- Bitcoin’s October beneficial properties largely stem from halving-driven provide shortage.

- As per AMBCrypto, a provide shock has but to dissipate.

Bitcoin [BTC] has been consolidating inside the $66K-$67K vary for the previous seven days, at present buying and selling at $67,160 with a slight 0.57% achieve from yesterday. This consolidation mirrors BTC’s July sample, the place resistance at $68K led to a swift drop under $55K. Thus, staying inside this vary is vital to keep away from an identical downturn.

Apparently, October’s beneficial properties have largely been pushed by a post-halving provide squeeze, bringing recent shortage to the market. Now, as BTC wraps up its most bullish month, situations could also be ripe for a provide shock if demand aligns.

Bitcoin halving impression is but to materialize

Traditionally, the post-halving interval has acted as a big catalyst for bullish rallies, notably from an financial standpoint. As BTC provide tightens, miners are sometimes essentially the most impacted, resulting in their widespread capitulation.

In easy phrases, as block rewards lower, miners might discover it difficult to cowl their operational prices, prompting many to exit the market.

This shakeout leaves solely essentially the most environment friendly miners within the ecosystem, probably making a extra strong setting for worth appreciation as provide diminishes.

As evidenced by the chart above, miner reserves have been steadily declining because the April halving, reflecting these dynamics.

Whereas one may assume this could create promoting strain, the shortage of BTC amongst miners – particularly as block rewards hit decrease lows – has not considerably impacted the market.

If demand stays excessive, a lot of the promoting strain is absorbed, creating supreme situations for a provide crunch.

This setting saved October bullish, with BTC almost testing $70K. Nonetheless, a breakout has but to materialize, indicating that the anticipated provide shock has not occurred.

This situation maintains optimism for a possible parabolic rally as we method the top of This fall.

