- Bitcoin realized $5.42 billion in earnings

- With rising netflows, BTC confronted short-term promoting strain close to $90k

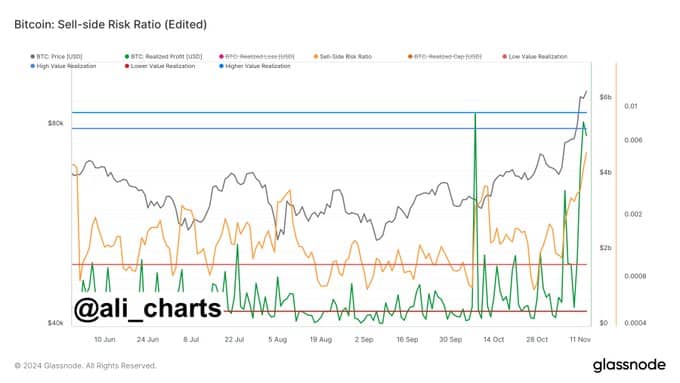

Bitcoin (BTC) has seen a realization of $5.42 billion in earnings, in line with market analyst Ali, because the Promote-side Danger Ratio surged to 0.524%. This metric, which evaluates the risk-reward stability for sellers, stays under historic highs, with the identical suggesting that promoting strain will not be but at excessive ranges.

Regardless of this, nonetheless, merchants are suggested to train warning as profit-taking intensifies.

The realized revenue figures surged forward of realized losses, with earnings spiking in direction of $8 billion whereas losses remained subdued at roughly $1 billion at press time. Such an imbalance is an indication of market optimism, as extra traders capitalize on positive factors quite than promoting at a loss.

Bitcoin’s market stays resilient regardless of current value drop

Bitcoin was buying and selling above $91,000 at press time, with a 24-hour buying and selling quantity of $84.43 billion. Whereas the cryptocurrency did appropriate on the charts not too long ago, BTC hiked by slightly below 4% within the final 24 hours.

On the similar time, information from IntoTheBlock revealed that 307,000 addresses collected Bitcoin round a median value of $89,200. This stage may act as an important zone of help or resistance, relying in the marketplace path.

Bitcoin’s capability to maintain its value close to this stage is being carefully watched as market individuals assess the following transfer.

Community exercise displays rising adoption

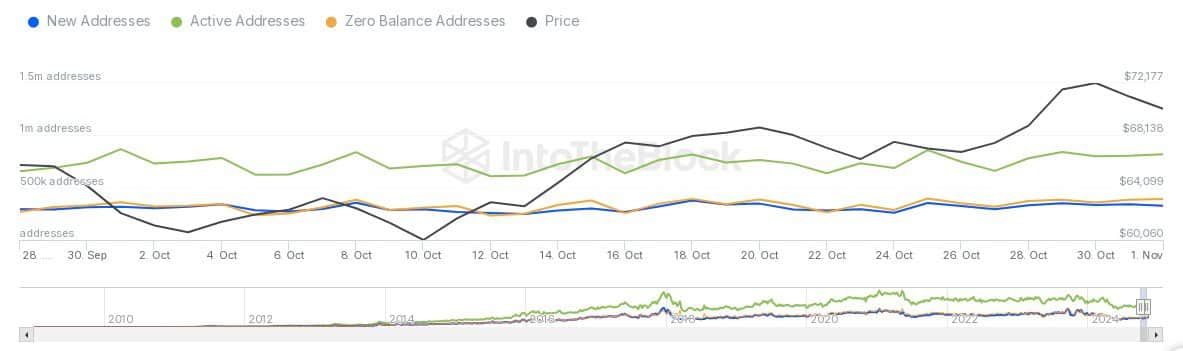

The hike in Bitcoin’s value correlated with a hike in community exercise. In actual fact, information confirmed an uptick in each new addresses and energetic addresses – An indication of heightened participation.

New addresses have risen steadily too, reflecting recent inflows of customers into the ecosystem. Energetic addresses, representing every day transaction individuals, additionally climbed to ~1.1 million, showcasing sustained community engagement.

In the meantime, the variety of zero stability addresses has remained comparatively flat, indicating no noticeable enhance in dormant or deserted wallets.

This pattern will be interpreted to recommend sustained belief and engagement from the group, whilst Bitcoin’s value fluctuates on the charts.

Quick-term promoting strain?

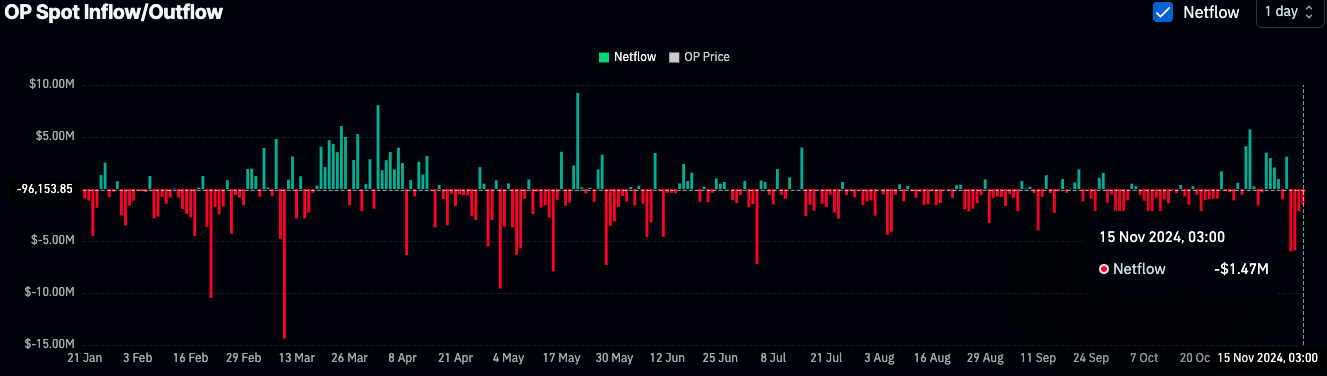

On 15 November , web inflows of $128.46 million had been recorded, suggesting a doable hike in promoting strain.

Traditionally, larger inflows to exchanges have been related to short-term corrections as merchants look to capitalize on current positive factors.

And but, Bitcoin’s efficiency has remained robust, supported by intervals of accumulation earlier within the yr. Between Could and August, constant destructive netflows indicated large-scale withdrawals from exchanges, usually linked to institutional traders or long-term holders.

This accumulation section possible fueled Bitcoin’s current rally, which noticed the value climb from $25k to over $90k.

Broader financial components may form Bitcoin’s future

In line with a current AMBCrypto report, uncertainty surrounding regulatory insurance policies and nationwide debt ranges may affect Bitcoin’s value trajectory.

The brand new administration might introduce fiscal measures to deal with debt considerations, which may heighten inflationary dangers.

Furthermore, with the Bitcoin/Gold ratio peaking at 35, Bitcoin is now valued at 35 instances gold’s value, marking a yearly excessive. It is a signal of Bitcoin’s ongoing outperformance towards conventional belongings, even amid macroeconomic uncertainty.