- The robust Bitcoin ETF inflows may spark the subsequent upward worth transfer.

- Altcoins may observe BTC beneficial properties, however would possibly wrestle to outperform the king anytime quickly.

Bitcoin [BTC] may break freed from its torpor quickly. Initially of this week, the value was at $67.7k, and the dearth of buying and selling quantity and speculative curiosity steered that BTC was not prepared for a powerful uptrend.

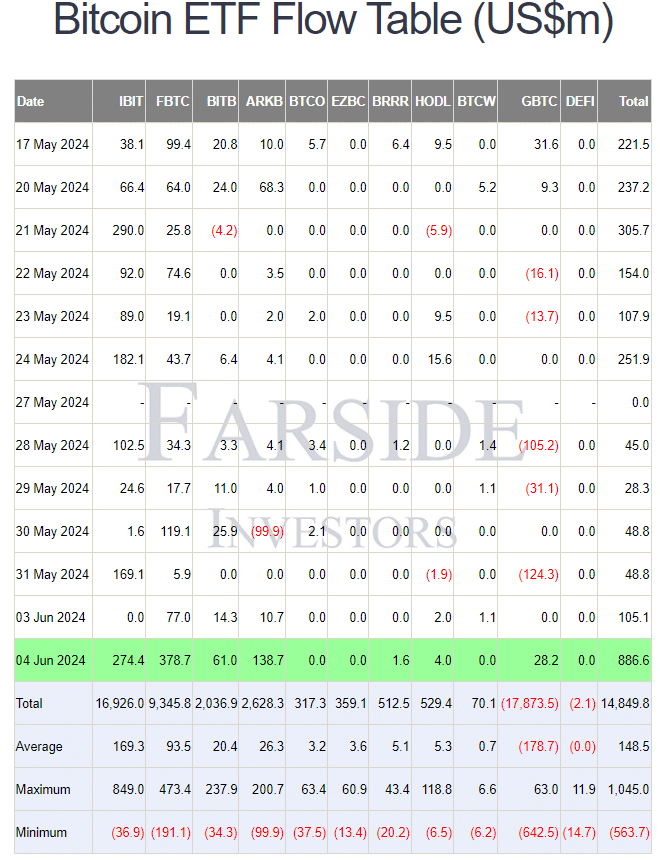

Supply: Farside Traders

This has begun to shift over the previous 24 hours. Information from Farside Traders confirmed that the Bitcoin exchange-traded funds noticed a $886 million influx on Tuesday, the 4th of June.

This stage of shopping for may spark a change and stir speculators and traders into motion.

Will the elevated consideration to Bitcoin see altcoin costs explode? Or will the altcoin season have to attend? Listed below are the findings from the altcoin season indicator.

How shut are we to the altcoin season?

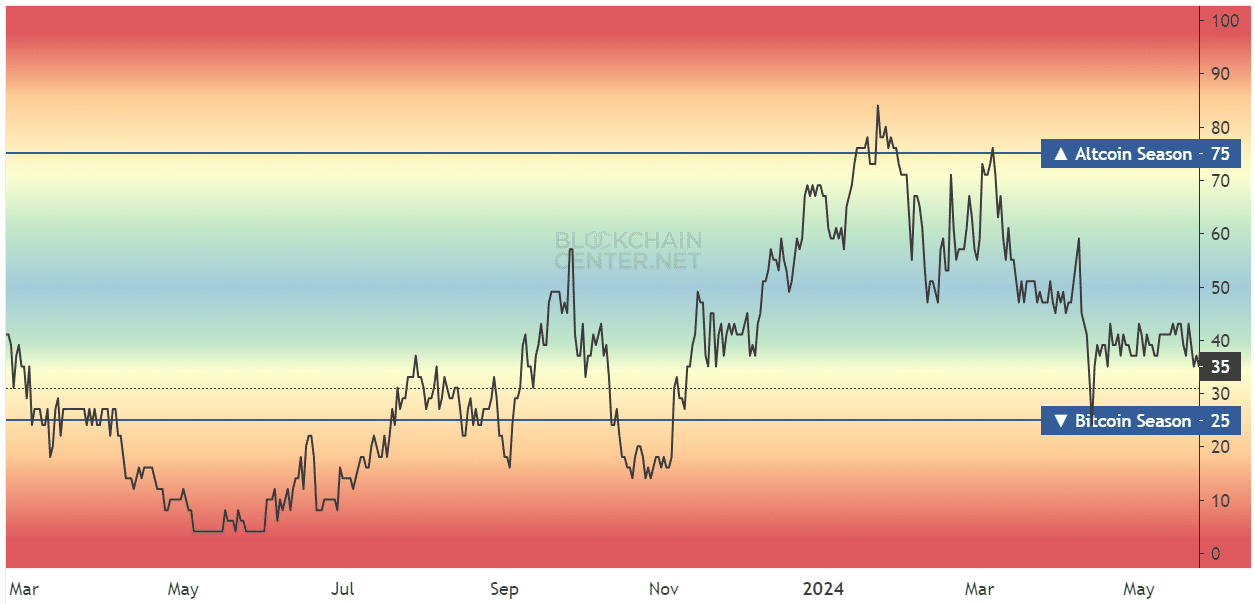

Supply: BlockchainCentre

The altcoin season index confirmed a studying of 31, in accordance with knowledge from BlockchainCentre. The index has trended downward from 80 to 31 over the previous six months.

