- The historic correlation between Bitcoin and the U.S. greenback is about for one more cameo this bull run.

- Bitcoin is nearing honest worth value as long-term holders collected extra BTC.

Worth motion patterns usually repeat themselves, which aids in predicting future costs of property like Bitcoin [BTC] and different cryptocurrencies.

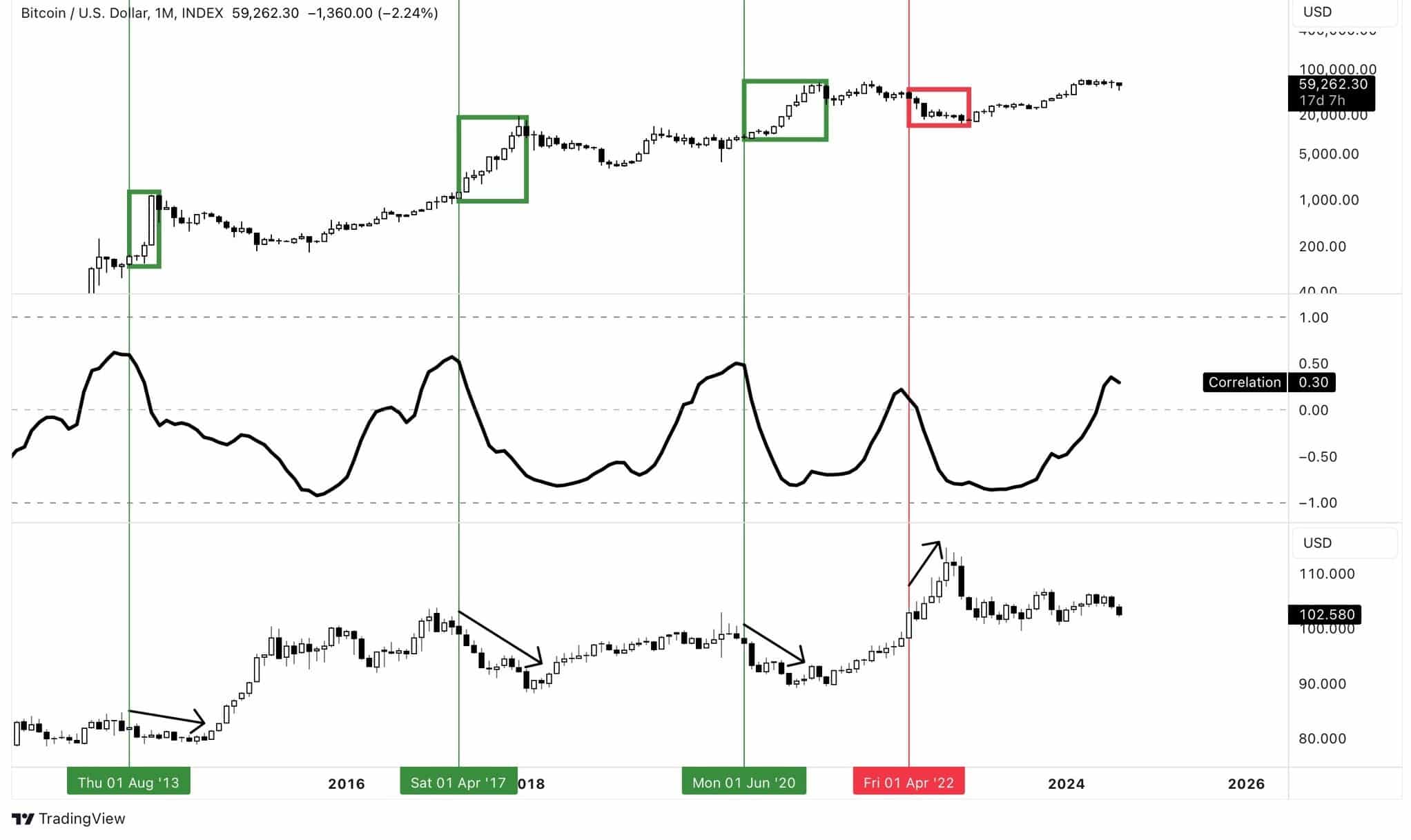

Analyzing the BTC/USD and DXY charts alongside their correlation coefficient revealed a key sample — when BTC’s month-to-month correlation with DXY shifts from constructive, it indicators a serious transfer, however the course will not be sure.

