- World liquidity in stablecoins might push crypto costs larger.

- Key indicators say Bitcoin is poised for escape.

September is commonly a bearish month for Bitcoin and different asset courses. Nonetheless, October usually marks a powerful bullish interval, with Bitcoin [BTC] displaying optimistic returns in 8 out of the final 9 Octobers.

On common, BTC value good points 22.9% throughout this month. This historic pattern could clarify why there’s constant shopping for within the choices market.

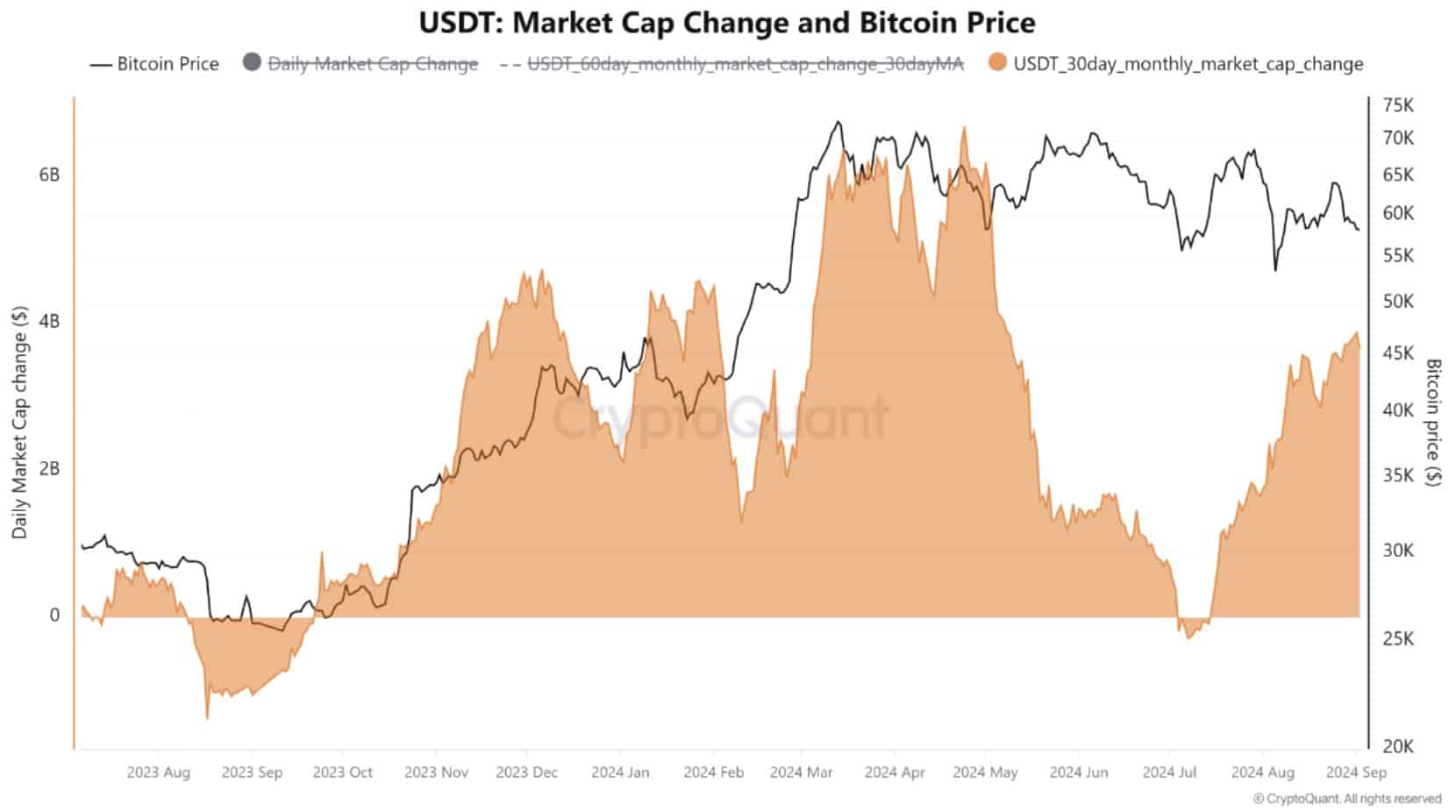

Whereas international liquidity is growing within the crypto market, it hasn’t but been totally allotted. A lot of this capital is at present tied up in stablecoins, ready to impression the BTC value.

When this “firepower” ultimately enters the market, it might result in a big transfer.

