- Bitcoin’s greed has slowed, with a noticeable lack of risk-taking amongst traders.

- Nonetheless, a dip might quickly incentivize traders to HODL.

The previous 24 hours have been a whirlwind for the crypto market, with Bitcoin [BTC] hitting the $100K milestone earlier than plunging over 5% later within the day.

Sometimes, such dips appeal to discount hunters, however subdued investor greed indicators waning enthusiasm for holding.

This bull run has already minted numerous millionaires and billionaires cashing in on substantial features. Now, the main target shifts to these betting on Bitcoin’s subsequent peak as a long-term funding.

What stays essential is the steadiness between these opposing forces – will profit-takers dominate, or will risk-takers push for outsized returns?

Lack of danger urge for food is holding Bitcoin again

On the 1-day timeframe, Bitcoin’s value chart exhibits blended indicators: a bearish MACD crossover and an RSI in impartial territory, regardless of Bitcoin reaching $100K.

Whereas there’s nonetheless room for development, all of it comes down as to whether traders are able to embrace the volatility for the prospect of multiplied features.

Not like the earlier ATH in March, the greed index has remained below 90 this time, indicating an absence of risk-taking. That is pushing Bitcoin again into the FUD (worry, uncertainty, doubt) zone.

Psychologically, this might create robust resistance amongst each new and seasoned traders, with many doubtless opting to money out for speedy features moderately than holding for the long run.

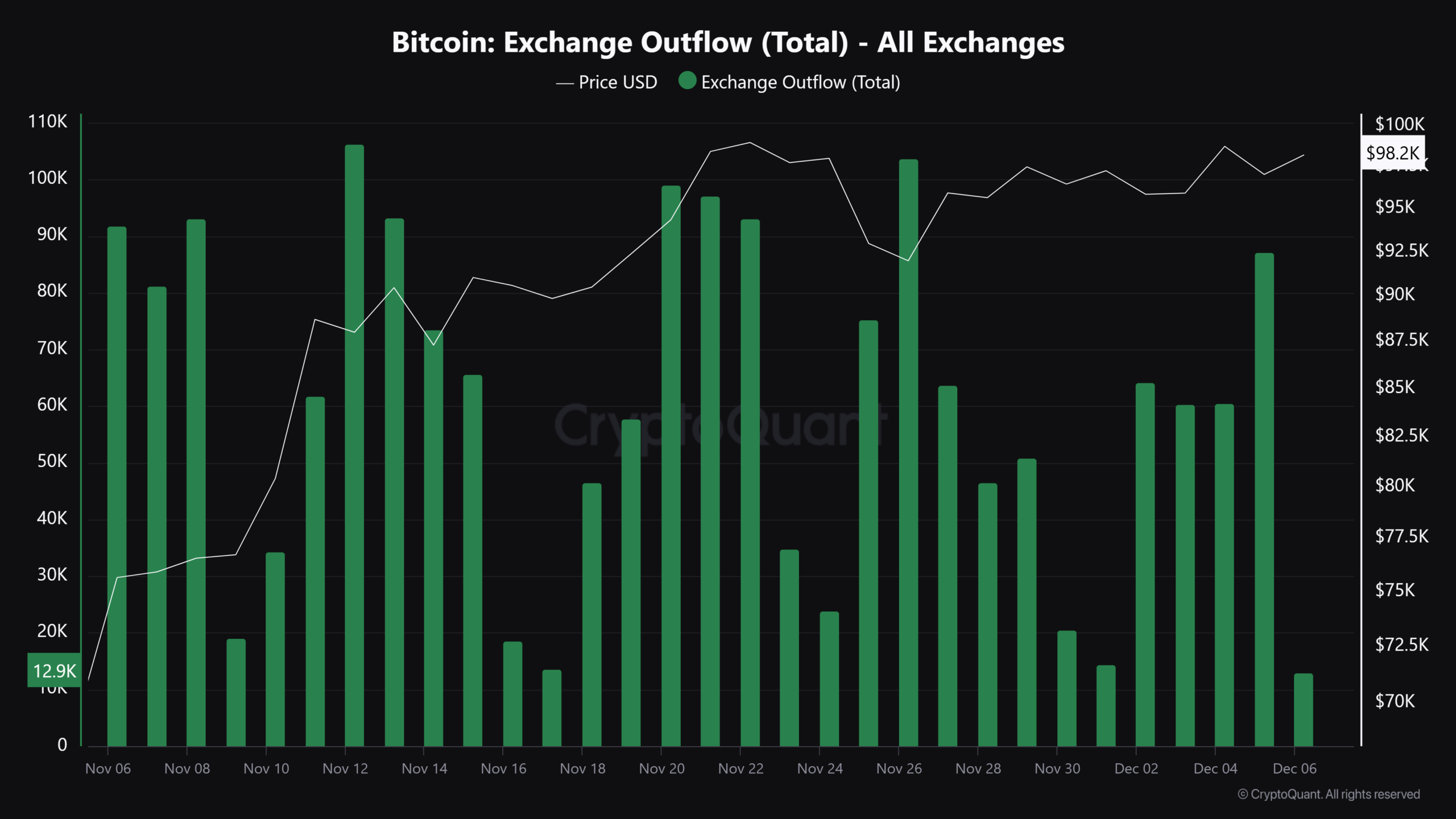

Consequently, the $100K milestone didn’t even final a day, with profit-takers dominating the alternate flows. Each short-term and long-term holders cashed in on features from earlier dips, whereas risk-takers didn’t step in and neutralize the promoting strain.

If this development continues every time Bitcoin hits $100K, it might create an countless loop, the place the dearth of greed provides profit-takers a greater probability to flee the market earlier than costs can really maintain larger ranges – creating circumstances ultimate for a brief squeeze.

So, do you have to money out too when BTC hits $100K?

Following the brand new ATH of $103,629, Bitcoin’s value closed at $92,285 – its lowest level of the day, creating one other dip-buying alternative, notably for short-term merchants trying to capitalize on a possible rebound.

Consequently, Bitcoin quantity rose by 5%, reaching round $124 billion, with alternate outflows (cash withdrawn from exchanges) persevering with to dominate the buying and selling platforms, indicating robust investor conviction.

Whales have additionally seized the chance, scooping up 600 Bitcoins at a discount value of $98,083.

Collectively, these elements recommend a possible backside formation round $96K, the place each investor and dealer curiosity might converge, setting the stage for a fair larger bounce again.

That is constructive information for bulls. A confirmed $96K backside, with new capital coming into the market, would push Bitcoin simply 4% into realized income by the point it hits $100K.

This modest achieve might not set off a major sell-off, because it’s unlikely to interrupt even for a lot of traders, encouraging them to HODL.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Due to this fact, the subsequent key value vary to observe is $96K – $98K, the place notable exercise is anticipated. Renewed greed on this vary might gas additional momentum.

So, this is perhaps the optimum time to purchase for a possible $103K breakthrough. Nonetheless, monitoring the liquidity inside this value band might be essential within the coming days.