- Bitcoin’s decentralization could possibly be in danger as mining energy turns into more and more centralized

- The function of BTC ETFs in powering this shift can’t be ignored

On the coronary heart of the Bitcoin [BTC] community are miners with main BTC holdings. In at the moment’s risky market, preserving observe of their reserves is extra essential than ever. Apparently, the quantity of BTC held in miner wallets has dropped to a yearly low of simply 1.809 million.

Whereas components like rising mining problem, breakeven bills, halving, and decreased rewards are sometimes blamed, there could also be a deeper shift at play. This shift could possibly be eroding miners’ affect over the market as extra buyers flock to different funding automobiles like Bitcoin ETFs.

Because of this, Bitcoin’s community dangers turning into extra centralized, elevating the query – Is that this a step ahead or a setback for Bitcoin’s decentralized future?

Bitcoin’s decentralized future may be below menace

A 12 months after the 2008 monetary disaster, Bitcoin emerged as a game-changer, eliminating the necessity for monetary middlemen. Over time, it has constructed a passionate neighborhood of ‘believers’ who see BTC not simply as a digital asset, however as a strong image of decentralization.

It’s no shock that miners play a key function in making this imaginative and prescient a actuality. Within the 15 years since Bitcoin’s creation, particular person miners have developed into massive firms, now holding important quantities of BTC themselves.

Marathon Digital Holdings (MARA) is main the best way, with over 40k BTC in its reserves. Whereas that is bullish for Bitcoin – driving up accumulation – it additionally indicators a troubling pattern – The rising centralization of mining energy, now managed by only a few key gamers.

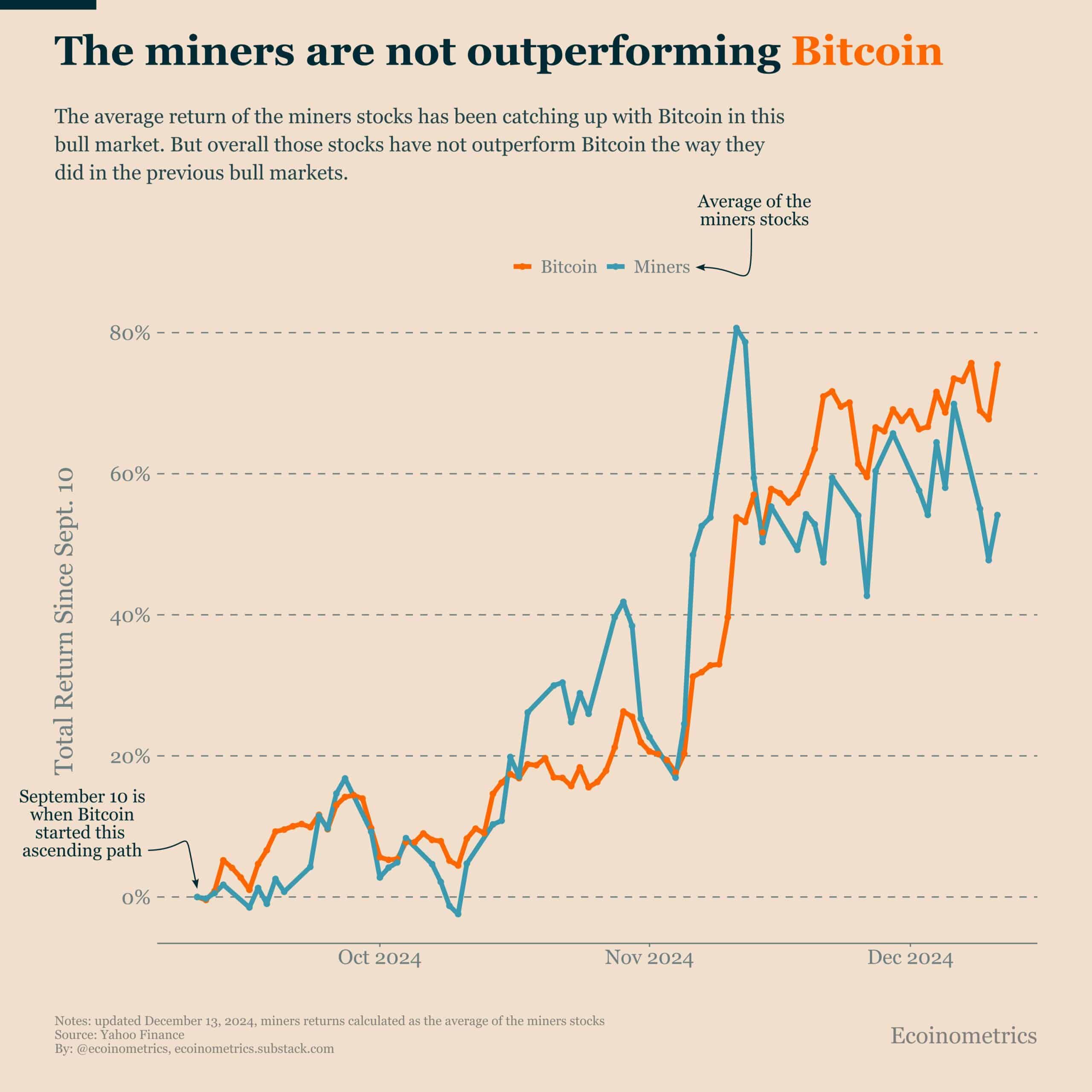

The plot thickens as buyers more and more flip to mining shares as an funding device, intently tied to Bitcoin’s value. When Bitcoin drops, these shares observe, leaving buyers with losses.

As ROI continues to shrink, extra buyers are pulling out, forcing mining firms to both unload their Bitcoin holdings or shut down. This dynamic, in flip, straight or not directly impacts Bitcoin’s value, including one more layer of volatility to the market.

A more in-depth take a look at the chart above revealed an fascinating sample – The anticipated returns on Bitcoin holdings didn’t play out the best way mining firms anticipated, notably as Bitcoin neared the $100k mark.

In a typical situation, this might have induced mining shares to surge, attracting new buyers looking forward to a slice of the motion.

And but, Marathon Digital Holdings (MARA) has been on a gradual downtrend, signaling a shift in a market that calls for deeper exploration.

What’s behind this variation?

Since launching in January, Bitcoin ETFs have made it simpler for each institutional and retail buyers to realize publicity to Bitcoin with out truly proudly owning it.

This new funding automobile removes the complexities of pockets administration and mining. In reality, on the day the “Trump pump” started, $1.3 billion in inflows had been recorded into Bitcoin ETFs.

Clearly, these newer gamers are shortly outpacing conventional mining shares, providing a “less risky” route for buyers wanting to faucet into Bitcoin’s potential.

Learn Bitcoin [BTC] Worth Prediction 2024-2025

However right here’s the catch – This shift isn’t with out its dangers. As large establishments like BlackRock (IBIT) scoop up enormous quantities of BTC, Bitcoin’s decentralized nature is beginning to really feel the pressure. In reality, ultimately rely, BlackRock held a staggering 530K BTC.

With such massive gamers within the combine, their affect on Bitcoin’s value is simple. Traders want to remain sharp, train warning, and hold an in depth eye on their holdings shifting ahead.