- Extra BTC LTHs have offered their holdings up to now week.

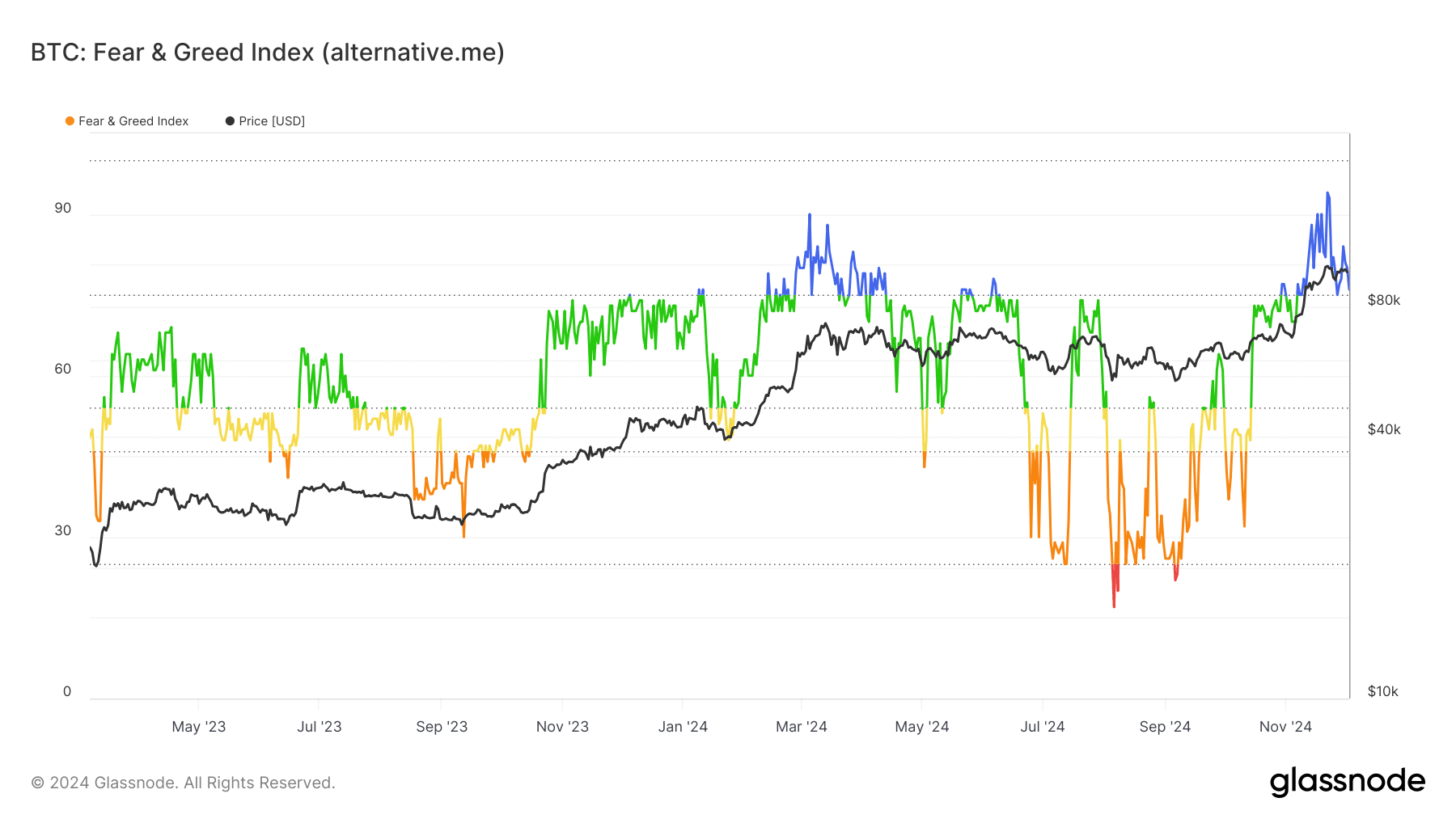

- The market remained within the “Greed” section regardless of these sell-offs.

