- Bitcoin stabilizes above $64,000, with metrics suggesting potential bullish momentum and ETF demand driving help.

- Analysts predict potential breakout targets between $88,000 and $100,000 if key resistance ranges are reclaimed.

Bitcoin [BTC] has not too long ago proven indicators of stabilization above the $64,000 mark, though it initially surged to $66,000 within the early hours of the thirtieth of September.

Since then, a correction has introduced the asset all the way down to $64,633, marking a slight 1.4% decline.

Regardless of this short-term dip, a broader view reveals Bitcoin’s development, with the asset up by 10.2% over the previous two weeks.

Nevertheless, the query stays: when will Bitcoin begin the bull run that many consultants predict may push its value into six figures?

To supply readability for buyers, CryptoQuant, an on-chain information supplier, has shared essential metrics for monitoring Bitcoin’s bullish momentum.

The platform printed a collection of posts on X (previously Twitter) aimed toward serving to buyers perceive the place Bitcoin is likely to be headed.

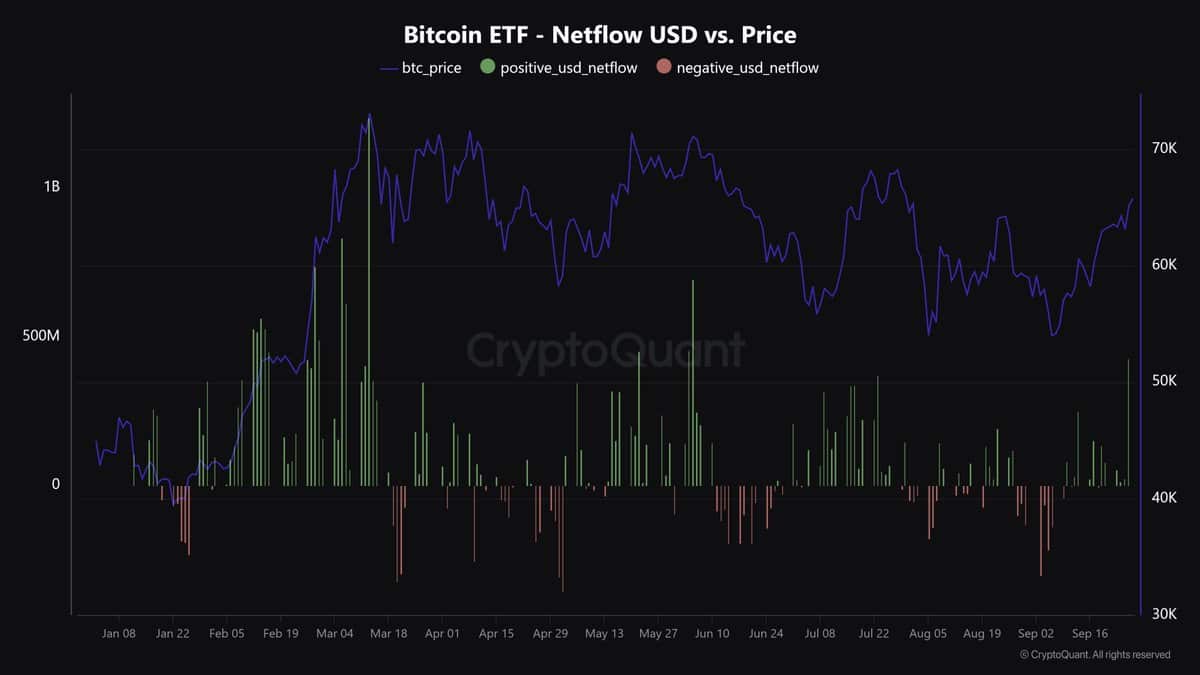

They famous that Bitcoin’s sturdy momentum over the previous three weeks—rising over 23% from $52,500 to above $65,000—has been partly fueled by elevated demand for spot Bitcoin Change-Traded Funds (ETFs).

