- Bitcoin confronted important resistance between $98K and $100K.

- Shrinking change reserves and inflows signaled diminished promoting strain, leaning in favor of long-term bullish sentiment.

Bitcoin’s [BTC] journey to reclaim the psychological $100K worth stage has encountered a stiff resistance. At press time, the value hovered close to a key pennant provide zone between $98K and $100K.

This key resistance zone has confirmed difficult for bulls, as quick place takers had been defending it vigorously.

Breaking via this resistance stage is important for Bitcoin to proceed its upward trajectory and keep away from a possible bearish reversal.

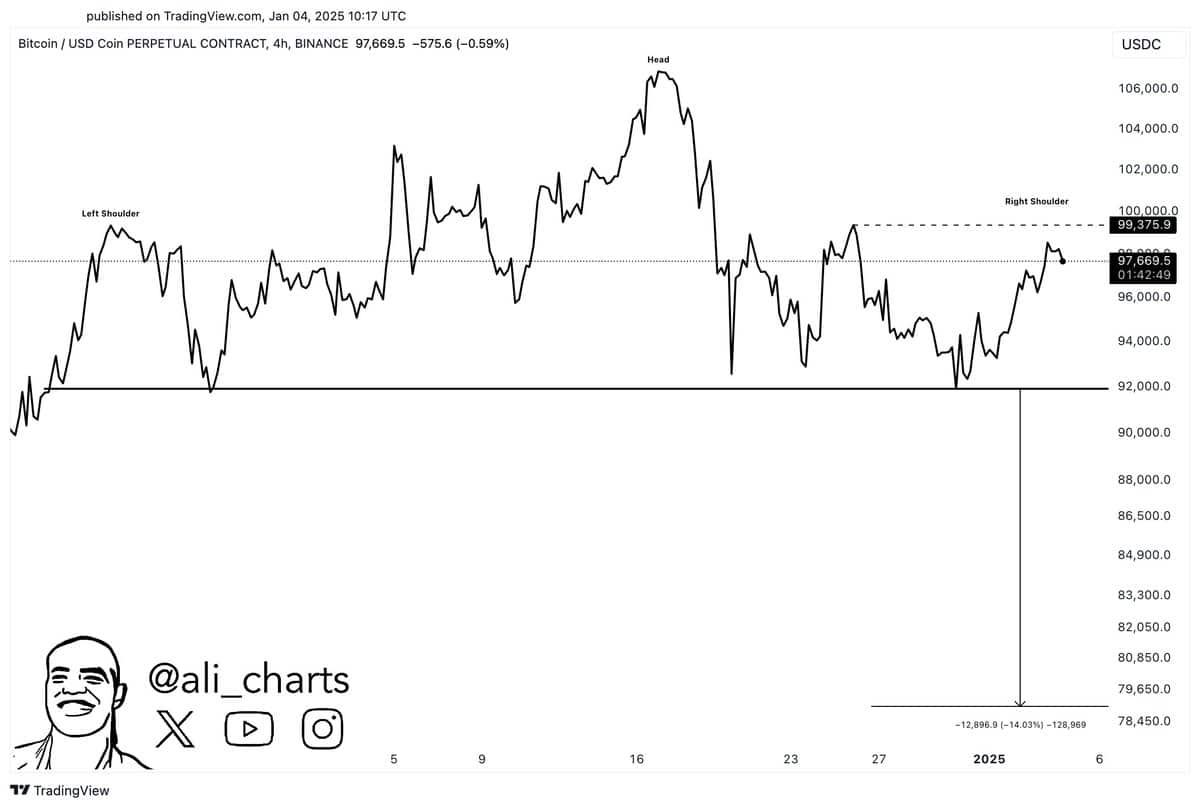

Head-and-shoulders sample looms

In keeping with a famend analyst on X, Bitcoin’s worth chart advised a attainable head-and-shoulders sample. If confirmed, this bearish setup may push the value right down to the $78,000 area.

Such a correction would align with technical expectations, given the sample’s historic accuracy.

Nonetheless, the sample stays invalidated till a decisive break under the neckline.

For bulls, a robust every day or weekly shut above $100K is crucial. This could invalidate the bearish outlook and set the stage for Bitcoin to discover new highs.