Traditionally, this has led Bitcoin to the ultimate leg of a bull run 75% of the time or a drop throughout a bear market 25% of the time.

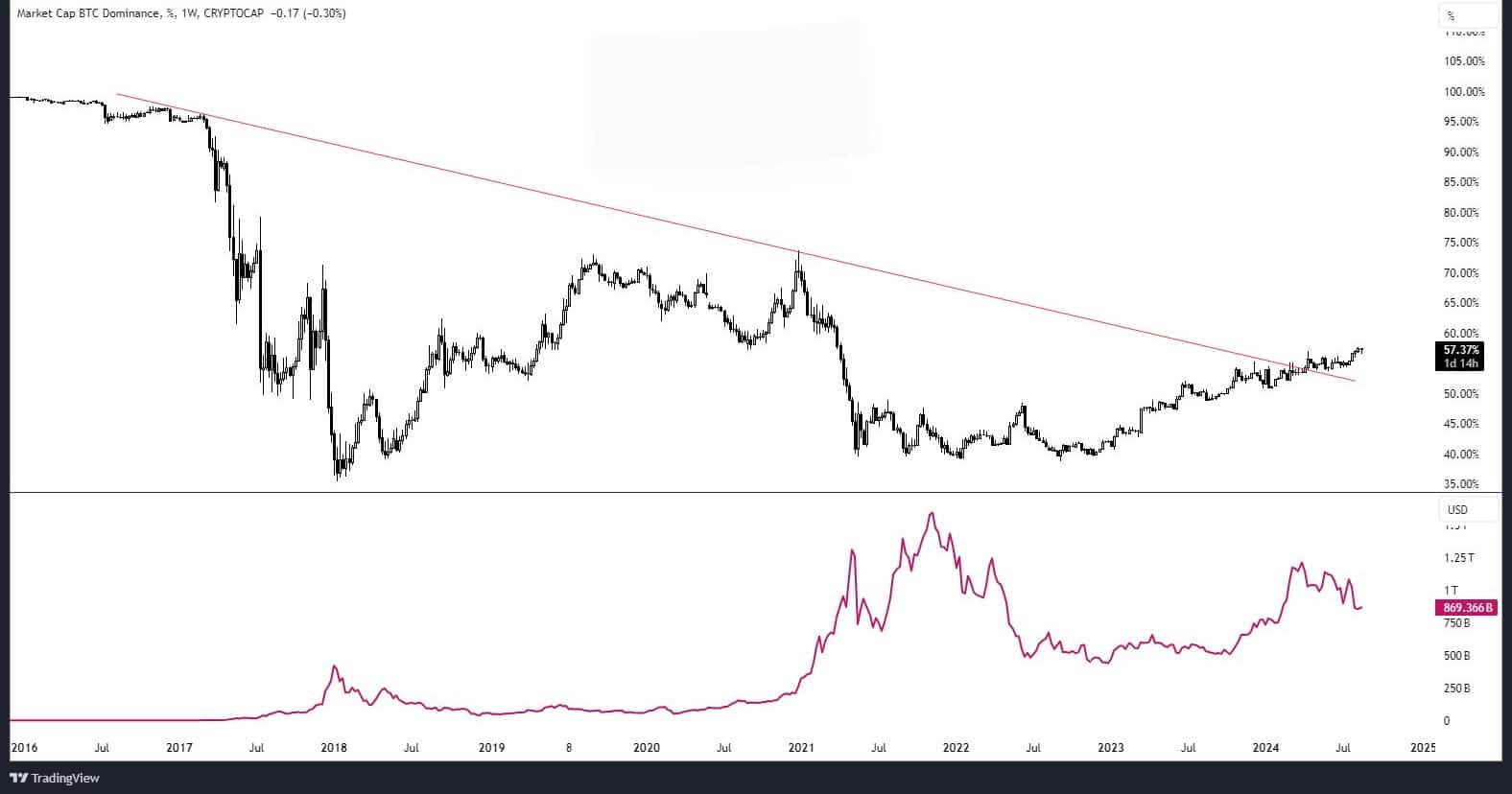

Many analysts are unsure about Bitcoin’s subsequent course, however AMBCrypto has the reply. First, Bitcoin’s weekly dominance chart has damaged out of a descending trendline, signaling potential energy.

Regardless of current value declines, Bitcoin has reclaimed the $60K stage. In the meantime, altcoin market caps seem to have bottomed out and are actually beginning to development upward.

This indicated that Bitcoin and different cryptocurrencies could also be making ready for a major upward motion.

Nonetheless, the Spot-Perpetual Worth Hole on Binance from CryptoQuant remained unfavourable, exhibiting ongoing promoting strain on Bitcoin.

This hole, pushed by aggressive liquidations and quick positions, advised that BTC value was nearing its honest worth. This signaled a possible alternative for traders to purchase, indicating Bitcoin was possible heading upward.

Bitcoin’s historic danger ranges

The chart beneath highlights a danger stage for Bitcoin, serving to with long-term shopping for and promoting factors available in the market. AT press time, the danger stage was round 0.5, indicating low danger and a positive shopping for alternative.

Merchants and traders can contemplate dynamic dollar-cost averaging on this area earlier than danger ranges rise, signaling the necessity to promote bigger parts.

