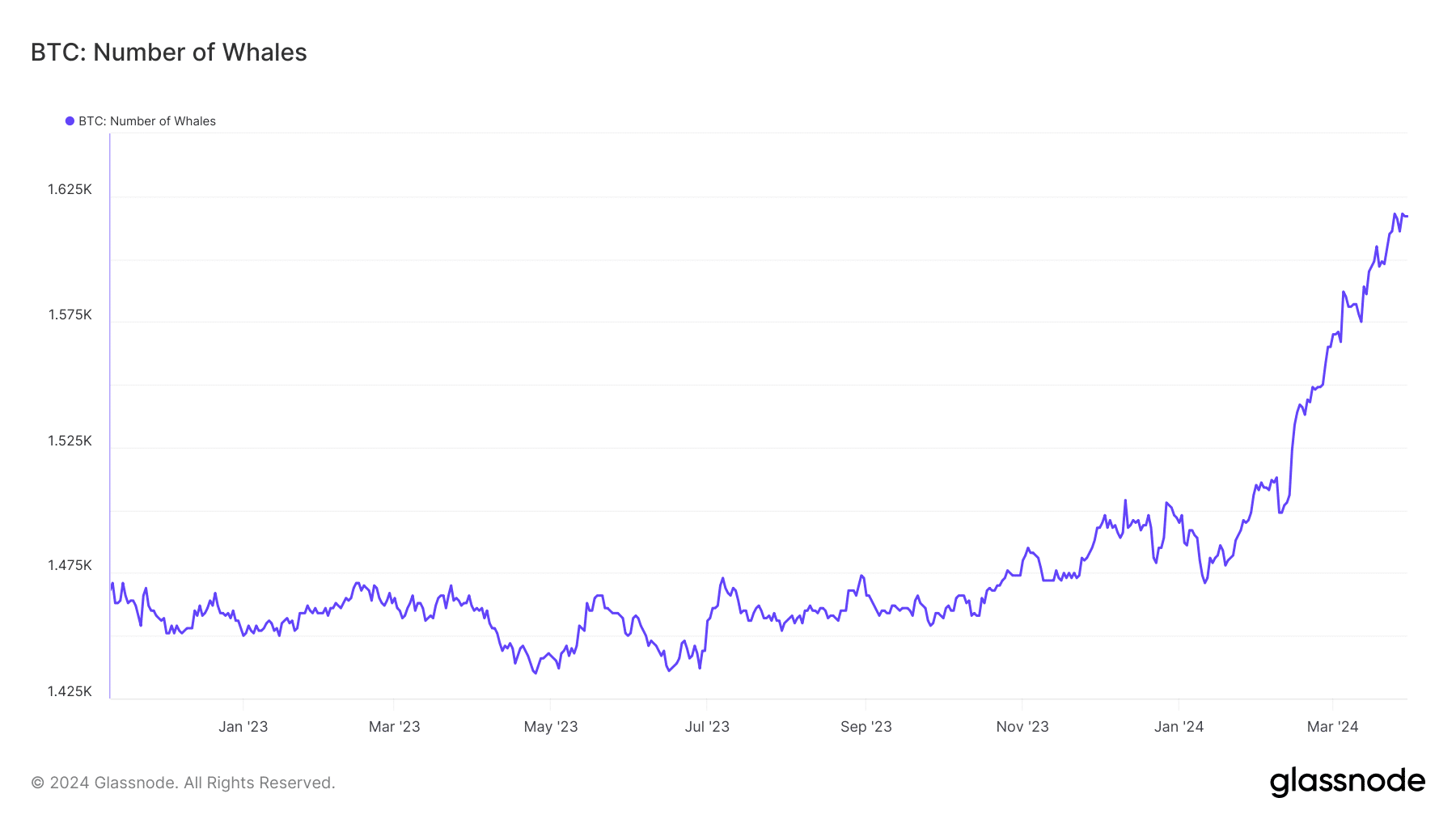

- The variety of entities having at the very least 1k cash shot up significantly.