Bitcoin is in consolidation

Bitcoin has been buying and selling inside a really slender vary for the previous month. This compression often precedes a big transfer in both course.

If Bitcoin experiences one other stable drop, it might full its present cycle and bounce again strongly. The weekly timeframe reveals some weak point, which isn’t excellent if BTC value is anticipated to succeed in new highs in October.

Nonetheless, it’s not too late for this to occur. The bottom line is for Bitcoin to interrupt out of its present consolidation with out trying again.

As soon as the capital at present held in stablecoins is allotted to Bitcoin, the worth might break by way of both facet of this vary, doubtlessly resulting in a continuation of the continued bull run.

Bitcoin nonetheless has room to develop

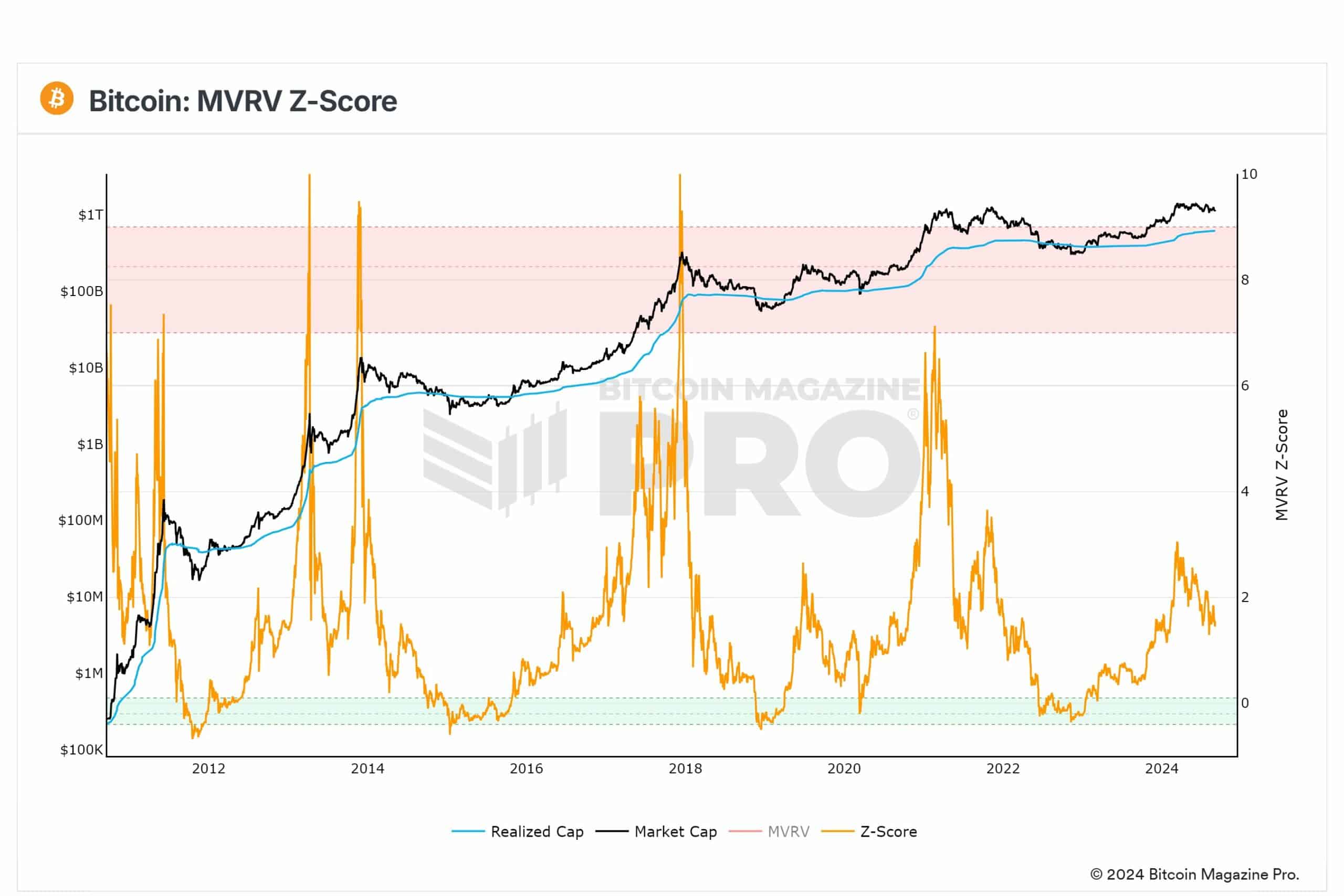

The MVRV Z-Rating, which at present reads round 1.8, means that the market is reasonably optimistic however not at an excessive level.

