- LINK’s community exercise elevated together with its value.

- Most metrics indicated a continued value rise, however a number of prompt in any other case.

Chainlink [LINK] has gained a lot traction of late as its value rallied considerably over the last week.

Apparently, the token’s reputation rose whereas Bitcoin [BTC] dominance witnessed a slight drop within the current previous. Let’s take a better take a look at what’s really occurring.

Decoding Chainlink’s state

IntoTheBlock not too long ago posted a tweet highlighting fairly a number of attention-grabbing developments associated to Chainlink.

The tweet first talked about that there was a big rise in LINK search pattern knowledge, reflecting newfound curiosity within the token.

The rise in reputation had a optimistic influence on the blockchain’s community exercise, as its variety of transactions began spiking.

To be exact, LINK recorded 5.82k transactions over the last day, which was close to its month-to-month excessive.

Nevertheless, it was attention-grabbing to notice that the rise in transactions didn’t assist entice extra customers, as there was not a serious change in its new handle graph.

However issues appeared good when it comes to traders’ curiosity as accumulation elevated. As per the tweet, there have been principally web withdrawals from exchanges, hinting at accumulation conduct.

Other than that, whales have been additionally stockpiling LINK, as its addresses holding over 0.1% of the provision present a web accumulation of 25 million LINK over the previous month.

LINK is incomes traders earnings

The rise in accumulation really helped the token start a bull rally. In accordance with CoinMarketCap, LINK was up by greater than 20% within the final seven days.

On the time of writing, it was buying and selling at $16.22 with a market capitalization of over $9.5 billion.

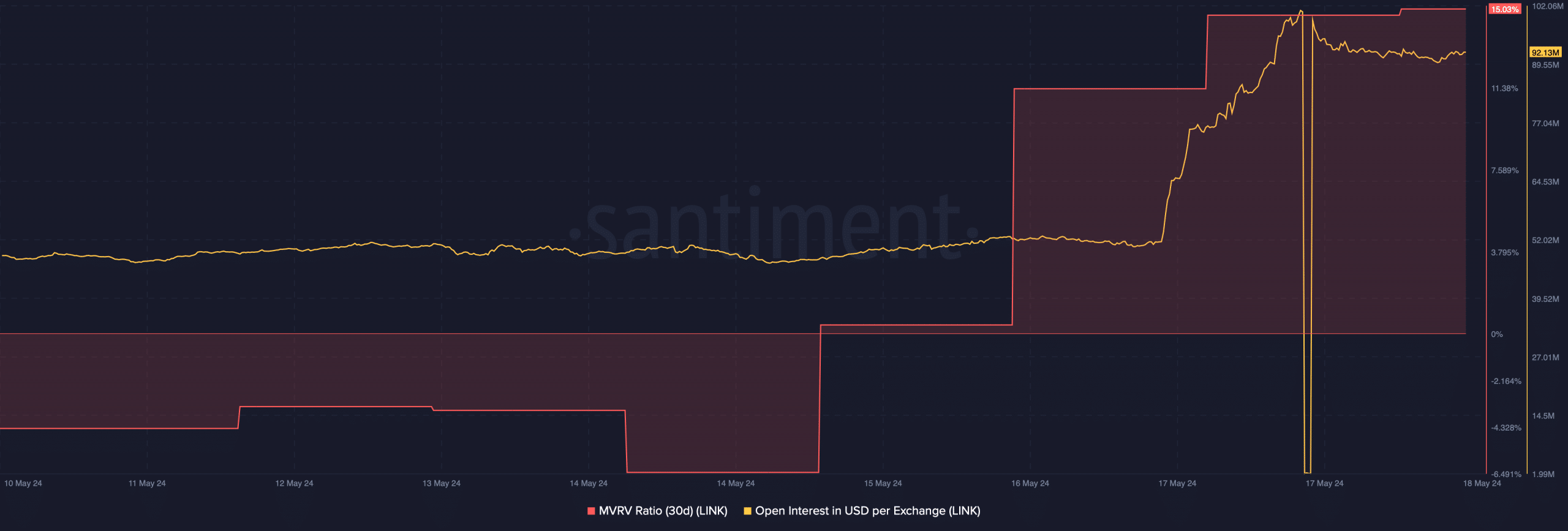

Due to that, LINK’s MVRV ratio registered a large enhance, suggesting that extra traders have been in revenue. Its Open Curiosity additionally elevated together with its value, hinting at a continued value rally.

Apparently, Santiment not too long ago posted a tweet highlighting that bullish sentiment across the token elevated. Actually, Chainlink was witnessing probably the most bullish sentiment in over a 12 months.

