- Bitcoin promote stress suggests sensible cash is taking some income off the desk.

- BTC on observe to conclude September with wholesome beneficial properties, however can it maintain the momentum in October?

Bitcoin [BTC] has kicked off this week on a bearish tone after displaying some bullish weak point through the weekend. The cryptocurrency maintained a gentle rally for the final three weeks however could possibly be on the verge of a retracement.

The Bitcoin rally was in step with the resurgence of robust bullish sentiment this month. Crowd sentiment particularly shifted aggressively from concern to greed in a matter of weeks.

The identical was evident in sensible cash sentiment, however the latter has extra impression over directional modifications.

BTC’s sensible cash sentiment just lately shifted again in the direction of the aspect of concern. That is in step with the resurgence of promote stress this week.

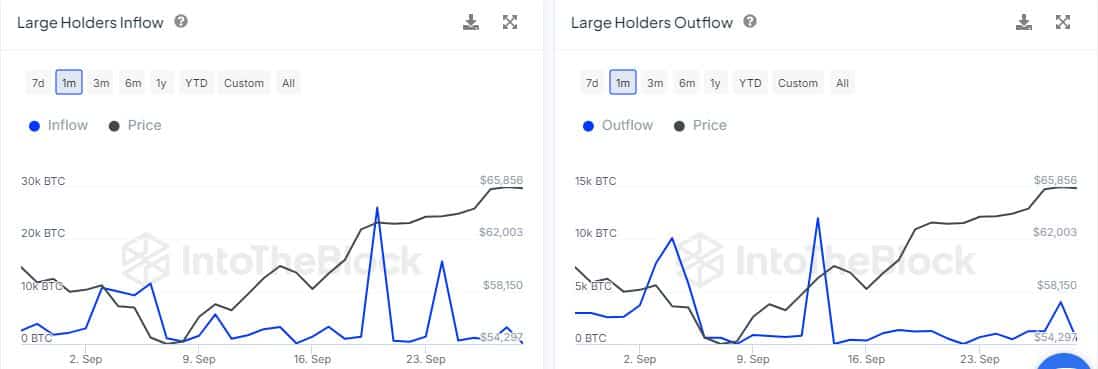

In the meantime, the gang sentiment remained on the aspect of greed. An evaluation of enormous holder flows revealed a decline in Bitcoin deal with inflows within the final 10 days.

There was additionally a internet acquire in giant holder outflows throughout the identical time.

Giant holder inflows had been right down to 101.15 BTC throughout Sunday’s buying and selling session. Giant holder outflows had been greater at 360 BTC, confirming that enormous addresses had internet outflows, thus shifting from bullish to bearish momentum.