Environment friendly miners are nonetheless within the sport

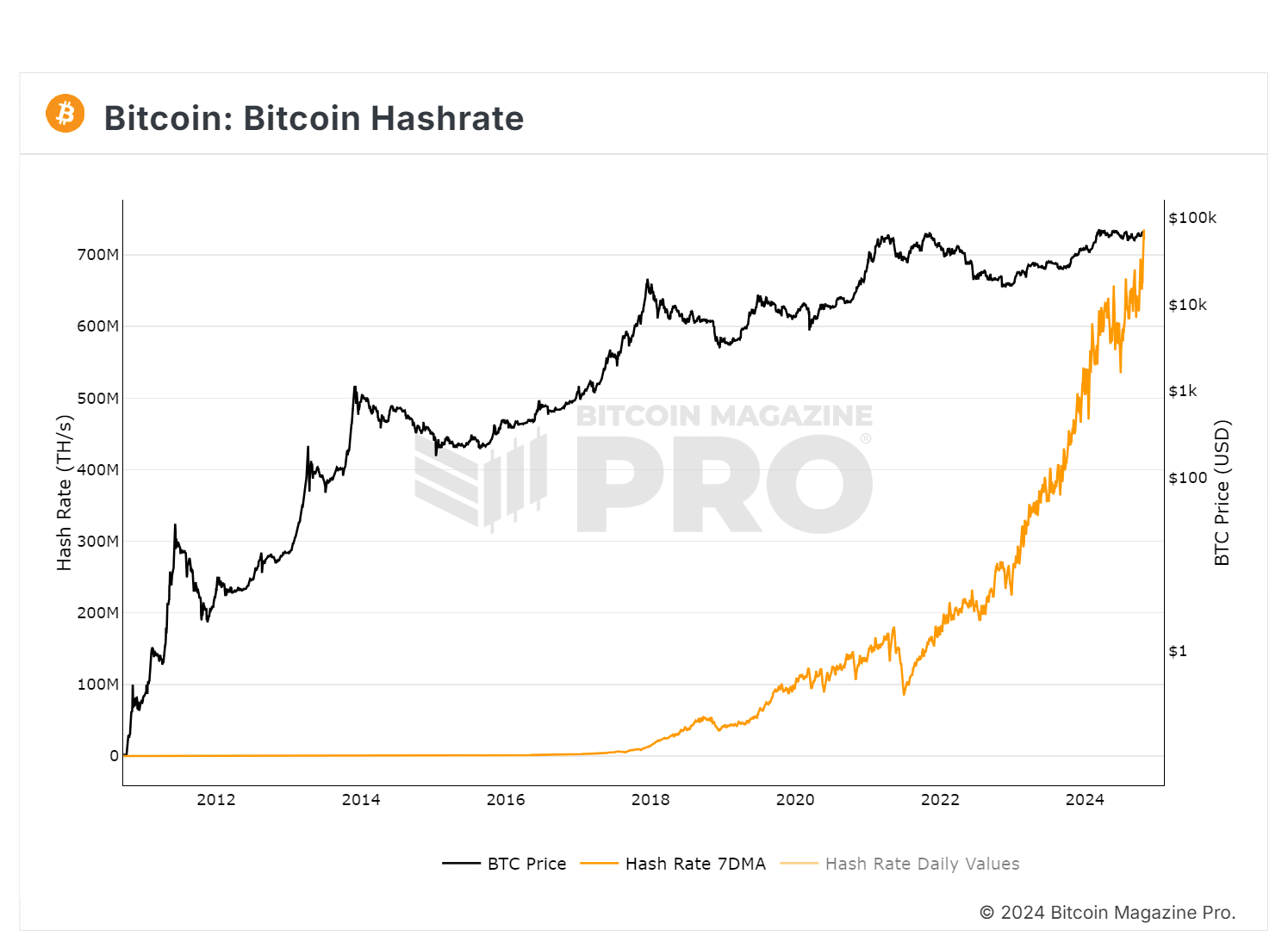

The consequences of the halving are evident: Bitcoin’s mining issue has reached an all-time excessive, which means it now requires extra computational energy to course of transactions. This case is forcing out much less environment friendly miners.

Because of this, the hash price has additionally elevated, indicating a safer and strong community. This pattern highlights the consolidation of mining operations, the place solely these with the very best know-how and lowest prices can survive.

In brief, a mass capitulation may nonetheless be on the horizon, probably resulting in a big worth improve as out there provide dwindles towards persistent demand.

Institutional curiosity is rising

At present, all exchanges are seeing a big improve in BTC reserves, indicating promoting strain primarily from the mining neighborhood for the explanations talked about above.

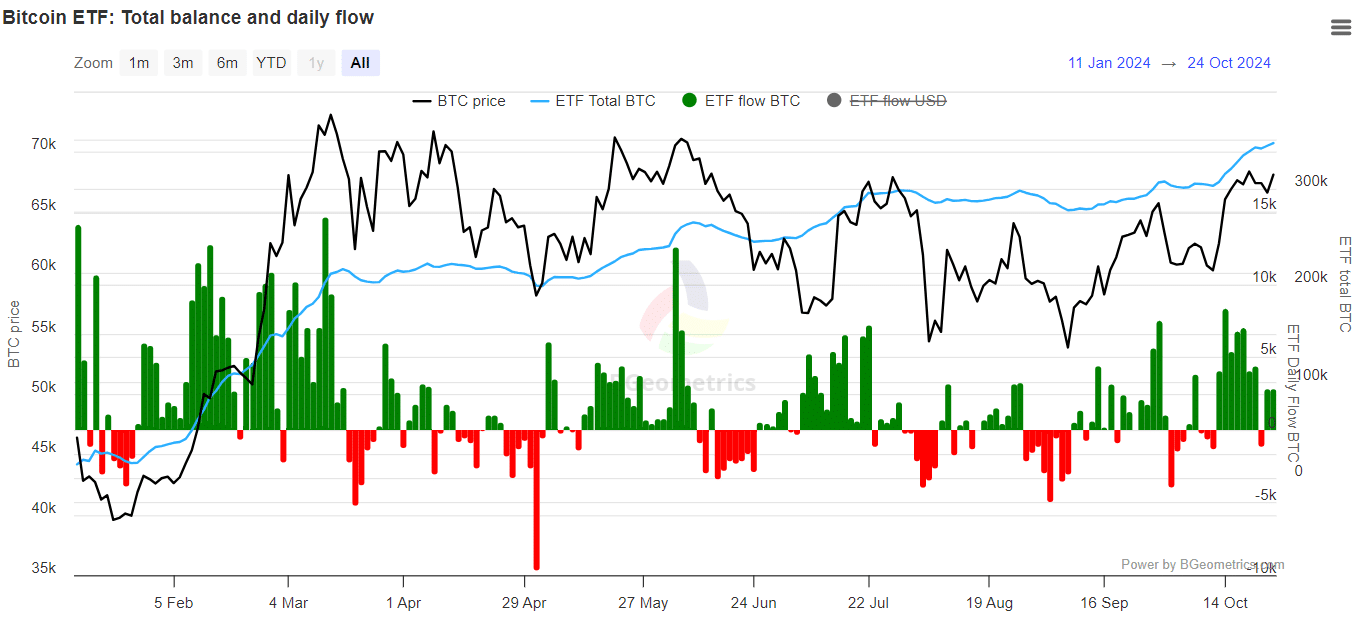

As famous earlier, a provide shock may materialize if demand stays excessive regardless of this strain; in any other case, a repeat of the July cycle may happen. Apparently, October has seen a notable uptick in ETF inflows, suggesting rising retail curiosity.

Moreover, BlackRock’s Bitcoin holdings have exceeded 400K BTC, reaching 403,725 BTC, value $26.98 billion. Over the previous two weeks alone, BlackRock has bought 34,085 BTC, valued at $2.3 billion.

This means that institutional demand is surging, reinforcing AMBCrypto’s preliminary speculation of a brewing provide shock.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Whereas the present consolidation is essential for stopping BTC from faltering, a constant stability between demand and provide will finally decide whether or not BTC can attain a brand new ATH earlier than the top of this quarter.

Regardless, the miner capitulation highlights the results of the post-halving setting; their exit now requires a extra sustained shopping for effort at present costs. Whereas a slight retracement might happen, a full-fledged pullback appears unlikely.