A yr in the past, the index confirmed robust BTC season.

Nevertheless that was in the course of the depths of the bear market, when Bitcoin was buying and selling at $25k and alts have been in a long-term downtrend or consolidation part.

At press time, though alts would possibly carry out effectively because of the Bitcoin bullish fervor, just a few choose alts would possibly outperform Bitcoin.

If the altcoin season indicator can climb above 75, it’d be an indication of untamed bullishness throughout the altcoin ecosystem.

Provided that there are much more alts proper now in contrast the earlier cycles, the beneficial properties throughout an altseason would possibly nonetheless be concentrated inside a bit of the alts moderately than market-wide rallies.

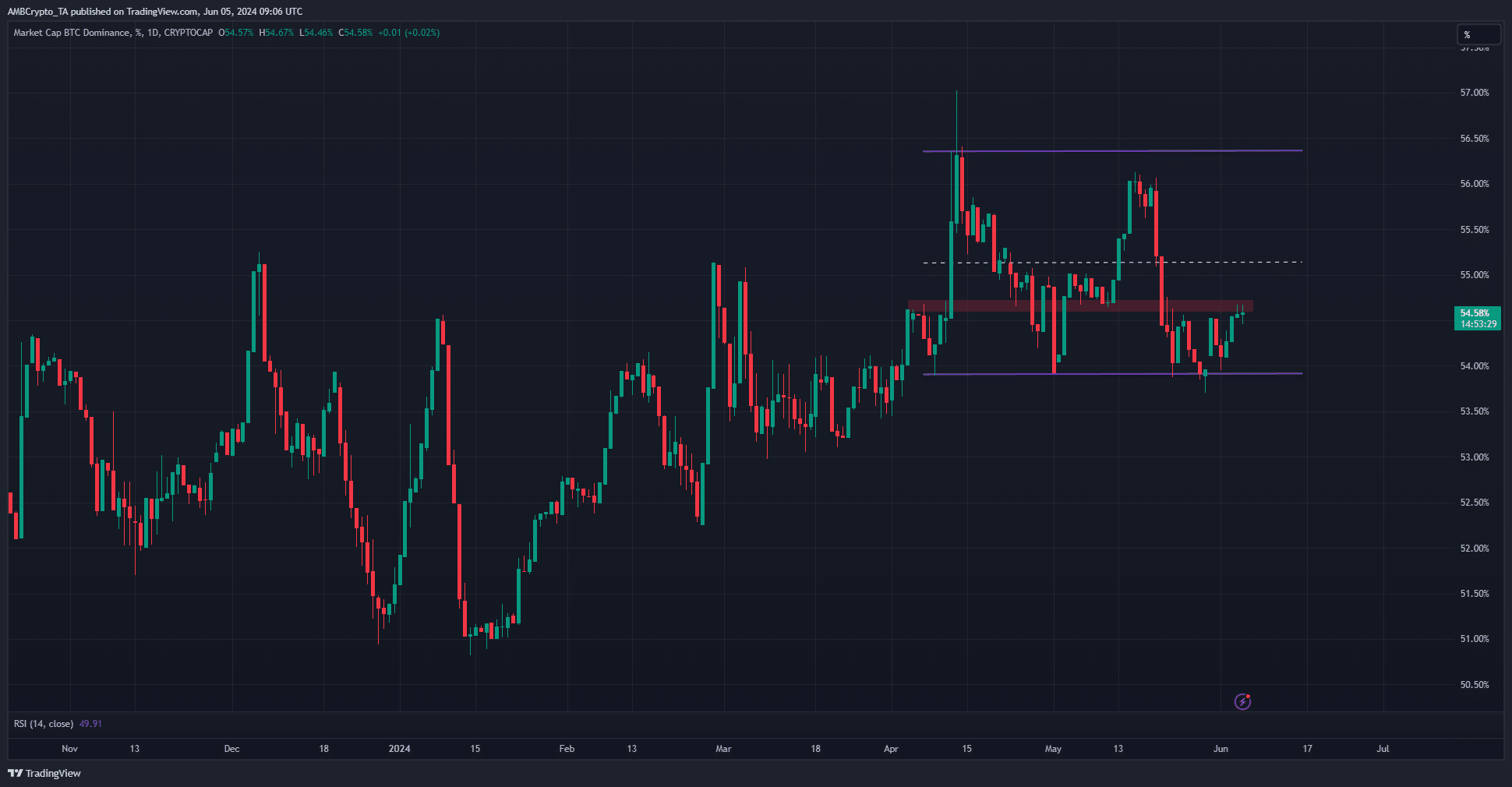

The range-bound Bitcoin Dominance and parallels from the previous

The Bitcoin Dominance chart represents the market capitalization of BTC as a proportion of the overall crypto market cap. The metric shaped a variety between 53.9% and 56.3% since April.

At press time, it was rebounding from the vary lows. A rise within the BTC.D means BTC is rising sooner than the remainder of the market, Ethereum [ETH] included.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

In 2021, from January to June, the BTC dominance fell from 72% to 40.4%. On this window, the altcoin market capitalization (excluding ETH) expanded from $122 billion to $934 billion.

Due to this fact, a powerful downtrend within the BTC.D chart is important for a real altcoin season to start.