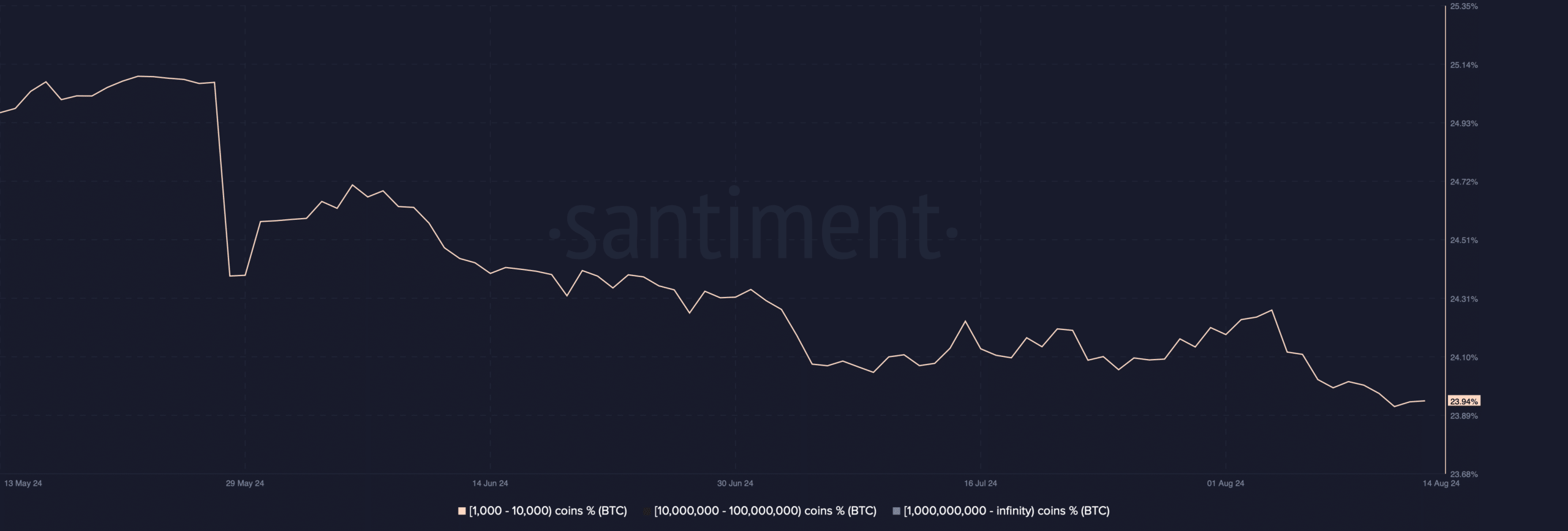

- The variety of BTC addresses holding 1k-10k BTC dropped during the last three months.

- Market indicators and metrics remained bullish, hinting at a continued value rise.

Bitcoin [BTC] bulls have remained dominant out there during the last seven days. Nevertheless, whereas BTC’s value gained upward momentum, whales selected to unload a considerable portion of their holdings.

Does this imply BTC will fall sufferer to a value correction quickly?

Bitcoin whales are promoting

CoinMarketCap’s knowledge revealed that BTC’s value surged by over 6% within the final seven days. In actual fact, within the final 24 hours alone, the king of cryptos witnessed a greater than 4% worth hike.

On the time of writing, BTC was buying and selling at $61,298.02 with a market capitalization of over $1.2 trillion.

AMBCrypto discovered that whereas BTC’s value moved up, the large pocketed gamers within the crypto area selected to promote their BTC holdings.

Our evaluation of Santiment’s knowledge revealed that the variety of BTC addresses holding 1k-10k BTC dropped drastically during the last three months.

Ali, a well-liked crypto analyst, just lately posted a tweet highlighting the identical story.

As per the tweet, a number of the largest Bitcoin whales have offloaded over 10,000 BTC previously week, valued at roughly $600 million.

This recommended that BTC whales had been missing confidence within the coin and had been anticipating its value to drop within the coming days.

Will BTC’s value get affected?

Although whales had been promoting, shopping for sentiment was general dominant out there. AMBCrypto reported earlier that Bitcoin’s alternate reserve reached as little as it was seen again in 2018.

This indicated that purchasing stress on the coin was on the rise. Our have a look at CryptoQuant’s knowledge revealed fairly a couple of bullish metrics.

