- Bitcoin holders need to be cautious within the brief time period on account of elevated promoting strain surrounding the halving.

- The halving occasion was in all probability not priced in, however that doesn’t assure the identical returns from this BTC cycle as earlier ones.

Bitcoin’s [BTC] halving didn’t instantly result in a large sell-off, as some market members feared. Whereas issues may change later this week, the $60k help zone was defended on the nineteenth of April.

For the reason that dip to $59.6k, costs have climbed by 9% at press time.

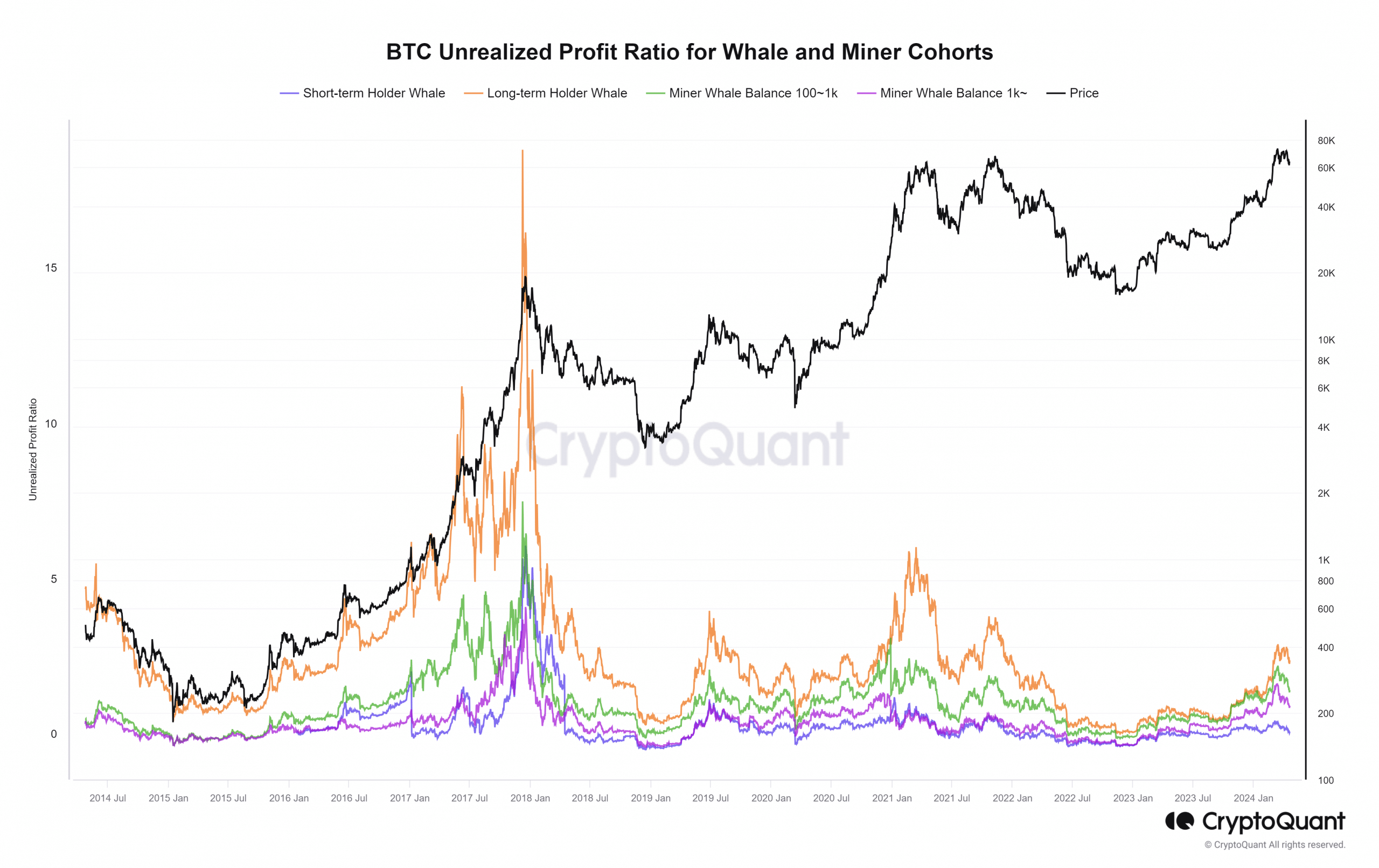

In a put up on X (previously Twitter), CryptoQuant CEO Ki Younger Ju identified that we aren’t near this cycle’s prime. The Unrealized Revenue Ratio metric confirmed that long-term whales had been solely at a 234% revenue.

