- Bitcoin charges dropped after the halving, decreasing miner income within the course of.

- Runes would possibly trigger a surge in exercise on Bitcoin’s block house, and charges would possibly spike once more.

Bitcoin [BTC] charges have been a serious topic within the crypto market because the halving on the twentieth of April. The day earlier than the halving, the common charge on the Bitcoin community surged to $128.

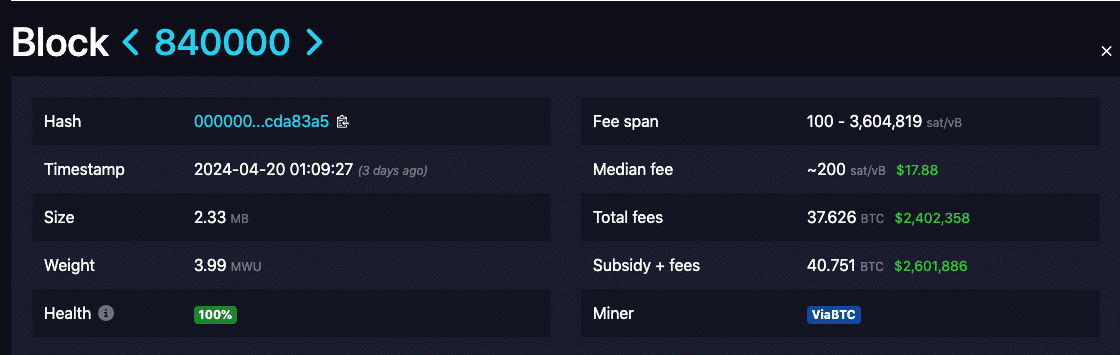

On halving day itself, the entire charges paid to have a transaction processed on the 840000th block was a mind-blowing $2.40 million. This worth was equal to 37.62 BTC, based on mempool.house.

However as of the writing, the charges have crashed and have been a median of $8 to $10. However why did the charges spike within the first place?

On this piece, AMBCrypto explains Bitcoin charges, why they immediately improve, and what else to count on. Learn on.

Bitcoin charges: A strategy to reward miners

Bitcoin charges are often known as transaction charges on the community. They’re paid to miners as an incentive for holding the community up and operating.

Most occasions, the common charge wanted to course of a transaction is small. Nevertheless, the sudden improve that occurs typically, might be because of the measurement of the transaction or congestion on the community.

Right here is a straightforward rationalization. On the Bitcoin community, information house for every block shouldn’t be boundless however restricted.

Due to this fact, if miners should course of a excessive variety of transactions inside one block, the charge turns into greater for the participant.

When does this occur? Bitcoin charges turn into extraordinarily excessive when lots of individuals need their transactions processed quick. Nevertheless, this final weekend was not the one time charges on the community spiked.

In January 2023, the launch of Ordinals created congestion on the community. At the moment, apart from excessive charges, miners discovered it exhausting to course of each transaction on every block, inflicting the community to stall for a while.

Thus, if you would like sooner transactions when the community is congested, you would want to pay a better charge. Alternatively, you possibly can anticipate the charges to be decrease earlier than making an attempt to have your transactions confirmed.

Nevertheless, this might take hours, and one time up to now, it took days.

