- Bitcoin shed quite a lot of its current features through the week previous Election Evening within the U.S

- Historic patterns pointed to an upcoming bull rally on the charts

After peaking ever nearer to its all-time excessive [ATH] with a worth of $73,600, Bitcoin [BTC] took a detour. In actual fact, it slid all the way down to a low of $67,459 on 3 November.

Nonetheless, does this decline imply the bear market is again or is it merely a short-term correction?

Why is Bitcoin down?

To reply the query, AMBCrypto took a more in-depth take a look at BTC’s historic knowledge to uncover that the worth drop would possibly truly be the latter. For example, again in 2016, the cryptocurrency depreciated by 10% simply days earlier than the election.

Equally, in 2020, Bitcoin’s worth dropped by 6.2%. BTC’s ongoing decline appears to be mirroring these previous patterns, with Bitcoin shedding over 8% of its worth because the aforementioned excessive.

Election-driven uncertainty

An identical outlook was shared by Quinten Francois, Co-founder of WeRate, who defined that the interval of heightened unpredictability earlier than elections instantly impacts investor sentiment. He posted on X,

“Financial markets don’t like uncertainty. There is a lot of uncertainty going into election week. That’s why $BTC is down.”

The Founding father of CryptoSea, famously referred to as Crypto Rover, supported this attitude by stating,

“Bitcoin always dumps right before the U.S. elections.”

Right here, it’s value declaring that at press time, the cryptocurrency had recovered to commerce slightly below $69,000 on the charts.

What’s subsequent for Bitcoin?

With the dip’s trigger seemingly rooted within the uncertainty surrounding the upcoming elections, the urgent query is – What comes subsequent for the king coin?

Properly, earlier patterns dictate that post-election intervals have marked the start of bull runs that reach properly into the next 12 months.

In 2016, Bitcoin gained by roughly 60% two months after the election.

Moreover, an approximate achieve of 150% was recorded after the presidential elections in 2020.

So, if historical past repeats itself, BTC might hit a brand new ATH within the upcoming months.

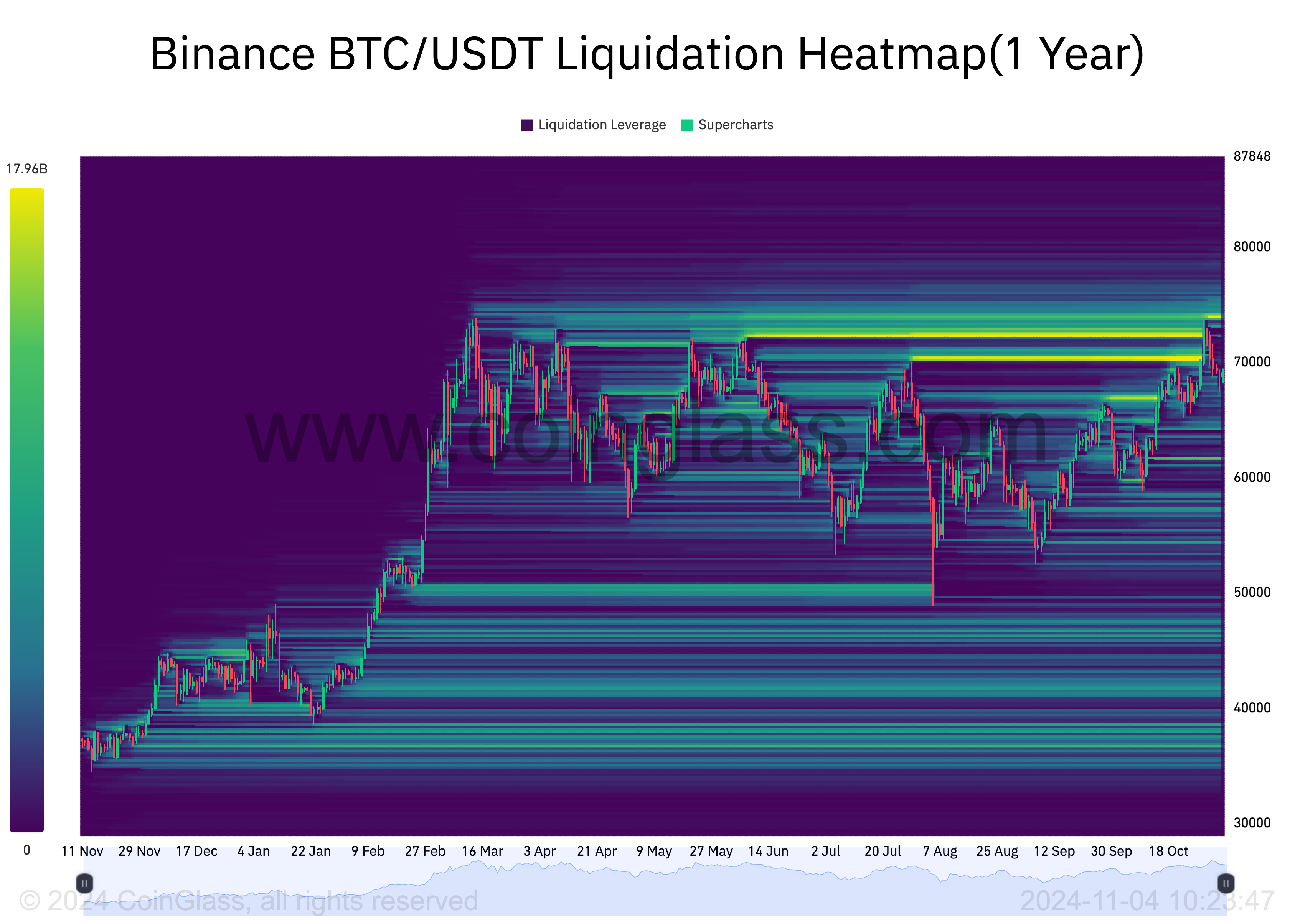

Lastly, AMBCrypto’s evaluation of the 1-year liquidation heatmap from Coinglass additionally alluded to the chance of extra highs.

A robust cluster of liquidity was shaped round $74,000. This magnetic zone might appeal to the worth, marking a brand new ATH for the king coin.

Altcoin outlook – Trump vs. Harris victory

Whereas a Bitcoin bull run appears seemingly whatever the election final result, the outlook for altcoins varies. AMBCrypto beforehand reported {that a} Donald Trump win might imply a extra favorable surroundings for altcoins.

This, due to probably relaxed crypto laws from the Republican administration. Clearer SEC pointers on which altcoins qualify as securities might additionally set off bull runs for the property.

Additionally, AMBCrypto famous that as Bitcoin traders redistribute earnings after elections, some altcoins might see features. Nonetheless, the chance of an enduring “altcoin season” stays unsure proper now.