- Bitcoin ETFs have attracted sturdy inflows, outpacing subdued demand for altcoin ETFs like Ethereum

- Layer 2 developments increase Bitcoin’s utility, difficult Ethereum and bolstering its market dominance

Bitcoin’s [BTC] market dominance is projected to stay sturdy all through 2025, based on a latest evaluation by JPMorgan. At the moment holding round 55% of the cryptocurrency market’s complete capitalization, Bitcoin continues to outpace Ethereum and different altcoins. Led by Nikolaos Panigirtzoglou, the workforce of analysts cited a number of components reinforcing Bitcoin’s place because the main digital asset, signaling its enduring affect in an more and more aggressive panorama.

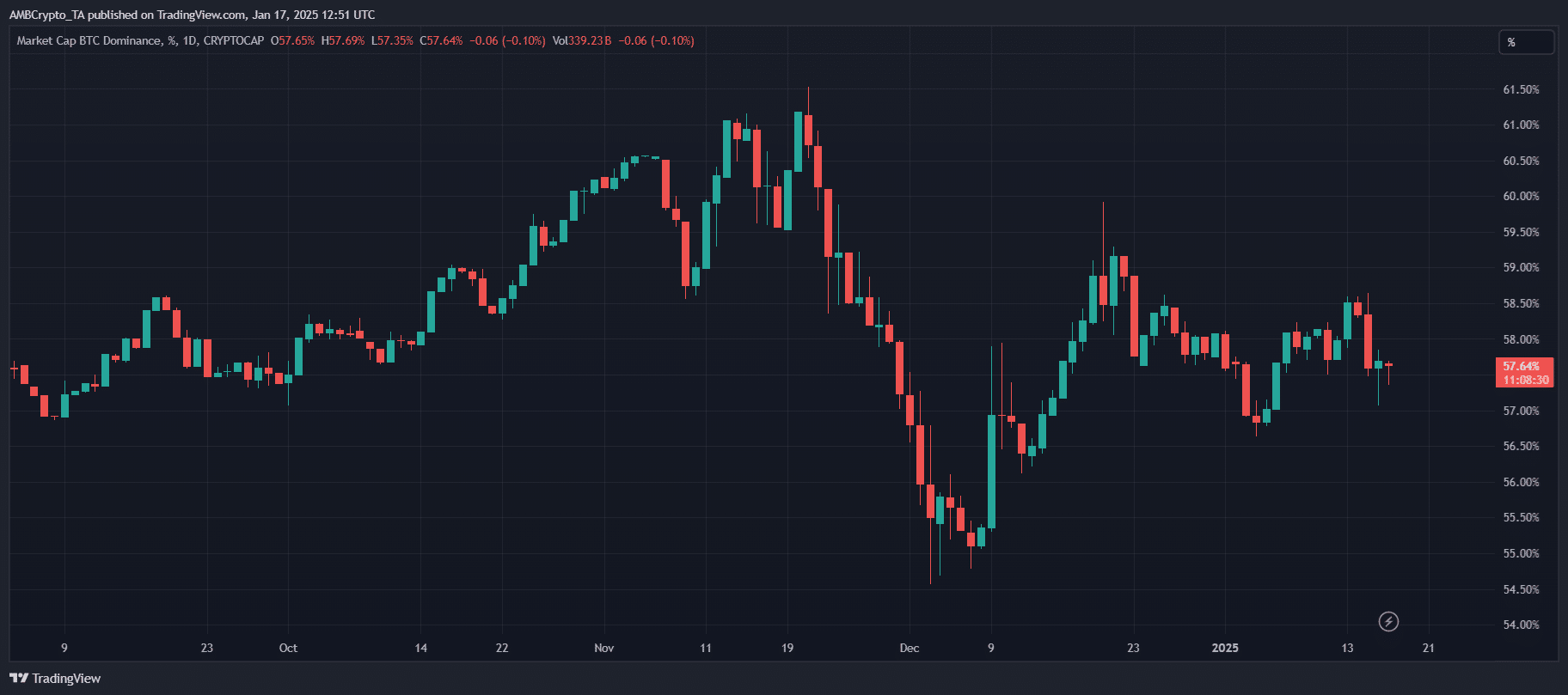

Bitcoin’s market dominance

BTC’s dominance has been fluctuating between 57% and 58% currently, showcasing constant energy regardless of unstable market situations. This stability stems from Bitcoin’s standing because the go-to retailer of worth amid uncertainty and regulatory challenges confronted by altcoins.

With Ethereum’s dominance stagnant and different altcoins failing to realize floor, Bitcoin continues to learn from institutional curiosity and its established popularity. The truth is, the chart additionally mirrored periodic corrections, that are anticipated as a part of pure market cycles.

General, Bitcoin’s dominance trajectory revealed its enduring attraction and highlighted its pivotal function in shaping the market panorama in 2025.

What’s behind it?

JPMorgan analysts have outlined eight key drivers that would maintain Bitcoin’s market dominance into 2025. On the forefront is Bitcoin’s positioning because the digital counterpart to gold, attracting important inflows into Spot Bitcoin ETFs, whereas altcoin ETFs, corresponding to Ether’s, have seen subdued demand with solely $2.4 billion in inflows to date. Including to that is MicroStrategy’s ongoing $42 billion Bitcoin acquisition technique, which is barely midway full and anticipated to bolster market momentum.

Future crypto reserve accumulation by U.S. states or central banks is one other issue more likely to favor Bitcoin solely, solidifying its function as a reserve asset. Moreover, developments in Bitcoin’s Layer 2 networks have enabled sensible contract capabilities, difficult Ethereum’s dominance in decentralized functions.

Institutional blockchain functions have more and more shifted to non-public networks, lowering reliance on public blockchains like Ethereum. In the meantime, rising tasks, corresponding to Base, are specializing in infrastructure over token issuance, shifting worth away from altcoins. Lastly, the uncertainty surrounding U.S. regulatory readability provides to Bitcoin’s attraction because the market consolidates.

Learn Bitcoin’s [BTC] Value Prediction 2025-26