- Bitcoin is just coming into the second, extra aggressively bullish part of the cycle, in keeping with one metric.

- The safety and community fundamentals remained intact, bolstering confidence.

Bitcoin [BTC] reached its all-time excessive in opposition to the U.S. Greenback on the 14th of March, 2024, reaching $73,777. Beforehand, the Bitcoin all-time excessive was at $69,000, set on the tenth of November.

Towards different fiat currencies, Bitcoin has already established an all-time excessive. The Turkish Lira, the Argentine and Philippine Peso, and the Indian Rupee are only a few.

This confirmed that USD confronted a decrease inflation charge than these currencies, but additionally meant that Bitcoin is more and more more likely to be seen as an inflation hedge.

The rationale behind the assumption in Bitcoin

In a latest AMBCrypto report, the Thermo Cap ratio metric was explored. The findings have been that the community fundamentals have been robust and the worth invested into the community was rising steadily.

Nevertheless, it was additionally famous that the Community Worth to Transactions metric was dropping. This meant customers weren’t transacting sufficient quantity to justify the BTC costs. The rising investor confidence and the rise of the “inflation hedge” argument.

One other report confirmed that the futures market individuals remained sidelined and the funding charge was subdued.

A strongly bullish piece of stories was wanted to shake Bitcoin out of its lethargy. The $886 million influx into U.S. Bitcoin ETFs on Tuesday, the 4th of June, did simply that.

Analyzing on-chain metrics to know the bull run

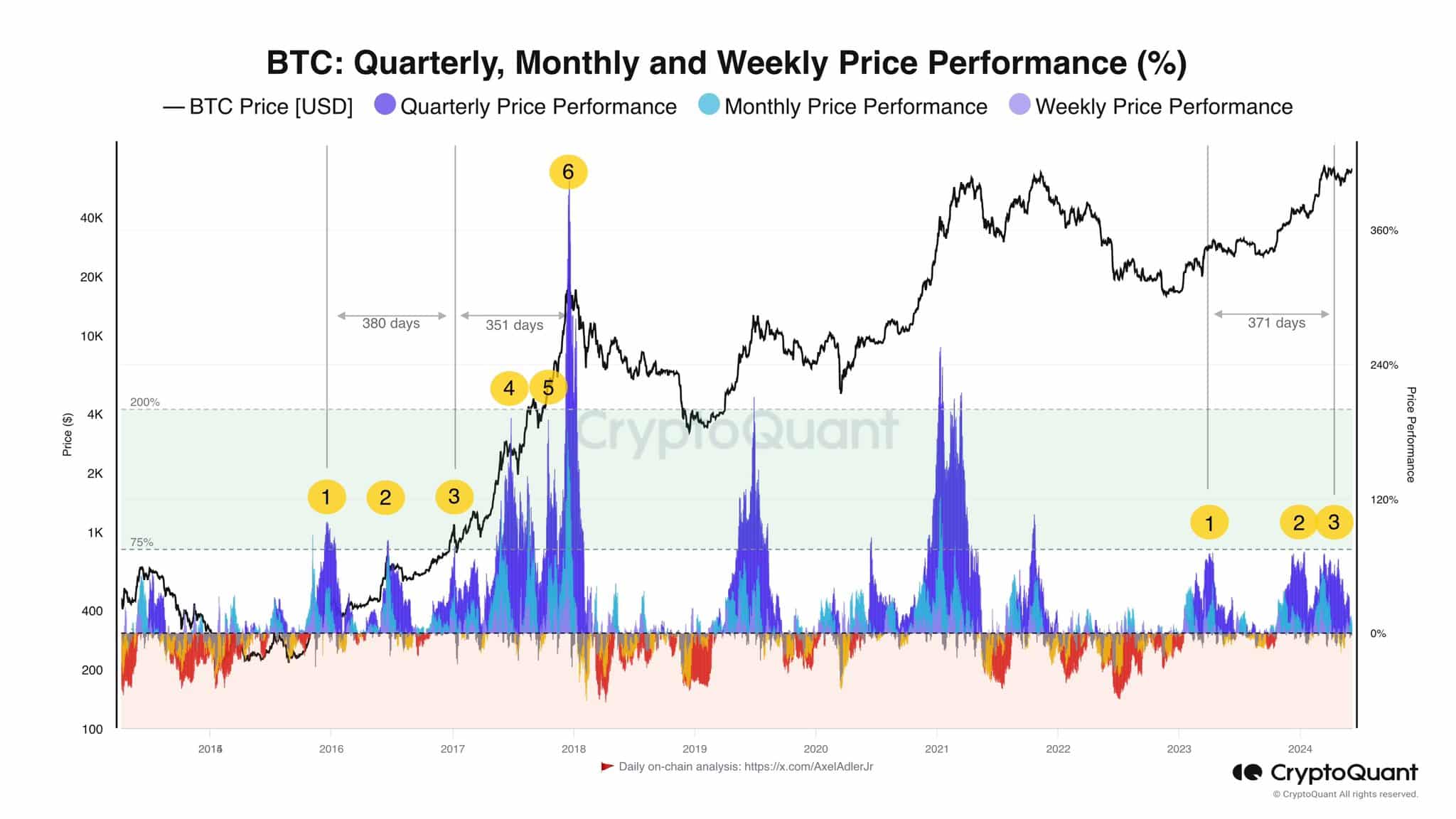

Supply: Axel Adler on X

In a publish on X (previously Twitter), crypto analyst Axel Adler identified that the worth efficiency of Bitcoin on the upper timeframes has not but gone parabolic.

