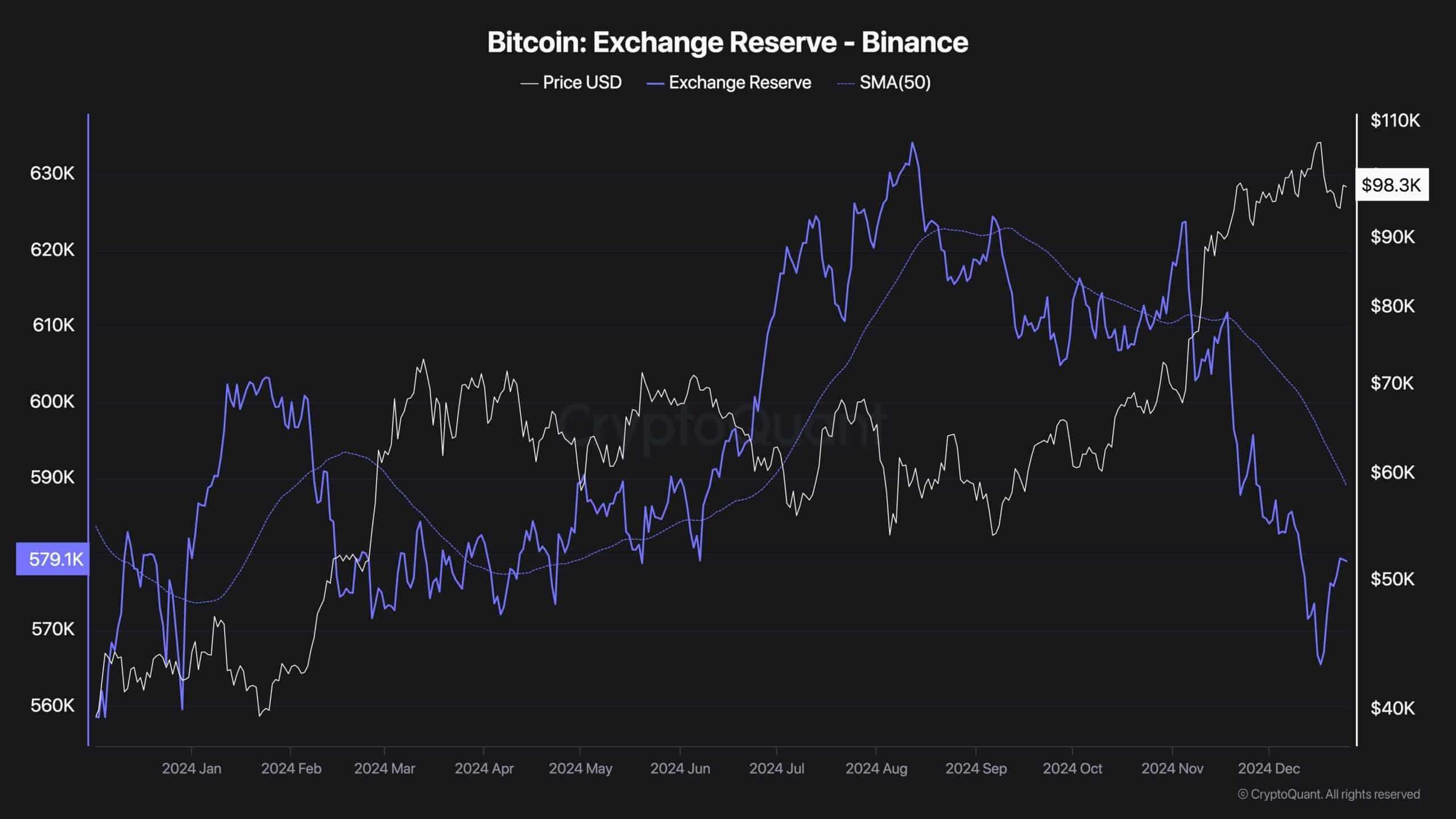

- Binance BTC reserve has dropped from over 630K BTC to 579K in 4 months.

- Can BTC climb above $105K amid looming demand shock?

Binance alternate Bitcoin [BTC] reserve has dropped to January 2024 lows, a development {that a} CryptoQuant analyst deemed as a optimistic outlook for the asset in the long run.

