- The Bitcoin halving has sparked short-term unpredictability.

- Debate over holding Bitcoin vs. taking income emerged amid market fluctuations.

Simply 4 days in the past, Bitcoin [BTC] skilled its much-anticipated halving occasion, but its post-halving worth efficiency continues to make headlines with its unpredictability.

In accordance with CoinMarketCap, the main cryptocurrency was flashing all greens in its weekly chart at press time, signaling notable bullish motion throughout the market.

Affect of Bitcoin halving

Shedding mild on the 30 days earlier than and after the interval of Bitcoin halving, Anthony Pompliano, in a current dialog with Bloomberg famous,

“What we’ve seen historically is that the halving does take some time to kind of work in.”

Sharing insights from a Bitwise report, he added,

“In the month before the halving the average return over the last couple of bull markets has been 19% in the month after the halving it’s been 1.7%.”

This highlighted that whereas short-term fluctuations might happen instantly earlier than and after the halving, the longer-term pattern sometimes exhibits an upward trajectory.

If seemed intently, this sample aligns with fundamental economics: when demand for Bitcoin stays fixed, however the incoming provide is halved, the value should regulate to make sure market equilibrium.

Pompliano urged that this time round, the end result was prone to observe the established sample.

He predicted a possible upward motion in Bitcoin’s worth over the approaching months, in step with historic developments.

“I think that this time won’t be any different.”

Echoing comparable sentiment, Vijay Boyapati, writer of “The Bullish Case for Bitcoin,” stated,

“All things being equal, if demand for bitcoins were to remain constant, the halving would result in an excess of demand over supply, causing the price to rise.”

What are the numbers saying?

Nonetheless, opposite to the aforementioned opinions, Layah Heilpern, Host of The Layah Heilpern Present, added,

“If don’t take profit this crypto bull run you’re making a HUGE mistake…”

This displays Heilpern’s evolving perspective. Whereas beforehand advocating for indefinite cryptocurrency holding, she now advises promoting upon vital revenue realization on this cycle.

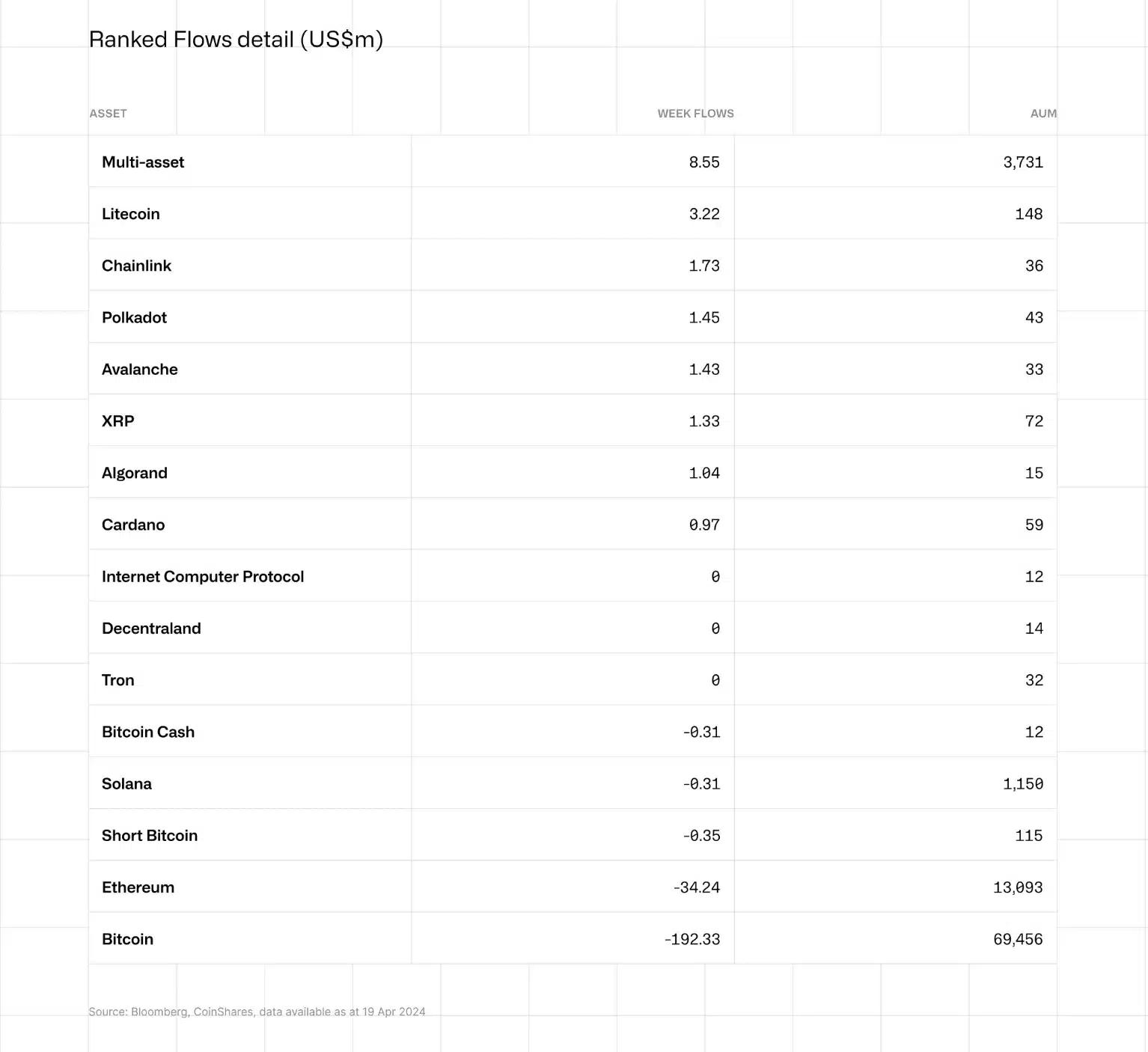

Evidently, if we take a look at the information from CoinShares, cryptocurrency outflows amounted to a considerable $206 million, with Bitcoin main the cost at $192 million, intently adopted by Ethereum [ETH] with $34 million.

Thus, whereas short-term fluctuations might elevate considerations, the long-term potential of Bitcoin holds vital advantages.