- The buildup banked on expectations of upper inflows into Bitcoin spot ETFs.

Bitcoin [BTC] was consolidating round outdated all-time highs (ATH) as of this writing, as market members eagerly waited for a decisive transfer to the following large goal of $75,000.

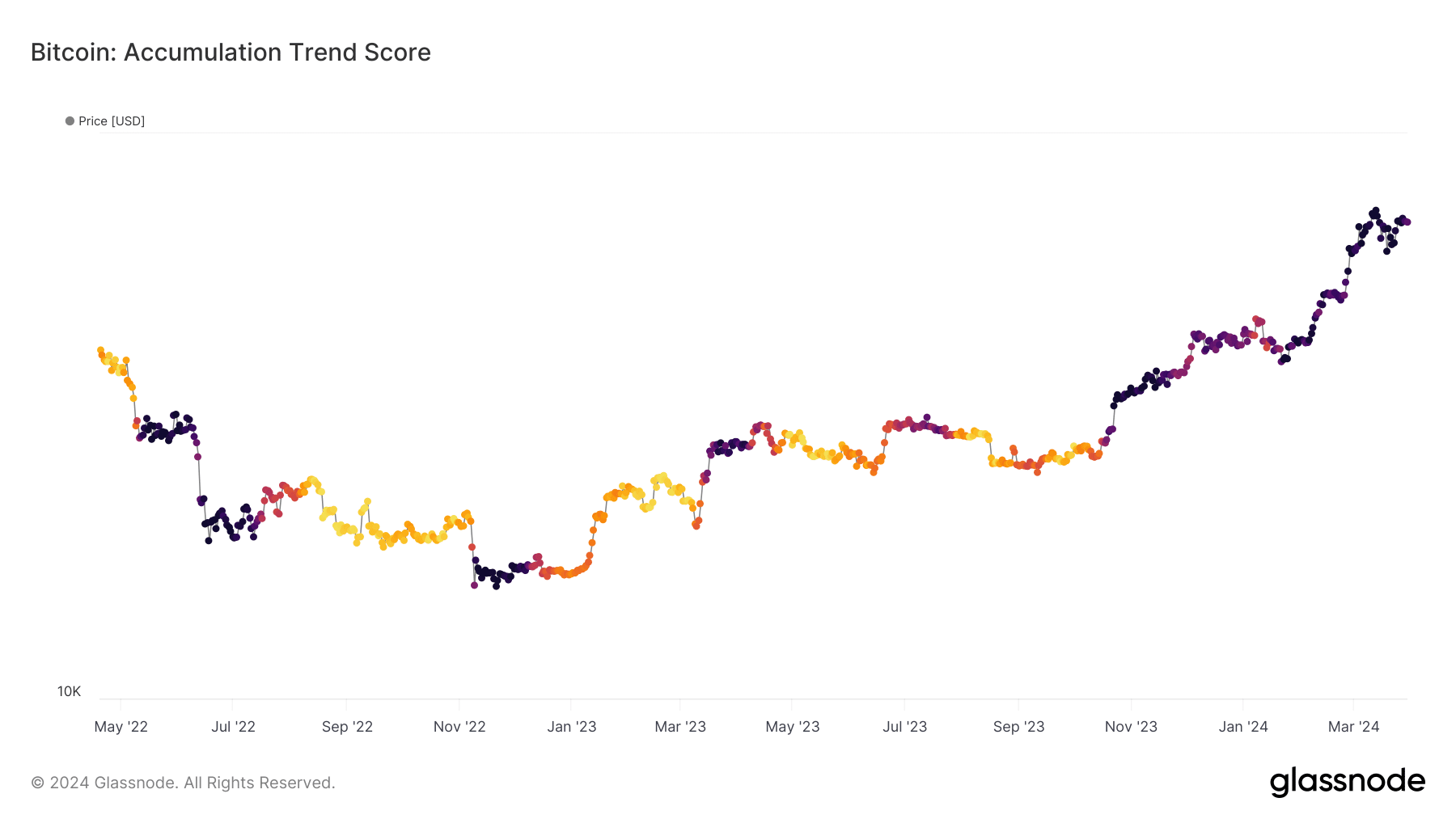

No drop in accumulation

The excellent news was that purchasing exercise remained sturdy. Based on AMBCrypto’s evaluation of Santiment’s knowledge, Bitcoin’s accumulation pattern rating was 0.78 at press time, implying that a lot of the bigger entities had been including to their positions.