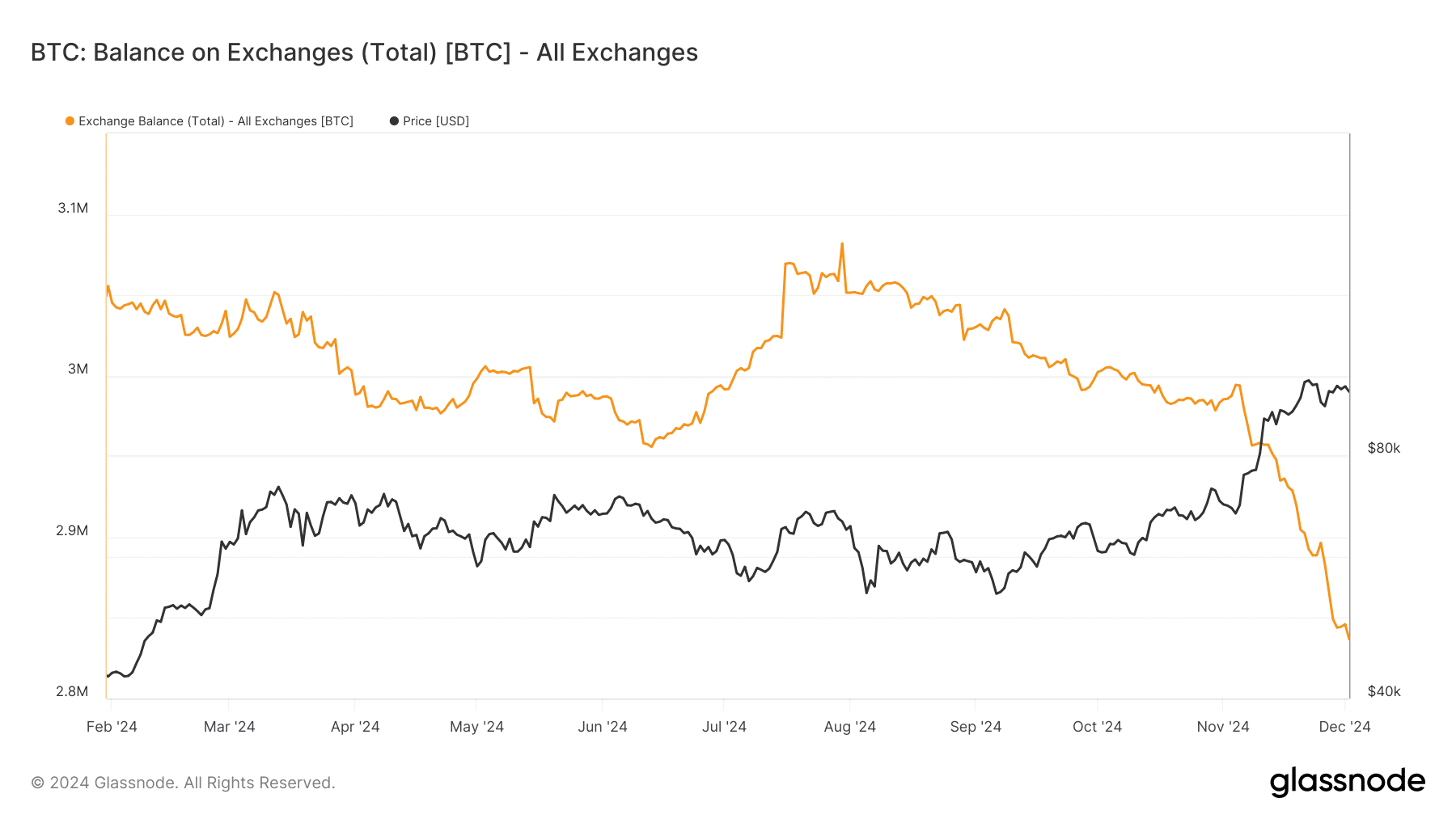

The Bitcoin[BTC] Change Stability has considerably declined, reaching ranges not noticed since early 2023. This sharp drop, mixed with bullish worth traits and modifications in long-term holder conduct, paints a compelling image of present market dynamics.

By analyzing on-chain metrics equivalent to alternate balances, long-term holder positions, and the Worry & Greed Index, AMBCrypto deciphered what this development means for Bitcoin’s worth trajectory and the broader crypto market.

Bitcoin alternate stability hits multi-year lows

Knowledge reveals that Bitcoin’s complete stability throughout all exchanges has fallen to roughly 2.8 million BTC, down from over 3.2 million BTC, earlier this yr.

This important discount in alternate reserves typically correlates with bullish market sentiment, suggesting a decreased probability of promoting strain.

Buyers withdrawing Bitcoin to non-public wallets typically point out long-term holding conduct or a transfer towards self-custody, reflecting confidence within the asset’s future worth appreciation.

Curiously, this development aligns with Bitcoin’s worth surging above $90,000, highlighting a possible accumulation section by each retail and institutional traders.

The connection between declining alternate balances and rising costs indicators tightening liquidity on exchanges, which may result in elevated worth volatility if demand spikes.

