- Bitcoin faces resistance at $60K, with costs down 23% from its March peak.

- Analysts recommend blended alerts, debating whether or not it is a non permanent stoop or the beginning of a bear market.

Bitcoin’s [BTC] value efficiency has remained beneath strain in current months, with the cryptocurrency persevering with to wrestle at key ranges. Regardless of earlier optimism, the asset has persistently confronted resistance each time it approaches the $60,000 mark.

This incapability to interrupt by way of the resistance has stored Bitcoin from regaining its March peak of over $73,000. As of press time, Bitcoin was buying and selling at $56,584, down 1% previously 24 hours and 23.3% from its excessive earlier this 12 months.

Based on IntoTheBlock, the market sentiment round Bitcoin has shifted considerably since earlier within the 12 months. At the moment, each retail and institutional traders have been hopeful that the asset would proceed its rally and attain new heights.

Nevertheless, macroeconomic circumstances and a slowdown in crypto adoption have led to elevated uncertainty about Bitcoin’s future. Many traders at the moment are questioning whether or not it is a non permanent lull or the start of a extra extended bear market.

Market traits and Bitcoin’s struggles

IntoTheBlock, highlighting the shift in market sentiment round Bitcoin in a lately uploaded publish shared the components which may have contributed to its present value struggles.

One of many key challenges talked about was the broader macroeconomic panorama. IntoTheBlock stated that with the opportunity of a recession looming, markets have been beneath strain, and threat belongings like Bitcoin have been no exception.

They added that whereas some count on that potential rate of interest cuts might ultimately profit cryptocurrencies, the affect of such measures might take time to materialize.

Till then, the macro setting will proceed to weigh on market sentiment and Bitcoin’s value efficiency.