Notably, mixed inflows from BlackRock, Constancy, and Ark totaled $324 million on the twenty sixth of September, signaling heightened curiosity from U.S. buyers.

THIS is essential for bullish momentum

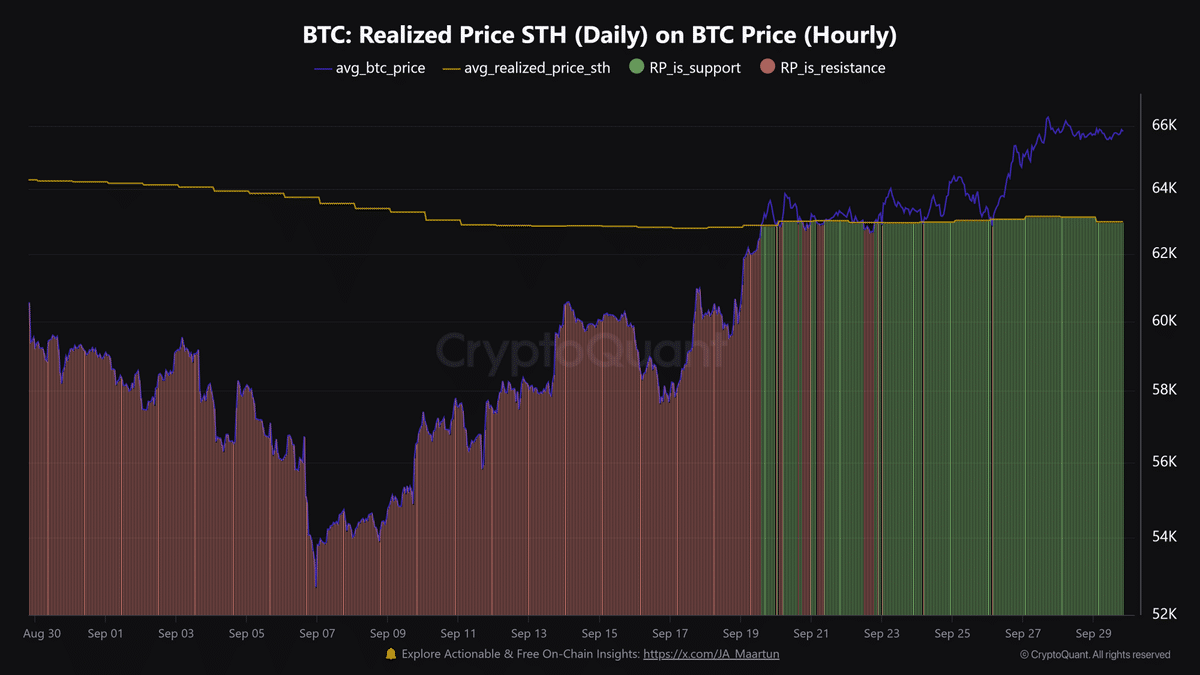

In line with CryptoQuant, one of many key drivers for Bitcoin’s latest rally is the resurgence of short-term holders again into revenue territory.

These holders, outlined as buyers who’ve moved their Bitcoin throughout the final 155 days, have a median buy value of round $63,000.

As Bitcoin’s value hovers above this stage, it may act as a powerful help stage, reinforcing bullish sentiment.

The futures market additionally presents vital insights into Bitcoin’s value tendencies. CryptoQuant revealed that Bitcoin’s Open Curiosity was $19.1 billion at press time.

Traditionally, surges previous $18.0 billion have led to cost corrections.

This marks the seventh time such a threshold has been crossed since March 2024, prompting warning round the potential of a short-term dip.

Regardless of this, the general pattern of accelerating futures exercise displays rising investor confidence.