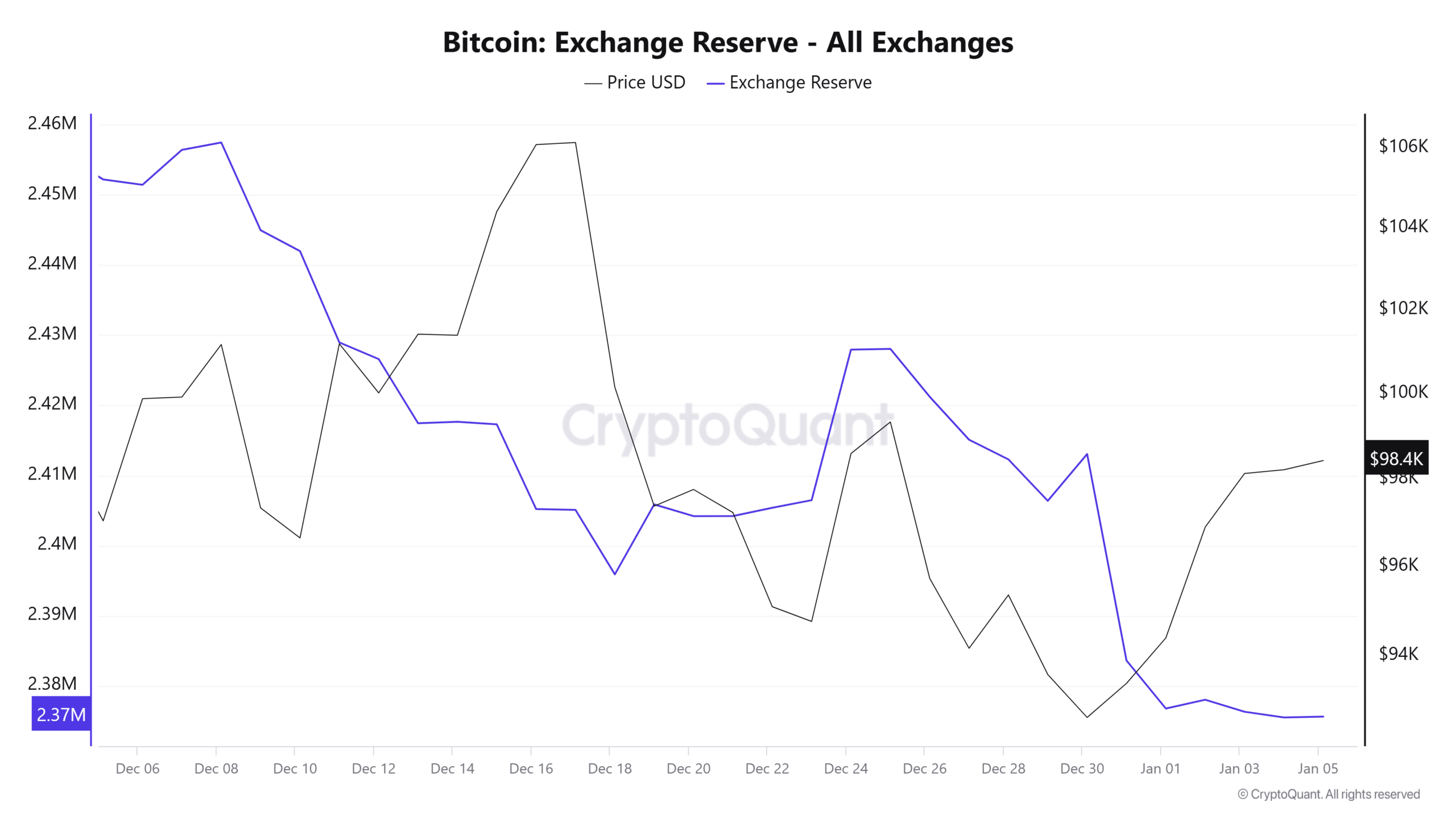

Reducing change reserves level to a bullish potential

On-chain metrics supplied a extra optimistic perspective. Bitcoin change reserves have seen a constant decline, signaling that fewer tokens can be found on the market.

This means that market individuals are more and more opting to carry their Bitcoin, therefore lowering the king coin’s promoting strain.

