- BTC’s Funding Price reached a multi-month excessive.

- BTC buyers had been accumulating the coin, hinting at a doable upcoming value rise.

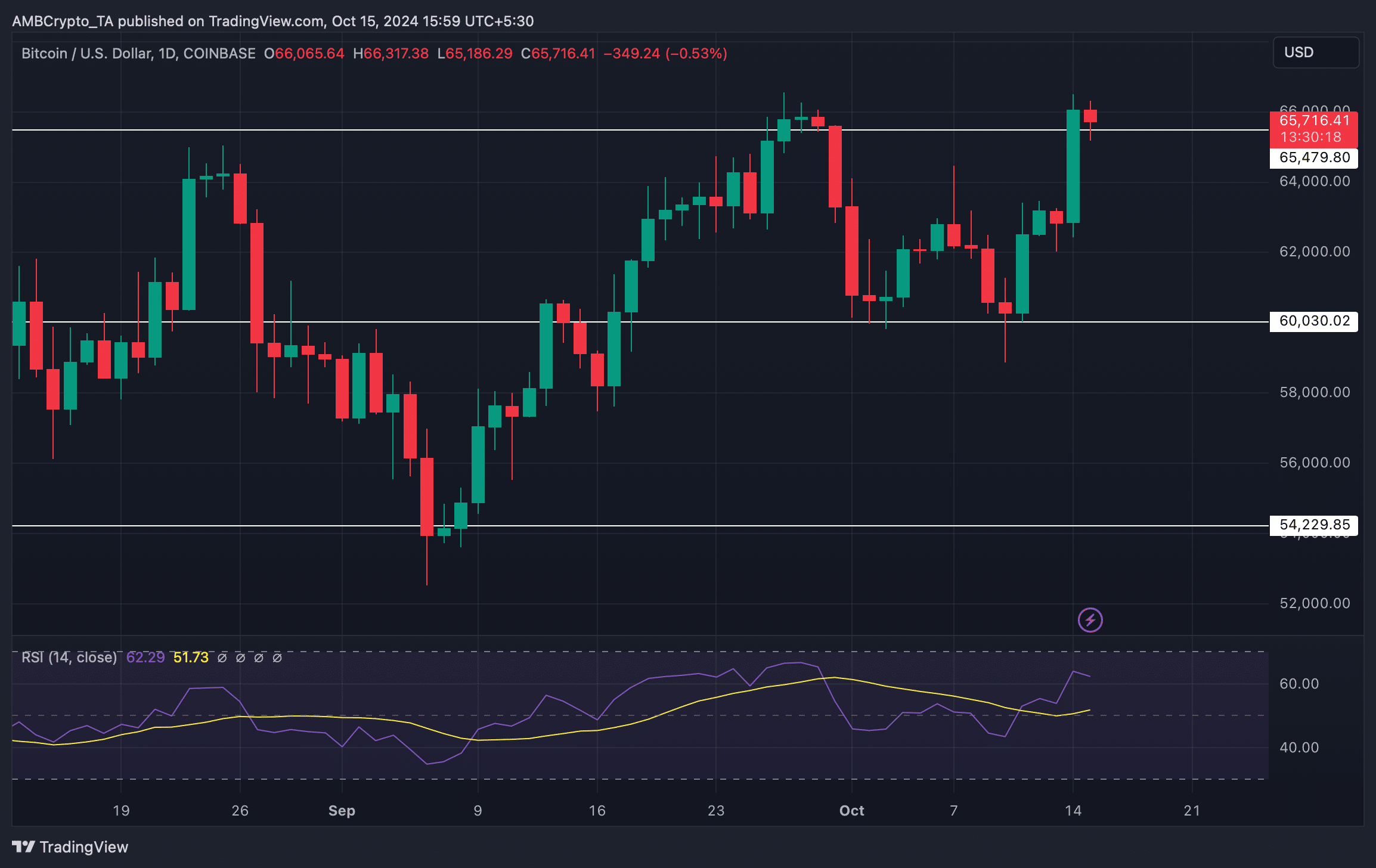

Bitcoin [BTC] has once more managed to cross the $65k resistance degree after plummeting below that just a few days in the past. This current value uptick should have stirred up bullish sentiment out there.

The higher information was {that a} key metric reached a multi-month excessive, additional suggesting an enormous rise in constructive sentiment across the king coin.

Bitcoin reaches new highs

BTC’s value motion has witnessed inexperienced over the previous few days as its value elevated by greater than 4% within the final seven days.

On the time of writing, the king coin was buying and selling at $65,561.08 with a market capitalization of over $1.3 trillion.

The king coin’s buying and selling quantity additionally elevated whereas its value surged, which usually acts as a basis for a bull rally.

Whereas all this occurred, BTC’s Futures reached new highs. To start with, BTC’s Funding Price touched a multi-year excessive.

When the Funding Price rises, it signifies that extra money is flowing right into a community, which hints at an increase in bullish sentiment.

Aside from that, Ali, a preferred crypto analyst, lately posted a tweet revealing one more achievement within the futures area.

As per the tweet, BTC’s Open Curiosity throughout all exchanges simply hit a brand new all-time excessive of $19.75 billion! A spike like this usually alerts massive value strikes forward, with extra capital on the road.