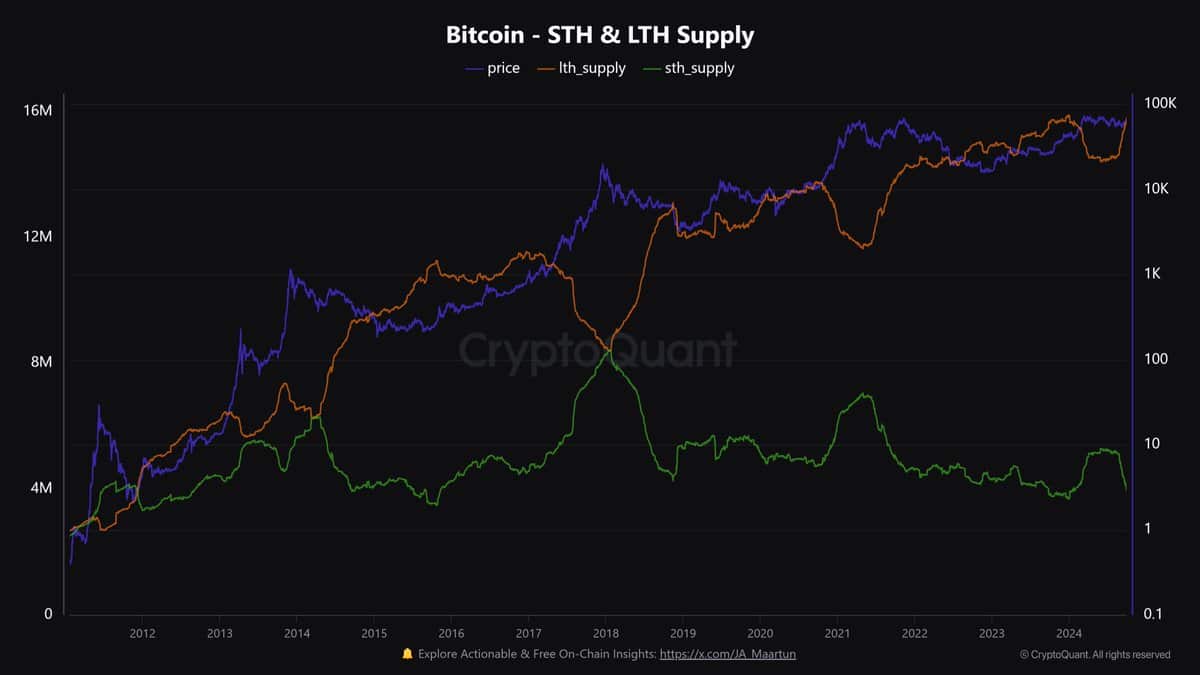

One other notable growth is the transformation of spot Bitcoin ETF holdings into long-term holder provide.

As cash surpass the 155-day holding interval, they’re more and more categorized as a part of the long-term provide.

Whereas this shift would possibly recommend a bullish outlook, CryptoQuant warns that such actions are sometimes noticed within the later phases of a bull market, indicating potential market maturity or a transition section in Bitcoin’s trajectory.

Analysts weigh in on Bitcoin’s potential rally

Past the basic metrics, a number of analysts have shared their views on the place Bitcoin may head subsequent.

Javon Marks, a outstanding crypto analyst, recommended that Bitcoin was nearing a essential resistance stage outlined by a “descending broadening wedge” sample.

In line with Marks, a bullish breakout previous this resistance may propel Bitcoin to a goal vary of $99,000 to $100,000, a rise of over 51% from its present value.

His outlook emphasised that Bitcoin could also be gearing up for a major transfer within the coming weeks.