Regular accumulation meant that traders had been satisfied that BTC’s market was not but saturated and there was scope for additional value positive aspects.

The bullishness was additionally mirrored within the quickly rising variety of whale addresses i.e, addresses holding a minimal of 1,000 cash. As of the thirtieth of March, the overall variety of whale entities was 1,617, up from 1,565 identical time final month.

The largest bullish set off

The optimism was probably pushed by expectations of upper inflows into Bitcoin spot ETFs. These funding autos have captured nearly all of Bitcoin’s provide since they started buying and selling early January.

The ten new spot ETFs have attracted inflows price greater than $12 billion since itemizing, in line with SoSo Worth knowledge.

And demand was more likely to get stronger. Jinze, an analyst at cryptocurrency funding agency LD Capital, predicted a powerful subsequent week as massive funds might shift capital to identify ETFs as a result of end-of-quarter rebalancing.

What do technical indicators inform?

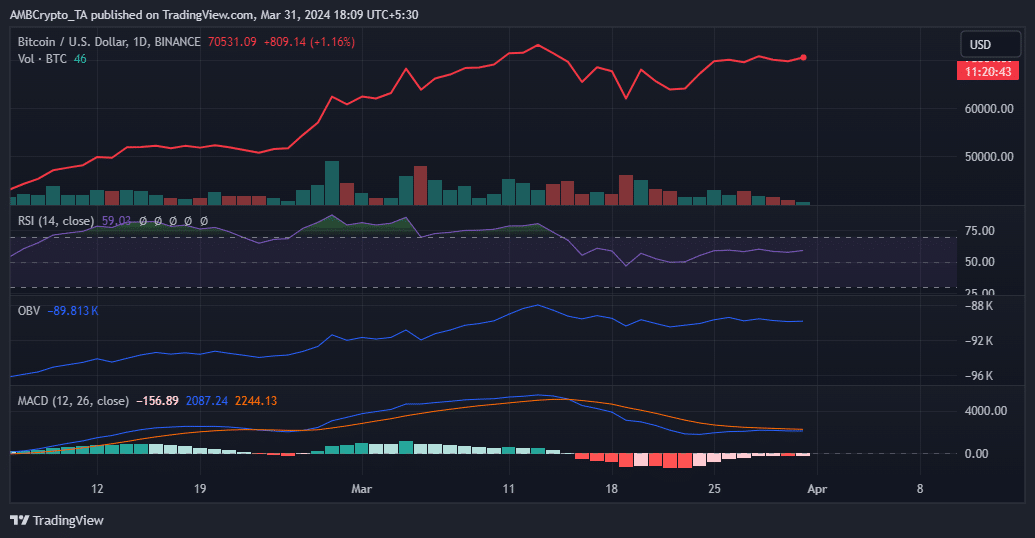

AMBCrypto analyzed a few of BTC’s key technical indicators to positive aspects insights on its subsequent directional strikes.

The Relative Energy Index (RSI) moved nearer to 60, a breach of which might add appreciable bullish optimism.

Learn BTC’s Value Prediction 2024-25

The On Stability Quantity (OBV) mirrored the value motion as of this writing, suggesting a stability between bullish and bearish forces.

The Transferring Common Convergence Divergence (MACD) indicator seemed more likely to make a bullish crossover with the sign line. Such an occasion might improve the probabilities of Bitcoin’s elevation within the days forward.