- BTC and ETH traded beneath their most ache factors, suggesting that merchants would possibly face extreme losses

- Implied Volatility dropped, implying an absence of bullish expectations going ahead

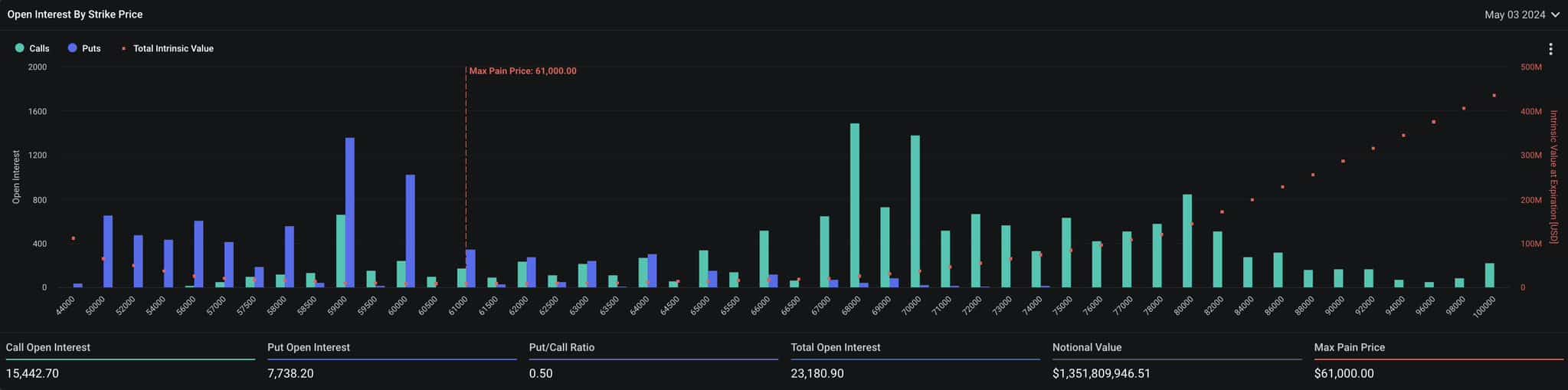

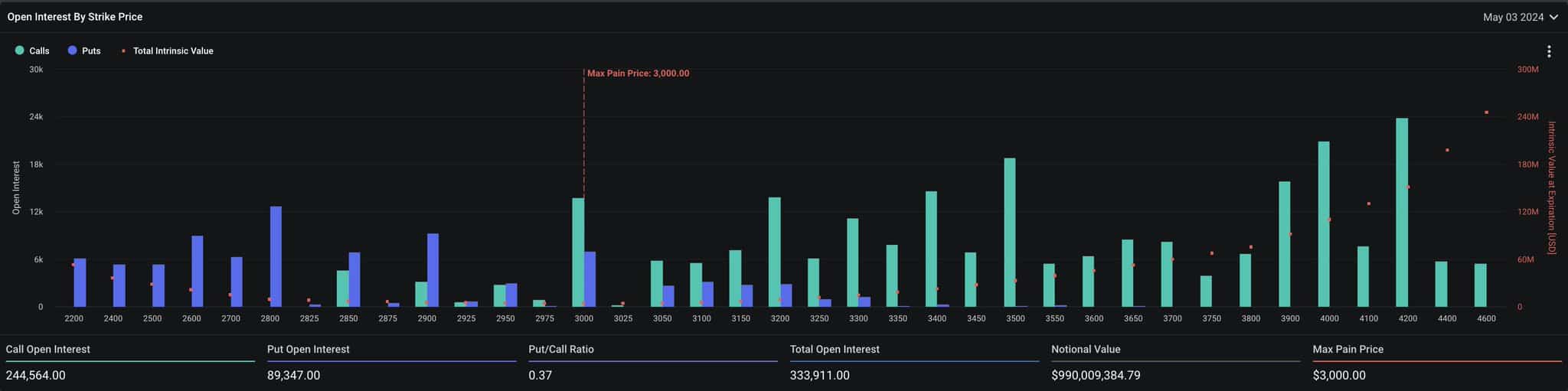

Bitcoin [BTC] and Ethereum [ETH] choices contracts value about $2.3 billion are set to run out on Friday, 3 Could. In line with Deribit Change, the Bitcoin choices are valued at $1.35 billion. ETH contracts, however, are value $990 million. The worth of those contracts appears to be decrease than the determine AMBCrypto reported final week – $9.3 billion.