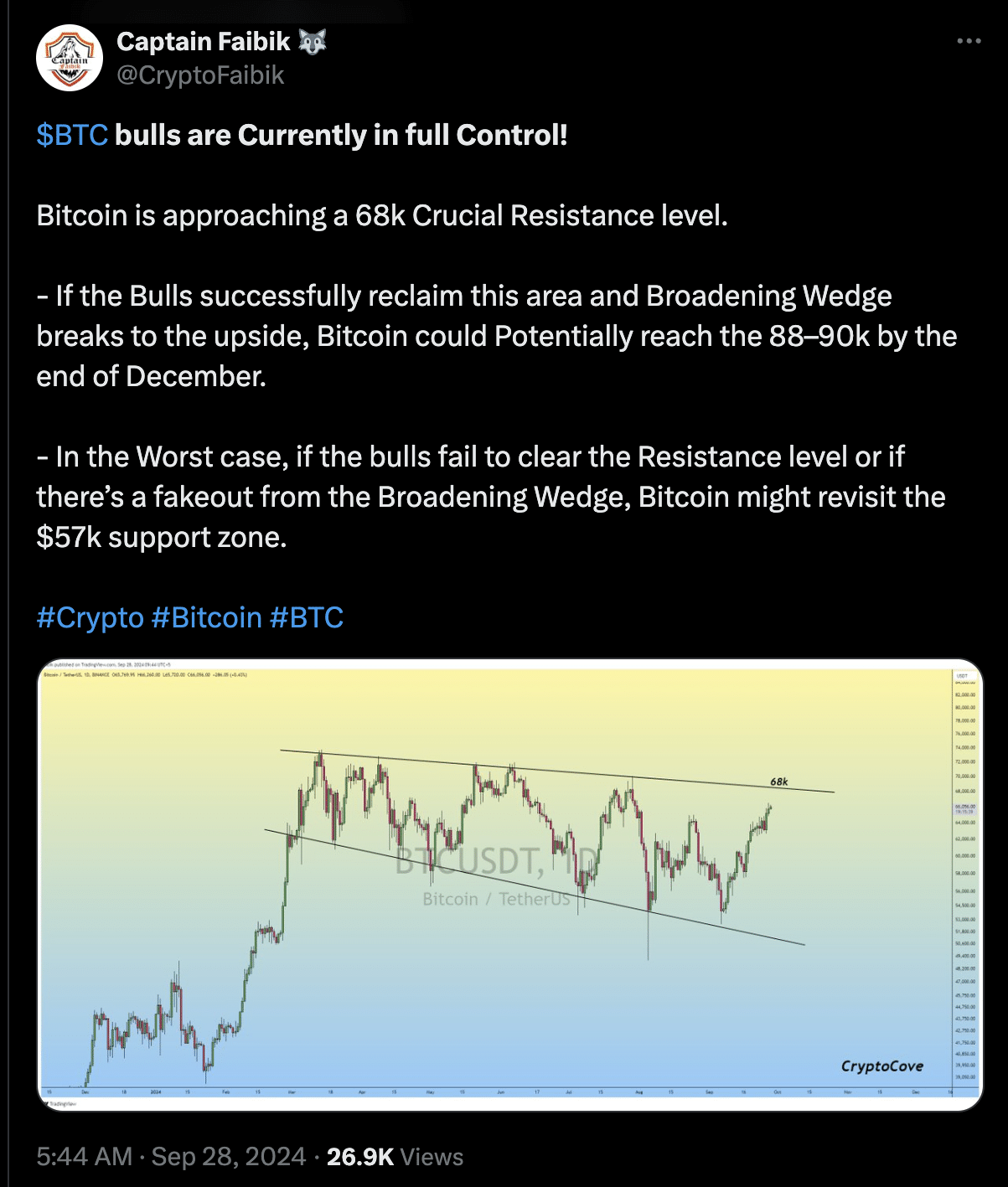

Equally, one other analyst, Captain Faibik, famous that Bitcoin bulls at present maintain a powerful place available in the market.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

With Bitcoin approaching an important resistance stage of $68,000, Faibik speculated {that a} profitable breakout from the broadening wedge may see the cryptocurrency attain $88,000 to $90,000 by the top of December.

Nevertheless, he additionally cautions that failure to interrupt by way of this resistance, or a possible fake-out, may see Bitcoin retest help zones round $57,000.