- Bitcoin HODLing has climbed to spectacular ranges, with holders now anticipating greater costs.

- Price assessing the potential threat in case of a serious sell-off

Bitcoin traders have been eagerly ready for Bitcoin to reclaim the $70,000 value stage. This may be evidenced by the huge quantity of unrealized earnings – An indication that BTC holders have been opting to HODL, in anticipation of upper costs.

In actual fact, based on a current CryptoQuant evaluation, Bitcoin presently has over $7 billion price of unrealized earnings. This statement highlights the extent of HODLing occurring and the expectations of upper value ranges. Nevertheless, it additionally underscores the potential for an enormous retracement if or when revenue taking resumes.

If Bitcoin holders beginning taking earnings off the desk, the promote strain could result in an consequence much like what occurred in direction of the top of July. On the time, the value crashed arduous in a matter of days. To this point, the prevailing optimism has allowed BTC to carry on to its positive factors on the charts.

At press time, Bitcoin was buying and selling at $68,350, lower than 2.4% away from hitting $70,000. The cryptocurrency additionally appeared to shut in on the subsequent resistance vary between $69,400 and $71,500.

Bitcoin flows fall to the bottom ranges in 2024

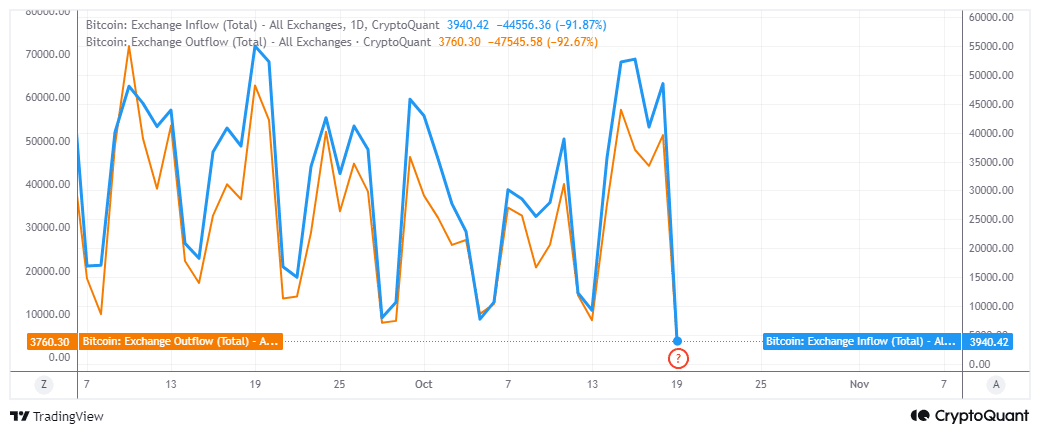

Bitcoin alternate flows may provide us attention-grabbing insights into the crypto’s newest bullish wave.

The newest uptick in each alternate inflows and outflows occurred between 13 and 16 October. Nevertheless, alternate flows have since cooled right down to their lowest ranges this yr.

In actual fact, information confirmed that 3,760 BTC moved out of exchanges within the final 24 hours. Roughly 3,940 BTC moved into exchanges, which suggests alternate inflows had been barely greater than the outflows.

Alternate move swings recommend that BTC could be prepared for a volatility resurgence. Nevertheless, will one other swing up have bullish or bearish vitality? That continues to be to be seen, though handle flows could provide us some insights.

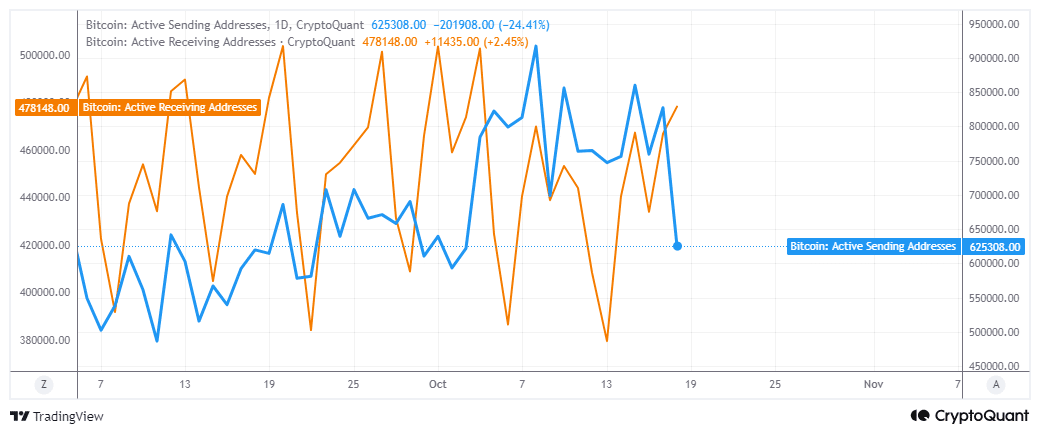

The variety of energetic sending addresses have been declining since mid-October. As an illustration – They fell from 860,161 addresses on 15 October to 478,148 addresses by 18 October.

Quite the opposite, receiving addresses grew from 379,545 addresses on 13 October to 625,308 addresses on 18 October. The information additionally revealed that addresses shopping for Bitcoin weren’t solely greater than these promoting it, however receiving addresses grew whereas sending addresses retreated.

Tackle exercise confirmed a shift, one demonstrating declining promote strain regardless of the current value hike. Whereas these outcomes recommend that Bitcoin could push greater, a shock wave of promote strain should be on the playing cards.