- Bitcoin ETFs face important outflows, indicating rising warning out there.

- Ethereum ETFs present combined efficiency with latest inflows amid ongoing skepticism.

The Bitcoin [BTC] ETF market has not too long ago shifted into bearish territory, as evidenced by a sequence of outflows spanning from the twenty sixth to the thirtieth of August.

Bitcoin ETF analyzed

In accordance with Farside Traders, this four-day interval noticed a considerable web outflow of $277 million from varied BTC ETFs.

Notably, ARK Make investments and 21Shares’ ARKB skilled important withdrawals totaling $220 million, whereas Grayscale’s GBTC confronted a surge in outflows amounting to $119 million.

Even BlackRock’s IBIT, which had beforehand seen optimistic inflows, reported zero flows on three out of 4 days, with flows stagnating at $13.5 million on twenty ninth August.

This pattern underscores a rising cautious sentiment within the Bitcoin ETF sector.

Neighborhood stays optimistic

Nonetheless, regardless of the latest downturn in Bitcoin’s efficiency, many business execs stay optimistic about its future.

Remarking on the identical, Chip from onthechain.io took to X to precise this sentiment, and mentioned,

“I don’t see Bitcoin disappearing anytime soon, especially with the solid support it has right now.”

Right here he highlighted how the introduction of BTC ETFs has strengthened Bitcoin’s standing within the monetary business.

Nonetheless, he additionally identified of phrase of warning and added,

“Still, as the market changes and new technologies arise, Bitcoin might eventually lose some of its appeal in the long run.”

Ethereum ETF defined

In distinction to Bitcoin ETFs, Ethereum [ETH] ETFs have demonstrated a extra secure efficiency.

Regardless of some outflows, totaling $12.6 million in the course of the noticed interval, Ethereum ETFs have proven indicators of restoration.

Grayscale’s Ethereum ETF (ETHE) skilled a notable outflow of $27.86 million.

Nonetheless, BlackRock’s ETHA and Grayscale’s Mini Ethereum Belief reported optimistic momentum, with inflows of $8.4 million and $3.57 million, respectively, suggesting a cautious but optimistic outlook for Ethereum within the ETF market.

Regardless of latest inflows, skepticism stays in regards to the potential of Ethereum ETFs, as highlighted by TourBillion who mentioned,

“Ethereum is just hanging on hopeium.”

Affect on value

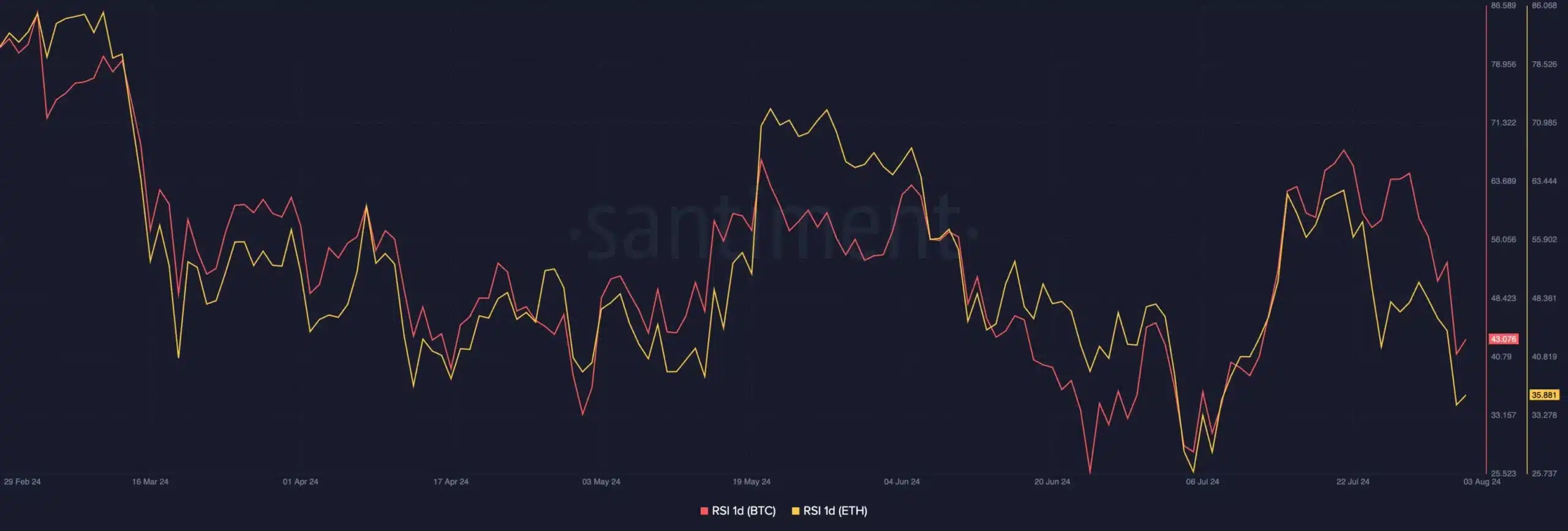

In the meantime, regardless of latest value upticks for each Bitcoin and Ethereum, with positive factors of 0.42% and 1.82% respectively, a deeper have a look at Santiment information reveals underlying bearish sentiment.

AMBCrypto’s evaluation of the 2 tokens signifies that, though costs are rising, the Relative Power Index (RSI) for each cryptocurrencies stays beneath the impartial stage.

This means that the market sentiment remains to be cautious and should take time to shift in the direction of a extra bullish outlook.