- BTC could possibly be in danger as carry commerce unwind persists.

- Will the risk-on mode from US BTC ETF traders proceed?

In line with consultants, Bitcoin [BTC] danger might compound amid ongoing Japanese-linked carry commerce unwind. The biggest crypto asset noticed a reduction rally to $58K earlier within the week. Nevertheless, it erased some positive factors after the Trump-Harris US presidential debate.

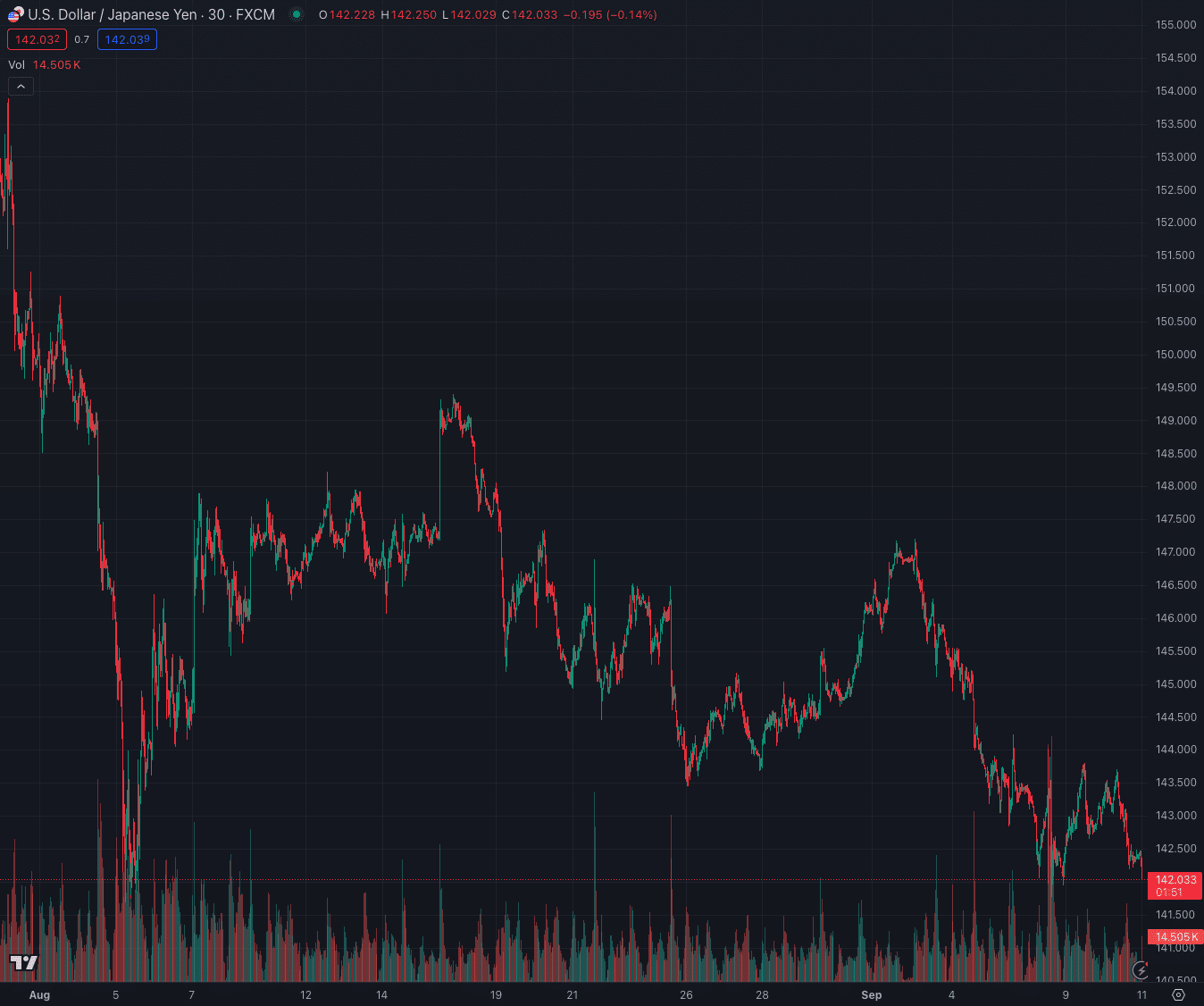

Moreover the US elections, the continued carry commerce unwind, which triggered the early August dump to $49K, might have an effect on BTC. The sell-off was linked to strengthening the Japanese Yen towards the US greenback.

Will carry commerce unwind have an effect on BTC?

The same pattern has been flashed, tipping BitMEX founder Arthur Hayes to sound a danger warning. He stated,

“$USDJPY breaking down, it’s about to be goblin town all over again in markets as it approaches 140. Let’s see if $BTC can hold up.”

For context, traders enter carry commerce by borrowing from low or near-zero interest-rate currencies for higher-return property. For about 17 years, the Yen has been the most affordable (virtually zero rates of interest), attracting carry commerce traders who search increased returns in US markets.

