- Bitcoin surged previous $70,000 because the Stablecoin Provide Ratio Oscillator highlighted excessive demand

- Open curiosity in Bitcoin climbed by 8.85%, suggesting potential for additional bullish momentum

After weeks of struggling to interrupt by means of the $70,000 resistance, Bitcoin lastly surged previous this crucial stage, buying and selling at near $72k at press time. The cryptocurrency’s current worth motion garnered a lot consideration, with the crypto climbing by 3.9% throughout the final 24 hours.

This rebound has come amid a common uptick in demand, indicated by varied market metrics – An indication that traders are regaining confidence in Bitcoin.

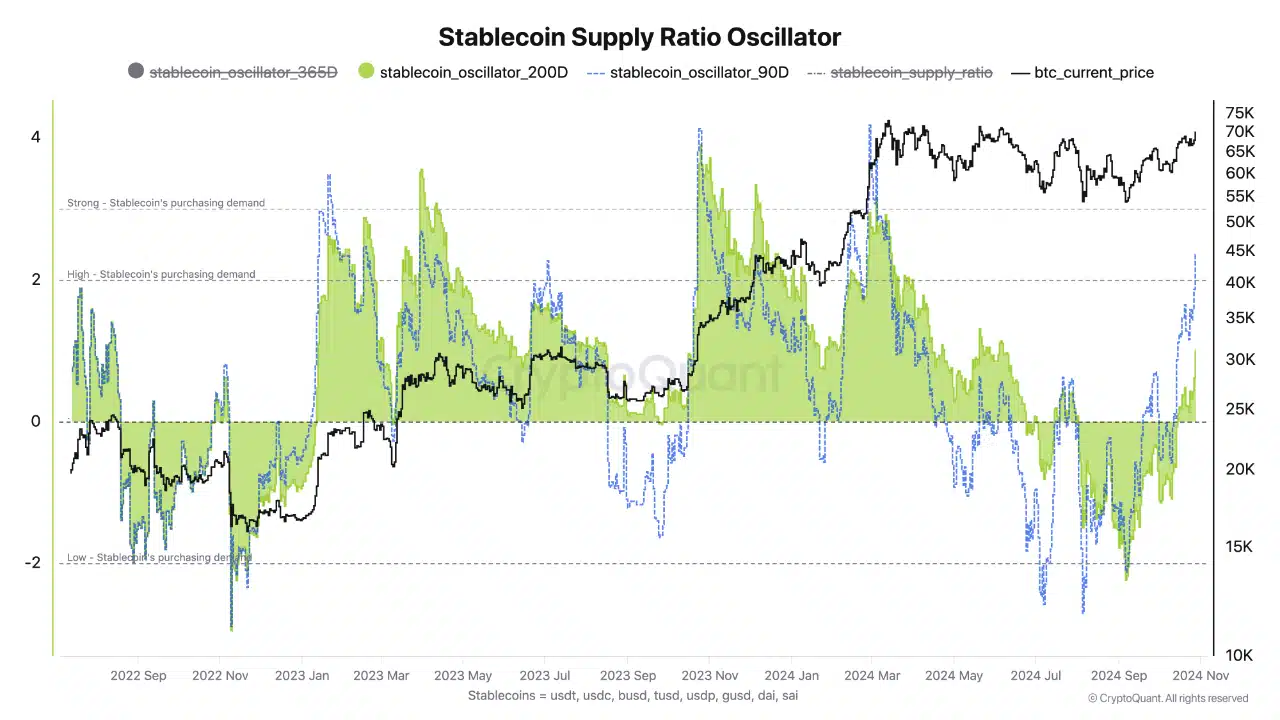

As an example – BinhDang, an analyst on CryptoQuant, highlighted that demand for BTC is now seeing a revival, as underlined by the Stablecoin Provide Ratio Oscillator (SSRO).