For instance, BTC’s aSORP was inexperienced, which means that extra buyers had been promoting at a loss. In the midst of a bear market, it will probably point out a market backside.

Additionally, its Binary CDD recommended that long run holders’ motion within the final seven days was decrease than the typical. Each of those indicators recommended that BTC would possibly proceed its upward value motion.

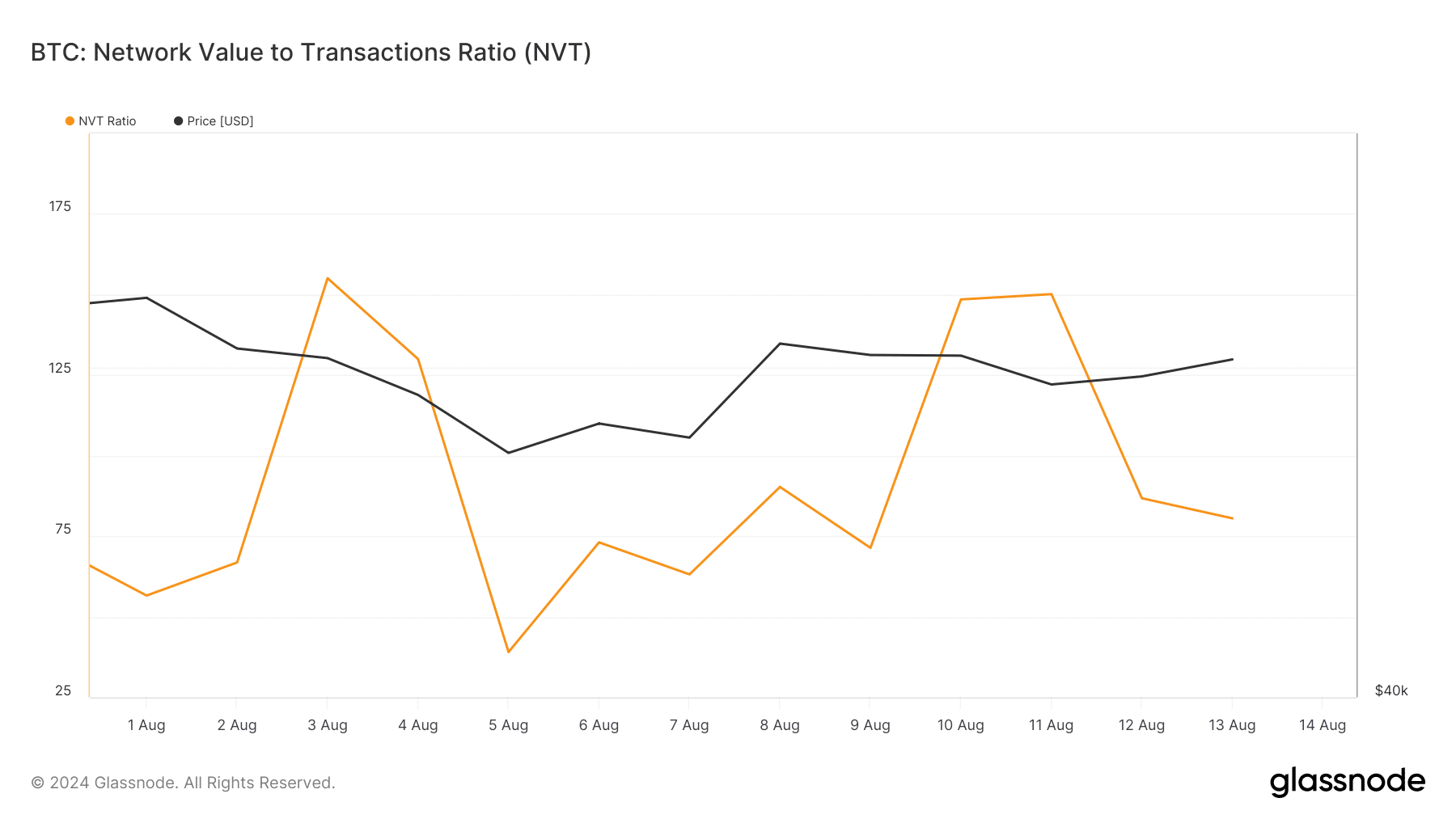

Other than this, AMBCrypto, when checking Glassnode’s knowledge, discovered that BTC’s NVT ratio had additionally dropped. Usually, a drop within the metric implies that an asset is undervalued, which hints at a value improve quickly.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

