- U.S. BTC ETFs noticed $156 million in outflows final week amidst market drawdown.

- GBTC noticed inflows for 2 days straight as markets improved.

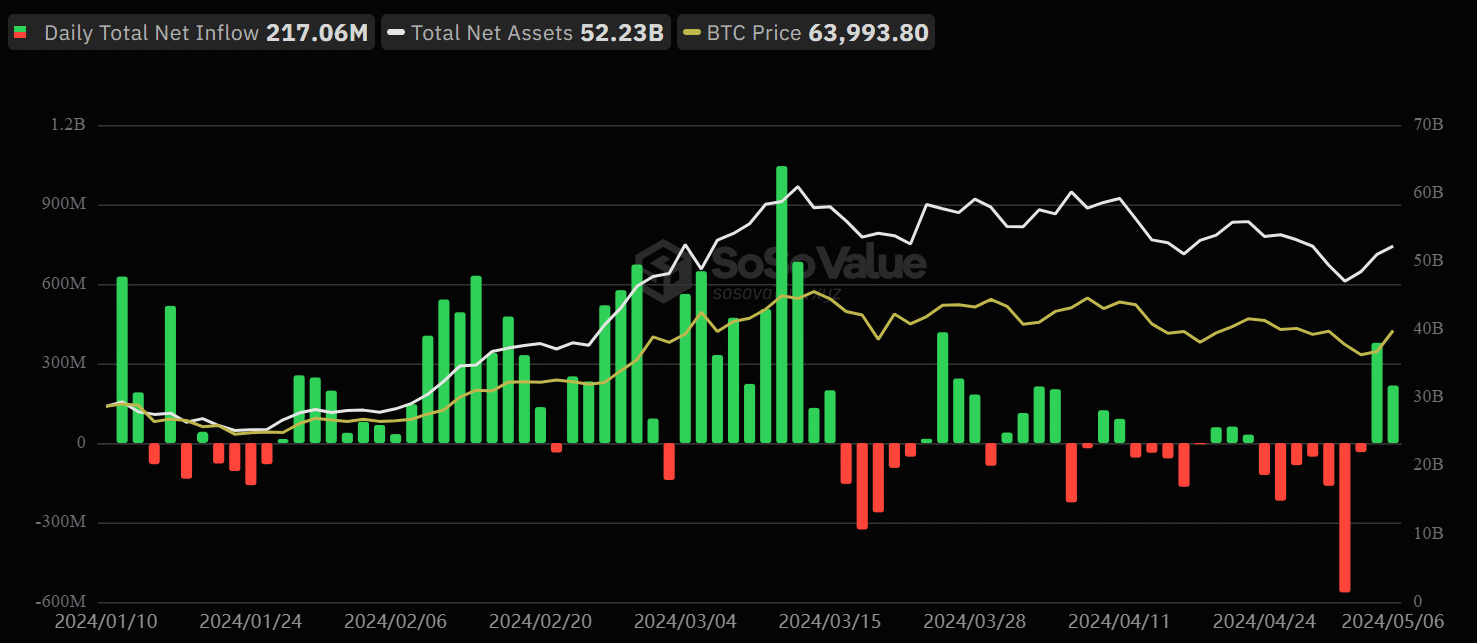

The brand new U.S. Bitcoin [BTC] ETFs noticed $156 million in outflows final week, however that appears to vary as Grayscale’s GBTC bleeding involves an finish.

In response to the CoinShares report, final week’s outflows had been vital because the BTC worth dropped under the common shopping for worth of the ETF issuers.

The report talked about that computerized promote orders may have spiked final week’s BTC drawdown.

“We estimate the average purchase price of these ETFs since launch to be US$62,200 per bitcoin; as the price fell 10% below that level, it may have triggered automatic sell orders.”

BTC hit a low of $56.5K on Might Day, inducing a market-wide massacre and liquidations. Each U.S. spot BTC ETF noticed huge outflows on Might Day, marking BlackRock’s IBIT’s first outflow since January.

Throughout the board, whole outflows on Might Day hit $563.7 million, with Constancy and Grayscale main the pack at $191.1 million and $167.4 million, respectively.

Nonetheless, the outflows eased later within the week, bringing final week’s total outflow to $156 million, per the report.

Will GBTC’s U-turn gas the Bitcoin ETF restoration?

Market sentiment improved as BTC recovered from $56.5K to $65K. Nonetheless, Grayscale’s GBTC pulled the most important shock in the course of the restoration.

It noticed the primary influx of $63.9 million final Friday and confirmed one other influx on Monday price $3.9 million.

Grayscale’s U-turn caught Bloomberg analysts abruptly, too. One of many analysts, Eric Balchunas, famous,

“But looks like inflows again today, too. They do have an extensive marketing budget. That, combined with the recent rebound and no more people looking to leave, could be why.”

The restoration additional fueled investor urge for food, as internet inflows hit $378.2 million final Friday. The U.S. BTC ETFs remained inexperienced on Monday and recorded one other internet influx of $217 million.

On the time of writing, BTC was again in its earlier worth consolidation vary of $60K—$71K however slipped under $64K after grabbing liquidity at $65.5K.

Ought to BTC’s restoration lengthen to the range-high, U.S. BTC ETFs may reverse final week’s $156 million outflows.