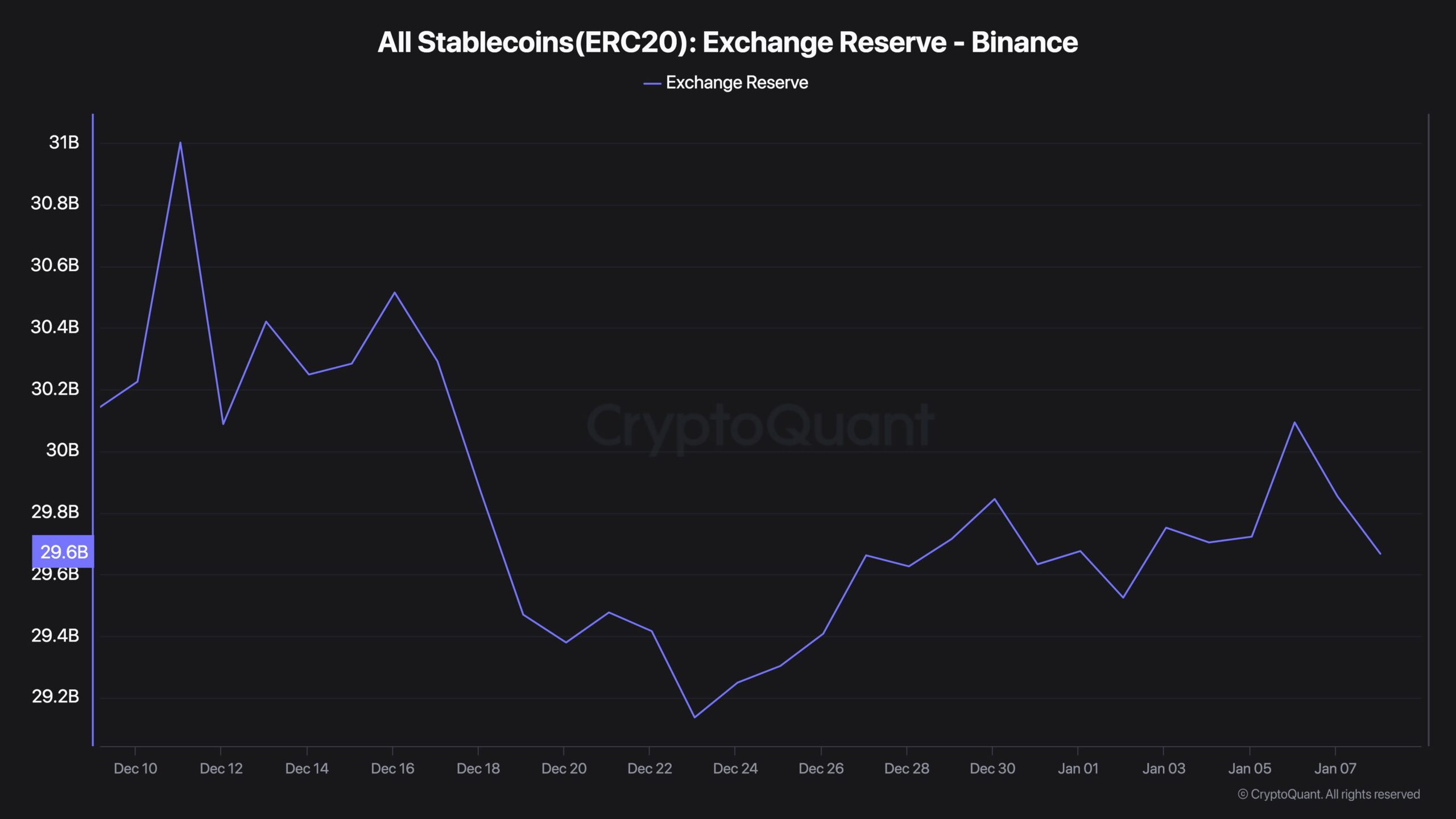

- The current weak sentiment was marked by prolonged Binance stablecoin outflows.

