- BTC is about to hit one other ATH.

- Extra merchants have taken brief positions regardless of this pattern.

Regardless of Bitcoin [BTC] buying and selling at $104,500 and sustaining a powerful upward pattern, the lengthy/brief ratio on Binance reveals almost 60% of merchants holding brief positions. With BTC buying and selling above key shifting averages, bulls stay in management, poised to push costs greater if resistance at $105,000 is breached.

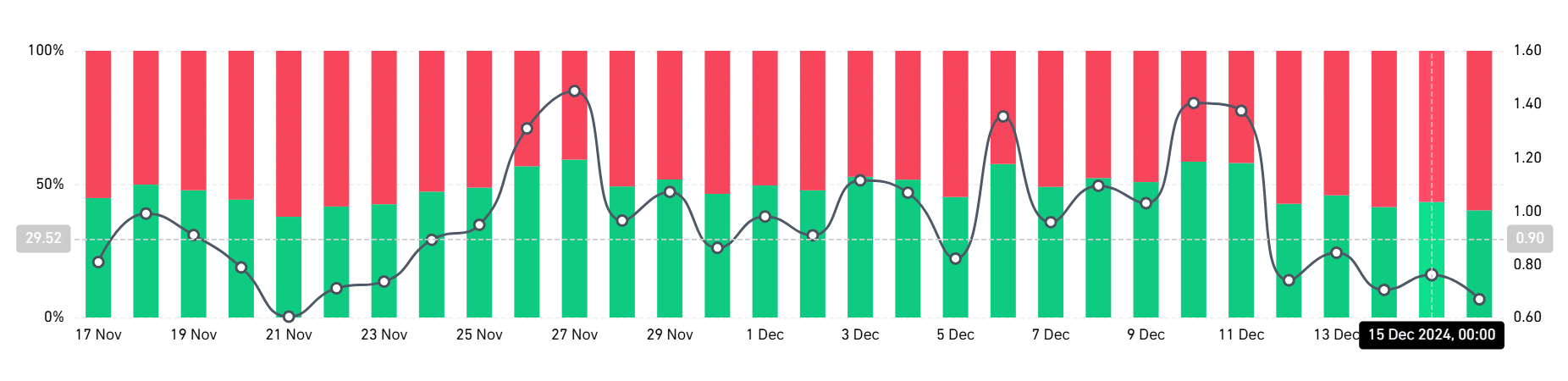

Lengthy/brief ratio indicators rising bearish bias

The most recent lengthy/brief ratio information evaluation on Coinglass highlights that almost 60% of merchants on Binance are holding brief positions in opposition to Bitcoin. This important skew towards bearish sentiment displays cautious sentiment amongst market individuals, whilst BTC continues its upward pattern.

The lengthy/brief ratio charts depict a constant dominance of brief positions over the past two buying and selling periods. The pattern means that many merchants are hedging in opposition to a doable correction or overbought circumstances.

Apparently, this bearish sentiment comes at a time when Bitcoin has maintained a powerful worth trajectory, buying and selling round $104,500.

Such a divergence between sentiment and worth efficiency could trace at underlying market energy, with bears doubtlessly setting themselves up for liquidation within the occasion of additional upside momentum.

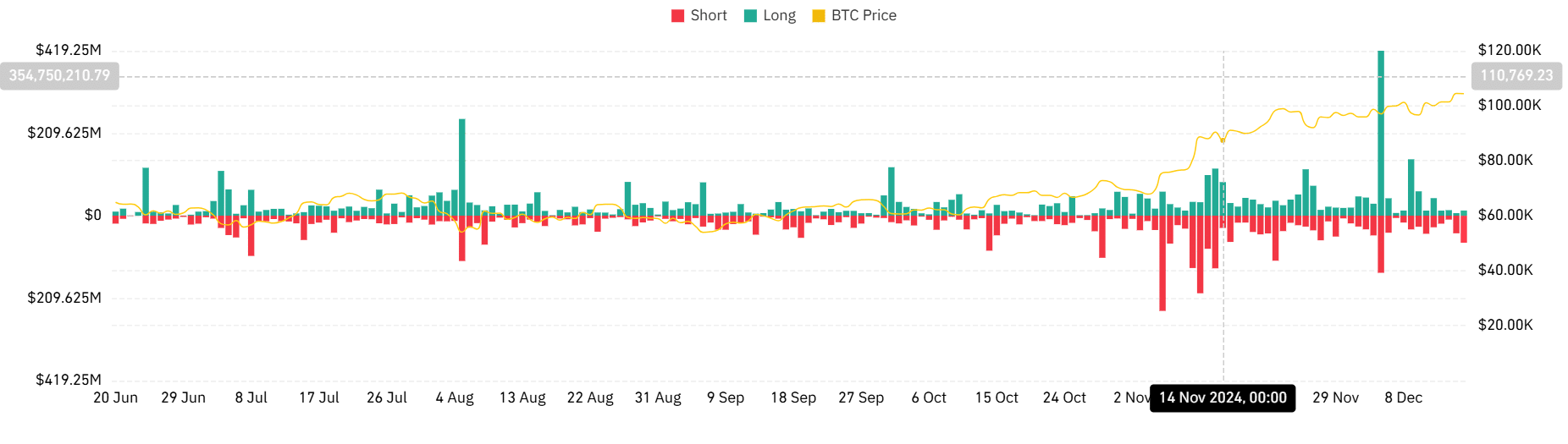

Liquidation tendencies: Shorts face rising danger

Over the previous two buying and selling periods, the liquidation information reveals that brief positions have confronted heavier liquidations than longs. The latest buying and selling session noticed a notable spike briefly liquidations, with 68.78 million for shorts and $13 million for longs.