This rating signifies that whereas Bitcoin nonetheless has room to develop, warning is required because the market might grow to be overvalued if the rating continues to rise.

The 1.8 studying implies that the cycle is way from over and may be starting. Because the BTC value strikes larger, it’s vital to watch this rating intently, because it might present early warnings of a market peak.

The quick to medium time period open curiosity

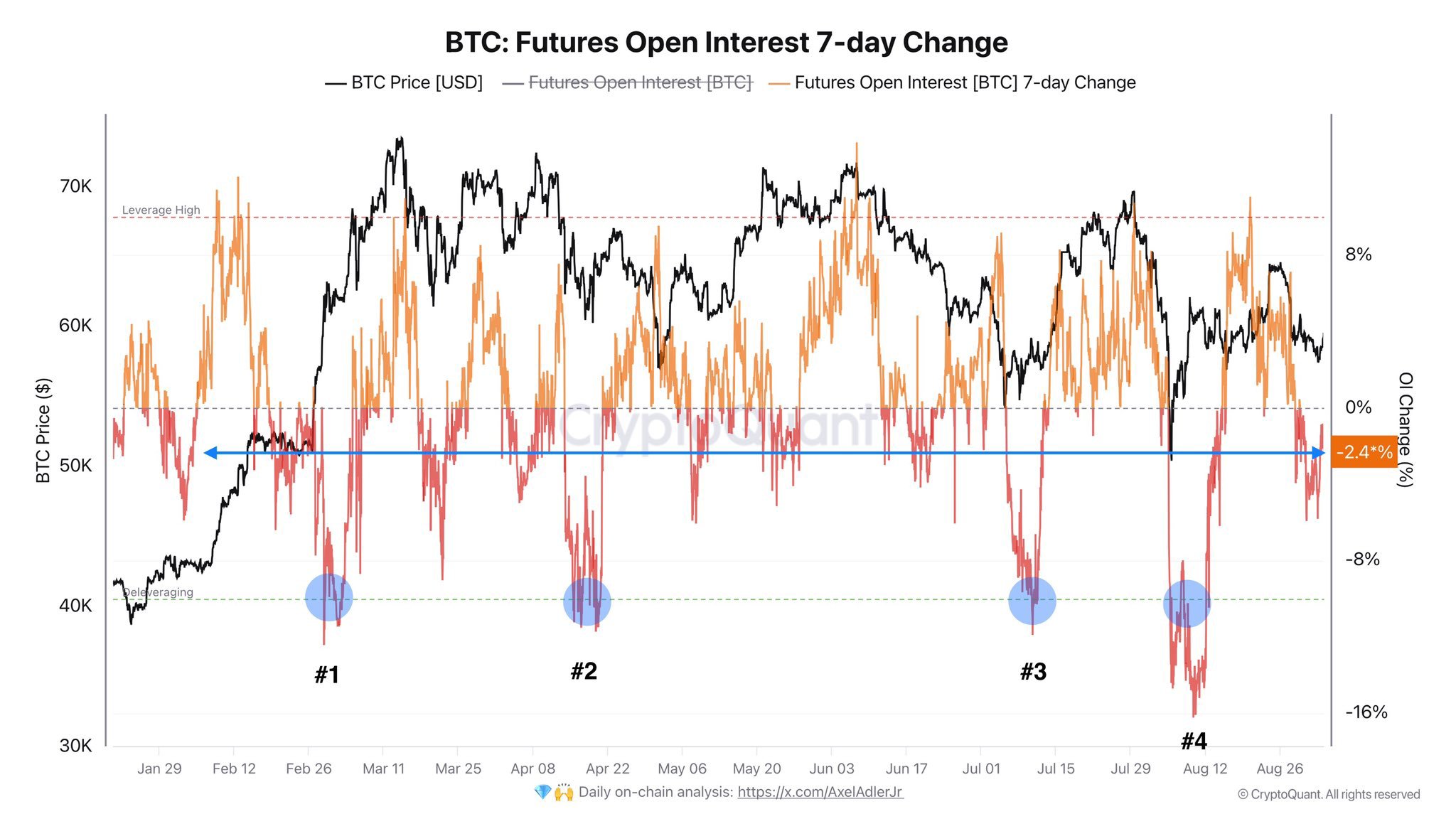

Within the quick to medium time period, open curiosity (OI) is comparatively excessive, which might hinder sustainable upward motion. For a more healthy market, OI would wish to lower by round 10%.

