- Liquidation of quick positions and rising Open Curiosity fuels hypothesis about Bitcoin’s worth trajectory

- Hike in dealer participation and good lengthy positions hinted at rising institutional confidence

Following vital liquidations of quick positions, an increase in Open Curiosity, and a notable shift in good lengthy positions, hypothesis is mounting about the opportunity of an area prime in Bitcoin’s [BTC] worth motion.

These current developments have captured the eye of merchants and analysts alike, prompting a deeper look into how the change in market sentiment might affect Bitcoin’s short-term worth trajectory.

Liquidation of quick positions and its affect

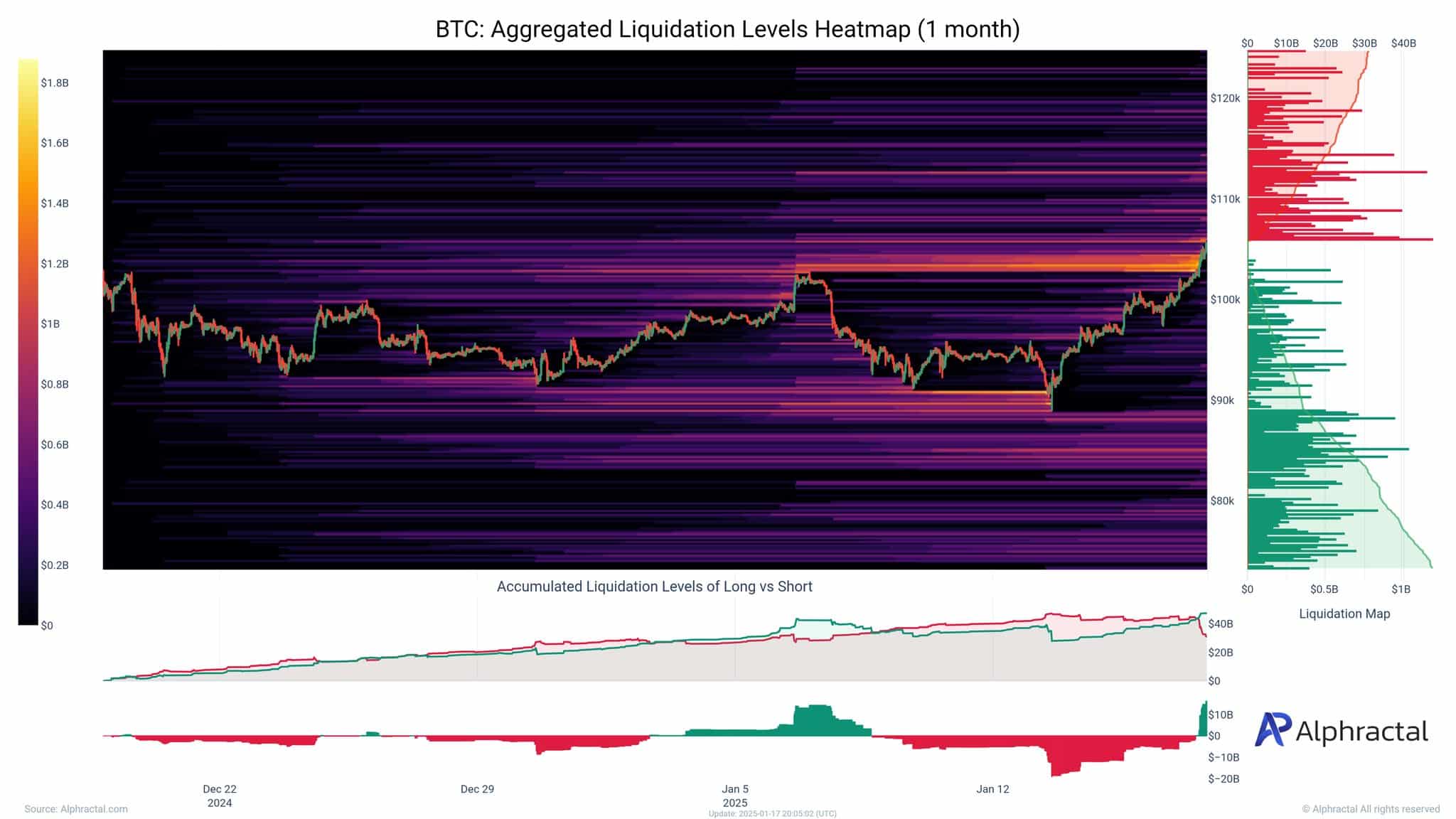

The liquidation heatmap revealed a major focus of liquidations close to the $100,000-mark. The newest rally in Bitcoin’s worth triggered the clearing of a overwhelming majority of quick positions, as evidenced by the hike in liquidation quantity in greater worth ranges.

The gathered liquidation ranges indicated a pointy imbalance, with quick liquidations overwhelmingly dominant within the days main as much as 17 January.

These liquidations have injected vital shopping for strain into the market, forcing shorts to cowl positions, thereby driving costs greater.

Moreover, the heightened quantity of liquidations round key resistance ranges highlighted how market contributors underestimated Bitcoin’s bullish momentum, inadvertently contributing to upward worth acceleration. This surge has strengthened Bitcoin’s bullish sentiment, albeit cautiously.