However this modified when the BoJ (Financial institution of Japan) hiked rates of interest in August, triggering a carry commerce unwind (closing positions) and a sell-off that additionally affected crypto markets.

In line with Yardeni Analysis, the carry commerce might proceed, particularly amid subsequent week’s expectations of a 50 bps (foundation factors) Fed price lower and liquidity pump. A part of Yardeni’s latest report learn,

“Expectations that the Fed will lower our interest rates, while the Bank of Japan raises their interest rates are boosting the yen and forcing traders to unwind their carry trades.”

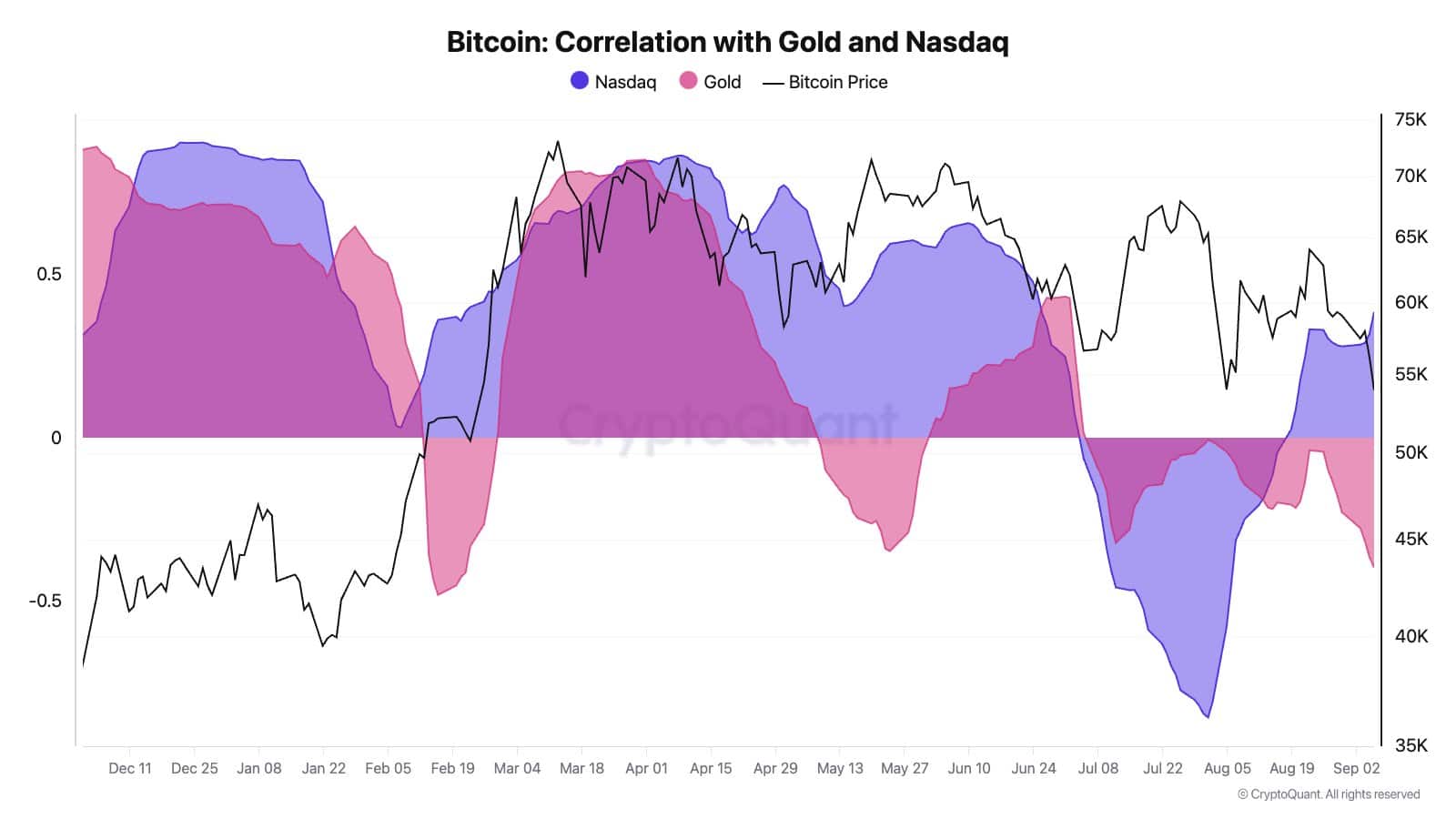

That stated, the carry commerce unwind impression on Bitcoin could possibly be elevated given the sturdy optimistic BTC correlation to Nasdaq than gold. In brief, one other market sell-off won’t spare BTC.

In the meantime, US BTC ETF traders adopted a risk-on method, matching the latest BTC reduction restoration. The merchandise skilled web each day inflows over the previous two days, breaking a protracted streak of over $1.2 billion in outflows.

Whether or not traders will keep confidence amid carry commerce unwind dangers stays to be seen