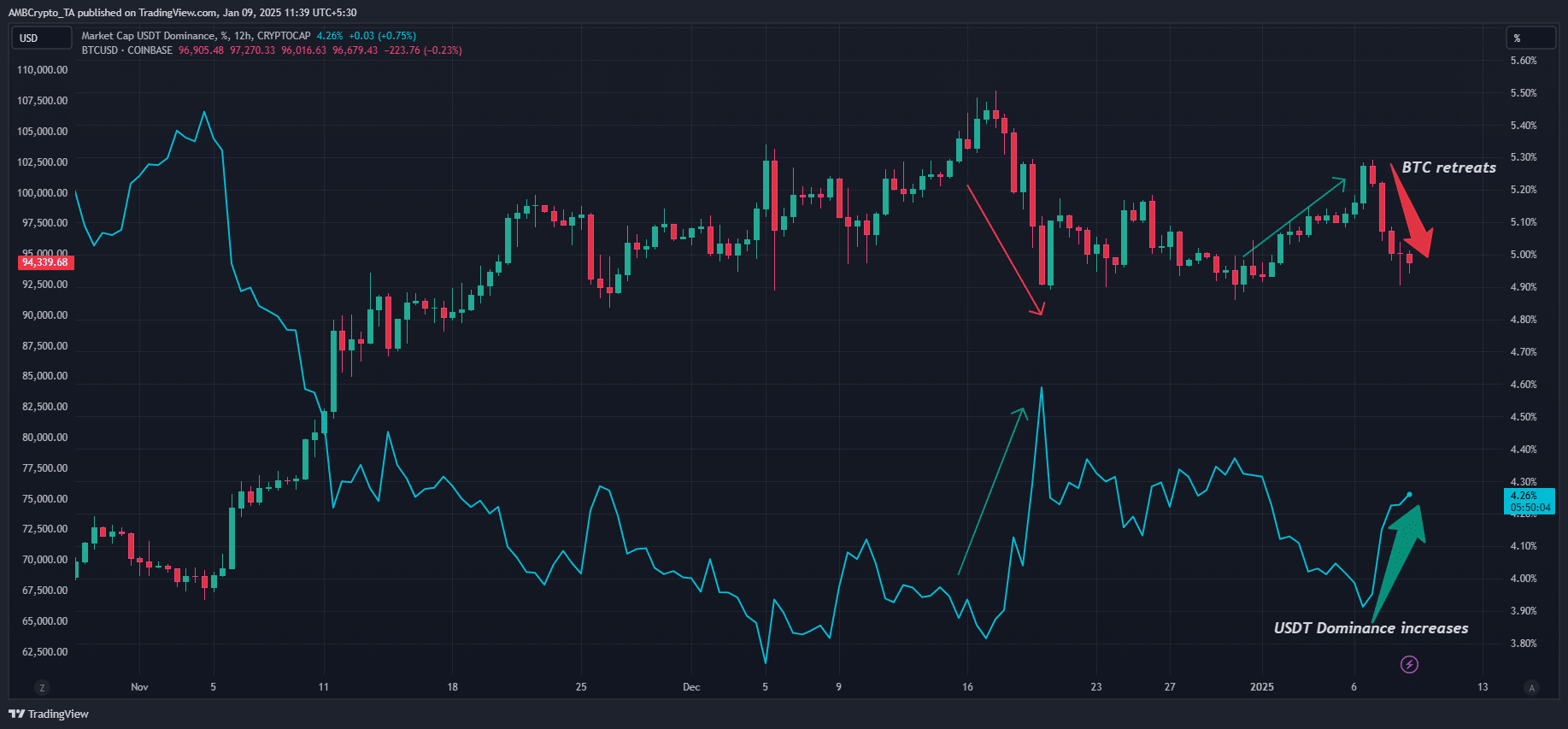

- USDT dominance additionally spiked as traders opted to protect capital as markets tanked.

This week’s risk-off sentiment has unnerved some crypto traders, forcing most to lock-in revenue or opt-out altogether to protect capital.

