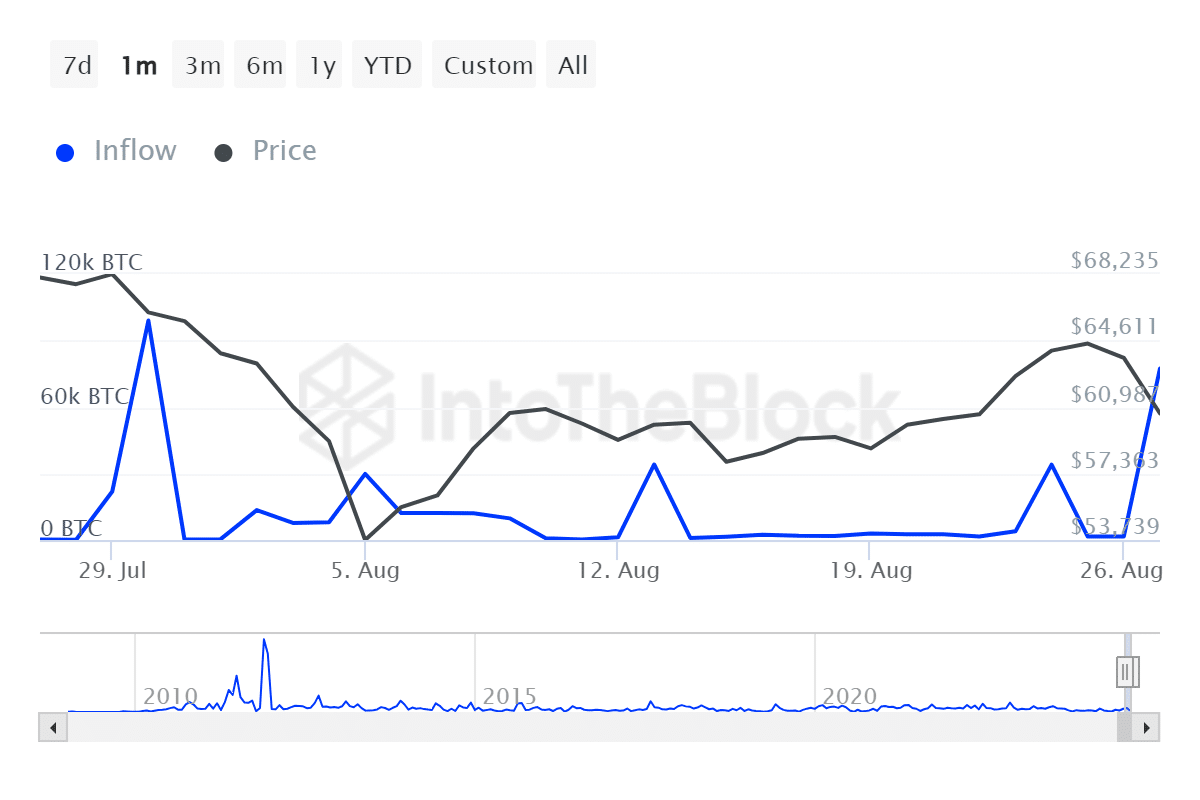

As such, when the market crashed earlier this month, massive holders influx elevated between the fifth and the ninth of August, driving costs again to $60,662 resistance degree.

Thus, such a cycle will seemingly repeat itself to drive costs above $60k.