This surge signifies that bearish merchants, anticipating a pullback, have been caught off-guard by Bitcoin’s resilience above key psychological ranges.

When combining this liquidation pattern with the excessive proportion of brief positions, it turns into evident that BTC’s upward momentum has positioned important strain on leveraged bears.

Merchants might want to carefully watch the liquidation ranges, as additional worth will increase might set off extra brief squeezes, doubtlessly propelling BTC greater.

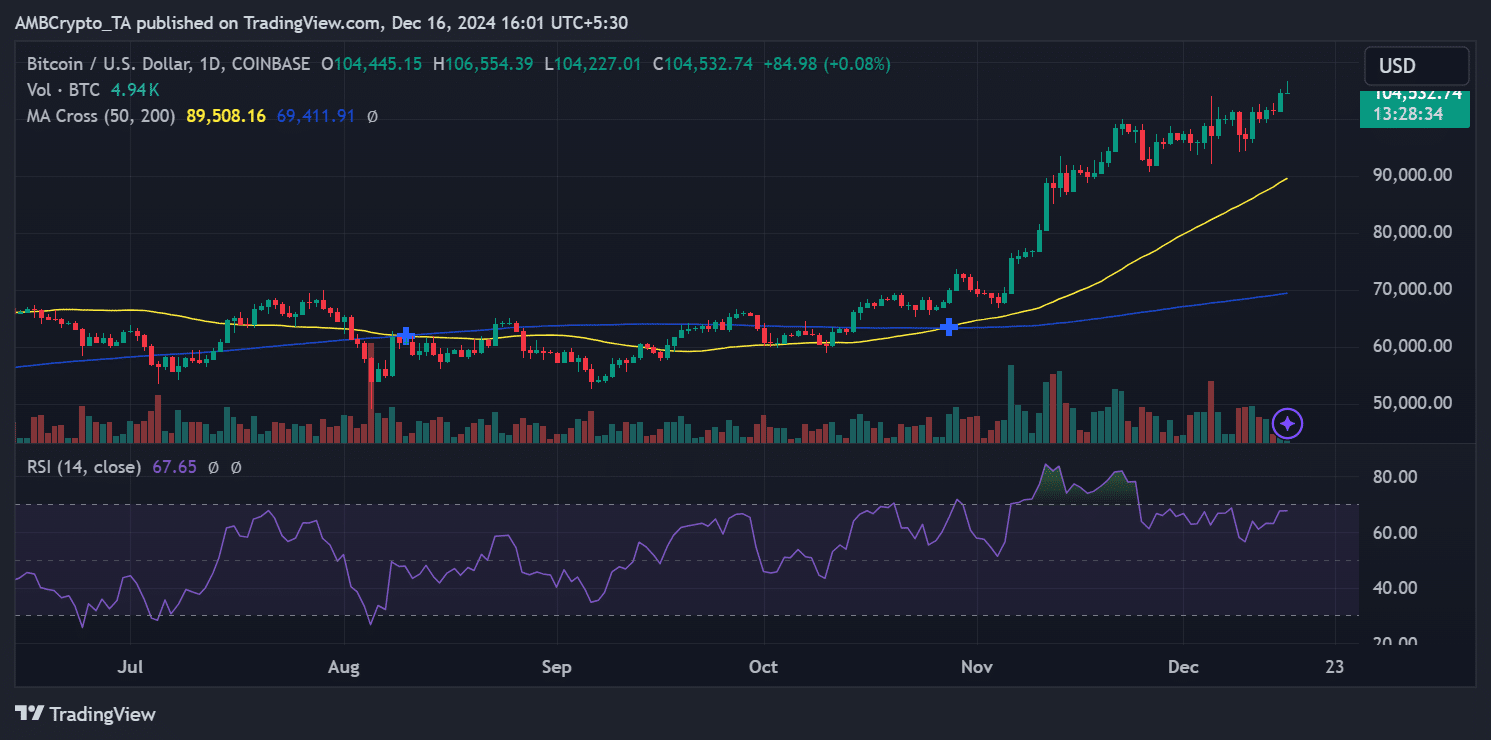

Bitcoin bulls in management amid RSI and shifting common indicators

Bitcoin’s worth motion stays bullish on the each day timeframe, supported by technical indicators signaling sturdy upward momentum. The Relative Energy Index (RSI) at present sits at 67.65, indicating that BTC is approaching overbought territory however nonetheless has room for additional upside.

Traditionally, RSI ranges close to 70 have been accompanied by short-term corrections; nevertheless, Bitcoin’s capability to maintain present ranges might invalidate fast bearish issues.

Moreover, BTC’s worth is buying and selling properly above its 50-day and 200-day shifting averages, additional reinforcing the bullish outlook. The Golden Cross continues to behave as a powerful assist for the continued rally.

A detailed above $105,000 might open the door to testing $110,000, whereas fast assist lies round $100,000.

Can bears stand up to BTC’s momentum?

The present bearish positioning amongst merchants seems misaligned with Bitcoin’s sturdy upward momentum. With brief liquidations piling up and BTC sustaining key assist ranges, the market might be primed for additional good points if brief merchants capitulate.

Learn Bitcoin (BTC) Value Prediction 2024-25

The interaction between the lengthy/brief ratio, liquidations, and worth motion means that Bitcoin bulls stay firmly in management for now.

As merchants assess the dangers, the market’s capability to soak up promoting strain and maintain its upward trajectory can be essential. Traders ought to monitor Bitcoin’s resistance at $105,000 and assist at $100,000 for indicators of the following directional transfer.