The SSRO measures Bitcoin’s market cap relative to stablecoins like USDT, USDC, BUSD, and others, providing insights into shopping for demand fueled by these stablecoins. In keeping with BinhDang, the oscillator’s knowledge pointed to a hike in stablecoin-fueled shopping for curiosity, a improvement seen equally when Bitcoin bottomed out in late 2022.

On the time of writing, Bitcoin’s 90-day SSRO signalled a resurgence in quarterly demand, surpassing the constructive 2-point mark. Because the cryptocurrency enters November, the continuation of this demand—coupled with constructive information within the macroeconomic panorama—might additional strengthen Bitcoin’s place, probably pushing it in direction of new highs.

Different key metrics present strengthening fundamentals

Past the crypto’s worth actions, Bitcoin’s basic metrics have additionally been exhibiting renewed energy.

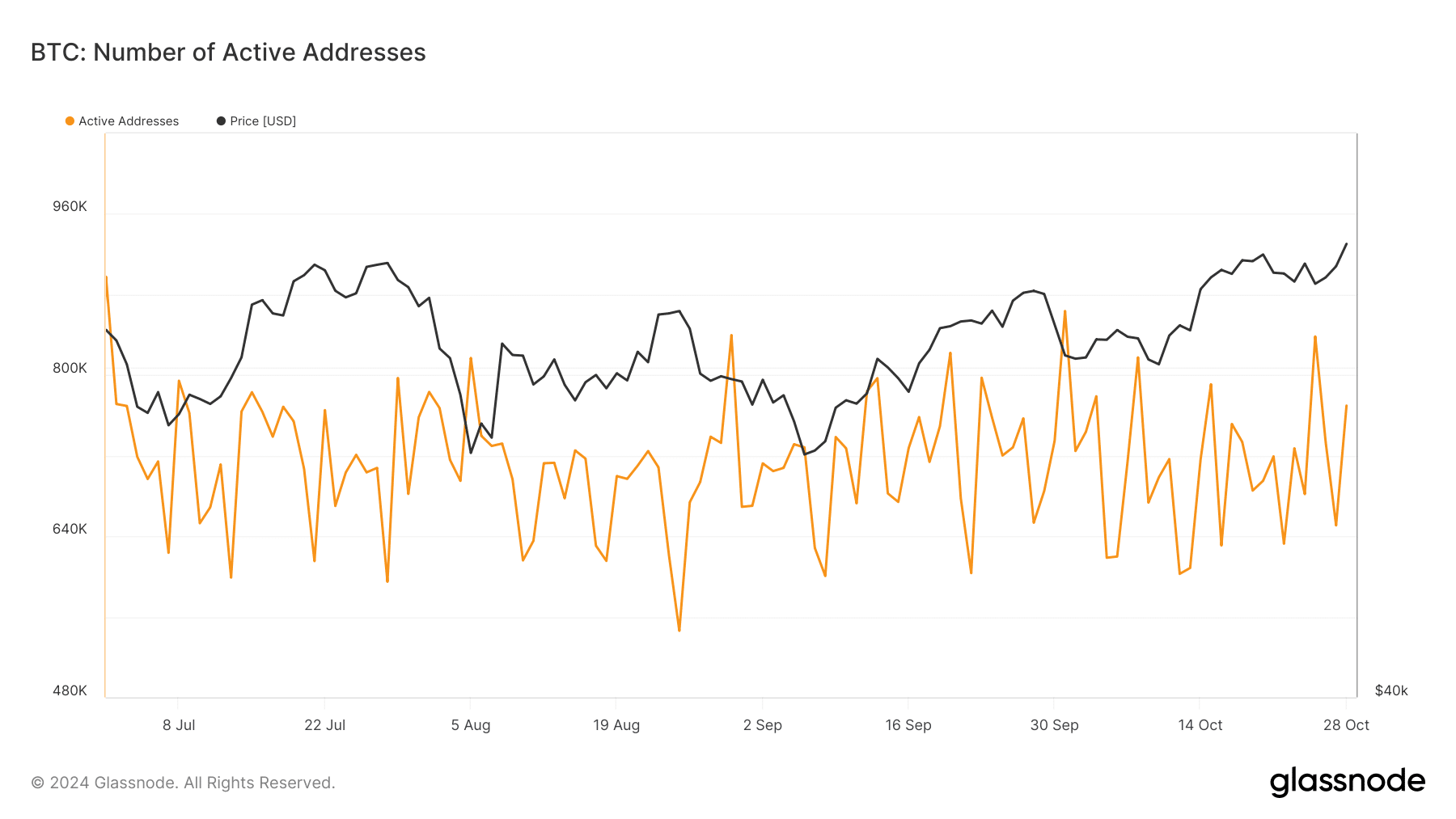