The 2021 run had long-term whales at 599% revenue on the metric’s peak in February 2021. Though BTC made a brand new excessive later that 12 months, the Unrealized Revenue metric couldn’t match it.

Enjoying the lengthy recreation

Supply: CryptoQuant

Evaluating the 2020-21 cycle to the 2017-18 rally, we discover that the long-term whales’ revenue was greater than 1700% in 2017. The respectable 599% determine considerably pales compared.

This raises the query of an extra drop in whale earnings throughout this cycle’s prime. Due to this fact, expectations of Bitcoin to $200k could be ambitious- however solely time will inform.

With a studying of 286% in mid-March, bulls can be hoping for the halving to spice up these numbers. Like Ki Younger Ju says, maybe this isn’t sufficient revenue to finish the cycle.

Crypto analyst Ali Martinez drew consideration to the sentiment round Bitcoin because it reaches its peak. Based mostly on the NUPL metric, we’ve got not but reached the “euphoric” part that often accompanies a Bitcoin prime.

Threats within the short-term

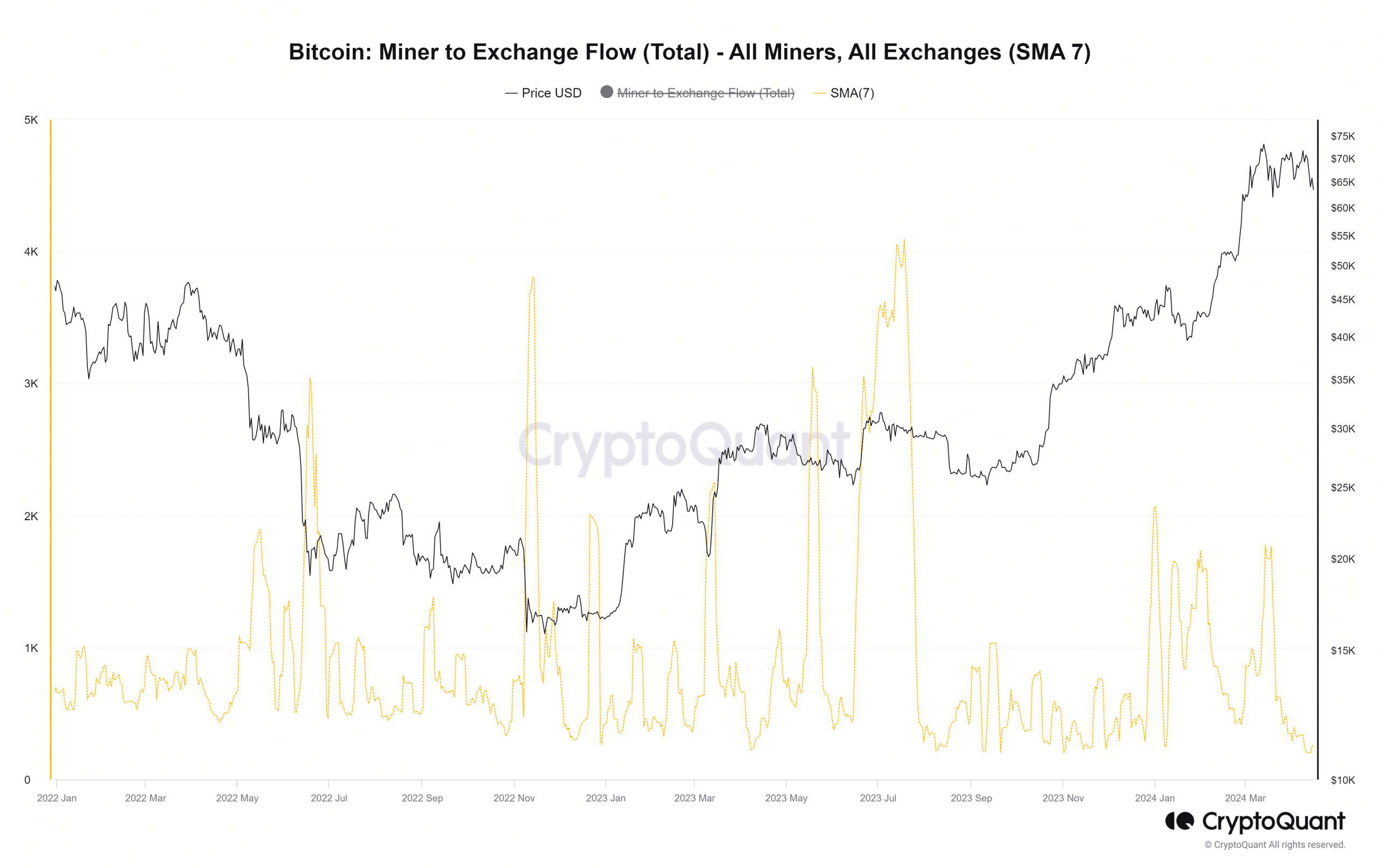

Supply: CryptoQuant

Whereas the long-term outlook argues for greater costs, there’s scope for volatility within the short-term. Information from CryptoQuant famous that miners had been sending much less BTC to exchanges prior to now month.

The falling 7-day easy transferring common of miner movement to exchanges was proof for a similar.

One chance is that miners had been hoarding Bitcoin to promote after the halving, since their rewards can be minimize in half. In flip, this might trigger vital downward strain available on the market.

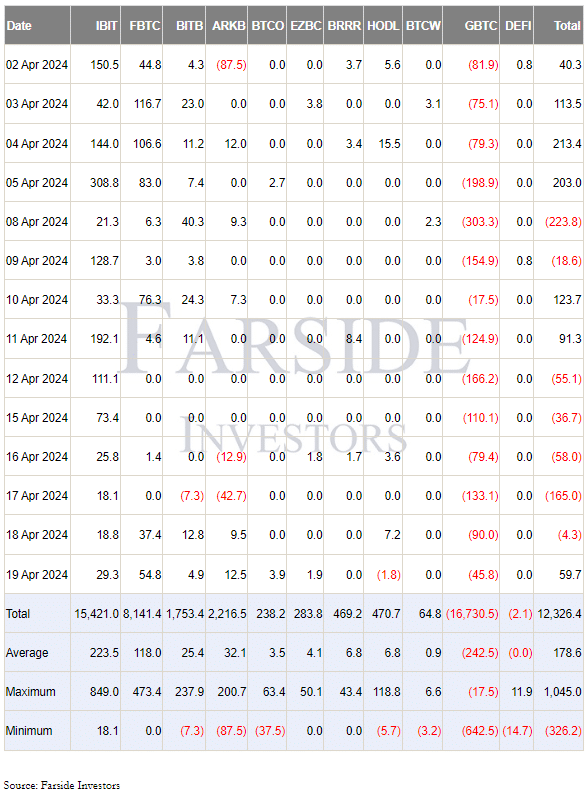

Supply: Farside Buyers