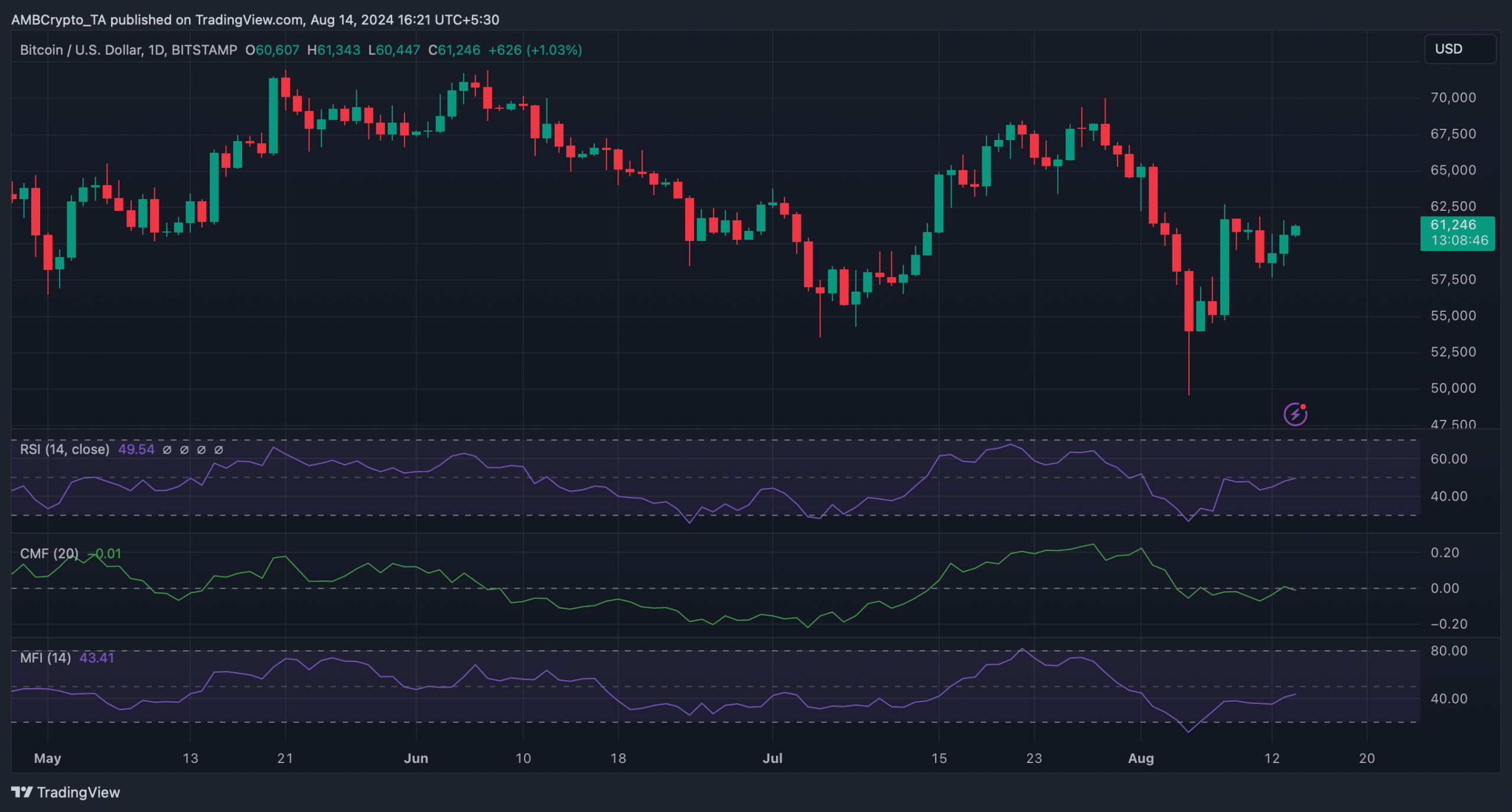

We then assessed Bitcoin’s each day chart to higher perceive which path BTC was planning to maneuver. The technical indicator Relative Energy Index (RSI) gained upward momentum.

Equally, the Cash Move Index (MFI) additionally registered an uptick, indicating a continued value improve. Nonetheless, the Chaikin Cash Move (CMF) turned bearish because it went down barely.