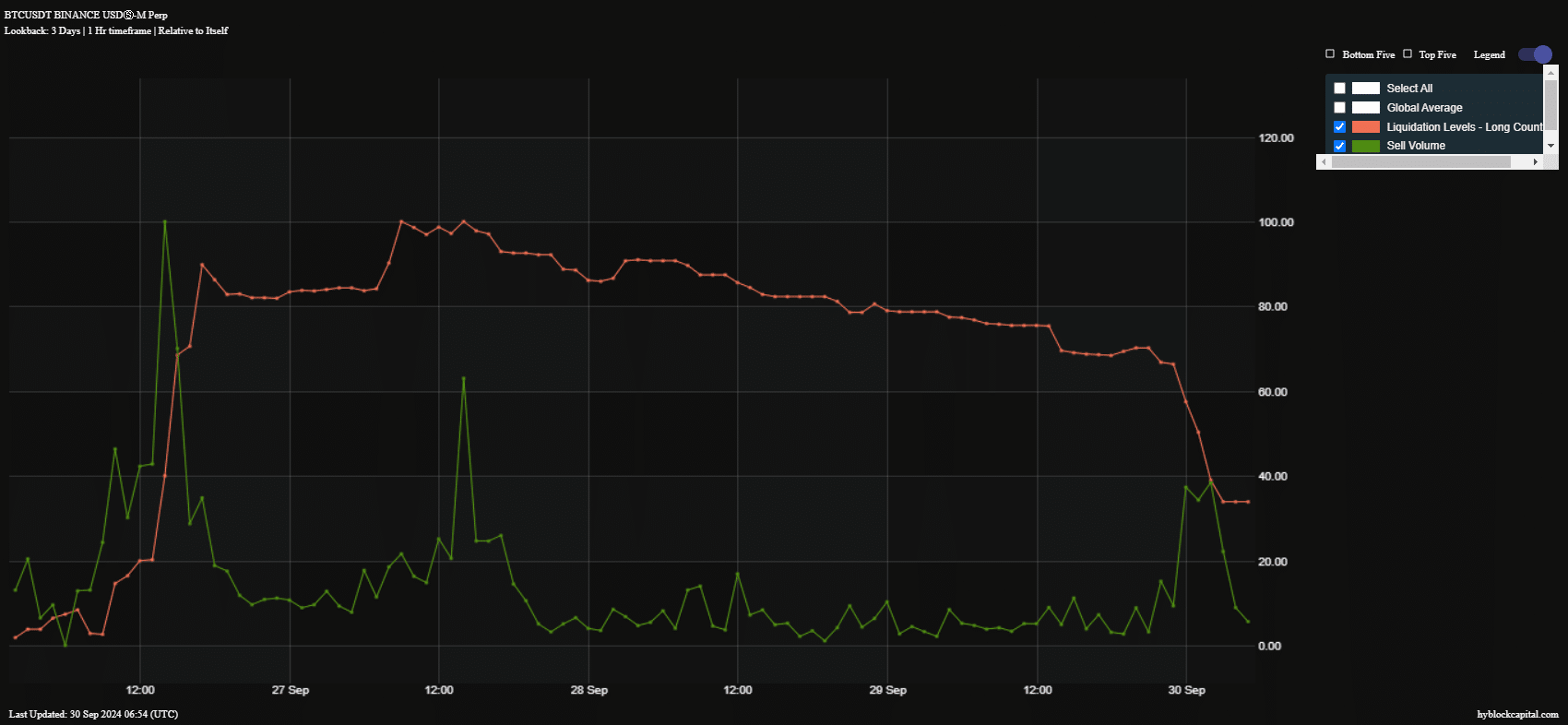

There was additionally a notable spike in promote quantity within the final 24 hours, though not as a lot as what we noticed on Friday.

The distinction is that this time the extent of liquidations has been declining versus the rising liquidations final week.

There was additionally a slight uptick within the variety of shorts executed within the final 24 hours. This confirms a surge in bearish sentiment.

Will Bitcoin slip beneath $60,000?

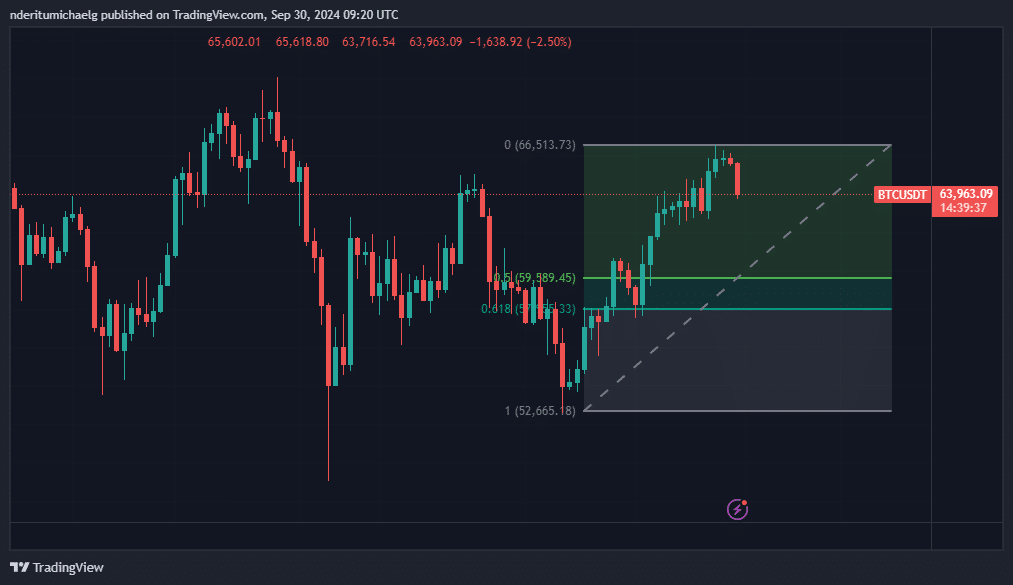

Bitcoin is on observe to shut September within the inexperienced regardless of the resurgence of promote stress. BTC exchanged arms at $64,073 at press time, which represents an 8.67% upside from its September opening value.

The cryptocurrency pulled off a 26.64% acquire from its lowest value, to its highest value within the final 4 weeks.

BTC’s newest pullback has thus far not demonstrated sturdy promote stress. Nonetheless, the market remains to be topic to alter, particularly within the occasion of a serious FUD occasion.

Learn Bitcoin’s [BTC] Value Prediction 2024 – 2025

However within the occasion of a large surge in promote stress, Bitcoin might discover its subsequent help stage between $57,955 and $59,589.

However, if Bitcoin kicks off September on a bullish tone, we might witness a bullish flag breakout. This may additional validate its restoration and potential push into value discovery.