Moreover, there was proof of a weakened demand for Bitcoin in current weeks. The liquidity inflows peaked on the twelfth of March and have slowed down in current weeks.

The previous two weeks noticed Bitcoin costs decline from 10% to fifteen%, however the ETF inflows weren’t boosted. It pointed towards a saturation within the demand for U.S.-listed Bitcoin ETFs for the time being.

The halving occasion should be priced in, says frequent sense

The halving occasion on the nineteenth of April (or the early hours of the twentieth in the event you’re within the japanese hemisphere) is an occasion the entire market has identified about for years.

The aftermath shouldn’t be so simple as rewards dropping to three.125 BTC per block mined.

The crux of the issue is the multitude of different elements in play, all of them revolving round provide and demand, and public sentiment towards Bitcoin.

Arguing that the occasion is priced in as a result of the market has identified about it for ages could be redundant, argues on-chain Bitcoin analyst Willy Woo.

A shift in public sentiment happens comparatively late in Bitcoin’s cycle. Bitcoin often captures public consideration near or after the NUPL euphoria part.

This cycle could be totally different because of the ETFs, however the argument in opposition to pricing remains to be legitimate.

We merely haven’t had the capital influx, but that can ultimately worth Bitcoin appropriately. As issues stand, the asset seems massively undervalued within the long-term.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

A extra pessimistic outlook would conclude that this cycle can be far shorter and never as parabolic as those that got here earlier than.

In both situation, the curler coaster journey has not but had its quota of air time. So strap in and maintain on.