- Over $2.5 billion value of Bitcoin shorts liquidations have been reportedly behind the slight restoration.

- BTC is predicted to be extra unstable in direction of the tip of the week as sentiment improves.

Bitcoin [BTC] was again above $60,000 as soon as once more as sentiment improved barely. Leveraged shorts liquidations might have had one thing to do with the marginally bullish consequence.

Bitcoin and general crypto market sentiment was in excessive concern throughout the weekend, however there was some restoration within the final three days.

The newest information from the concern and greed index indicated a gradual restoration, with the index at 30 as per press time readings.

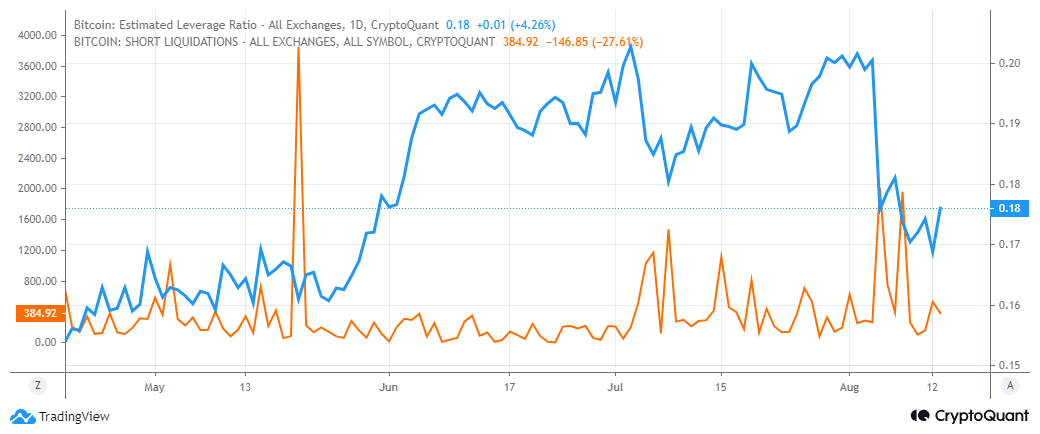

Bitcoin’s bullish momentum might have additionally been fueled by the liquidation of leveraged brief positions. Latest information advised that over $2.5 billion value of leveraged brief positions have been lately liquidated.

This resulted in some shopping for strain.

On-chain information from CryptoQuant confirmed that Bitcoin registered a 231% surge in shorts liquidations on the twelfth of August. The urge for food for leverage briefly tanked to 2-month lows earlier than adopting an uptrend.

After evaluating Bitcoin’s heatmap, we discovered that there have been 81.5 million internet longs on Binance between $60,852 and $60,880.

This, mixed with the surge within the uptick in estimated leverage ratio, in addition to the enhancing sentiment, advised a gradual shift in direction of bullish optimism.

Is Bitcoin headed for extra volatility forward?

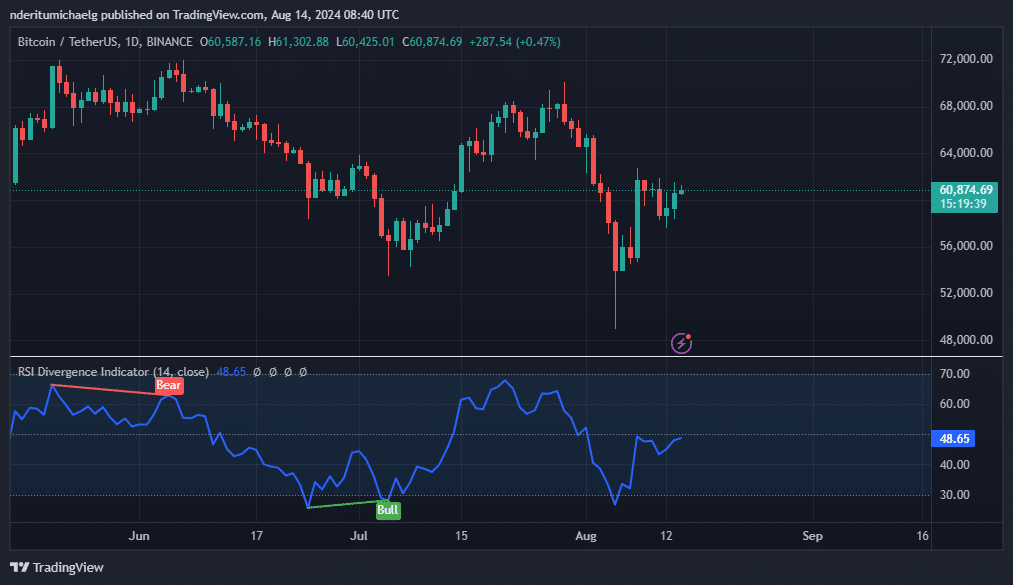

Bitcoin had a $60,890 price ticket at press time. The next push will see it retest the $61,700 stage, the place it has been dealing with resistance and low demand these days.

Unsurprisingly, this worth vary additionally coincided with the 50% RSI stage. This might clarify why shorts have been loading up close to this stage, in anticipation of extra draw back.

A cocktail of low demand and shorts liquidations has stored costs inside a slender vary for the previous couple of days. Nonetheless, there can also be a 3rd purpose.

The market tends to expertise low exercise forward of main financial information. Adopted by a surge in exercise as a response when the info is launched.

The market has been trying ahead to a number of financial information this week. This contains producer worth information (PPI), which was launched yesterday.

CPI information slated to return out as we speak might set off extra volatility and doubtlessly a robust directional transfer out of the present vary.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Bitcoin’s present stage highlighted the state of uncertainty available in the market. The surge in leverage brief positions suggests rising bearish expectations.

Alternatively, the market sentiment gave the impression to be enhancing in the previous couple of days. This alerts a big likelihood of a rally past the present resistance.