- Bitcoin struggled to remain above $60,000, with some analysts forecasting a possible rally to $68,000.

- Whale transactions and a potential “golden cross” signaled constructive indicators for Bitcoin’s near-term efficiency.

Bitcoin [BTC] has confronted problem in sustaining a rally above the $60,000 mark, regardless of transient intervals of buying and selling above it final week.

As of the time of writing, the cryptocurrency was buying and selling at $58,947, marking a modest 2.1% improve over the previous 24 hours.

The market’s present volatility has saved Bitcoin from making a major upward motion, and the asset has now dipped beneath the crucial $60,000 stage.

Nevertheless, regardless of this current efficiency, some analysts proceed to precise optimism about Bitcoin’s potential for a rally within the coming weeks.

Rebound amid market uncertainty?

Captain Faibik, a widely known crypto analyst on X (previously Twitter), not too long ago shared his optimistic outlook for Bitcoin, suggesting that the asset should still be poised for a major rally. Based on Faibik,

“BTC is still moving within a Bullish Flag Pattern. It may test the $54k support area again, and it’s crucial for the bulls to defend this level. If Bitcoin bounces back from the $54k support, it could rally up to $68k in September.”

For context, a bullish flag sample is a continuation sample that seems after a powerful worth motion, usually characterised by a short consolidation or pullback section that kinds an oblong form resembling a flag.

This sample means that the asset may resume its upward pattern as soon as it breaks out of the flag formation, doubtlessly resulting in a major worth improve.

Faibik’s evaluation indicated that whereas Bitcoin might face short-term volatility, the general pattern may nonetheless be upward, particularly if the $54,000 assist stage holds.

One other constructive sentiment within the crypto neighborhood comes from Crypto Jelle, who highlighted the formation of a weekly golden cross on Bitcoin’s chart.

Jelle famous,

“Bitcoin is forming a weekly golden cross for the first time in its history. The 100-week MA is crossing above the 200-week MA this week. In traditional markets, these crossovers are considered a bullish sign; will it work for BTC too?”

Notably, a golden cross happens when a short-term transferring common crosses above a long-term transferring common, usually considered as a powerful indicator of an upcoming bullish pattern.

The prevalence of a golden cross on the weekly timeframe for Bitcoin is seen as a doubtlessly vital occasion that would sign additional upward momentum.

Bitcoin’s rising whale exercise

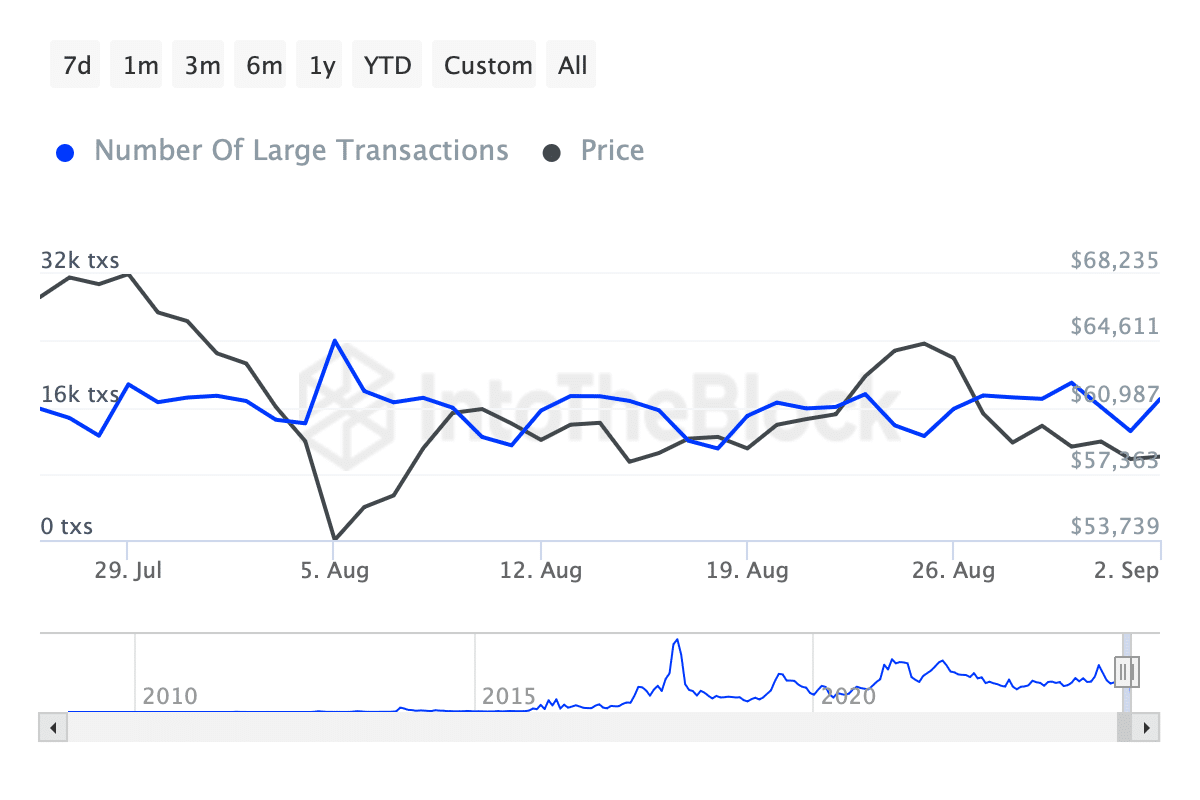

Past technical indicators, Bitcoin’s fundamentals additionally prompt a constructive outlook. Information from IntoTheBlock revealed a notable improve in whale transactions—these exceeding $100,000—over the previous week.

