- Shopping for strain on Bitcoin elevated within the final 24 hours.

- In case of a worth correction, BTC may as nicely drop to $57k once more.

Bitcoin [BTC] has lastly managed to cross the $60k barrier after struggling for fairly a number of days. This leap above $60k gave hope for an additional worth rise. But it surely may face sturdy resistance going ahead.

Bitcoin climbs above $60k once more!

Ali, a preferred crypto analyst, posted a tweet revealing that BTC’s TD sequential indicator flashed a promote sign. The tweet talked about that there could be a brief correction.

Notably, that really occurred, as BTC dropped to $58k from $59k. The excellent news was that the king coin gained bullish momentum after that because it surged above $60k.

The coin’s worth rose by greater than 4% within the final 24 hours and at press time was buying and selling at $60,363.00 with a market capitalization of over $1.19 trillion.

Due to the value rise, over 43 million BTC addresses turned worthwhile, which accounted for 81% of all Bitcoin addresses.

AMBCrypto then checked CryptoQuant’s information to see how this worth uptick affected market sentiment. We discovered that Bitcoin’s alternate reserve was dropping, signaling an increase in shopping for strain.

Moreover, each its Coinbase Premium and Korea Premium indicated that purchasing sentiment was comparatively sturdy amongst US and Korean traders.

BTC’s subsequent targets

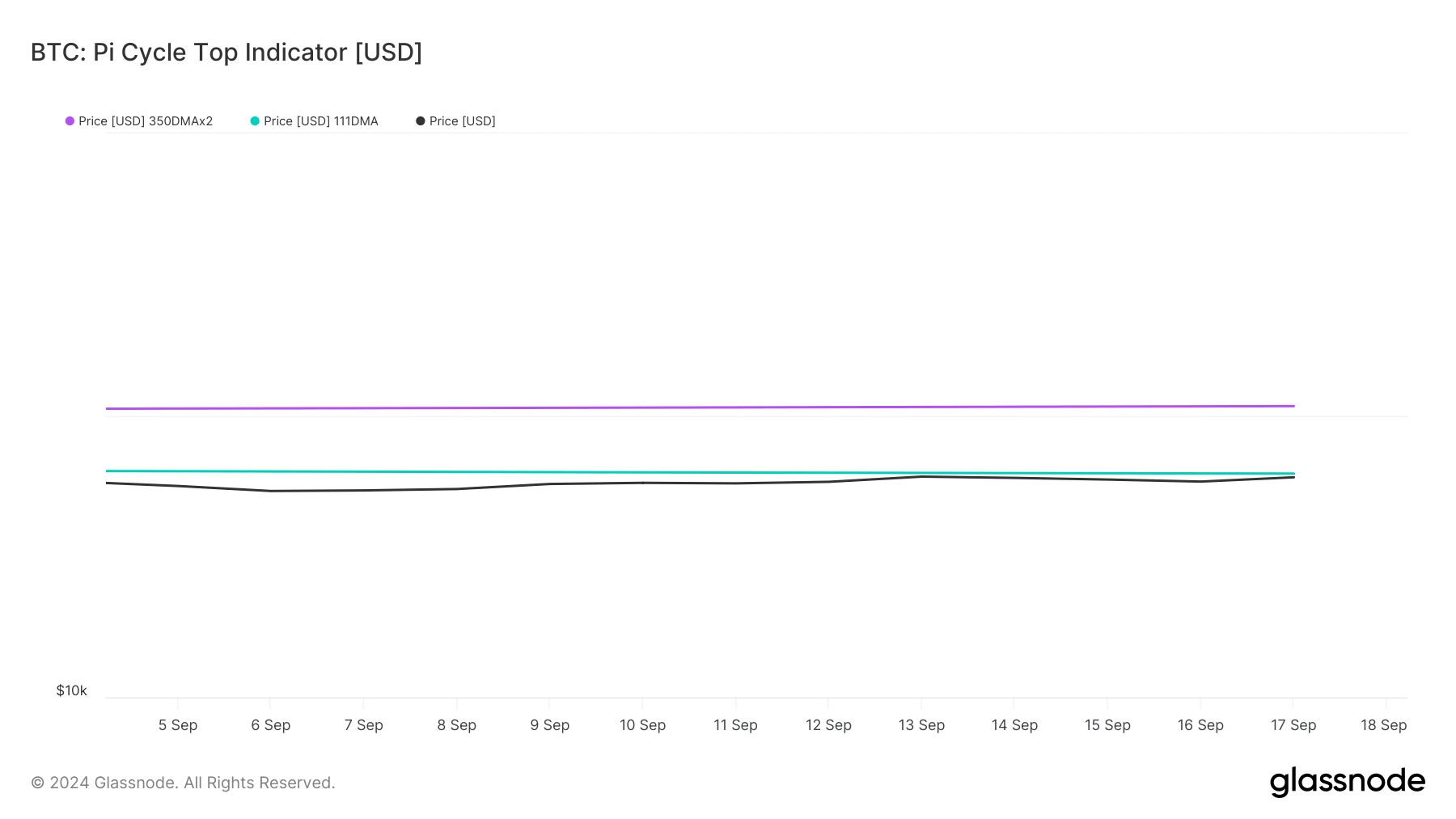

Our take a look at Glassnode’s information revealed that BTC’s was lastly approaching its doable market backside because it has been buying and selling under it for a number of weeks.

