Market Overview: Bitcoin

Bitcoin current worth motion suggests a possible climax in shopping for stress, transitioning the market from a powerful uptrend right into a sideways and even corrective part.

This weekend marks a pivotal occasion in Bitcoin’s historical past – the fourth halving. This built-in mechanism reduces the reward for mining new Bitcoin blocks by 50%, limiting its provide and probably impacting its worth.

The primary halving in 2012 noticed Bitcoin’s worth surge from round $12 to over $1,000 inside a 12 months. Subsequent halvings have additionally been correlated with worth will increase, though with various magnitudes.

Halvings spotlight Bitcoin’s anti-inflationary design. With a finite provide, its rising shortage may drive additional demand and probably influence its long-term worth. This halving arrives as Bitcoin navigates a possible market turning level. Would be the Bitcoin worth larger after the following halving?

Bitcoin

The costs depicted on our charts are sourced from Coinbase’s Change Spot Value. It’s essential to notice that the spot worth of Bitcoin is constantly in movement; buying and selling exercise by no means ceases. Which means that market fluctuations and worth modifications happen across the clock, reflecting the dynamic nature of cryptocurrency buying and selling.

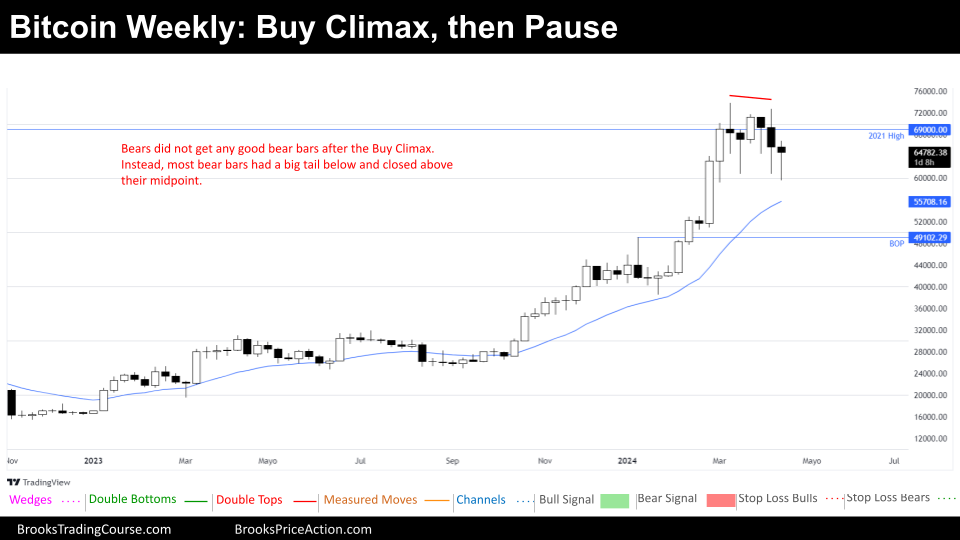

The Weekly chart of Bitcoin

The dominant bullish development that propelled Bitcoin by way of a powerful bull channel since early 2023 seems to have reached a climactic peak upon hitting the 2021 all-time excessive. The next six weeks of sideways worth motion after briefly surpassing this main resistance degree strongly recommend a possible exhaustion of shopping for stress.

This climatic habits aligns with the basic expectation of a buying and selling vary or a bearish correction following a major rally. Throughout the context of a possible vary, the main focus shifts from trend-following methods to figuring out and buying and selling off double/triple bottoms close to help and double/triple tops close to resistance.

Within the coming weeks, sideways to downward worth motion is the most probably situation. Whereas decided bulls may hope for an eventual continuation of the uptrend, shopping for breakouts above the all-time excessive will demand excessive warning. Sturdy affirmation and follow-through shall be important to keep away from false breakouts.

Merchants will subsequently search for potential shopping for alternatives at double or triple bottoms close to help, and promoting alternatives at double or triple tops close to resistance. The elevated chance of range-bound buying and selling and potential corrective strikes heightens the significance of strict danger administration.

Whereas the present outlook favors a range-bound or corrective situation, merchants ought to stay adaptable and ready for surprising worth motion, together with bullish breakouts, in the event that they happen.

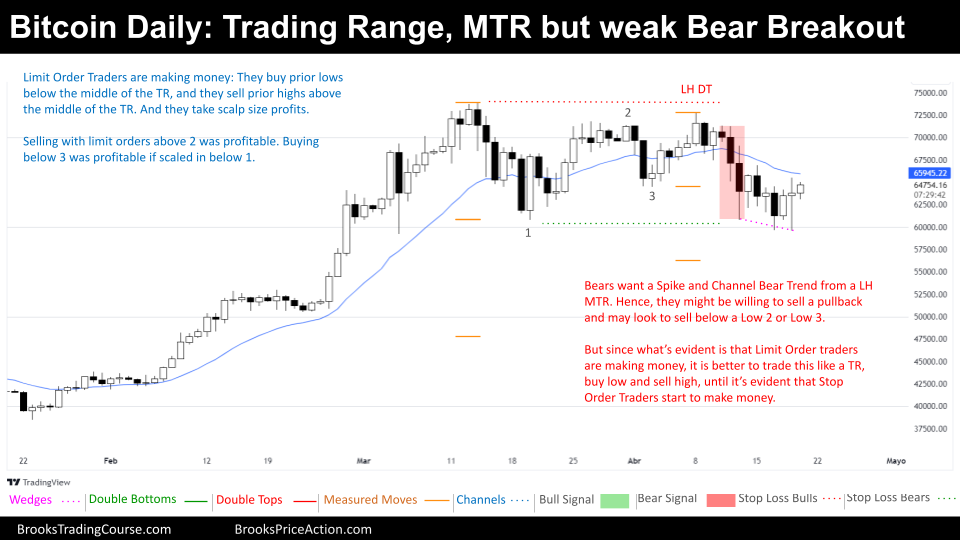

The Each day chart of Bitcoin

The present each day chart for Bitcoin suggests a buying and selling vary surroundings the place each bulls and bears have discovered alternatives to revenue utilizing restrict order methods. This entails shopping for beneath established lows and promoting close to prior highs.

It’s essential to keep in mind that this buying and selling vary follows a major Main Development Reversal sample. Final week’s Decrease Excessive Double Prime, adopted by a breakout beneath a previous low, initially signaled potential bearish momentum. Nonetheless, this bearish breakout proved weak and conclusively failed to interrupt the buying and selling vary low.

The formation of a Wedge Backside and a Double Backside Decrease Low sample might supply some encouragement for bulls. Nonetheless, it’s important to stay cautious, as the present surroundings primarily favors restrict order merchants who give attention to well-defined vary boundaries.

Merchants who closely depend on cease orders for entries might discover this surroundings significantly troublesome. The potential for whipsaws and false breakouts will increase the danger of getting stopped out prematurely. Persistence is vital; ready for a transparent and sustained breakout into a brand new ‘Always in Long’ or ‘Always in Short’ development is probably going a extra prudent strategy.

For the rapid future, scalping methods that target shopping for close to help and promoting close to resistance throughout the established buying and selling vary might supply the most effective alternatives.

Thanks for studying! For those who discovered this evaluation useful, please take into account sharing it with fellow merchants and go away your ideas within the feedback beneath.

Market evaluation studies archive

You may entry all weekend studies on the Market Evaluation web page.