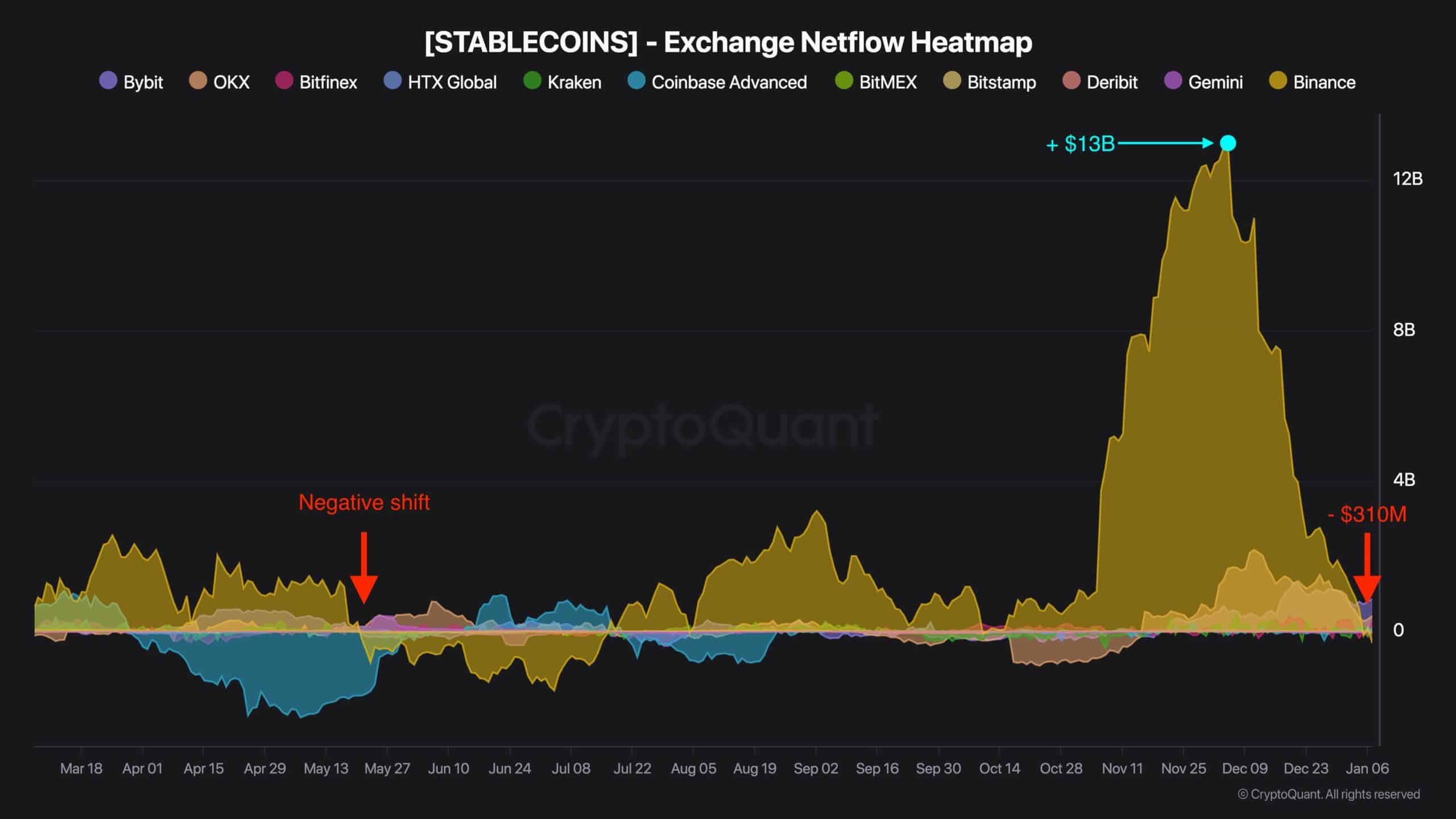

In line with pseudonymous CryptoQuant analyst Darkish Fost, the reversal of Binance stablecoins from a +$13B influx in November to file an outflow of $310M in early January, mirrored final summer season’s BTC market stoop.

He said,

“We are currently witnessing a reversal in stablecoin flow dynamics on Binance. This type of trend reversal was last observed in May 2024, right before Bitcoin’s sharp price decline during the summer.”

Bitcoin market on edge

Fost added {that a} lukewarm stablecoin influx sometimes signifies weak shopping for energy.

Nevertheless, he warned that persistent outflows, as seen since mid-December, underscored market warning and will dent the Bitcoin [BTC] outlook.

“While a reduction in stablecoin inflows signals weakening a buying pressure, outright stablecoin outflows indicate a more significant market shift, with investors leaning toward caution.”

The weak market sentiment was triggered by sticky U.S. inflation, reinforcing the Fed’s sluggish charge lower path, which might stall risk-on belongings.

Moreover, hawkish FOMC Minutes and information of the U.S. authorities reportedly getting approval to promote seized BTC from Silk Highway muted market optimism.

The rising Tether (USDT) dominance additionally confirmed Darkish Fost issues. The indicator is inversely correlated with BTC value, and the current spikes marked the native high at $108K and $102K.

In truth, some analysts, like Peter Brandt, beforehand warned that BTC’s inverted head-and-shoulder sample might drag it to $75K ranges if it breaks beneath $90K.

Whether or not the USDT dominance will high out once more above 4% and permit BTC to rebound stays unsure.

Nevertheless, Benjamin Cowen and CoinDesk’s senior analyst James Van Straten downplayed the current BTC decline as a typical January pullback through the post-halving yr.

At press time, the asset tried to stabilize above $94K.