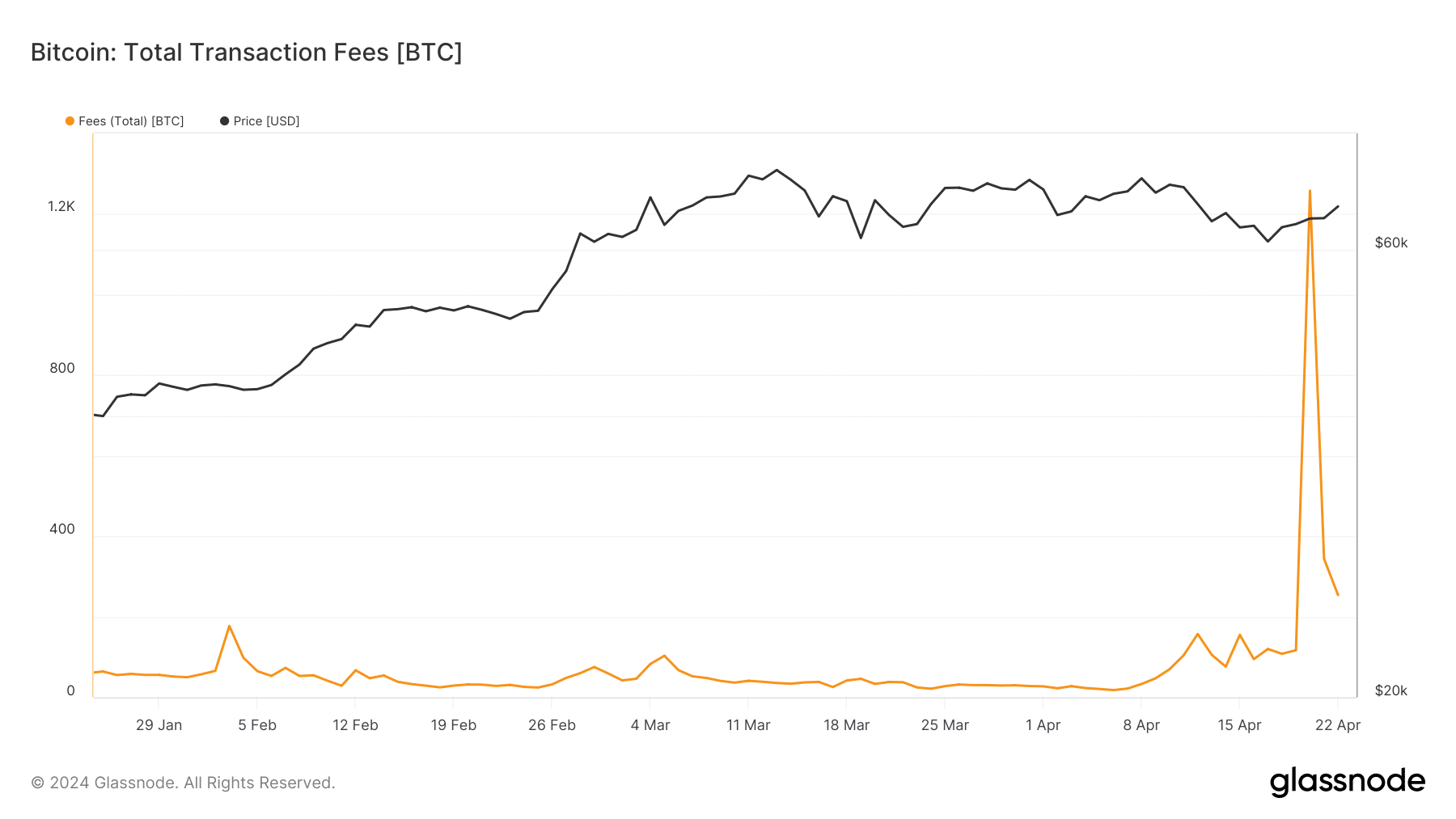

In line with AMBCrypto’s on-chain evaluation utilizing Glassnode, charges on the community rose to 1,257.71 BTC on 20 April.

Recall, that it was additionally on the identical day that miners’ rewards have been reduce in half— from 6.25 to three.125 BTC.

However on the time of writing, the metric was down to $253.93 BTC, indicating that congestion on the community had decreased.

Runes and Ordinals to have an effect on Bitcoin charges and miners-How?

Sooner or later, there’s a probability that congestion would possibly return due to the event of Runes. The Runes protocol is a regular for minting tokens on the Bitcoin community.

For Bitcoin developer Casey Rodarmor, Runes presents a extra environment friendly strategy to create fungible tokens in a means that Ordinals can’t.

Curiously, Rodarmor was additionally the creator of Ordinals, which led to the event of BRC-20 tokens.

Whereas tokens haven’t formally launched on Runes, Rodarmor defined why Runes was higher than BRC-20 on his X (previously Twitter) web page. In line with him,

“One advantage of runes vs BRC-20 is that if you have a UTXO which has some quantity of runes, you can create multiple PSBTs offering to sell different quantities of those runes from the UTXO, with runestones that transfer different amounts to the buyer and return the remainder the seller.”

For context, UTXO stands for Unspent Transaction Output. On the protocol, the UTXO represents the steadiness of cash {that a} consumer can spend sooner or later by way of a selected deal with.

For miners, Runes can have lots of advantages. Theoretically, the event may improve transaction quantity on the community.

This, may, in flip, enhance Bitcoin charges and miners’ income which is anticipated to shrink may need gotten a saving grace.