The decline might be attributed to the worth motion of each cryptocurrencies. For a lot of the week, BTC and ETH recorded extreme declines earlier than current appreciation. Because of this, merchants have been cautious about opening extra positions.

On the time of writing, Bitcoin’s put/name ratio (PCR) was 0.50. This ratio gauges the general market temper. A PCR increased than 1 means that merchants are shopping for extra places than calls— An indication of bearish sentiment.

Anarchy looms as merchants gear up for outcomes

Nonetheless, if the PCR is decrease than 0.70, it implies extra calls than places, which means that the broader sentiment is bullish. Merely put, the studying means that merchants count on Bitcoin to finish the week stronger than the way it began.

For Bitcoin, the utmost ache level was $61,000 on the charts. Which means that if Bitcoin drops to this value, most choices merchants will undergo intense losses.

In Ethereum’s case, its PCR was 0.37, implying that there have been extra bullish bets than bearish ones. The utmost ache level for ETH was $3,000. As such, merchants would possibly must hope that the altcoin trades above this degree earlier than the day ends.

At press time, each Bitcoin and Ethereum have been valued at ranges beneath the max ache level. If this stays the case by the point the contracts expire, the day might be a “red one” for a lot of merchants.

There are a number of explanation why BTC and ETH would possibly finish the week on a bearish notice. Greeks.stay, the notable Choices buying and selling deal with on X, defined,

“The Hong Kong ETF listing failed to bring much incremental volume, the US BTC ETF continued to flow out, the weakness of the market led to weakening market confidence. The current point of sustained sideways trading is unlikely, no rebound is bound to be a downward relay, the giant whale on the lack of confidence in the market.”

Volatility falls: Will BTC and ETH observe?

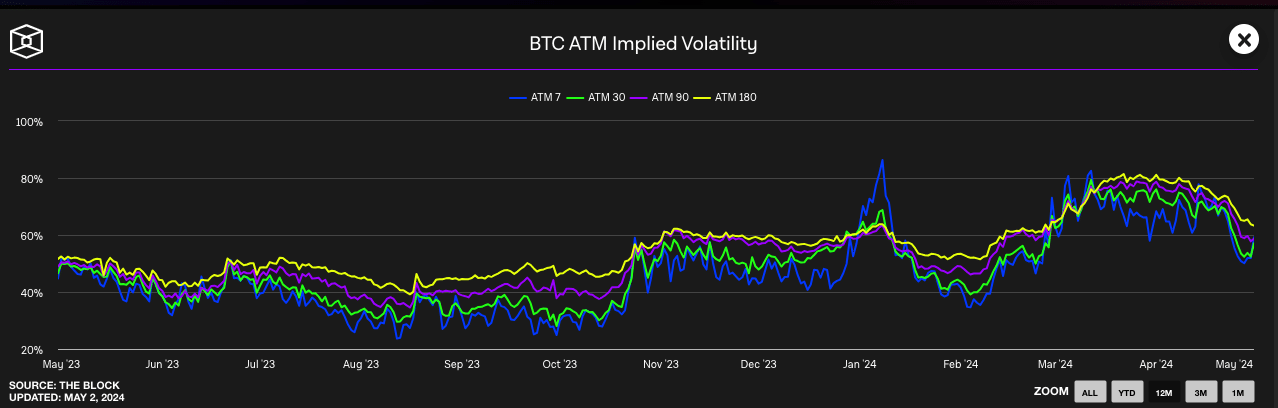

As well as, AMBCrypto checked out Bitcoin’s Implied Volatility (IV). The IV reveals the extent of confidence out there, and if it could be a good suggestion to purchase name/put choices going ahead.

If the IV will increase, market individuals are unsure the place the subsequent costs would possibly transfer. Nonetheless, if the metric declines, it means merchants are unwilling to pay a further payment to safeguard their current positions.

Given the worth of Bitcoin and ETH, the IV declined, suggesting that merchants have been unsure that their bullish bets would repay.

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

Ought to this sentiment play out, ETH’s value would possibly slip beneath $2,900 once more. For BTC, it would begin buying and selling at a decrease worth than $59,000 once more.