- Curiosity in Bitcoin accumulation remained excessive regardless of the current correction.

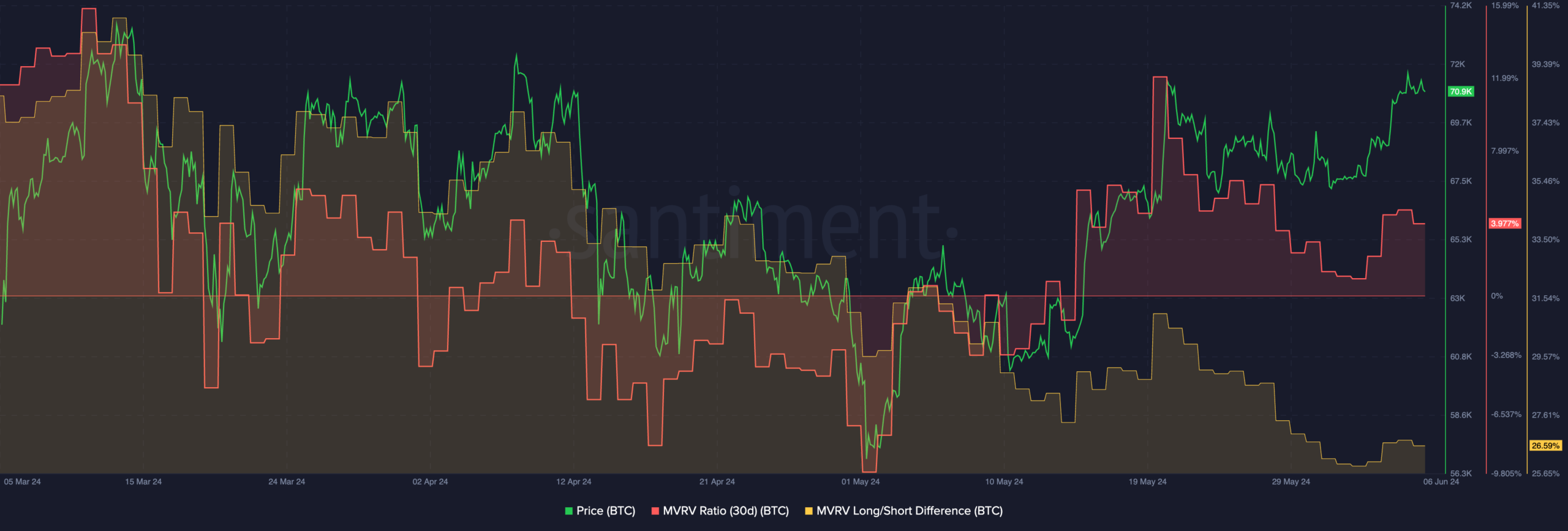

- The profitability of BTC was excessive although costs fell.

Bitcoin [BTC] witnessed a big correction over the previous few days. Regardless of the worth decline, consumers continued to point out optimism.