Particularly, these transactions have surged from beneath 13,000 final week to roughly 16,940 as of at this time.

This improve in giant transactions usually indicators rising curiosity from institutional traders or high-net-worth people, which may drive additional worth appreciation.

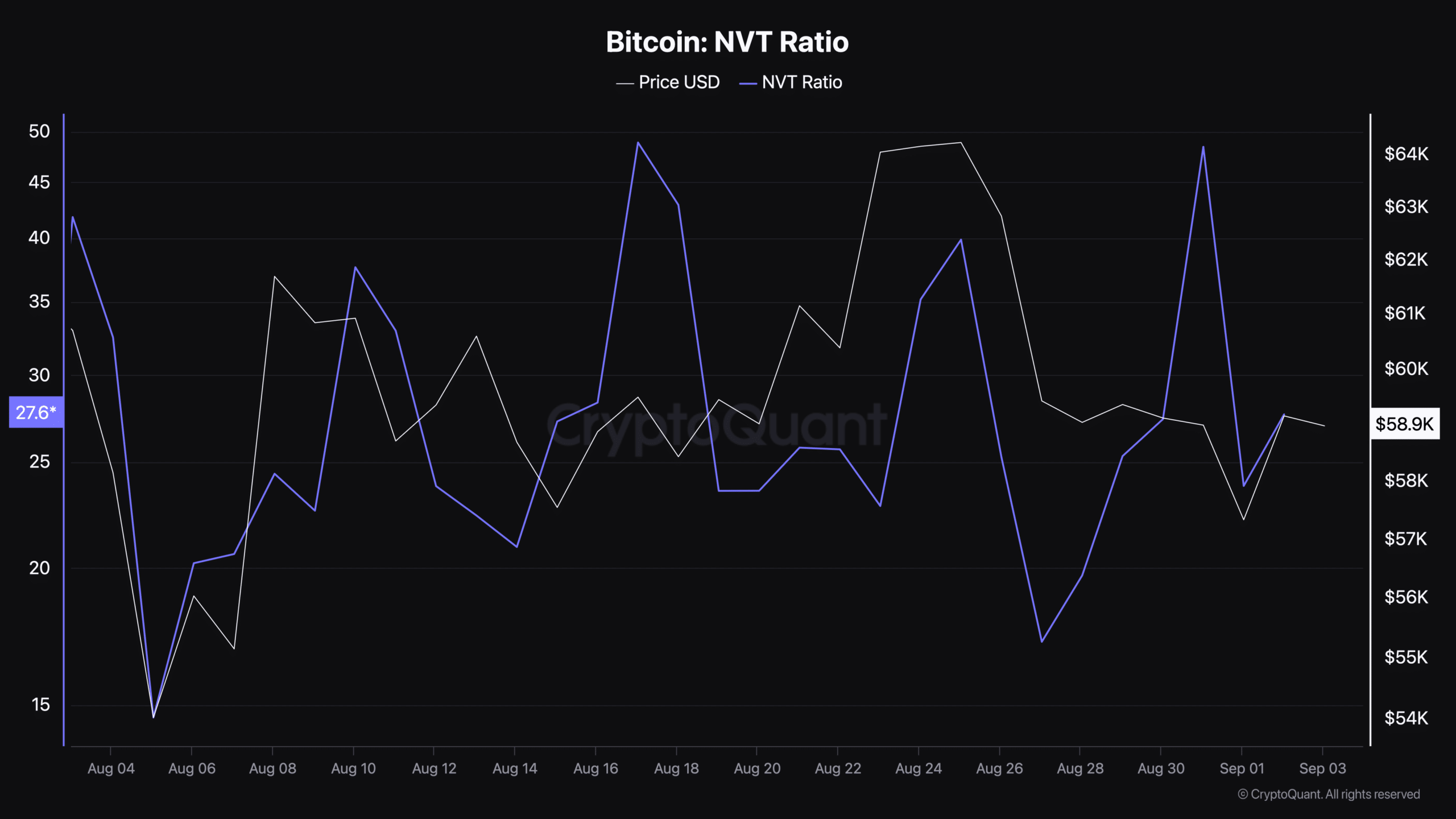

Moreover, Bitcoin’s Community Worth to Transactions (NVT) ratio, used to evaluate the asset’s valuation relative to its transaction exercise, sat at 27.63 at press time, in accordance with information from CryptoQuant.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

The NVT ratio is usually in comparison with the price-to-earnings (P/E) ratio in conventional markets, the place a decrease NVT ratio may point out that Bitcoin is undervalued, whereas the next ratio may counsel it’s overvalued.

With the press time NVT ratio of 27.63, Bitcoin’s valuation gave the impression to be in an affordable vary, doubtlessly supporting additional development if transaction exercise continues to extend.