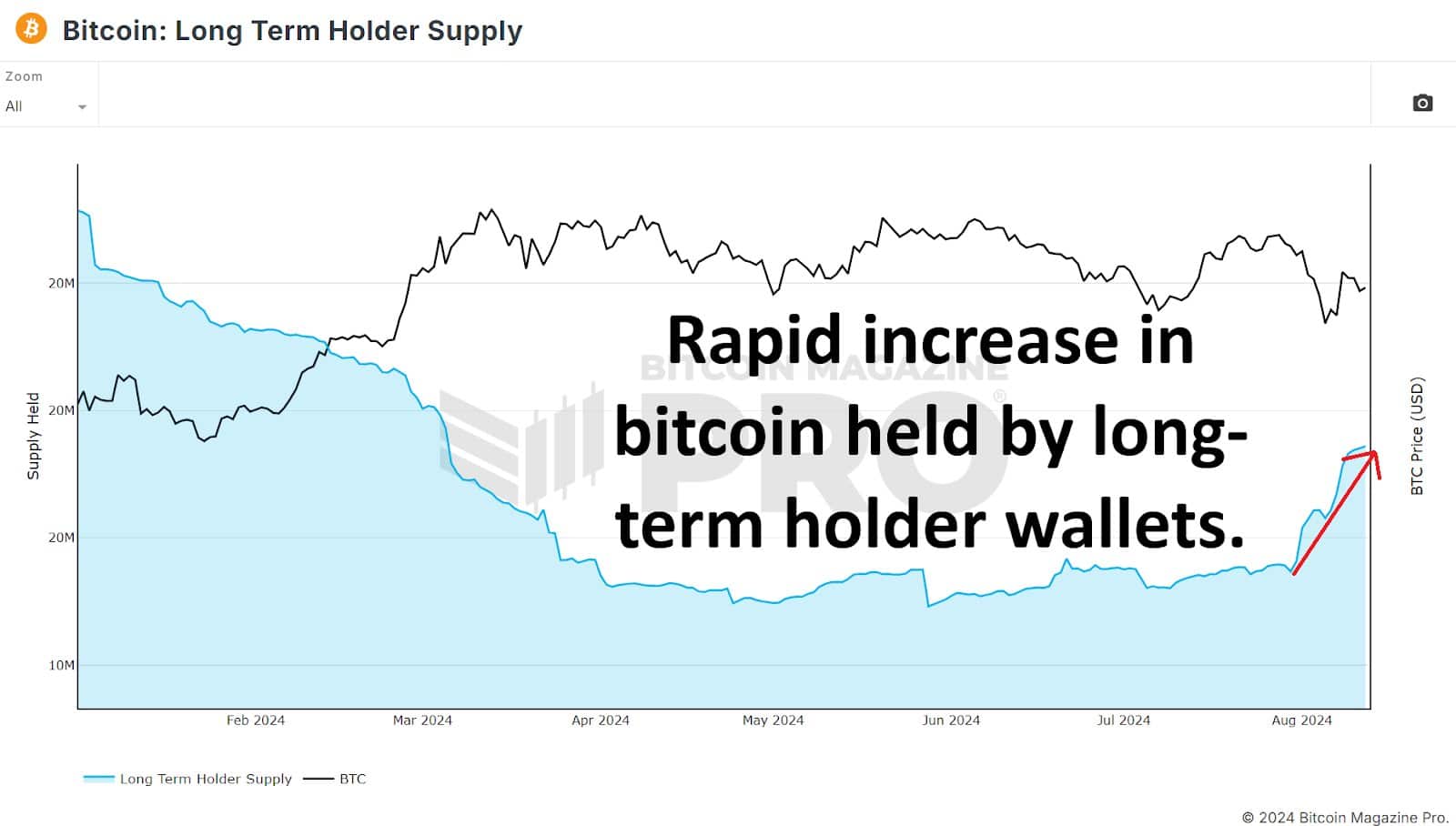

Additionally, because the thirtieth of July, over 500,000 BTC have been added to long-term holder wallets, signaling a bullish development for Bitcoin.

This surge indicated that whales and establishments had been actively accumulating Bitcoin, reflecting rising confidence in its future worth.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