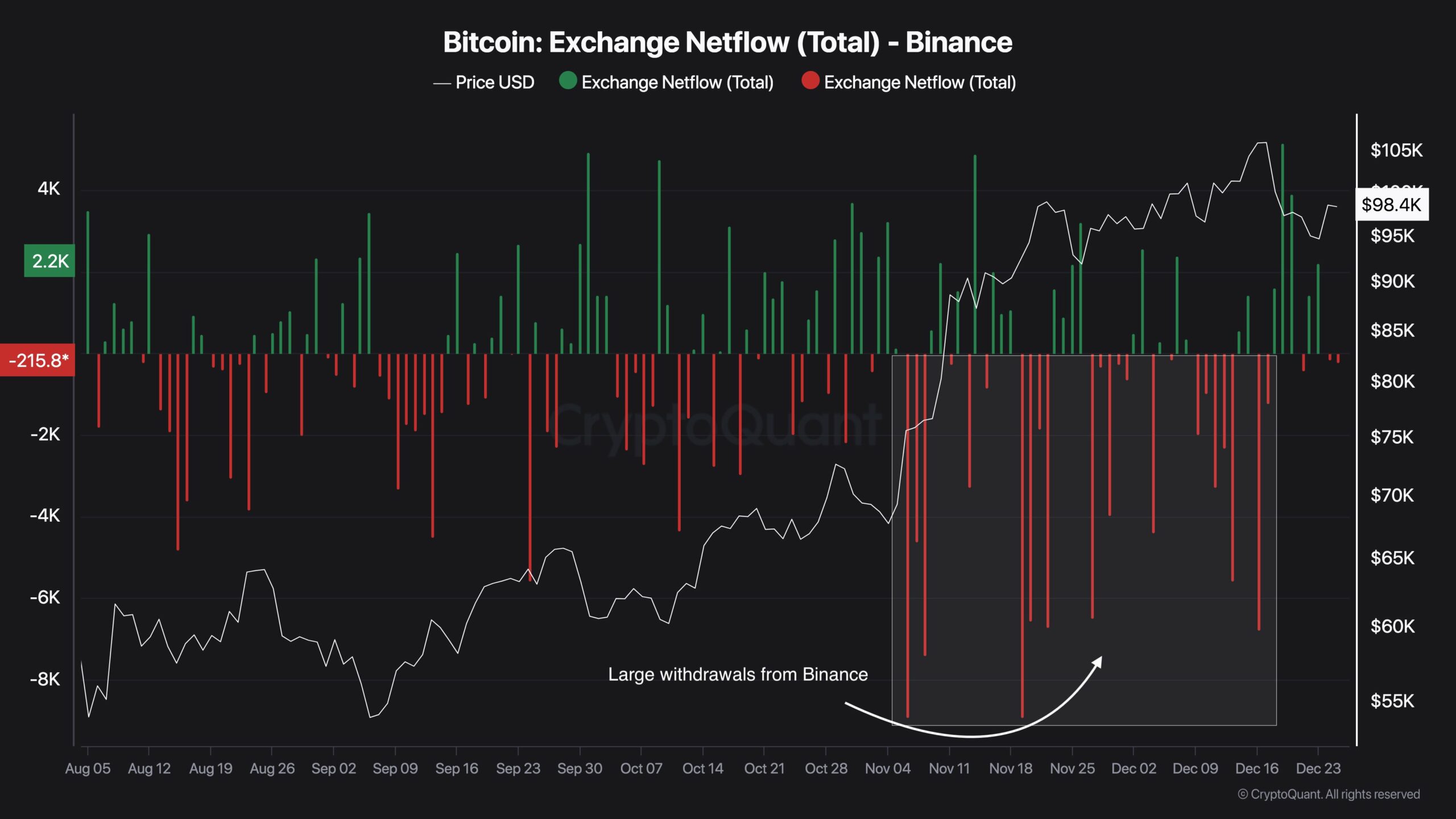

Since August, the Binance reserve has declined from 630K BTC to just about 580K BTC.

These low ranges had been final seen in January, simply earlier than US BTC ETFs went reside and triggered a 90% pump, famous pseudonymous analyst Darkish Fost.

Bitcoin: Extra rally or worth vary?

The declining reserve meant that extra BTC was moved from Binance for self-custody, indicating a possible worth rally sooner or later.

Fost added that the outflows bolstered BTC’s optimistic long-term prospect.

Curiously, the August-December decline in BTC reserve on the Binance alternate additionally coincided with the cryptocurrency pump to a document excessive of $108K.

So, with Christmas out of the way in which and the main focus shifting to the upcoming Trump inauguration, what’s subsequent for BTC?

Bitget Analysis chief analyst Ryan Lee anticipated BTC to stay range-bound between $94K-$105K, with a possible breakout after the vacation season. He mentioned,

“The expected trading range for BTC this week is $94,000 – $105,000. The price is expected to exceed $105,000 after Christmas.”