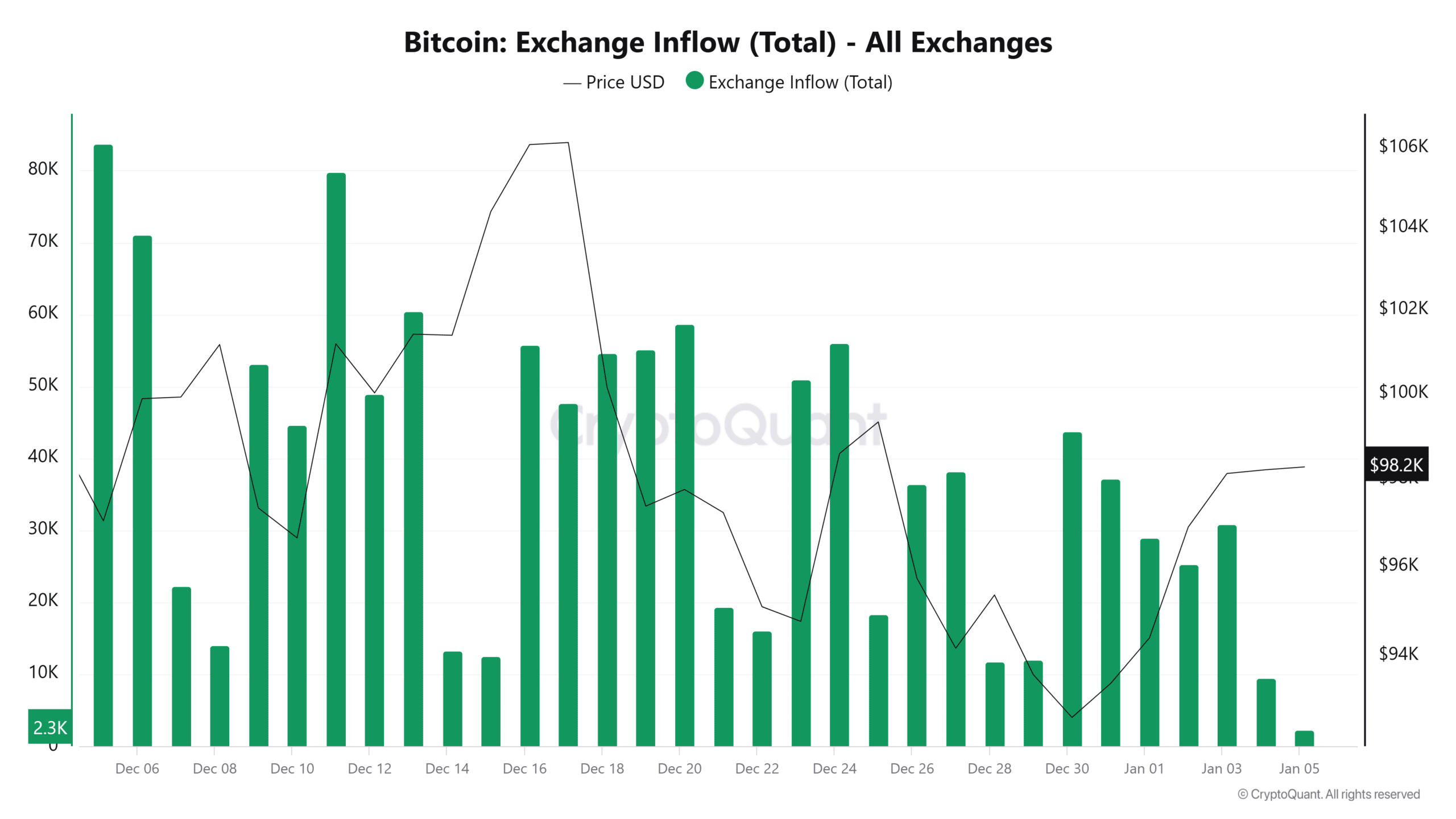

Including to this, change inflows—a key metric for assessing potential promoting exercise—have been steadily reducing for the reason that thirtieth of December.

The diminished inflows reported by CryptoQuant counsel that much less Bitcoin is being transferred to exchanges, which additional supported its bullish outlook.

What lies forward for Bitcoin?

The battle between Bitcoin’s bulls and bears intensifies, the king crypto stays trapped beneath the $100K resistance stage.

A breakout above this key resistance stage may set the stage for additional beneficial properties. Nonetheless, failure to take action may validate the bearish head-and-shoulders sample.

Regardless of this technical uncertainty, on-chain information paints a bullish image.

Learn Bitcoin’s [BTC] Worth Prediction 2025–2026

Lowered change reserves and inflows counsel a shift in sentiment, with holders showing extra assured in Bitcoin’s long-term prospects somewhat than shorting their present positions.

Bitcoin’s subsequent transfer will majorly depend on its skill to beat the $100K resistance.