Nevertheless, these optimistic metrics didn’t assist LINK maintain its bull rally, because the token’s value dropped by almost 2% within the final 24 hours.

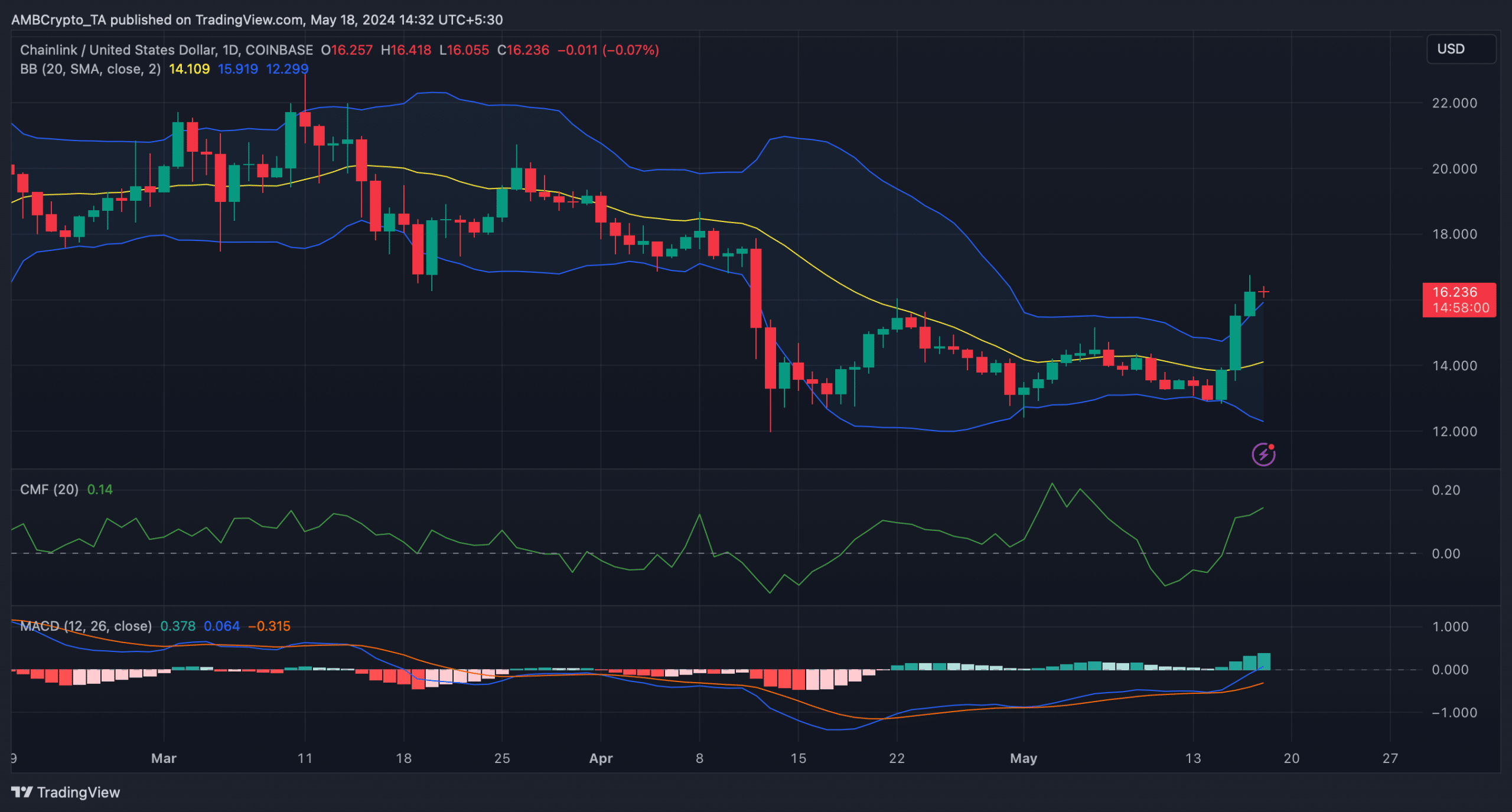

To see whether or not this was the tip of LINK’s double-digit bull rally, AMBCrypto analyzed its day by day chart. As per our evaluation, the MACD remained within the consumers’ favor.

Is your portfolio inexperienced? Take a look at the LINK Revenue Calculator

Furthermore, the Chaikin Cash Circulate (CMF) registered a pointy uptick. This indicated that the most recent value correction may be short-term and that LINK would resume its rally quickly.

Nevertheless, the token’s value had touched the higher restrict of the Bollinger Bands, which appeared regarding.