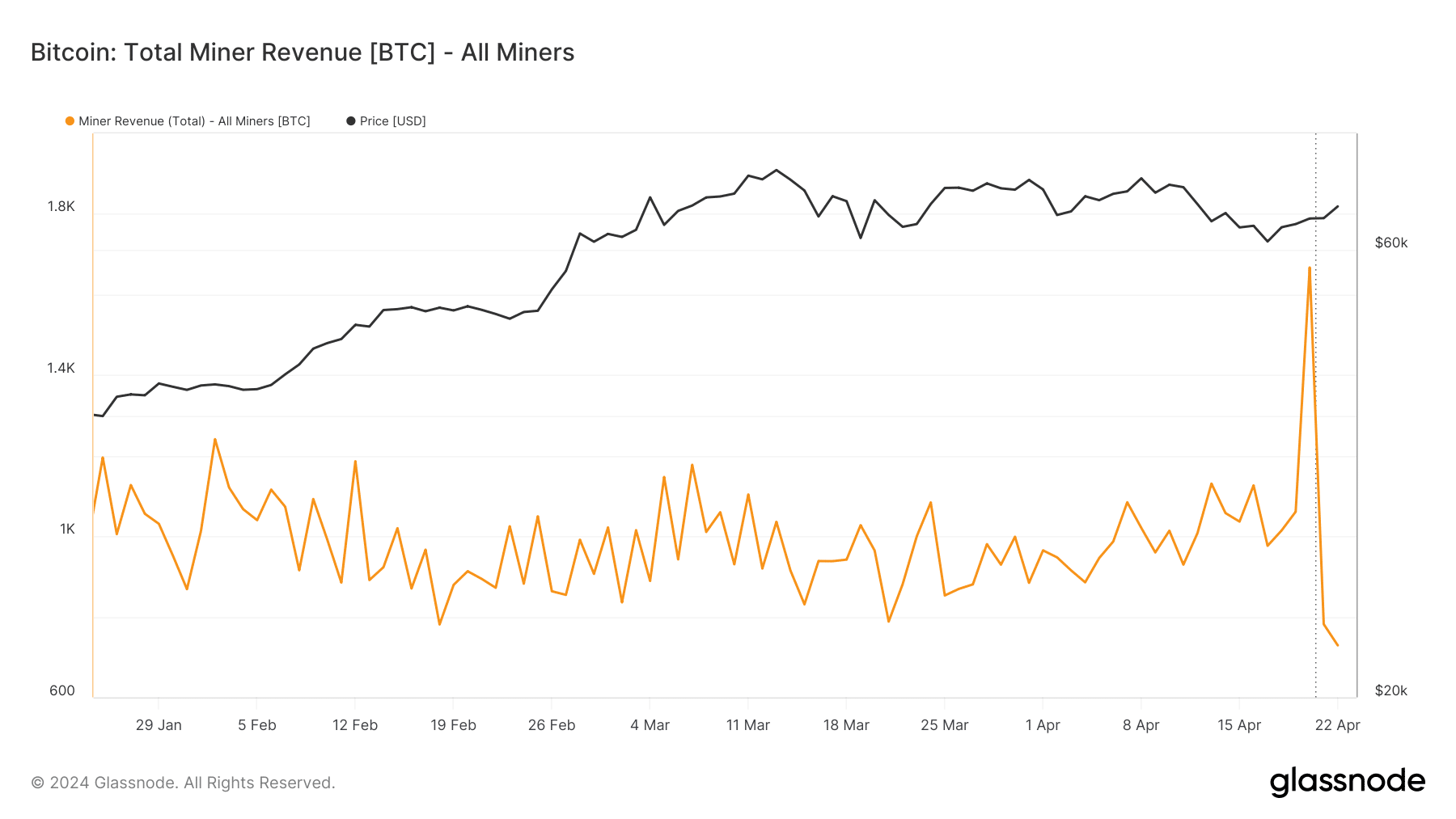

Within the meantime, AMBCrypto checked out miners’ income. This metric is the entire of charges and block rewards miners get.

At press time, the entire income was 728.93 BTC, which was a 38.83% lower from what it was on the day of the halving.

Within the brief time period, Bitcoin charges would possibly stay low and inexpensive. Nevertheless, customers mustn’t rule out one other spike in charges, particularly as tokens on the Runes protocol would possibly quickly be deployed.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

If the tokens come to life, individuals would possibly interact the OP_RETURN. For context, the OP_RETURN permits folks so as to add arbitrary to transactions.

Ought to this turn into rampant, the usual locking scripts may set off excessive demand for BTC, trigger congestion on the community once more, and charges may return to the anomaly.