Within the 2017-18 run, 380 days of regular features have been adopted by one other 351 days of parabolic uptrend.

If it repeats, BTC may see one other 12 months of uptrend.

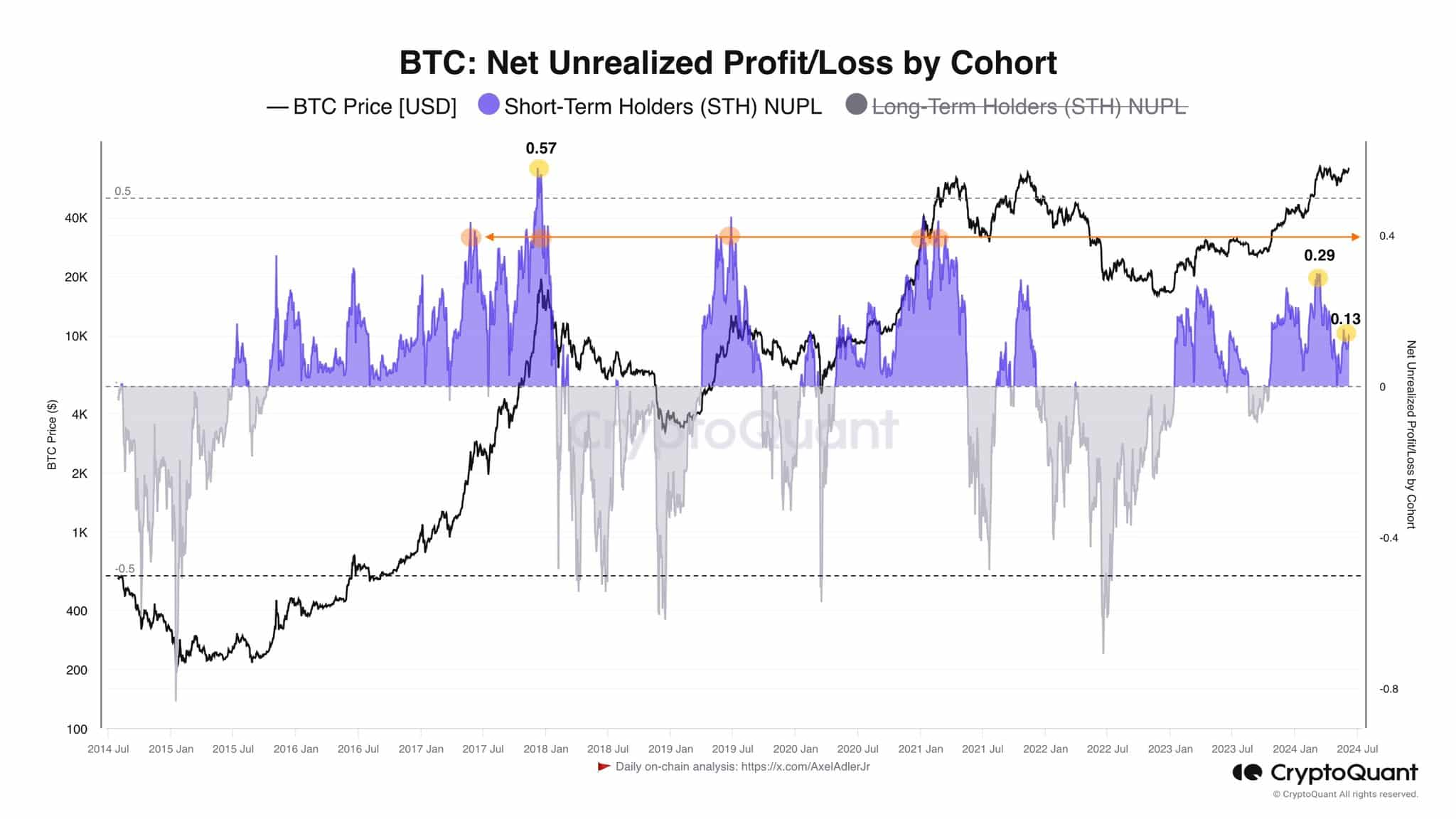

Supply: Axel Adler on X

The short-term holder (STH) Web Unrealized Revenue/Loss (NUPL) has not peaked both. In line with the analyst, it will have to climb above 0.4 to mark the tip of the present bull run.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The best it has gone was 0.29 in March which was adopted by a big correction as BTC consolidated over the previous two months.

Subsequently, the Bitcoin all-time excessive could be very seemingly solely a matter of time from right here on.