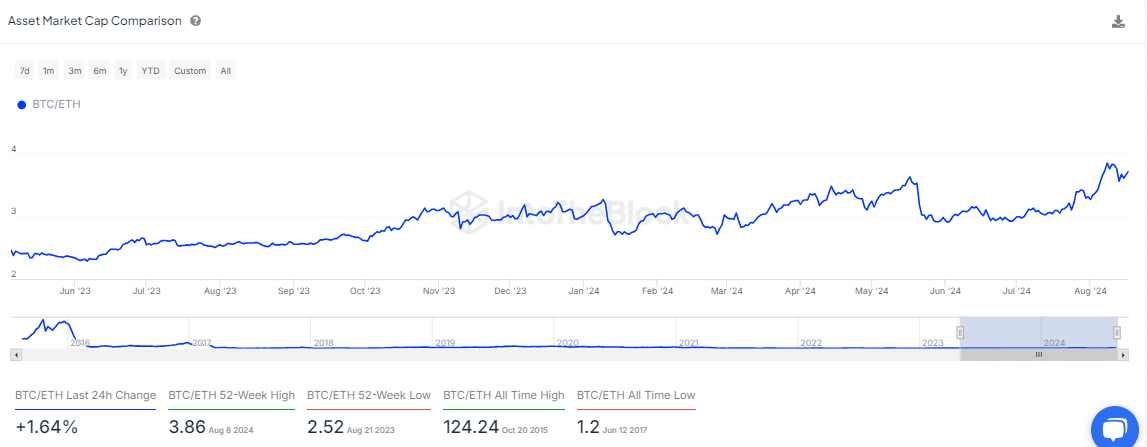

Lastly, Bitcoin gained momentum over Ethereum at press time. The BTC/ETH market cap ratio has steadily elevated in August, indicating stronger accumulation of the king coin.

This development advised that Bitcoin was poised for additional upward motion.