- Bitcoin maintained a balanced Put/Name Ratio forward of the deadline

- ETH merchants face potential losses as its value was near the utmost ache level

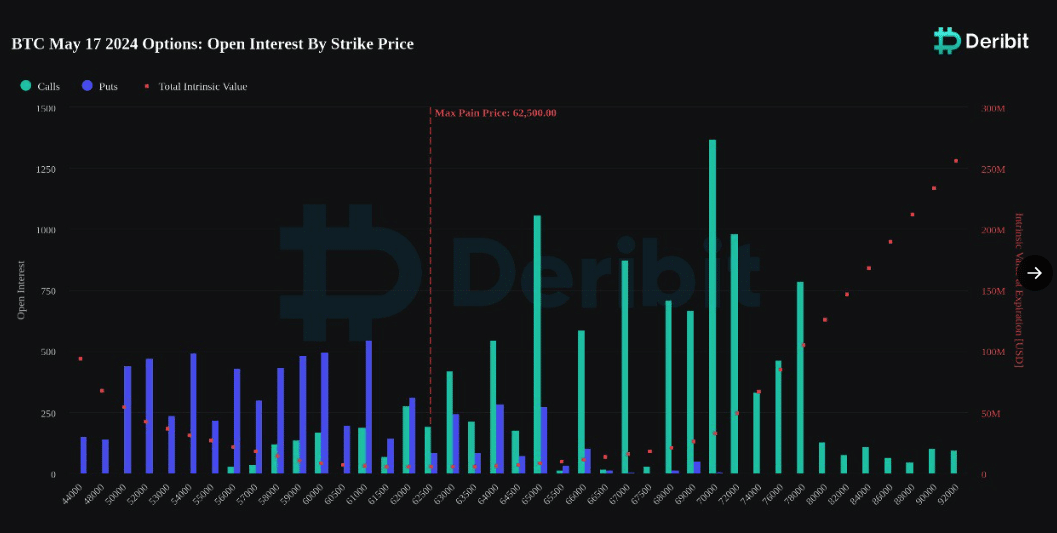

In response to knowledge from Deribit, the market-leading derivatives alternate, Bitcoin [BTC] choices with a notional worth of $1.18 billion will expire on 17 Could.

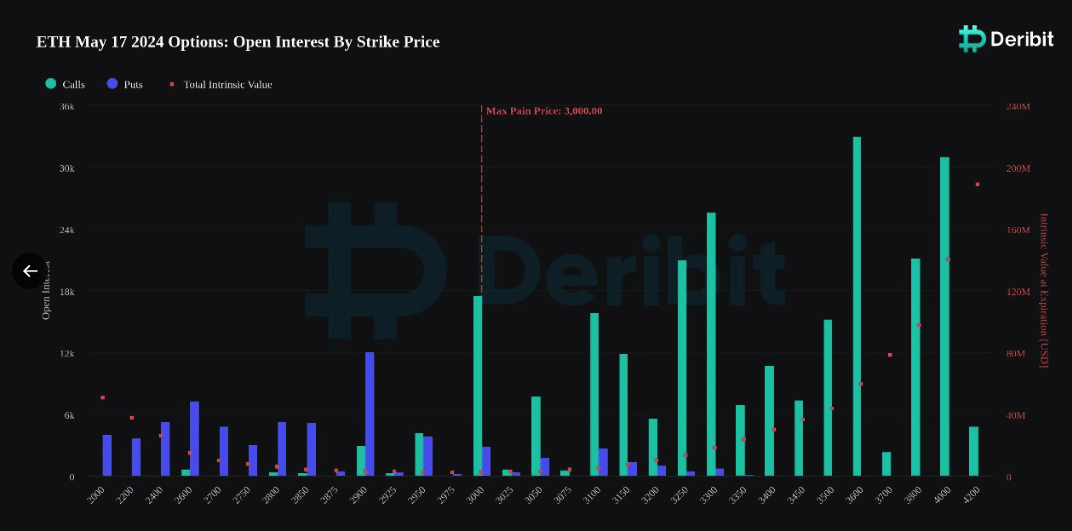

Additionally, Ethereum [ETH] contracts, valued at $950 million, would expire on the identical day. At press time, the Put/Name Ratio for Bitcoin was 0.61 whereas the utmost ache level was $62,500.

The place do each BTC and ETH stand?

In buying and selling choices, a put implies that a dealer has positioned a place to put a contract up on the market. On this case, the expectation is that the value of the asset decreases so the place could make positive factors.

However, a name implies a purchase order, indicating that the wager is for a value hike. If the studying of the Put/Name Ratio is 0.70 and above, it implies that merchants are shopping for extra places than calls.

Conversely, a studying of 0.50 and under implies a bullish sentiment out there. For Bitcoin, the ratio revealed that the variety of put and name positions was shut, indicating a stability between bearish and bullish positions.

For ETH, the Put/Name Ratio was 0.21 – An indication that a lot of the bets had been bullish. ETH had a most ache level of $3,000. If the cryptocurrency trades at this stage or under by the tip of the day, a whole lot of merchants may face large monetary losses.

It might be the identical for Bitcoin if the value hits $62,500 or drops under it. On the time of writing, the value of Bitcoin was $66,443, indicating that it is perhaps tough for the crypto to trigger a whole lot of ache.

Nonetheless, on the identical time, ETH was valued at $3,018. The closeness of this to the utmost ache level leaves ETH merchants at an enormous threat of dropping.

ETH’s weak point has not deterred future bets

As well as, Greeks.reside, an choices buying and selling repository, commented on the matter. The deal with agreed with AMBCrypto’s evaluation for Bitcoin by way of X. For Ethereum, it famous,

“Btc is more balanced between long and short, while the ETH price is weak leading to continued weakening of the market confidence, and selling calls have become the absolute main deal.”

Nonetheless, knowledge from Deribit revealed that merchants count on ETH to get better from its struggles going ahead. Based mostly on AMBCrypto’s observations, there was a rise in bets focusing on $3,600 between the final week of Could and June.

One of many causes for this prediction might be the looming SEC choice on the quite a few Ethereum ETF functions. A nod on this entrance might drive ETH’s value larger, and merchants may acquire from the identical.

Real looking or not, right here’s ETH’s market cap in BTC phrases

However, delay or rejection might drive the value of the altcoin additional decrease. Ought to this be the case, merchants might need to take care of large monetary losses.