- IBIT’s choices debut hit $4.28 billion, driving Bitcoin to a brand new all-time excessive.

- Grayscale’s upcoming launch of spot Bitcoin ETF choices alerts growing competitors within the crypto funding panorama.

On nineteenth November, choices buying and selling for the primary spot Bitcoin [BTC] ETF made its debut, fueling Bitcoin’s ascent to yet one more all-time excessive.

As anticipated, BlackRock’s iShares Bitcoin Belief (IBIT), the inaugural spot Bitcoin ETF accepted for choices buying and selling, spearheaded this milestone.

Seyffart on Bitcoin ETF choices

The launch generated important market exercise, with practically $1.9 billion in notional publicity traded, as highlighted by Bloomberg Intelligence ETF analyst James Seyffart.

Remarking on the identical, Seyffart famous,

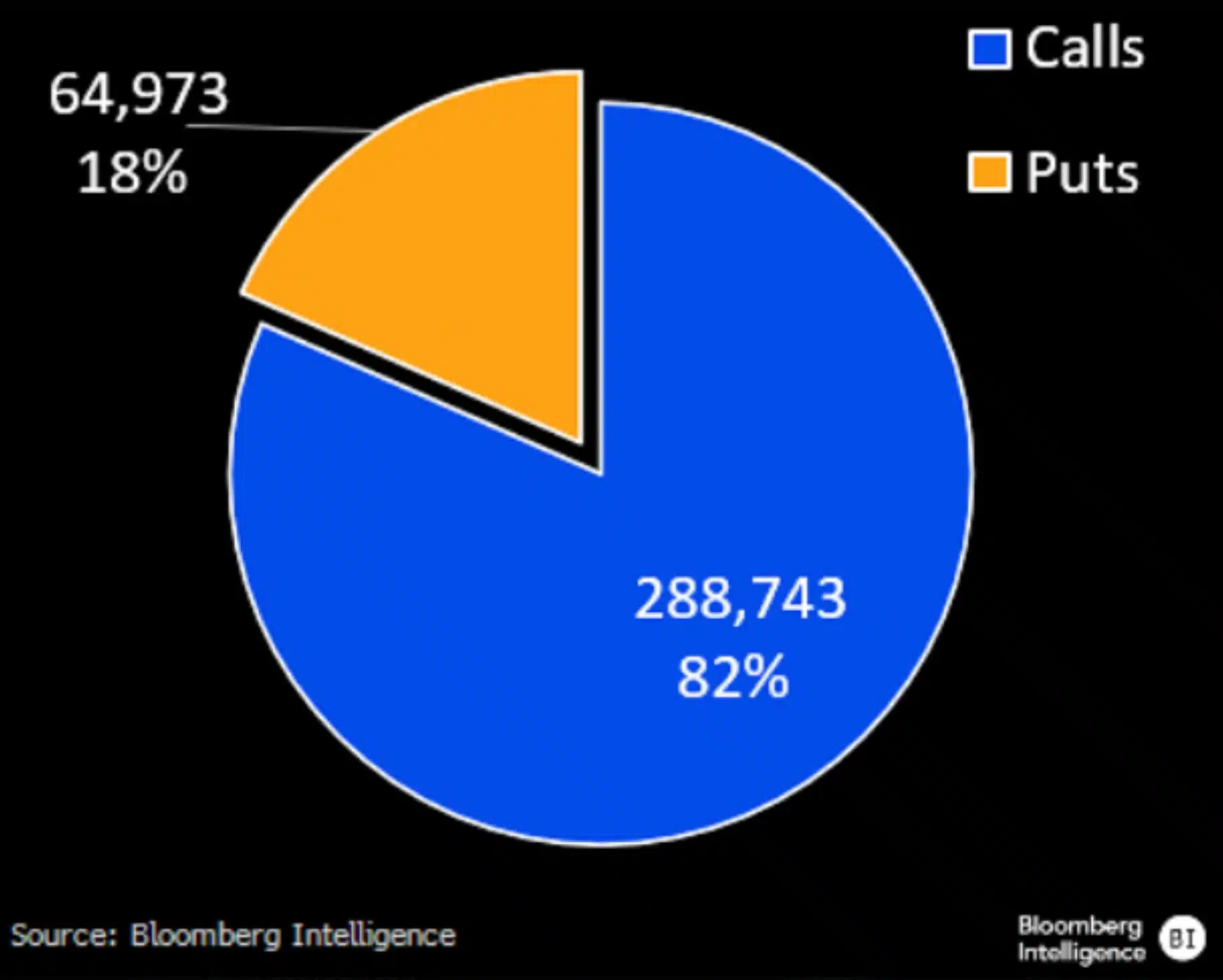

“Final tally of $IBIT’s 1st day of options is just shy of $1.9 billion in notional exposure traded via 354k contracts. 289k were Calls & 65k were Puts.”

He added,

“That’s a ratio of 4.4:1. These options were almost certainly part of the move to the new #Bitcoin all time highs today.”

How will the choices buying and selling assist Bitcoin ETF?

For these unaware, within the realm of choices buying and selling, a name choice grants the client the proper, however not the duty, to buy an asset at a predetermined worth inside a set timeframe.

If exercised, the vendor of the decision is required to promote the asset on the agreed worth.

Conversely, a put choice permits the holder to promote the asset at a specified worth on or earlier than its expiration date, offering a strategic mechanism for hedging or taking advantage of worth actions out there.

When in comparison with the ProShares Bitcoin Technique ETF (BITO), the primary ETF providing Bitcoin publicity within the U.S., the current exercise in Bitcoin choices buying and selling stands out considerably.

As an example, BITO, which launched with a lot anticipation, recorded $363 million in buying and selling quantity on its debut.

Balchunas echoes the same sentiment

Bloomberg’s senior ETF analyst, Eric Balchunas, highlighted this comparability to underscore the substantial momentum behind the brand new choices market, reflecting the rising investor curiosity in Bitcoin-related monetary merchandise and mentioned,

“$1.9 billion is unheard of for day one.”

Balchunas additional emphasised the outstanding progress of a newly launched Bitcoin-related ETF, which has already reached $1.9 billion in buying and selling quantity regardless of working underneath a 25,000 contract place restrict.

This efficiency far surpasses the $363 million milestone achieved by $BITO over 4 years.

Nevertheless, when in comparison with well-established ETFs like $GLD, which recorded $5 billion in a single day, the brand new ETF nonetheless has room for progress.

These figures spotlight its sturdy potential to draw even larger investor curiosity because it continues to construct momentum out there.

What’s subsequent?

Evidently, the outstanding success of IBIT’s choices buying and selling debut has pushed a formidable $4.28 billion in worth traded on nineteenth November, a milestone typically related to mixed flows from a number of high-performing funds reasonably than a single entity.

This achievement underscores the rising urge for food for Bitcoin-related monetary devices.

In the meantime, Grayscale is about to accentuate competitors with the launch of choices for its spot Bitcoin ETFs on twentieth November.

Thus, it might be attention-grabbing to see how this may sign a quickly evolving panorama for institutional-grade crypto funding merchandise in the USA.