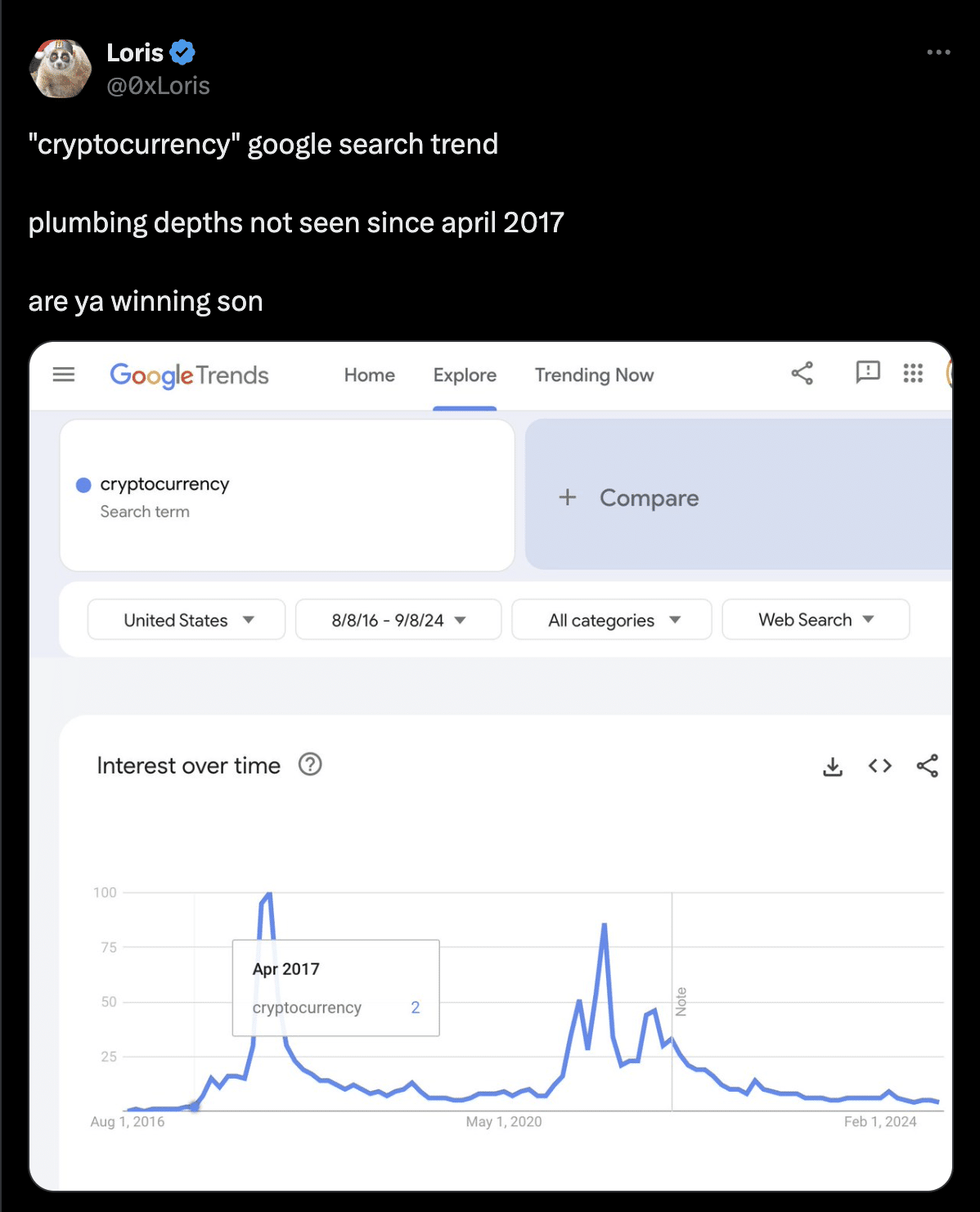

Moreover, curiosity in cryptocurrencies seems to be declining, as indicated by a number of metrics. Search traits for cryptocurrency-related matters have seen a noticeable drop, reflecting a cooling of the market in comparison with the thrill throughout bull market durations.

This decline is additional illustrated by consumer exercise on platforms resembling Coinbase, the place app rankings have fallen, suggesting that fewer persons are actively partaking with crypto belongings.

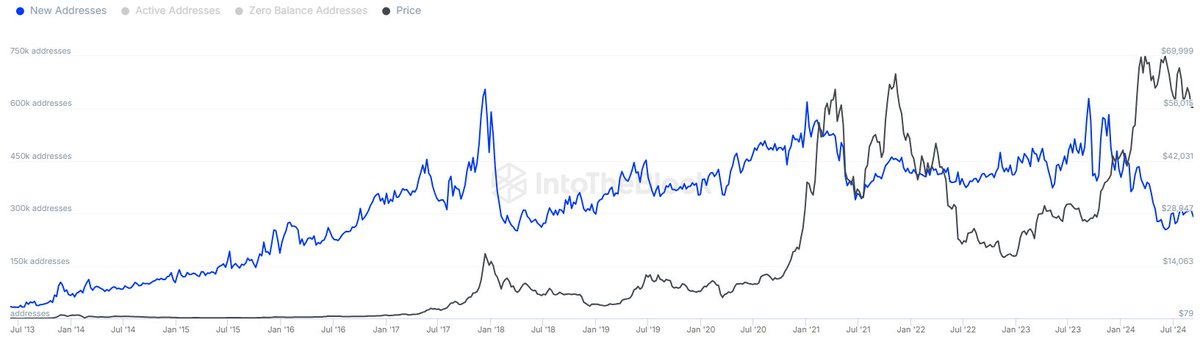

IntoTheBlock additionally identified that on-chain knowledge paints an image of stagnation in Bitcoin’s market exercise. The variety of new Bitcoin addresses stays low, signaling a slowdown within the inflow of recent members into the market.

Supply: IntoTheBlock

This lower in new customers factors to waning enthusiasm in comparison with earlier within the 12 months, when Bitcoin’s value surge attracted a flood of recent traders.

The shortage of recent market members might hinder Bitcoin’s capacity to regain its earlier highs within the close to time period, IntoTheBlock revealed.