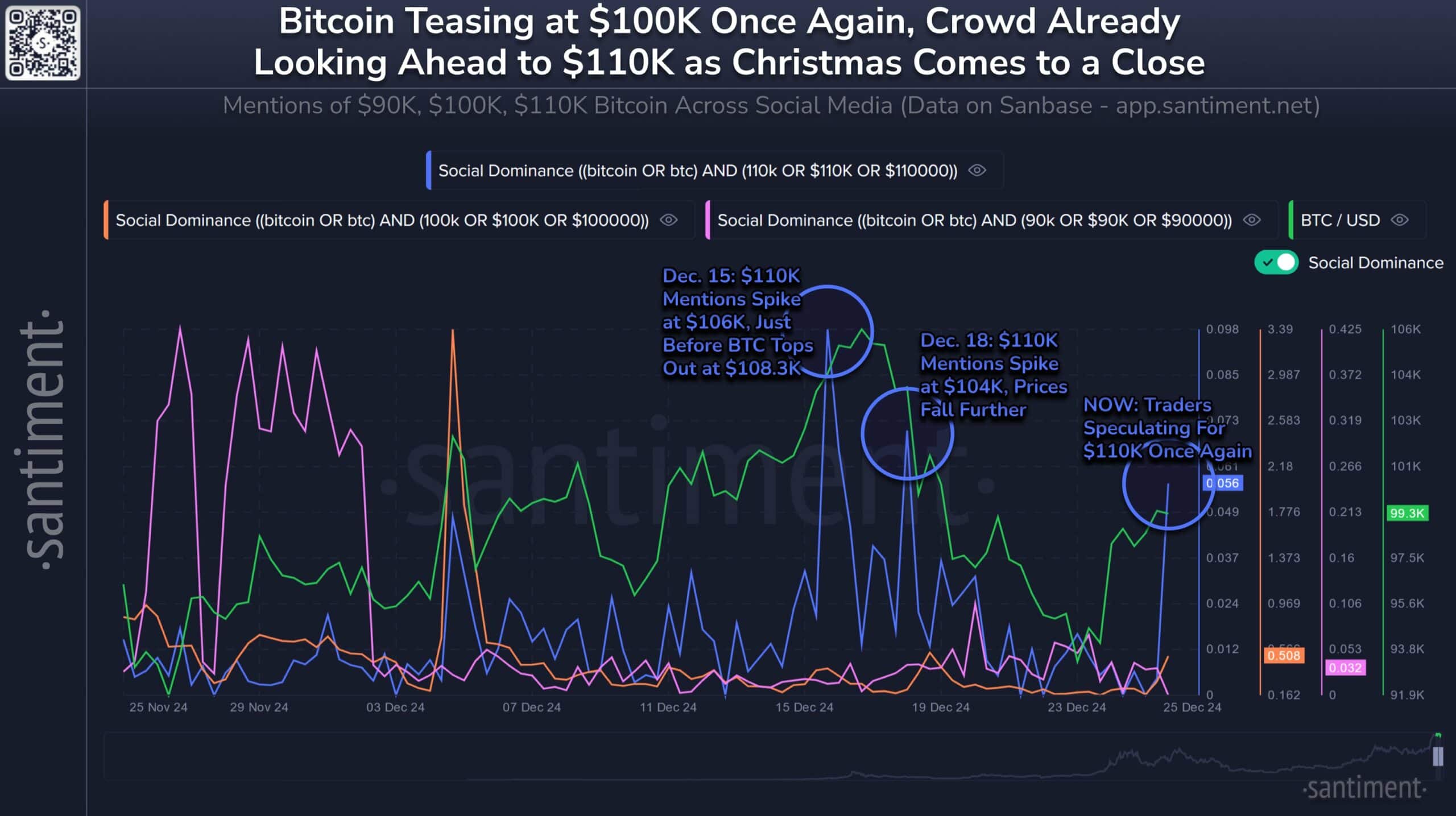

Since Christmas Eve, BTC has flirted with the $100K, rising bullish requires $110K up to now few hours.

However Santiment cautioned {that a} breakout to $110K would most likely occur when individuals least anticipate it. The analytics agency acknowledged,

“Traders are now swinging bullish once again, with speculation of $110K getting rampant. Historically, we will see $110K Bitcoin only after the crowd doesn’t expect it, as this image shows.”

As of writing, BTC was valued at $97.8K, about 10% away from its all-time excessive of $108.3K.