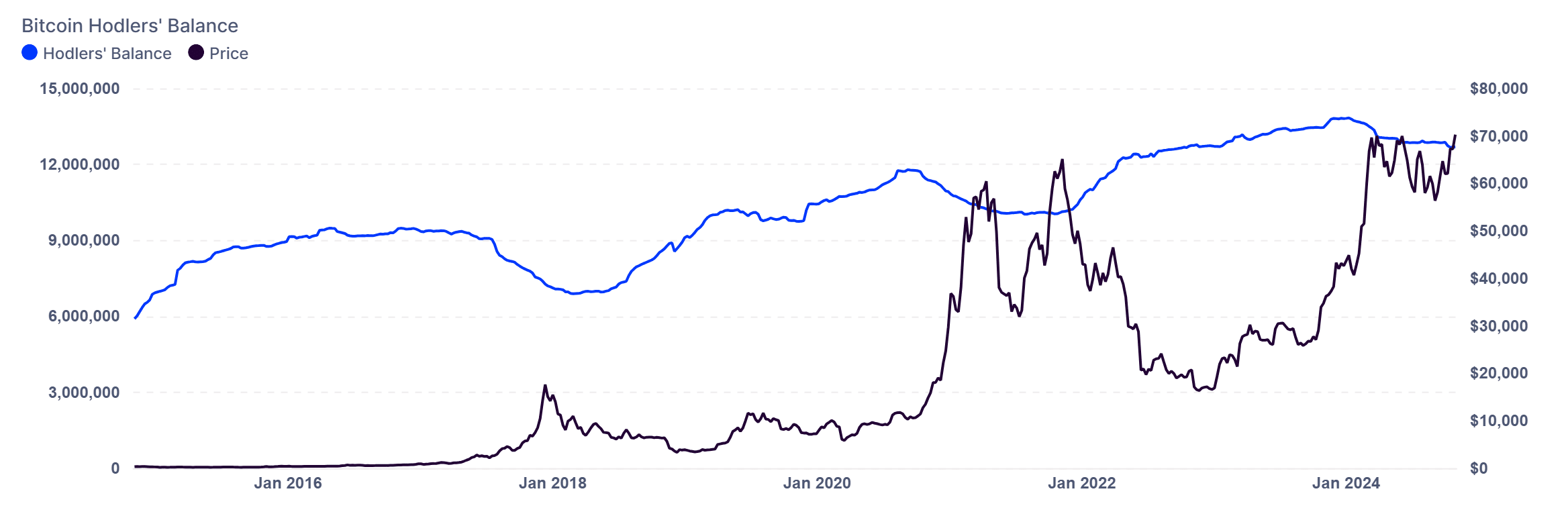

- The BTC Hodler’s steadiness has seen a slight drop lately.

- BTC’s worth has maintained a powerful development regardless of this drop.

Bitcoin [BTC] is witnessing an intriguing shift in market dynamics as long-term holders, or “Hodlers,” undertake a extra restrained method to promoting within the present market cycle.

Not like earlier bull runs marked by aggressive sell-offs, knowledge now reveals a modest decline in Hodlers’ balances. This conduct suggests warning regardless of Bitcoin’s rising costs, probably marking a brand new development in Bitcoin’s market conduct.

Bitcoin hodlers’ steadiness exhibits gradual decline

In response to latest knowledge from IntoTheBlock, Hodlers’ Bitcoin steadiness has steadily, albeit mildly, decreased in latest weeks.

On 4th November, the Hodlers’ steadiness stood at roughly 12,681,159 BTC, a slight drop from 12,686,790 BTC recorded on twenty eighth October.

Not like previous cycles, the place vital sell-offs typically coincided with peak costs, this measured discount suggests a shift in technique amongst Hodlers, reflecting warning and a want to carry via the present worth appreciation.

This tempered method contrasts with historic conduct, the place speedy worth will increase led to extra aggressive promoting.

Now, as Bitcoin’s worth developments upward, Hodlers appear extra affected person, progressively decreasing their holdings as a substitute of overwhelming the market with a speedy sell-off. This transformation might mirror a extra mature method to managing features amid an evolving market panorama.

Bitcoin worth dynamics amid average promoting stress

Bitcoin’s present worth motion displays stability within the face of average promoting from Hodlers. As Bitcoin trades round $68,789, it exhibits resilience regardless of the gentle promoting exercise by long-term holders.

Technical indicators additional illustrate this balanced atmosphere. The Relative Energy Index (RSI), which at present stands at 54.66, indicators neutral-to-slightly bullish sentiment, with a studying above 50 suggesting that purchasing stress is barely stronger than promoting stress.

The RSI stays properly under the overbought threshold of 70, indicating that the asset nonetheless has room to develop earlier than it faces stronger promoting resistance.

The Choppiness Index (CHOP) additionally factors to stability, standing at 49.90, which signifies a comparatively balanced development with out extreme volatility. A CHOP studying round 50 normally implies that the market is neither in a powerful development nor extremely unstable.

This aligns properly with the gradual decline in Hodlers’ balances, suggesting that the promoting exercise is being met by regular shopping for curiosity with out inflicting main worth swings.

This stability could also be interesting to each retail and institutional traders on the lookout for much less unstable entry factors.

A brand new market cycle dynamic?

The latest conduct of Bitcoin Hodlers might trace at an evolving cycle dynamic. Their reluctance to promote aggressively, even in a good worth atmosphere, would possibly recommend sustained and even additional worth progress expectations.

This conservative method might additionally mirror cautious optimism, as Hodlers look like testing the market by making smaller, incremental gross sales moderately than taking vital income abruptly.

Learn Bitcoin (BTC) Worth Prediction 2024-25

As Bitcoin’s market matures, the development of gradual promoting moderately than sharp sell-offs might sign a shift towards a extra secure market atmosphere.

This conduct would possibly assist mitigate the acute volatility historically related to Bitcoin cycles, supporting the asset’s resilience. If this development continues, it might signify a long-term shift in how Bitcoin holders interact with the market.