Actually, knowledge from Glassnode indicated a rise in lively BTC addresses over the previous few weeks, suggesting that extra contributors are re-entering the market. As of late October, lively addresses had surpassed 760,000, up from under 700,000 simply days prior.

This metric’s fluctuation highlighted shifting market engagement, with the newest uptick implying renewed curiosity, which regularly correlates with bullish worth motion. Larger exercise throughout addresses implies that extra transactions are occurring on the BTC community, usually a positive indicator of rising demand and market exercise.

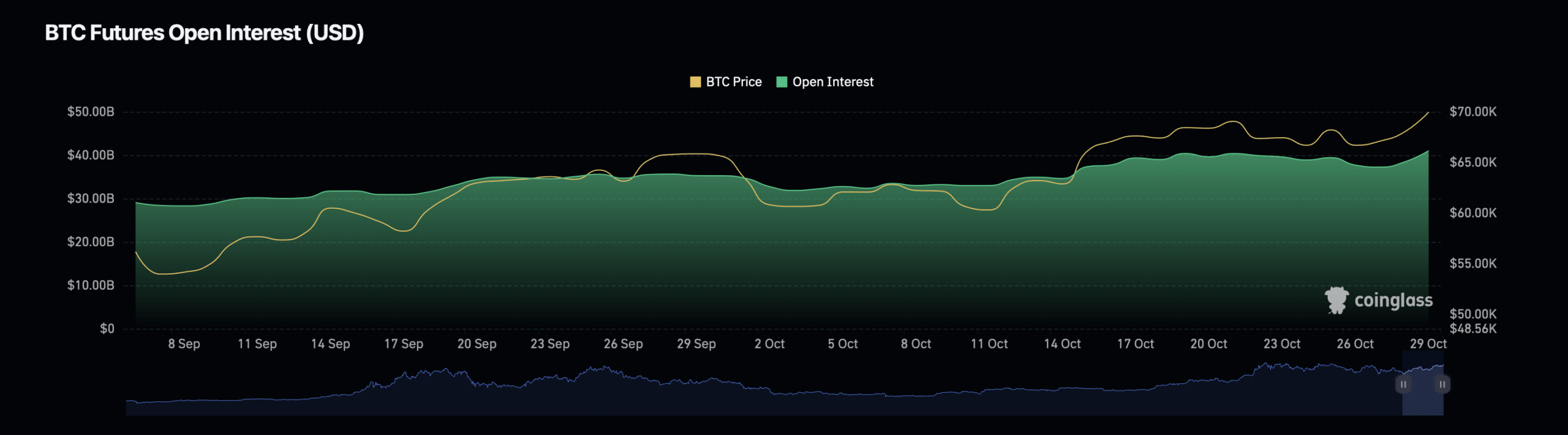

Concurrently, Bitcoin’s Open Curiosity, as tracked by Coinglass, hiked by 8.85% to achieve $42.56 billion. This surge in Open Curiosity—notably notable because it rose by 118.55% in quantity to $80.43 billion—demonstrated increased participation from Futures and derivatives merchants.

A rising Open Curiosity sometimes implies that extra capital is flowing into the market. This will create momentum and push costs increased as merchants place themselves to capitalize on Bitcoin’s subsequent potential transfer.