Just lately, OI has reset following a short-term rise through the newest drop, bringing BTC value again to the place it began.

This reset is a optimistic signal, because it reduces the probability of a significant market downturn and will increase the possibilities of continued vary buying and selling on decrease timeframes. If market circumstances enhance, Bitcoin’s value might surge larger.

Supply: CryptoQuant

HODL cycles and periodicity

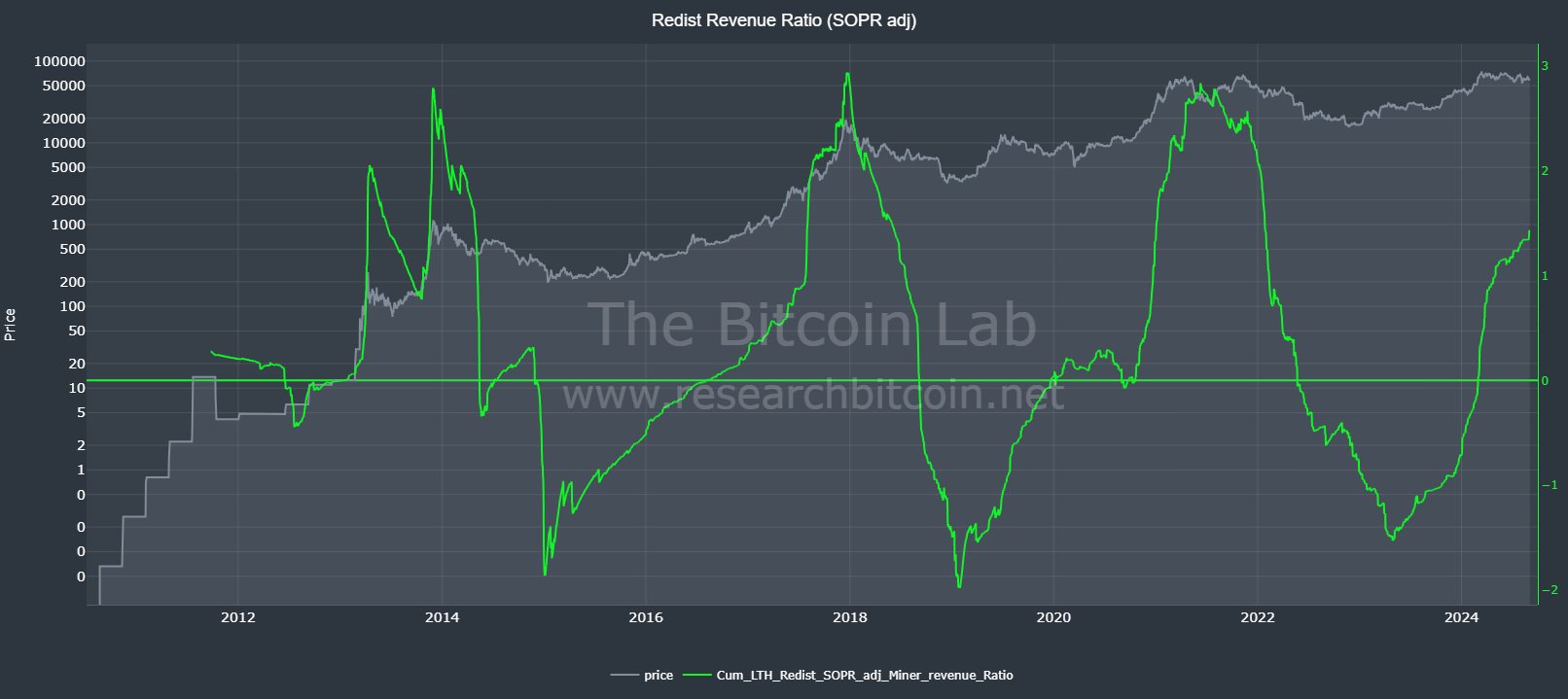

The Redistributed Income Ratio, which compares long-term holder exercise to Proof of Work incentives, reveals a transparent sample of HODL cycles.

The ratio adjusted with the Spent Output Revenue Ratio (SOPR) is round 1.5, suggesting that Bitcoin has not peaked but.

Supply: The Bitcoin Lab

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

As international liquidity continues to develop, and as soon as stablecoins are allotted to Bitcoin, the worth might rise considerably.

Bitcoin is prone to be one of many major beneficiaries when this capital lastly enters the market, doubtlessly pushing BTC value larger.