The Pi Cycle High indicator additionally prompt that the Bitcoin’s doable market high was above $100k.

Within the meantime, IntoTheBlock additionally posted a tweet highlighting a number of notable updates. As per the tweet, on-chain resistance ranges had been comparatively evenly distributed, however a serious stage to observe was $64k, the place 1.57 million addresses are at the moment holding at a loss.

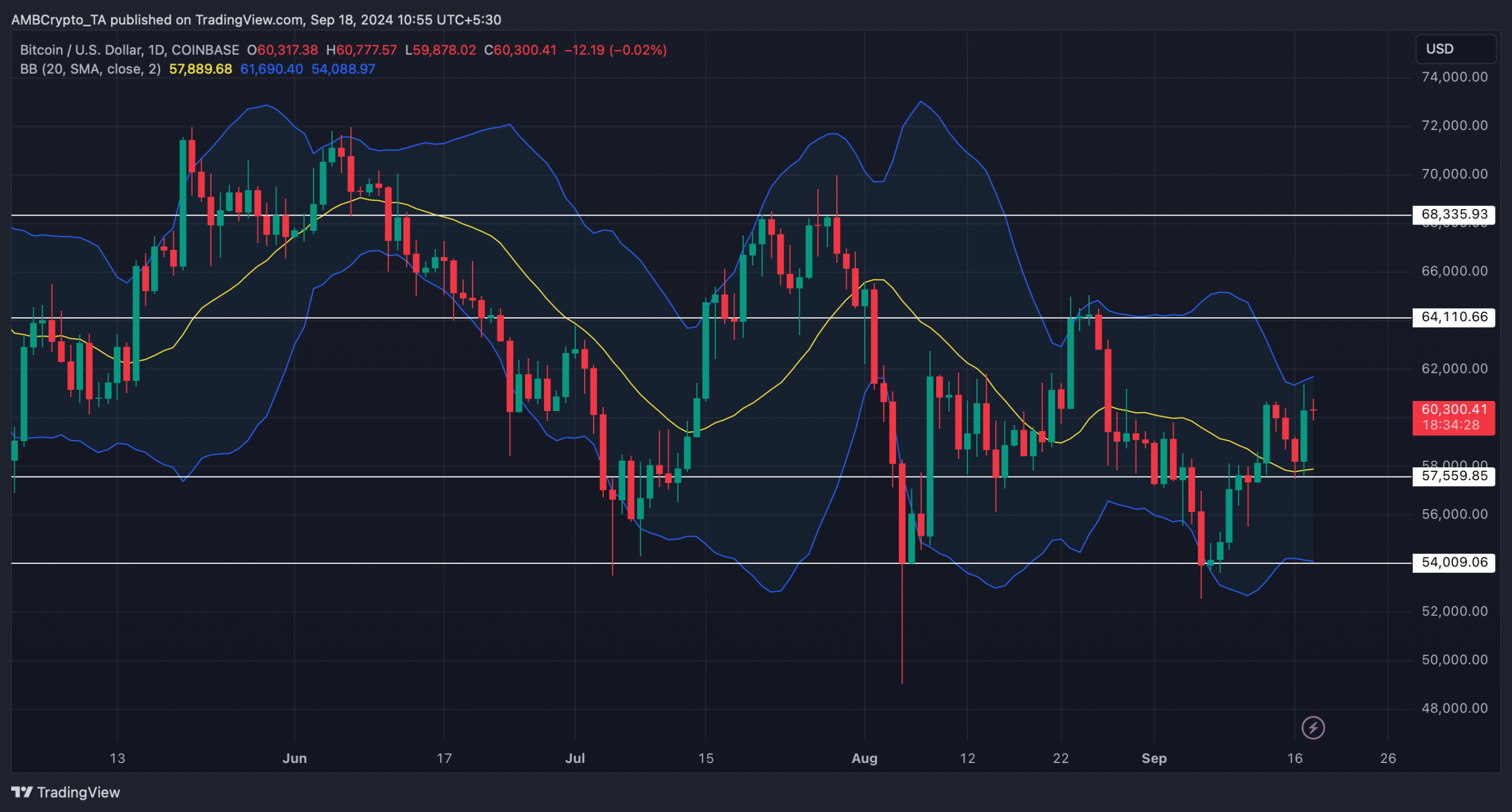

Due to this fact, AMBCrypto checked Bitcoin’s day by day chart to see what market indicators prompt concerning a worth hike in direction of the $64k mark.

As per our evaluation, BTC had efficiently examined and remained nicely above its 20-day easy transferring common (SMA), as indicated by the Bollinger Bands.

Nevertheless, Bitcoin’s worth had touched the higher restrict of the identical metric, which frequently leads to worth correction.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

In case the check of the Bollinger Bands’ higher restrict leads to a worth drop, then it received’t be shocking to see BTC as soon as once more dropping to $57k. This appeared to be the case as liquidation will rise at that mark.

Nonetheless, if the bull run continues, it’ll be essential for BTC to go above $62k earlier than it targets $64k.