Analyst outlook on BTC

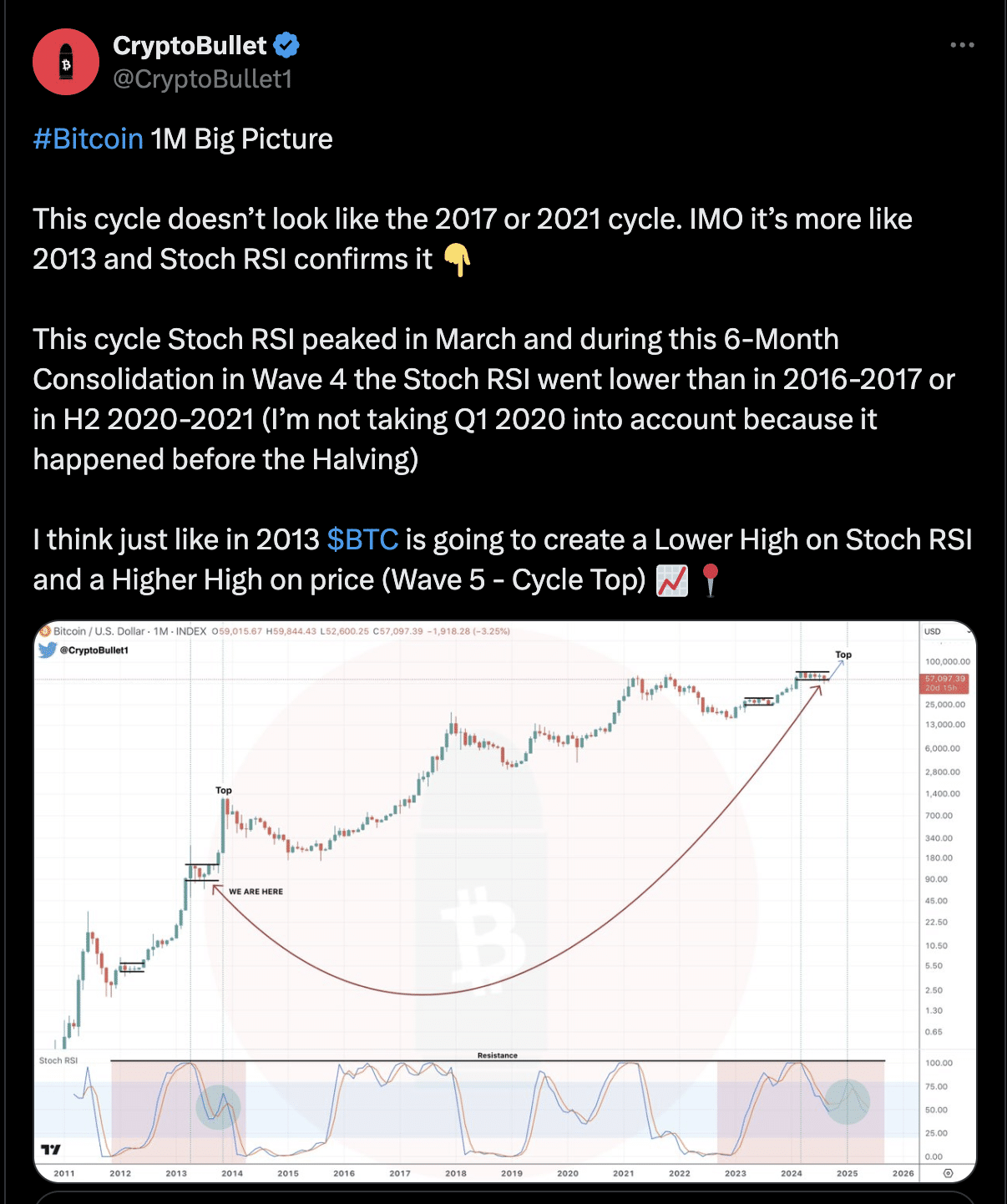

Bitcoin’s value cycles, some analysts imagine that the present section mirrors earlier durations of consolidation.

Notably, CryptoBullet, an analyst, has drawn comparisons to 2019, a 12 months during which Bitcoin skilled an analogous slowdown after reaching an area excessive.

Throughout that interval, the market underwent a chronic consolidation earlier than ultimately turning bullish once more. CryptoBulle argue that Bitcoin might be following an analogous path now, with the present market dip being a part of a broader cycle.

The analyst shared the insights on Bitcoin’s value cycles on X, evaluating the present market to earlier years.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Based on his evaluation, this cycle doesn’t resemble the 2017 or 2021 cycles however is extra just like the 2013 cycle.

He highlighted the behaviour of the Stochastic Relative Power Index (Stoch RSI), suggesting that Bitcoin is present process a consolidation section earlier than coming into a fifth wave that would result in new highs.