Bitcoin (BTC), the flagship cryptocurrency, endured a brutal week, shedding over $4,500 and tumbling beneath the essential $67,000 help stage. This sudden value reversal triggered a cascade of liquidations throughout buying and selling platforms, with a staggering $427 million vanishing inside a 24-hour interval, in accordance with knowledge from CoinGlass.

Analysts are scrambling to pinpoint the precise explanation for the downturn, however clues from the choices market and exercise on retail exchanges supply some insights.

Choices Market Foreshadowed Downturn

QCP Capital, a crypto-focused buying and selling agency, believes the choices market served because the preliminary spark for the downward spiral. Their evaluation, launched earlier this week, revealed a draw back skew in threat reversals, a refined indicator inside the choices market that usually precedes value drops. This implies that some choices merchants anticipated a possible decline and positioned themselves accordingly.

Retail Frenzy Fuels Volatility

The dramatic descent was additional amplified by substantial liquidations on retail-oriented exchanges like Binance. Perpetual funding charges, which gauge market sentiment on leverage, witnessed a dramatic shift.

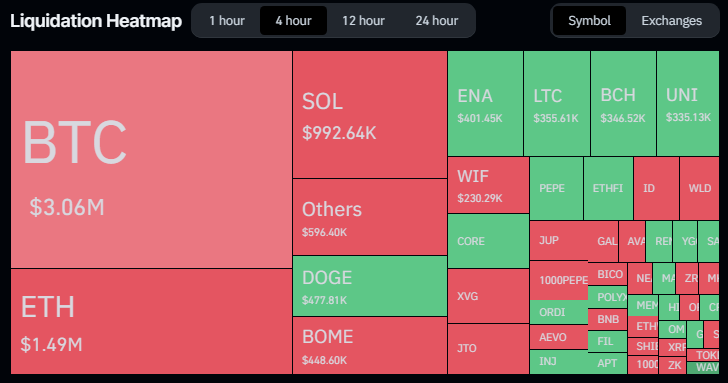

Supply: Coinglass

Charges plummeted from a lofty 77%, indicating robust bullish sentiment with leveraged positions closely skewed in the direction of value will increase, to flat territory inside a brief timeframe. This fast unwinding of leverage positions exacerbated value volatility, making a self-fulfilling prophecy as falling costs triggered additional margin calls and compelled promoting.

Lengthy Positions Crushed

The brunt of the liquidations fell on lengthy positions, representing bets that the value would rise. A staggering $342 million of the whole liquidations got here from these bullish positions. Bitcoin itself grew to become the epicenter of the storm, with over $130 million in lengthy positions forcibly liquidated on the flagship cryptocurrency.

BTC market cap at the moment at $1.3 trillion. Chart: TradingView.com

A Stark Reminder of Crypto’s Dangers

This episode serves as a stark reminder of the inherent dangers and volatility that plague the cryptocurrency market. When costs plummet unexpectedly, merchants using leverage are pressured to dump their holdings at a loss to fulfill margin necessities. This hearth sale mentality can additional speed up value declines, making a vicious cycle.

Associated Studying: Spot ETF Frenzy Cools Down – Are Bitcoin Traders Shifting Focus Now?

The Highway Forward For Bitcoin

Whereas Bitcoin has recovered barely because the preliminary plunge, hovering across the $66,500 mark, the current turmoil has undoubtedly shaken investor confidence.

The approaching weeks might be essential in figuring out whether or not this can be a non permanent setback or the beginning of a extra sustained correction for Bitcoin. Whether or not bulls can regain management or bears proceed to dictate the market stays to be seen.

Featured picture from Everypixel, chart from TradingView