- Hong Kong Bitcoin ETFs will begin buying and selling this week.

- Australia joins the BTC ETF mania; will APAC demand increase BTC costs?

The much-awaited and distinctive “in-kind” Hong Kong Bitcoin [BTC] ETFs are right here. Slated to begin buying and selling on Tuesday, the thirtieth of April, market watchers view the debut as a recreation changer for Asia.

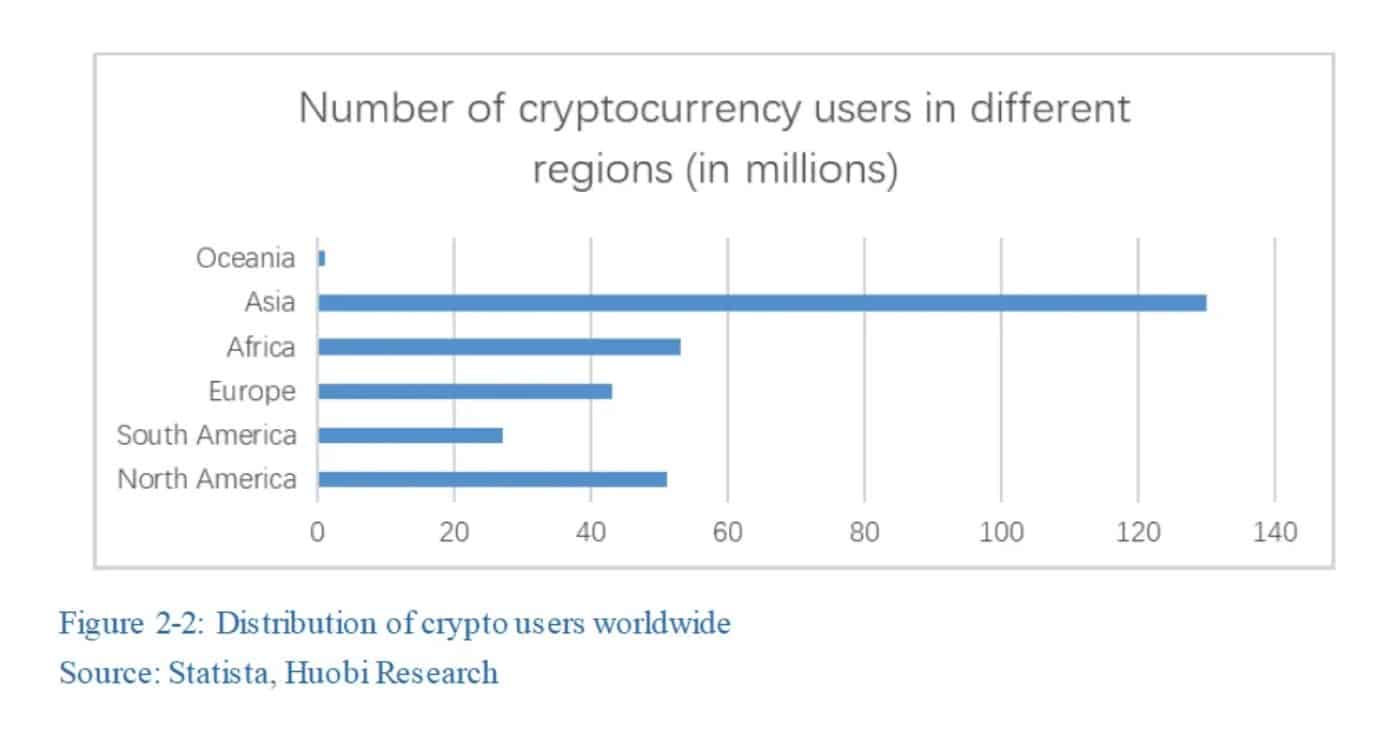

One market watcher, Willy Woo, underscored the Hong Kong ETF’s significance within the area by citing Asia’s highest crypto consumer statistics.

“The Asian market in user count is BIGGER than the US and European markets combined.”

Hong Kong Bitcoin ETFs charge wars and market dimension

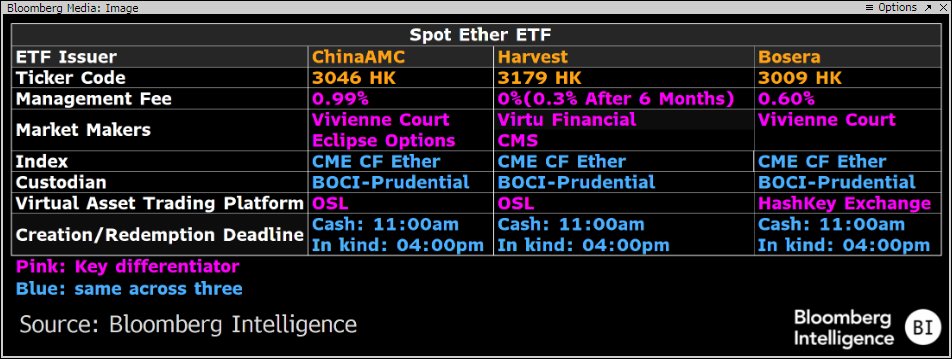

The primary batch of accepted merchandise from Bosera, ChinaAMC (Hong Kong), and Harvest Fund will go reside on the Hong Kong inventory change on the thirtieth of April.

On common, Bloomberg analyst James Seyffart famous that Hong Kong issuers have set very low prices that would entice charge wars.

“A potential fee war could break out in Hong Kong over these #Bitcoin & #Ethereum ETFs. Harvest coming in hot with a full fee waiver and the lowest fee at 0.3% after waiver.”

There was preliminary pleasure concerning the potential affect on BTC costs if Hong Kong spot BTC ETFs begin buying and selling.

In mid-April, Singapore-based crypto analysis agency, Matrixport, projected that Hong Kong’s spot BTC ETFs may entice $25 billion in inflows.

Nonetheless, a Bloomberg analyst, Eric Balchunas, downplayed the estimates because it grew to become obvious that Mainland China would face restrictions.

The analyst up to date his earlier $200 million estimate to $1 billion in AUM (belongings underneath administration), noting that,

“Our asset estimate is now $1b in first two years (which is healthy IMO but still nowhere near the $25b that some have said), but a lot depends on infrastructure improvement.”

Moreover, the report famous that the APAC area had solely round $250M in present BTC ETFs shared between Hong Kong and Australia-based funds.

“The Asia-Pacific region’s BTC ETFs currently manage $251 million in assets, split between three funds in Kong Kong and two in Australia.”

Australia follows U.S., Hong Bitcoin ETF frenzy

Nonetheless, Australia is reportedly within the superior levels of enlisting extra spot BTC ETFs on its bigger Australian Inventory Change (ASX).

A current Bloomberg report, dated the twenty ninth of April, highlighted that potential issuers like Van Eck, BetaShares, and DigitalX have lodged functions for spot Bitcoin ETFs in Australia.

ASX didn’t present an official timeline. Nonetheless, an eventful approval may gasoline institutional adoption and strengthen Hong Kong Bitcoin ETFs and the general APAC area.

Within the meantime, BTC’s value hovered barely above its range-low of $60.8K.

Given the US Fed fee resolution scheduled on Wednesday and quite a lot of liquidity on the chart positioned on the upside, wild volatility is probably going this week.