Subsequently, AMBCrypto deliberate to examine the king coin’s on-chain information to seek out out whether or not this newfound curiosity in BTC would lead to a continued value hike.

What’s subsequent for BTC?

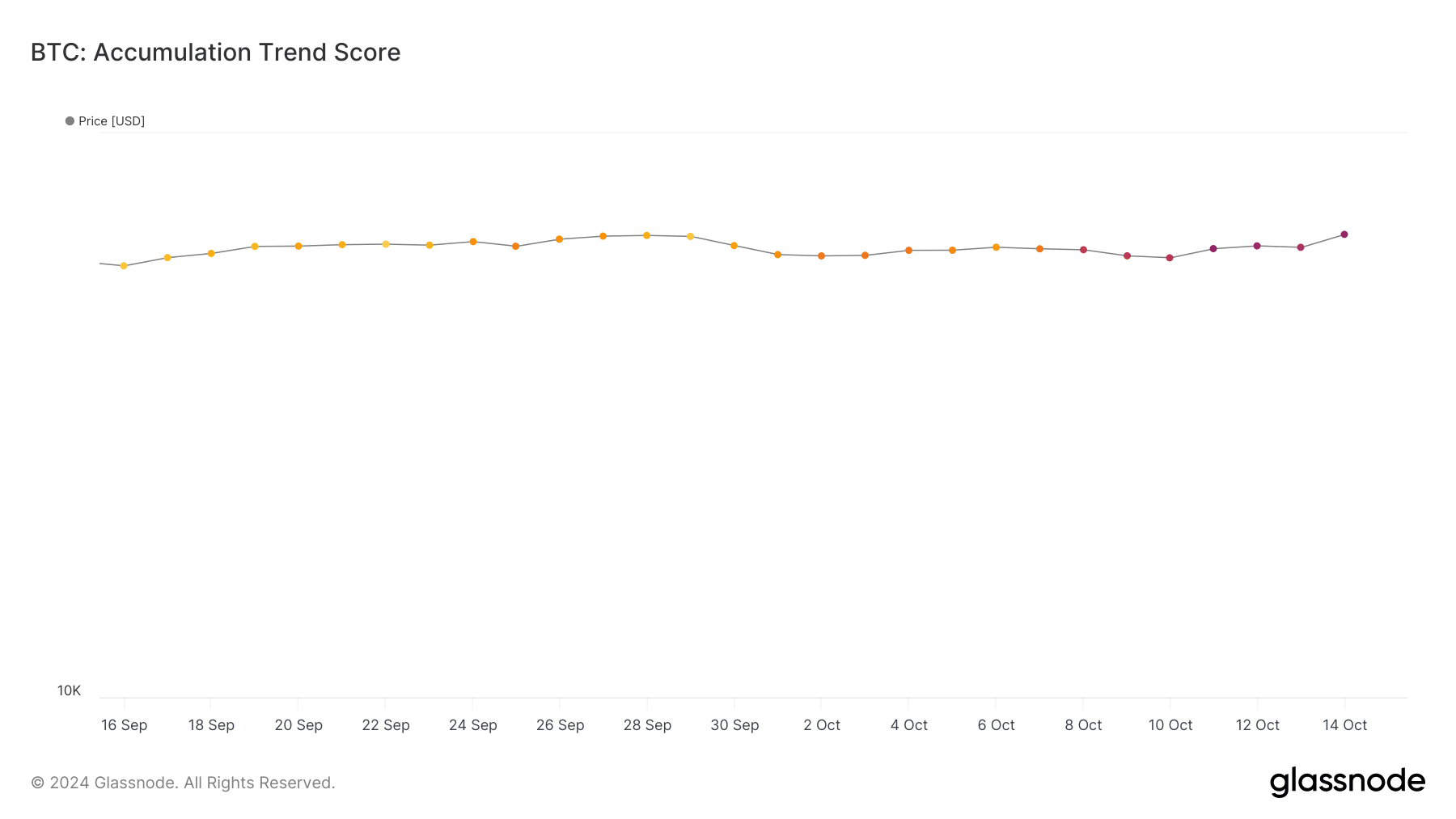

As per our evaluation of Glassnode’s information, buyers’ curiosity in BTC additionally mirrored in accumulation. We discovered that BTC’s accumulation pattern rating elevated from 0.2 in late September to 0.6 in October.

For starters, the buildup pattern rating is an indicator that displays the relative measurement of entities which can be actively accumulating cash on-chain when it comes to their BTC holdings.

A quantity nearer to 1 signifies that shopping for strain is rising.

Nevertheless, not every thing was in Bitcoin’s favor.

AMBCrypto’s have a look at CryptoQuant’s information revealed that BTC’s web deposit on exchanges was excessive in comparison with the final seven-day common, suggesting that promoting strain elevated in the previous few days.

Every time promoting strain rises, it hints at a value correction.

Life like or not, right here’s PEPE’s market cap in BTC’s phrases

Subsequently, AMBCrypto assessed BTC’s each day chart to raised perceive what to anticipate. We discovered that after breaking a resistance, BTC turned the identical degree into its assist.

Nevertheless, the Relative Power Index (RSI) registered a downtick. This recommended that BTC won’t maintain its assist.