Resurgence in curiosity

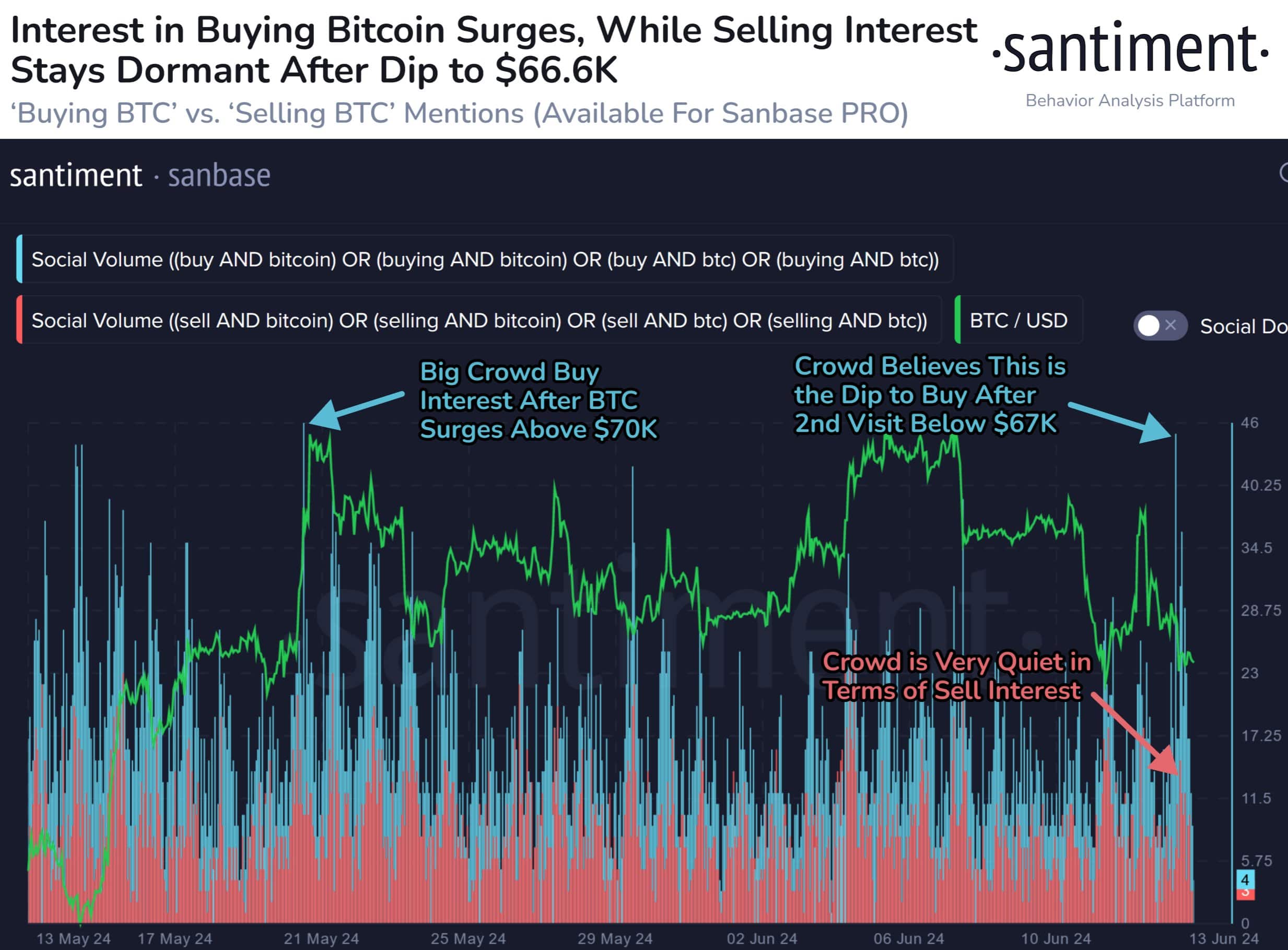

In response to Santiment’s information, a current dip in Bitcoin’s worth under $67,000 on thirteenth June, triggered a surge in shopping for exercise, marking the second-largest spike in investor curiosity for Bitcoin within the final two months.

The primary situation when this occurred, concerned a sudden worth enhance in Might 2024. This sort of surge can entice merchants to leap in, anticipating additional worth hikes and potential earnings.

They could be pushed by the idea that they’re lacking out on a profitable alternative in the event that they don’t take part within the rally.

Conversely, a worth drop, just like the one witnessed on June thirteenth, can even set off a shopping for frenzy. On this situation, some merchants may consider the worth decline is unwarranted and represents a shopping for alternative.

They anticipate a fast restoration and an opportunity to capitalize on a short lived dip.

Bitcoin merchants step again

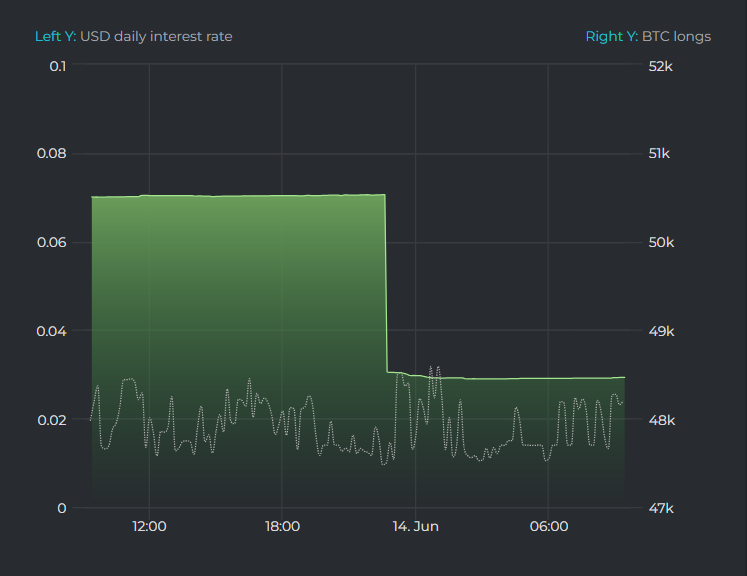

On the flipside, merchants have been turning into increasingly more cautious. Information from Datamish revealed a big motion by Bitfinex whales between 22:35 and 22:41 UTC+8 on June thirteenth.

Throughout this temporary window, these large-scale traders reportedly diminished their lengthy positions by roughly 2,000 BTC, bringing their present holdings right down to 48,464 BTC.

This coincides with a broader development of lengthy place liquidation on Bitfinex since June eleventh, totaling roughly 76.4 BTC.

This sell-off by whales means that regardless of the surge in retail shopping for, some bigger traders are adopting a extra cautious strategy, doubtlessly anticipating additional worth fluctuations or searching for to lock in earnings.

Learn Bitcoin (BTC) Value Prediction 2024-2025

At press time, BTC was buying and selling at $66,918.83, its worth had declined by 0.18% within the final 24 hours. The quantity at which it was being traded at had fallen by 24.99% as nicely.

The MVRV ratio for BTC remained excessive indicating most holders have been worthwhile on the time of writing.