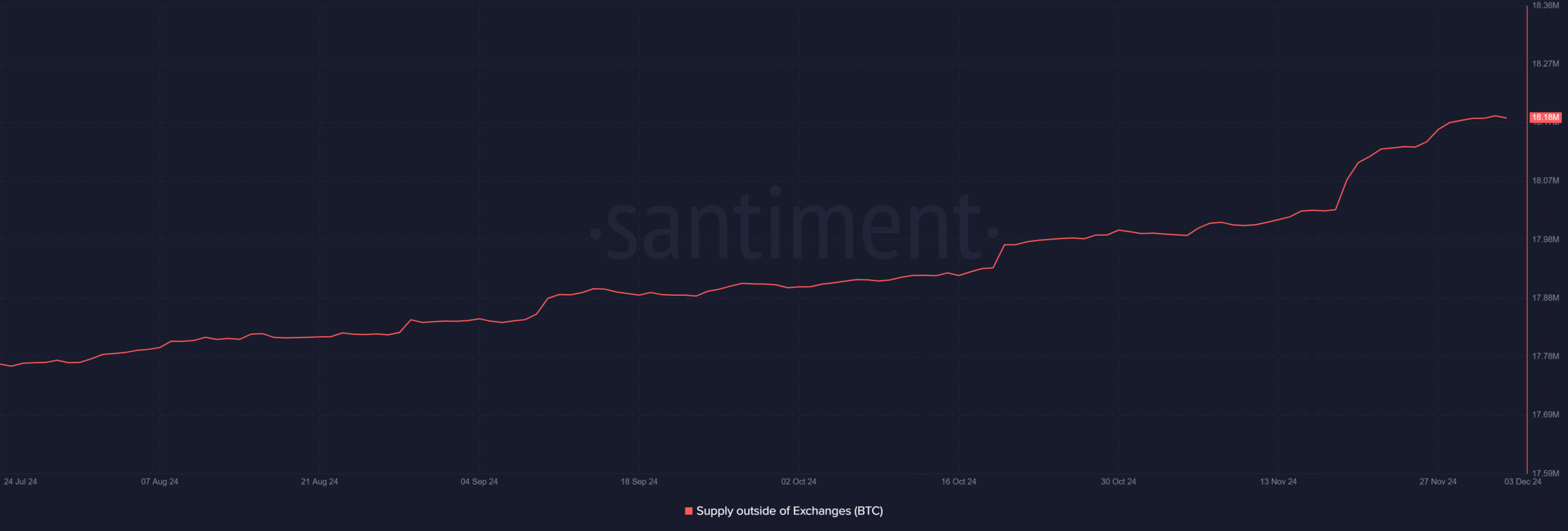

Extra BTC goes off exchanges

Complementing this development, the availability of Bitcoin exterior of exchanges has risen steadily, surpassing 18.18 million BTC.

Traditionally, such strikes away from exchanges correlate with decreased promoting strain, contributing to tighter provide dynamics. These components typically create favorable circumstances for upward worth actions, particularly throughout heightened demand.

Lengthy-term holders shift gears

Evaluation of the Lengthy-Time period Holder (LTH) internet place change reveals an important narrative. After months of accumulation, LTHs have began to scale back their positions. This internet discount signifies profit-taking at present worth ranges, a typical conduct throughout bullish market cycles.

Nonetheless, the discount in LTH positions will not be essentially bearish, as it’s offset by elevated exercise amongst short-term members and a surge in self-custody.

Sentiment stays optimistic amid declining stability

The Worry & Greed Index indicators “Greed,” reflecting Bitcoin’s latest worth highs and bullish sentiment. The index has stayed within the “Greed” or “Extreme Greed” zone for a number of weeks, which is linked to elevated retail participation and speculative shopping for.

Whereas excessive ranges of greed can sign overbought circumstances, they’re additionally in step with sturdy upward momentum within the quick to medium time period.

The development and declining Bitcoin Change Stability point out a possible provide crunch that might push Bitcoin costs greater, barring any important macroeconomic disruptions.

What does this imply for Bitcoin

Bitcoin’s sharp decline in alternate balances and the corresponding rise in provide exterior of exchanges spotlight a market in transition. The mix of decreased alternate balances, profit-taking by long-term holders, and excessive ranges of greed suggests a fancy however bullish market dynamic.

Declining alternate reserves point out a tightening provide. Nonetheless, profit-taking by long-term holders introduces the opportunity of short-term volatility because the market digests these gross sales.

Learn Bitcoin (BTC) Worth Prediction 2024-25

Wanting forward, Bitcoin’s means to maintain its bullish momentum will rely on continued accumulation traits, steady macroeconomic circumstances, and its means to draw new capital inflows.

If the present traits persist, Bitcoin may proceed its climb towards new all-time highs, supported by sturdy on-chain metrics and optimistic sentiment. On the time of writing, BTC was buying and selling at round $95,000.